TIDMBAF

BRITISH & AMERICAN INVESTMENT TRUST PLC

FINANCIAL HIGHLIGHTS

For the six months ended 30 June 2020

Unaudited Unaudited Audited

6 months 6 months Year ended

to 30 June to 30 June 31

2020 2019 December

2019

GBP'000 GBP'000

GBP'000

Revenue

Return before tax 989 356 862

_________ _________ _________

Earnings per GBP1 ordinary shares - basic 3.31p 0.77p 2.26p

(note 5)

_________ _________ _________

Earnings per GBP1 ordinary shares - 2.86p 1.05p 2.61p

diluted (note 5)

_________ _________ _________

Capital

Total equity 7,888 8,243 6,504

_________ _________ _________

Revenue reserve (note 9) 1,112 414 110

_________ _________ _________

Capital reserve (note 9) (28,224) (27,171) (28,606)

_________ _________ _________

Net assets per ordinary share (note 6)

- Basic GBP0.23 GBP0.24 GBP0.19

_________ _________ _________

- Diluted GBP0.23 GBP0.24 GBP0.19

_________ _________ _________

GBP0.20

Diluted net assets per ordinary share at

28 October 2020

_________

Dividends*

Dividends per ordinary share (note 4) 2.7p 2.7p 2.7p

_________ _________ _________

Dividends per preference share (note 4) 1.75p 1.75p 1.75p

_________ _________ _________

Basic net assets and earnings per share are calculated using a value of fully

diluted net asset value for the preference shares.

*Dividends declared for the period. Dividends shown in the accounts are, by

contrast, dividends paid or approved

in the period.

Copies of this report will be posted to shareholders and be available for

download at the company's website: www.baitgroup.co.uk.

INVESTMENT PORTFOLIO

As at 30 June 2020

Company Nature of Business Valuation Percentageof

GBP'000 portfolio

%

Geron Corporation (USA) Biomedical 2,925 23.17

Dunedin Income Growth Investment Trust 1,920 15.21

Lineage Cell Therapeutics (USA) Biotechnology 1,053 8.34

Aberdeen Diversified Income & Investment Trust 655 5.19

Growth

AgeX (USA) Biotechnology 92 0.73

________ ________

Braemar Shipping Services Transport 56 0.44

B.S.D. Crown Software and computer 25 0.20

services

OncoCyte (USA) Biotechnology 23 0.18

ADVFN Other financial 20 0.16

Audioboom Group Media 19 0.15

________ ________

10 Largest investments (excluding 6,788 53.77

subsidiaries)

Investment in subsidiaries 5,822 46.11

Other investments (number of 16 0.12

holdings: 6)

________ ________

Total investments 12,626 100.00

________ ________

Unaudited Interim Report

As at 30 June 2020

Registered number: 433137

Directors Registered office

David G Seligman (Chairman) Wessex House

Jonathan C Woolf (Managing Director) 1 Chesham Street

Dominic G Dreyfus (Non-executive and Chairman of the London SW1X 8ND

Audit Committee)

Alex Tamlyn (Non-executive) Telephone: 020 7201 3100

Website:

www.baitgroup.co.uk

Chairman's Statement

I report on our results for the six months to 30 June 2020.

As previously noted in our 2019 annual report, these interim results are

released one month later than usual in accordance with the extended reporting

deadlines introduced by the Financial Conduct Authority (FCA) for listed

companies due to the Coronavirus (COVID-19) pandemic.

Revenue

The profit on the revenue account before tax amounted to GBP1.0 million (30 June

2019: GBP0.4 million), an increase of 177.8 percent. This was due to an

increased level of income received from our subsidiary companies.

Gross revenues totalled GBP1.27 million (2019: GBP0.6 million) during the period.

In addition, film income of GBP29,000 (30 June 2019: GBP31,000) and property unit

trust income of GBP7,000 (30 June 2019: GBP7,000) was received in our subsidiary

companies. In accordance with IFRS10, these income streams are not included

within the revenue figures noted above.

A gain of GBP0.5 million (30 June 2019: GBP1.8 million gain) was registered on the

capital account before capitalised expenses and foreign exchange gains/losses,

comprising a realised loss of GBP0.7 million (30 June 2019: GBP0.2 million loss)

and an unrealised gain of GBP1.2 million (30 June 2019: GBP1.9 million gain).

Revenue earnings per ordinary share were 3.3 pence on an undiluted basis (30

June 2019: 0.8 pence) and 2.9 pence on a fully diluted basis (30 June 2019: 1.0

pence).

Net Assets and performance

Company net assets were GBP7.9 million (GBP6.5 million, at 31 December 2019), an

increase of 21.3 percent. Over the same six month period, the FTSE 100 index

decreased by 18.2 percent and the All Share index decreased by 18.7 percent.

The net asset value per GBP1 ordinary share was 23 pence on a fully diluted

basis.

This increase in net assets over the period and substantial outperformance

compared to our benchmark indices was primarily the result of gains of 60

percent in the value of our largest US holding, Geron Corporation. As noted in

our annual report at the end of June, this increase reflected the ongoing

recovery in market perception of Geron after a severe reversal in valuation in

2018 following the unexpected withdrawal of its partner Johnson & Johnson.

Since that time, Geron has worked steadily to demonstrate that its clinical

oncology drug programme remains on track with ever improving results. During

the period, a number of positive developments have occurred, including the

announcement of FDA agreement for a second Phase 3 trial (in Myelofibrosis, MF)

to add to its continuing Phase 3 trial (in Myelodysplastic Syndrome, MDS) and

the completion of a $150 million equity fundraising in which leading biotech

sector investment funds took large positions. In addition, leading market

analysts covering Geron have maintained or increased their value targets for

Geron's share price at many multiples of current value.

The Covid-19 pandemic which struck in the first half of 2020 has wreaked havoc

on the economies, everyday activities and livelihoods of people in most

countries in the world. From an initial epidemic in China in January, the

disease spread quickly to Europe and the USA by the end of the first quarter.

Strict lockdown measures introduced at that point to curtail the outbreak

severely impacted citizens' daily lives, jobs and the working of their

economies. As a corollary to the lockdowns, governments were forced to provide

unprecedented levels of financial and fiscal support through novel mechanisms

such as guaranteed emergency loans and furlough arrangements to both

corporations and individuals through this period.

The measures proved to be generally effective and by the end of the second

quarter the rapid growth in the infection rate, hospitalisations and deaths was

first stabilised and then reduced to substantially lower levels. Additionally,

many jobs in those industries forced to shut their doors were kept open through

extensive government-supported furlough arrangements.

Most governments had readily accepted that in the trade-off between protecting

citizens, particularly the elderly, from the disease and the economic damage

caused by shutting down everyday activity, protection of citizens was

paramount. As a result, never before seen disruption to economic activity

occurred in the first half of 2020, with GDP falling by 23 percent in the UK

and 35 percent in the USA. The bulk of this fall occurred in the second quarter

coinciding with the severest lockdown period when GDP in the UK fell by 20

percent and by 30 percent in the USA.

Against this highly uncertain background, equities have unsurprisingly

experienced a very high degree of volatility over the period. In the UK, the

leading index fell by almost 35 percent over 10 days at the end of the first

quarter but by the end of the second quarter had recovered by 23 percent,

resulting in a decline of 18 percent over the first half. A similar drop was

seen in the USA but the recovery in prices was much stronger with the leading

index recovering most of its losses by the half year and even returning briefly

to year opening levels by August.

Equities were already standing at relatively high levels by the end of 2019

following a ten year bull run since the financial crisis of 2008/9 and so it is

somewhat surprising that the shock delivered to the world economic system by

Covid-19 did not result in more retracement by the time the first wave of the

pandemic had passed through the system at the half year, particularly since the

outlook for effective medical treatments or vaccines continues to remain unsure

for the time being. Forces supporting investment in equities which have been

in evidence for some time, including ultra low and in some cases negative

interest rates, quantative easing programmes and highly accommodative future

policy indications from the US Federal Reserve, together with an absence of

interest in other asset classes such as commodities, real estate, fixed

interest securities and even cash have continued to support equity prices

despite the effects of the pandemic.

As noted in my previous statement, our holdings of Geron and other US

biotechnology stocks which do not track general market movements so closely

have allowed us to avoid the more extreme effects of this volatility and have

in fact enabled us in this period to outperform our benchmarks significantly.

Dividend

We intend to pay an interim dividend of 2.7 pence per ordinary share on 10

December 2020 to shareholders on the register at 20 November 2020. This

represents an unchanged dividend from last year's interim dividend and a yield

of approximately 9 percent on the ordinary share price averaged over the

period. A preference dividend of 1.75 pence will be paid to preference

shareholders on the same date.

Outlook

The Covid-19 pandemic and the plethora of other major issues, financial,

economic and geopolitical which have been present and growing for some time as

we have reported on previous occasions make any enlightened view on the outlook

for investment over the coming period virtually impossible.

It has become evident that the effects of the pandemic are likely to last

longer than perhaps originally expected as governments grapple with the

realities of exiting the lockdowns without returning to the high levels of

infection and death of the first half of the year.

The dramatic falls in GDP seen in the first half have partially reversed as

countries started to dismantle the severest restrictions and gradually return

towards normalcy. However, the lightened levels of restrictions introduced in

recent months have resulted in new and rapid growth in the infection rate in

many countries and in some areas of the UK have recently necessitated the

re-imposition of increased localised restrictions over an as yet unknown

timeframe. This will inevitably result in a slowing of the recovery in GDP

and, as governments reduce the levels of emergency support, to long term damage

to many sectors of the economy and the permanent loss of jobs. It seems

unavoidable that a significant amount of economic activity will now be

permanently lost.

To counter this and other negative economic trends, governments, central banks

and international agencies such as the IMF continue to push strongly for

continued monetary and fiscal stimulus for an indeterminate period which should

support equity prices through this crisis.

Having trimmed some of our general sterling based investments over the last two

years which we do not expect to replace in the foreseeable future, our

portfolio has become more focused on our US biopharma investments which do not

tend to track general market movements and which we believe hold significant

investment promise as they progress steadily towards commercialisation of their

ground-breaking and valuable technologies.

As at 28 October, company net assets were GBP7.0 million, a decrease of 10.7

percent since 30 June. This compares with a decrease in the FTSE 100 index of

9.5 percent and a decrease of 7.5 percent in the All Share index over the same

period, and is equivalent to 20.1 pence per share (prior charges deducted at

fully diluted value) and 20.1 pence per share on a fully diluted basis.

David Seligman

30 October 2020

Managing Director's Report

This time last year I reported that US and UK equity markets had entered one of

the longest periods of uninterrupted growth on record, with the UK market

growing by 105 percent and the US market growing by 275 percent over the

preceding 10 years. While it was noted at the time that numerous and growing

headwinds made it unlikely that such increases would continue uninterrupted,

little was it realised that the catastrophe of the Covid-19 pandemic would

strike in just a few short months, not only halting the growth in equity

markets abruptly in the first quarter of this year but, in the case of the UK,

taking the market back by the end of the quarter to its level of the last

financial crisis in 2008/9, with falls of well over 30 percent. A veritable

'black swan' event.

Equity markets quickly rebounded in the second quarter to recover approximately

50 percent of their falls of the first quarter, as swift and comprehensive

interventions by governments curtailed the uncontrolled growth of the virus.

However, there was a growing realisation over the summer months that, in the

absence of effective treatments or the quick availability of a new vaccine, the

virus would return in a second wave as the initially severe restrictions were

reduced to restart economies and as the winter approached. The equity market

in the UK has therefore weakened again in the third quarter and has not

sustained the recovery of the second quarter.

In the USA, which has followed a somewhat different and much less focussed

policy towards Covid-19, the equity market has continued its recovery back to

almost pre-pandemic levels. This reflects the lesser emphasis on and in some

quarters misplaced scepticism of the dangers of the virus in favour of

maintaining economic activity or personal liberties. In addition, the Federal

Reserve implemented significant additional monetary stimulus through a change

to its inflation targeting policy, switching from a fixed ceiling of 2 percent

to an average target of 2 percent over time. This is designed to allow the

economy to 'run hotter'. At the same time it has also made unprecedented

long-term commitments to maintain interest rates at their near zero level for a

number of years.

Although the US federal government has not yet been able to agree a

continuation in some form of the financial assistance measures given to

citizens and corporations during the height of the pandemic earlier this year,

which will inevitably lead to lowered levels of growth and increased

joblessness in the USA over the coming period, the actions of the Federal

Reserve to pump large and long term amounts of liquidity into the economy has

supported equity prices over the last few months despite the virus continuing

to take its toll in the USA.

Looking forward, it is generally believed that even if one or more effective

vaccines are approved and become available in early 2021, large scale adoption

of these or other treatments heralding a turning point in the fight against the

virus will not be seen before the end of next year. Thus, sustained return to

normal social and economic activity is unlikely to be seen before 2022.

Consequently, the outlook for economic recovery remains very uncertain for the

medium term. This is compounded by all the other concomitants of this

devastating pandemic, including a permanent loss of economic activity and

likely permanent changes to the way social interaction and business activities

are conducted in the future. In the short term, a significant loss of jobs and

even of whole businesses is anticipated as governments modulate their hitherto

comprehensive financial rescue and stimulus measures in order to reduce

pressure on the public finances.

In these circumstances, it is extremely difficult for investors to know where

sensibly and safely to commit their investment funds over the coming years. A

brief summary of the perceived prospects in the current circumstances for

investment in the various mainstream asset classes is given below as an

illustration of this:

Equities. After the 10 year bull run from 2009 to 2019, which was artificially

prolonged in the latter years by US fiscal and monetary stimulus, equity

valuations were standing at historically high levels before the pandemic

struck. All sectors had risen steadily over this period, giving rise to market

multiples well in excess of long term levels; but certain sectors, particularly

technology, far out-ran the market enjoying increases of many hundreds and in

some cases thousands of percent. This year, for example, the market value of

the five leading US tech companies (known as FAANGs) reached US$ 4 trillion,

representing over 15 percent of the value of the entire S&P 500 index. It is

these stocks which have led and sustained the bull run in equities but which

have also contributed to market volatility in the current year. As another

example, Apple Corporation achieved a market value of US$ 2 trillion this year

which is in excess of the entire value of all the companies in the FTSE 100

index.

These companies have of course created much value and innovation over the past

few years. Some have also recently benefitted greatly from changed consumer

habits as a result of the pandemic, as well as from the US administration's

confrontational international trade policy. However, it is plain that the

elevated valuations of these companies and of equities more generally also

derive from the amount of excess liquidity pumped into the system by central

banks together with the perceived lack of palatable alternative mainstream

investment opportunities available to investors under current circumstances.

There is also the forthcoming US presidential election and should a change of

administration occur, it would be likely particularly to place new pressures on

these FAANG companies in terms of changes to the tax regime and their

operations. While such a change might seem disadvantageous to this particular

sector, on a more general level the likely return to more normal and less

erratic government in the USA would be considerably more conducive to the

successful operation of the economy, as recent reactions of the market seem to

indicate.

Fixed interest. Historically the second most favoured global institutional

investment asset, fixed interest bonds currently generate little or even

negative yield over some maturities and are open to the risk of future

inflationary forces, a real prospect following the large-scale fiscal and

monetary stimulus of recent years and in the current year the response to the

pandemic.

Precious metals. Gold and other precious metals have risen strongly over the

past year, with the gold price increasing by 35 percent this year to reach

historic highs, in response to forces such as US dollar weakness, loosened

monetary policy and geopolitical instability. This asset class generates no

income and the combination of factors supporting the current high levels might

very well not continue into the future. The abundance of liquidity which has

created capital growth in this and similar asset classes will inevitably be

withdrawn as inflationary pressures increase in the years to come, although in

these circumstances gold itself would be likely to benefit from resilience at

some level as a hedge against inflation.

Commodities and real estate. These investments are vulnerable to the large

scale and potentially protracted global slowdown which the pandemic has caused.

More generally, changed ways of living following the pandemic in such areas as

consumption, retail and office life could have a major impact on the future

prospects of commercial real estate investment.

Cash. As the investment of final resort in times of severe investment

uncertainty, cash or cash funds have always provided a refuge when other

investments are considered too risky. However, even cash is no longer an

attractive proposition with near zero interest rates and even negative rates

operating in some leading currencies such as the Swiss Franc, Euro, Japanese

Yen, and potentially in prospect for others. Additionally, the prospect of a

return to inflation, which could even potentially become a government policy

goal to address the fast growing levels of public debt, also compounds the

unattractiveness of cash over the longer term.

Investors have therefore seen no alternative but to continue investing in

equities, despite the currently high multiples, the likely economic

uncertainties ahead and an expected downturn in corporate earnings over the

coming period. Even the traditional income generating advantage of equities

has now come under pressure with the familiar pattern of ever increasing

dividends coming to an end this year and even being reversed. As seen with

some of the UK's leading stocks, dividends have been cut, cancelled or even in

the case of banks been disallowed by government. This year, for example, 40

percent of FTSE 100 companies cut or cancelled their dividends resulting in a

fall of 50 percent in total dividend income for investors.

For all the above reasons and as previously noted, we have been trimming our

exposure to some of our general sterling-based equity investments and continue

with our focused and long-term strategic investments in US biopharma, which are

not so susceptible to the market forces and policy distortions driving capital

valuations at the moment and from which we hope to capture significant value as

they progress steadily towards commercialisation of their ground-breaking and

valuable technologies. As already noted, this investment approach has enabled

us this year significantly to outperform our benchmarks and we hope to achieve

similar results in the periods to come as this programme matures.

Jonathan Woolf

30 October 2020

CONDENSED INCOME STATEMENT

Six months ended 30 June

2020

Unaudited Unaudited Audited

6 months to 30 June 6 months to 30 June Year ended 31 December

2020 2019 2019

Revenue Capital Revenue Capital Revenue Capital

Note return return Total return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment income 3 1,269 - 1,269 597 - 597 1,243 - 1,243

Holding gains on 1,207 1,207 1,925 1,925 1,657 1,657

investments at fair

value through profit - - -

or loss

Losses on disposal (747) (747) (152) (152) (1,113) (1,113)

of investments at - -

fair value through -

profit or loss

(52) 53 1 (1) (1) (2) (57) (4)

Foreign exchange 53

gains/(losses)

Expenses (199) (119) (318) (215) (116) (331) (381) (242) (623)

_____ _____ _____ _____ _____ _____ _____ _____ _____

Profit before 394 1,412 1,656 2,037 915 245 1,160

finance costs and 1,018 381

tax

Finance costs (29) (12) (41) (25) (25) (50) (53) (49) (102)

_____ _____ _____ _____ _____ _____ _____ _____ _____

382 1,371 1,631 1,987 196 1,058

Profit before tax 989 356 862

Taxation 13 - 13 12 - 12 52 - 52

_____ _____ _____ _____ _____ _____ _____ _____ _____

Profit for the 382 1,384 1,631 1,999 196 1,110

period 1,002 368 914

_____ _____ _____ _____ _____ _____ _____ _____ _____

Earnings per 5

ordinary share

Basic 3.31p 1.53p 4.84p 0.77p 6.52p 7.29p 2.26p 0.78p 3.04p

Diluted 2.86p 1.09p 3.95p 1.05p 4.66p 5.71p 2.61p 0.56p 3.17p

The company does not have any income or expense that is not included in profit

for the period and all items derive from continuing operations. Accordingly,

the 'Profit for the period' is also the 'Total Comprehensive Income for the

period' as defined in IAS 1(revised) and no separate Statement of Comprehensive

Income has been presented.

The total column of this statement is the company's Income Statement, prepared

in accordance with IFRS. The supplementary revenue return and capital return

columns are both prepared under guidelines published by the Association of

Investment Companies.

All profit and total comprehensive income is attributable to the equity holders

of the company.

CONDENSED STATEMENT OF CHANGES IN EQUITY

Six months ended 30 June 2020

Unaudited

Six months ended 30 June 2020

Share Capital Retained Total

capital* reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2019 35,000 (28,606) 110 6,504

Profit for the period - 382 1,002 1,384

Ordinary dividend paid - - - -

Preference dividend paid - - - -

________ ________ ________ ________

Balance at 30 June 2020 35,000 (28,224) 1,112 7,888

________ ________ ________ ________

Unaudited

Six months ended 30 June 2019

Share Capital Retained Total

capital* reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2018 35,000 (28,802) 1,721 7,919

Profit for the period - 1,631 368 1,999

Ordinary dividend paid - - (1,500) (1,500)

Preference dividend paid - - (175) (175)

________ ________ ________ ________

Balance at 30 June 2019 35,000 (27,171) 414 8,243

________ ________ ________ ________

Audited

Year ended 31 December 2019

Share Capital Retained Total

capital* reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2018 35,000 (28,802) 1,721 7,919

Profit for the period - 196 914 1,110

Ordinary dividend paid - - (2,175) (2,175)

Preference dividend paid - - (350) (350)

________ ________ ________ ________

Balance at 31 December 2019 35,000 (28,606) 110 6,504

________ ________ ________ ________

*The company's share capital comprises GBP35,000,000 (2019 - GBP35,000,000) being

25,000,000 ordinary shares of GBP1 (2019 - 25,000,000) and 10,000,000 non-voting

convertible preference shares of GBP1 each (2019 - 10,000,000).

CONDENSED BALANCE SHEET

As at 30 June 2020

Note Unaudited Unaudited Audited

30 June 30 June 31

2020 2019 December

2019

GBP'000 GBP'000

GBP'000

Non-current assets

Investments - fair value through

profit or loss (note 1) 6,804 9,565 6,704

Subsidiaries - fair value 5,822 5,537 5,335

through profit or loss

_________ _________ _________

12,626 15,102 12,039

Current assets

Receivables 1,584 3,543 1,588

Cash and cash equivalents 2,192 232 2,504

_________ _________ _________

3,776 3,775 4,092

_________ _________ _________

Total assets 16,402 18,877 16,131

_________ _________ _________

Current liabilities

Trade and other payables (2,359) (1,593) (3,617)

Bank loan (2,843) (2,772) (2,635)

_________ _________ _________

(5,202) (4,365) (6,252)

_________ _________ _________

Total assets less current 11,200 14,512 9,879

liabilities

_________ _________ _________

Non - current liabilities (3,312) (6,269) (3,375)

_________ _________ _________

Net assets 7,888 8,243 6,504

_________ _________ _________

Equity attributable to equity

holders

Ordinary share capital 25,000 25,000 25,000

Convertible preference share 10,000 10,000 10,000

capital

Capital reserve (28,224) (27,171) (28,606)

Retained revenue earnings 1,112 414 110

_________ _________ _________

Total equity 7,888 8,243 6,504

_________ _________ _________

Net assets per ordinary share - 6 GBP0.23 GBP0.24 GBP0.19

basic

_________ _________ _________

Net assets per ordinary share - 6 GBP0.23 GBP0.24 GBP0.19

diluted

_________ _________ _________

CONDENSED CASHFLOW STATEMENT

Six months ended 30 June 2020

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31

30 June 30 June December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Profit before tax 1,371 1,987 1,058

Adjustment for:

Gains on investments (460) (1,739) (544)

Proceeds on disposal of investments at

fair value

through profit or loss 1,811 7,459 16,316

Purchases of investments at fair value

through profit or loss (2,226) (7,638) (14,521)

Interest 41 50 102

________ ________ ________

Operating cash flows before movements

in working capital 537 119 2,411

(Increase)/decrease in receivables (213) 567 2,417

Decrease in payables (361) (12) (363)

________ ________ ________

Net cash from operating activities

before interest (37) 674 4,465

Interest paid (23) (50) (97)

________ ________ ________

Net cash flows from operating activities (60) 624 4,368

________ ________ ________

Cash flows from financing activities

Dividends paid on ordinary shares (285) (618) (1,778)

Dividends paid on preference shares (175) - (175)

Bank loan 208 (18) (155)

________ ________ ________

Net cash used in financing activities (252) (636) (2,108)

________ ________ ________

Net (decrease)/increase in cash and cash (312) (12)

equivalents 2,260

Cash and cash equivalents at beginning of 2,504 244 244

period

________ ________ ________

Cash and cash equivalents at end of 2,192 232 2,504

period

________ ________ ________

NOTES TO THE COMPANY'S CONDENSED FINANCIAL STATEMENT

1. Accounting policies

Basis of preparation and statement of compliance

This interim report is prepared in accordance with IAS 34 'Interim Financial

Reporting' and on the basis of the accounting policies set out in the company's

Annual Report and financial statements at 31 December 2019 with the exception

of the application of new accounting standards.

The company's condensed financial statements have been prepared in accordance

with International Financial Reporting Standards (IFRS) as adopted by the

European Union, which comprise standards and interpretations approved by the

IASB and International Accounting Standards and Standing Interpretations

Committee interpretations approved by the IASC that remain in effect, and to

the extent they have been adopted by the European Union.

In accordance with IFRS 10, the group does not consolidate its subsidiaries and

therefore instead of preparing group accounts it prepares separate financial

statements for the parent entity only.

The financial statements have been prepared on the historical cost basis except

for the measurement at fair value of investments, derivative financial

instruments, and subsidiaries. The same accounting policies as those published

in the statutory accounts for 31 December 2019 have been applied.

Significant accounting policies

In order to better reflect the activities of an investment trust company and in

accordance with guidance issued by the Association of Investment Companies

(AIC), supplementary information which analyses the income statement between

items of a revenue and capital nature has been presented alongside the income

statement.

As the entity's business is investing in financial assets with a view to

profiting from their total return in the form of interest, dividends or

increases in fair value, listed equities and fixed income securities are

designated as fair value through profit or loss on initial recognition. The

company manages and evaluates the performance of these investments on a fair

value basis in accordance with its investment strategy, and information about

the group is provided internally on this basis to the entity's key management

personnel.

Investments held at fair value through profit or loss, including derivatives

held for trading, are initially recognised at fair value.

All purchases and sales of investments are recognised on the trade date.

After initial recognition, investments, which are designated as at fair value

through profit or loss, are measured at fair value. Gains or losses on

investments designated at fair value through profit or loss are included in

profit or loss as a capital item, and material transaction costs on acquisition

and disposal of investments are expensed and included in the capital column of

the income statement. For investments that are actively traded in organised

financial markets, fair value is determined by reference to Stock Exchange

quoted market closing prices or last traded prices, depending upon the

convention of the exchange on which the investment is quoted at the close of

business on the balance sheet date. Investments in units of unit trusts or

shares in OEICs are valued at the closing price released by the relevant

investment manager.

In respect of unquoted investments, or where the market for a financial

instrument is not active, fair value is established by using an appropriate

valuation technique.

Investments of the company in subsidiary companies are held at the fair value

of their underlying assets and liabilities.

This includes the valuation of film rights in British & American Films Limited

and thus the fair value of its immediate parent BritAm Investments Limited. In

determining the fair value of the film rights, estimates are made. These

include future film revenues which are estimated by the management. Estimations

made have taken into account historical results, current trends and other

relevant factors.

Where a subsidiary has negative net assets it is included in investments at GBP

nil value and a provision is made for it on the balance sheet where the

ultimate parent company has entered into a guarantee to pay the liabilities if

they fall due.

Dividend income from investments is recognised as income when the shareholders'

rights to receive payment has been established, normally the ex-dividend

date.

Interest income on fixed interest securities is recognised on a time

apportionment basis so as to reflect the effective interest rate of the

security.

When special dividends are received, the underlying circumstances are reviewed

on a case by case basis in determining whether the amount is capital or income

in nature. Amounts recognised as income will form part of the company's

distribution. Any tax thereon will follow the accounting treatment of the

principal amount.

All expenses are accounted for on an accruals basis. Expenses are charged as

revenue items in the income statement except as follows:

- transaction costs which are incurred on the purchase or sale of an investment

designated as fair value through profit or loss are expensed and included in

the capital column of the income statement;

- expenses are split and presented partly as capital items where a connection

with the maintenance or enhancement of the value of the investments held can be

demonstrated, and accordingly investment management and related costs have been

allocated 50% (2019 - 50%) to revenue and 50% (2019 - 50%) to capital, in order

to reflect the directors' long-term view of the nature of the expected

investment returns of the company.

The 3.5% cumulative convertible non-redeemable preference shares issued by the

company are classified as equity instruments in accordance with IAS 32

'Financial Instruments - Presentation' as the company has no contractual

obligation to redeem the preference shares for cash or pay preference dividends

unless similar dividends are declared to ordinary shareholders.

2. Segmental reporting

The directors are of the opinion that the company is engaged in a single

segment of business, that is investment business, and therefore no segmental

reporting is provided.

3. Income

Unaudited Unaudited Audited

6 months 6 months Year ended

to 30 June to 30 June 31

2020 2019 December

GBP'000 GBP'000 2019

GBP'000

Income from investments 1,226 568 1,185

Other income 43 29 58

_________ _________ _________

1,269 597 1,243

_______ _______ _______

Of the GBP160,000 (30 June 2019 - GBP568,000, 31 December 2019 - GBP1,185,000)

dividends received from listed investments in the company accounts, GBP89,000 (30

June 2019 - GBP434,000, 31 December 2019 - GBP879,000) related to special and other

dividends received from investee companies that were bought after the dividend

announcement. There was a corresponding capital loss of GBP424,000 (30 June 2019

- GBP498,000, 31 December 2019 - GBP1,027,000) on these investments.

Under IFRS 10 the income analysis is for the parent company only rather than

that of the consolidated group. Thus, film revenues of GBP29,000 (30 June 2019 -

GBP31,000, 31 December 2019 - GBP106,000) received by the subsidiary British &

American Films Limited and property unit trust income of GBP7,000 (30 June 2019 -

GBP7,000, 31 December 2019 - GBP14,000) received by the subsidiary BritAm

Investments Limited are shown separately in this paragraph for information

purposes.

4. Proposed dividends

Unaudited Unaudited Audited

6 months to 6 months to Year ended

30 June 2020 30 June 2019 31 December 2019

Interim Interim Final

Pence per GBP'000 Pence per GBP'000 Pence per GBP'000

share share share

Ordinary shares 2.7 675 2.7 675 - -

Preference shares

- 1.75 175 1.75 175 - -

fixed

_________ _________ _________

850 850 -

_______ _______ _______

The directors have declared an interim dividend of 2.7p (2019 - 2.7p) per

ordinary share, payable on 10 December 2020 to shareholders registered on 20

November 2020. The shares will be quoted ex-dividend on 19 November 2020.

The dividends on ordinary shares are based on 25,000,000 ordinary GBP1 shares.

Dividends on preference shares are based on 10,000,000 non-voting 3.5%

convertible preference shares of GBP1.

The holders of the 3.5% convertible preference shares will be paid a dividend

of GBP175,000 being 1.75p per share. The payment will be made on the same date as

the dividend to the ordinary shareholders.

The non-payment in December 2019 of the dividend of 1.75 pence per share on the

3.5% cumulative convertible preference shares, consequent upon the non-payment

of a final dividend on the Ordinary shares for the year ended 31 December 2019,

has resulted in arrears of GBP175,000 on the 3.5% cumulative convertible

preference shares.

Amounts recognised as distributions to ordinary shareholders in the period:

Unaudited Unaudited Audited

6 months to 6 months to Year ended

30 June 2020 30 June 2019 31 December 2019

Pence per GBP'000 Pence per GBP'000 Pence per GBP'000

share share share

Ordinary shares -

final - - 6.0 1,500 6.0 1,500

Ordinary shares -

interim - - - - 2.7 675

Preference shares

- - - 1.75 175 3.5 350

fixed

_________ _________ _________

- 1,675 2,525

_______ _______ _______

5. Earnings per ordinary share

Unaudited Unaudited Audited

6 months 6 months Year ended

to 30 June to 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Basic earnings per share

Calculated on the basis of:

Net revenue profit after preference 827 193 564

dividends

Net capital gain 382 1,631 196

_________ _________ _________

Net total earnings after preference 1,209 1,824 760

dividends

_______ _______ _______

Number'000 Number'000 Number'000

Ordinary shares in issue 25,000 25,000 25,000

_______ _______ _______

Diluted earnings per share

Calculated on the basis of:

Net revenue profit 1,002 368 914

Net capital gain 382 1,631 196

_________ _________ _________

Profit after taxation 1,384 1,999 1,110

_______ _______ _______

Number'000 Number'000 Number'000

Ordinary and preference shares in issue 35,000 35,000 35,000

_______ _______ _______

Diluted earnings per share is calculated taking into account the preference

shares which are convertible to ordinary shares on a one for one basis, under

certain conditions, at any time during the period 1 January 2006 to 31 December

2025 (both dates inclusive).

6. Net asset value attributable to each share

Basic net asset value attributable to each share has been calculated by

reference to 25,000,000 ordinary shares, and company net assets attributable to

shareholders as follows:

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Total net assets 7,888 8,243 6,504

Less convertible preference shares at (2,254) (2,355) (1,858)

fully diluted value

__________ __________ __________

Net assets attributable to ordinary 5,634 5,888 4,646

shareholders

________ ________ ________

Diluted net asset value is calculated on the total net assets in the table

above and on 35,000,000 shares, taking into account the preference shares which

are convertible to ordinary shares on a one for one basis, under certain

conditions, at any time during the period 1 January 2006 to 31 December 2025

(both dates inclusive).

Basic net assets and earnings per share are calculated using a value of fully

diluted net asset value for the preference shares.

7. Non - current liabilities

Guarantee of subsidiary liability Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Opening provision 3,375 6,396 6,396

Decrease in period (63) (127) (161)

Transfer to allowance for doubtful debt - - (2,860)

__________ __________ __________

Closing provision 3,312 6,269 3,375

________ ________ ________

The provision is in respect of a guarantee made by the company for liabilities

between its wholly owned subsidiaries, Second BritAm Investments Limited,

BritAm Investments Limited and British & American Films Limited. The guarantee

is to pay out the liabilities of Second BritAm Investments Limited if they fall

due. There is no current intention for these liabilities to be called.

During the year ended 31 December 2019 as part of a transaction to hedge the

company against exchange effects of the foreign currency loan, an amount

corresponding to the $USD value was loaned by British & American Investment

Trust PLC to Second BritAm Investments Limited. As a result of this, and other

related intercompany transactions, GBP2,860,000 of amounts previously guaranteed

became an asset of the company and the provision brought forward against this

has been transferred to become an allowance against doubtful debt. During the

period to 30 June 2020, an allowance against doubtful debt has increased by GBP

230,000.

8. Related party transactions

Romulus Films Limited and Remus Films Limited have significant shareholdings in

the company: 6,902,812 (27.6%) ordinary shares held by Romulus Films Limited

and 7,868,750 (31.5%) ordinary shares held by Remus Films Limited). Romulus

Films Limited also holds 10,000,000 cumulative convertible preference shares.

The company rents its offices from Romulus Films Limited, and is also charged

for its office overheads. During the period the company paid GBP15,000 (30 June

2019 - GBP17,000 and 31 December 2019 - GBP33,000) in respect of those services.

The salaries and pensions of the company's employees, except for the three

non-executive directors and one employee, are paid by Remus Films Limited and

Romulus Films Limited and are recharged to the company. Amounts charged by

these companies in the period to 30 June 2020 were GBP186,000 (30 June 2019 - GBP

179,000 and 31 December 2019 - GBP380,000) in respect of salary costs and GBP23,000

(30 June 2019 - GBP23,000 and 31 December 2019 - GBP41,000) in respect of pensions.

At the period end an amount of GBP804,000 (30 June 2019 - GBP876,000 and 31

December 2019 - GBP390,000) was due to Romulus Films Limited and GBP321,000 (30

June 2019 - GBP560,000 and 31 December 2019 - GBP154,000) was due to Remus Films

Limited.

During the period subsidiary BritAm Investments Limited paid dividends of GBP

1,066,000 (30 June 2019 - GBPnil and 31 December 2019 - GBP74,000) to the parent

company, British & American Investment Trust PLC.

British & American Investment Trust PLC has guaranteed the liabilities of GBP

3,312,000 (30 June 2019 - GBP6,269,000 and 31 December 2019 - GBP3,375,000) due

from Second BritAm Investments Limited to its fellow subsidiaries if they

should fall due.

During the period the company paid interest of GBP18,000 (30 June 2019 - GBPnil and

31 December 2019 - GBP5,000) on the loan due to BritAm Investments Limited.

During the period the company received interest of GBP13,000 (30 June 2019 - GBP

8,000 and 31 December 2019 - GBP20,000) from British & American Films Limited, GBP

30,000 (30 June 2019 - GBP2,000 and 31 December 2019 - GBP17,000) from Second

BritAm Investments Limited and GBPnil (30 June 2019 - GBP19,000 and 31 December

2019 - GBPnil) from BritAm Investments Limited.

During the period the company entered into investment transaction to sell stock

for GBP456,000 to BritAm Investments Limited (30 June 2019 - GBPnil and 31 December

2019 - GBPnil).

All transactions with subsidiaries were made on an arm's length basis.

9. Retained earnings

The table below shows the movement in the retained earnings analysed between

revenue and capital items.

Capital Retained

reserve earnings

GBP'000 GBP'000

1 January 2020 (28,606) 110

Allocation of profit for the period 382 1,002

Ordinary and preference dividends paid - -

_________ _________

At 30 June 2020 (28,224) 1,112

_______ _______

The capital reserve includes GBP5,333,000 of investment holding losses (30 June

2019 - GBP7,255,000 loss, 31 December 2019 - GBP7,418,000 loss).

10. Financial instruments

Financial instruments carried at fair value

All investments are carried at fair value. Other financial assets and

liabilities of the company are held at amounts that approximate to fair value.

The book value of cash at bank and bank loans included in these financial

statements approximate to fair value because of their short-term maturity.

Fair value hierarchy

The table below analyses recurring fair value measurements for financial assets

and financial liabilities.

These fair value measurements are categorised into different levels in the fair

value hierarchy based on the inputs to valuation techniques used. The different

levels are defined as follows:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or

liabilities that the company can access at the measurement date.

Level 2: Inputs other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly or indirectly:

1. Prices of recent transactions for identical instruments.

2. Valuation techniques using observable market data.

Level 3: Unobservable inputs for the asset or liability.

Financial assets and financial liabilities Level 2 Level 3 Total

at fair value through profit or loss at 30 Level 1 GBP'000 GBP'000 GBP'000

June 2020 GBP

'000

Investments:

Investments held at fair value through 6,803 - 1 6,804

profit or loss

Subsidiary held at fair value through - - 5,822 5,822

profit or loss

Total financial assets and liabilities 6,803 - 5,823 12,626

carried at fair value

With the exception of the Sarossa Capital, BritAm Investments Limited (unquoted

subsidiary) and Second BritAm Investments Limited (unquoted subsidiary), which

are categorised as Level 3, all other investments are categorised as Level 1.

Fair Value Assets in Level 3

The following table shows the reconciliation from the opening balances to the

closing balances for fair value measurement in Level 3 of the fair value

hierarchy.

Level 3

GBP'000

Opening fair value at 1 January 2020 5,336

Purchases -

Sales proceeds -

Gains on sales -

Investment holding gains 487

Closing fair value at 30 June 2020 5,823

Subsidiaries

The fair value of the subsidiaries is determined to be equal to the net asset

values of the subsidiaries at year end plus the uplift in the revaluation of

film rights in British & American Films Limited, a subsidiary of BritAm

Investments Limited.

The fair value of the film rights have been determined by estimating the

present value of the pre-tax film revenues in the next 10 years discounted at a

discount rate of 5%. The directors' valuation of British & American Films

Limited has been based on pre-tax profits as sufficient group relief exists to

mitigate the tax effect.

There have been no transfers between levels of the fair value hierarchy during

the period. Transfers between levels of fair value hierarchy are deemed to have

occurred at the date of the event or change in circumstances that caused the

transfer.

11. Financial information

The financial information contained in this report does not constitute

statutory accounts as defined in Section 435 of the Companies Act 2006. The

financial information for the period ended 30 June 2020 and 30 June 2019 have

not been audited by the Company's Auditor pursuant to the Auditing Practices

Board guidance. The information for the year to 31 December 2019 has been

extracted from the latest published Annual Report and Financial Statements,

which have been lodged with the Registrar of Companies, contained an

unqualified auditors' report and did not contain a statement required under

Section 498(2) or (3) of the Companies Act 2006.

DIRECTORS' STATEMENT

Principal risks and uncertainties

The principal risks and uncertainties faced by the company continue to be as

described in the previous annual accounts. Further information on each of these

areas, together with the risks associated with the company's financial

instruments are shown in the Directors' Report and notes to the financial

statements within the Annual Report and Accounts for the year ended 31 December

2019.

The Chairman's Statement and Managing Director's report include commentary on

the main factors affecting the investment portfolio during the period and the

outlook for the remainder of the year.

Directors' Responsibilities Statement

The Directors are responsible for preparing the half-yearly report in

accordance with applicable law and regulations. The Directors confirm that to

the best of their knowledge the interim financial statements, within the

half-yearly report, have been prepared in accordance with IAS 34 'Interim

Financial Reporting'. The Directors are required to prepare the financial

statements on the going concern basis unless it is inappropriate to presume

that the company will continue in business. The Directors further confirm that

the Chairman's Statement and Managing Director's Report includes a fair review

of the information required by 4.2.7R and 4.2.8R of the FCA's Disclosure and

Transparency Rules.

The Directors of the company are listed in the section preceding the Chairman's

Statement.

The half-yearly report was approved by the Board on 30 October 2020 and the

above responsibility statement was signed on its behalf by:

Jonathan C Woolf

Managing Director

Independent review report to the members of British & American Investment Trust

PLC

Introduction

We have been engaged by the company to review the condensed set of financial

statements in the half-yearly financial report of British & American Investment

Trust PLC for the six months ended 30 June 2020 which comprises the Condensed

Income Statement, the Condensed Statement of Changes in Equity, the Condensed

Balance Sheet, the Condensed Cashflow Statement and related Notes to the

Company results. We have read the other information contained in the

half-yearly financial report being the Financial Highlights, the Chairman's

Statement, the Managing Director's Report, the Investment Portfolio and the

Directors' Statement, and considered whether it contains any apparent

misstatements or material inconsistencies with the information in the condensed

set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been

approved by, the directors. The directors are responsible for preparing the

half-yearly financial report in accordance with the Disclosure and Transparency

Rules of the United Kingdom's Financial Conduct Authority.

As disclosed in note 1, the annual financial statements of the company are

prepared in accordance with International Financial Reporting Standards as

adopted by the European Union. The condensed set of financial statements

included in this half-yearly financial report has been prepared in accordance

with International Accounting Standard 34, 'Interim Financial Reporting', as

adopted by the European Union.

Our responsibility

Our responsibility is to express a conclusion on the condensed set of financial

statements in the half-yearly financial report based on our review.

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, 'Review of Interim Financial Information

Performed by the Independent Auditor of the Entity' issued by the Auditing

Practices Board for use in the United Kingdom. A review of interim financial

information consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK) and consequently does

not enable us to obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do not express an

audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to

believe that the condensed set of financial statements in the half-yearly

financial report for the six months ended 30 June 2020 is not prepared, in all

material respects, in accordance with International Accounting Standard 34,

'Interim Financial Reporting', as adopted by the European Union and the

Disclosure and Transparency Rules of the United Kingdom's Financial Conduct

Authority.

Use of our report

This report is made solely to the company, in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of Interim

Financial Information performed by the Independent Auditor of the Entity'

issued by the Auditing Practices Board. Our review work has been undertaken so

that we might state to the company those matters we are required to state to it

in an independent review report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to anyone other

than the company for our review work, for this report, or for the conclusion we

have formed.

HAZLEWOODS LLP

AUDITOR

Cheltenham

30 October 2020

END

(END) Dow Jones Newswires

October 30, 2020 07:59 ET (11:59 GMT)

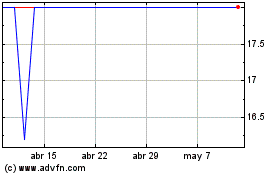

British & American Inves... (LSE:BAF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

British & American Inves... (LSE:BAF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024