TIDMBIDS

RNS Number : 0078E

Bidstack Group PLC

02 July 2021

NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF

AMERICA, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR

ANY OTHER JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE RETAINED VERSION OF EU REGULATION 596/2014 AS

APPLIED IN THE UK ("MAR").

2 July 2021

Bidstack Group Plc

("Bidstack" or the "Company")

Results of Fundraise

Bidstack Group Plc (AIM: BIDS), the native in-game advertising

group, is pleased to announce the results of the placing

("Placing") undertaken by Cenkos Securites Plc ("Cenkos") as agent

of the Company and the subscription ("Subscription") (together the

"Fundraise") announced on 1 July 2021.

In aggregate the Company has conditionally raised gross proceeds

of a GBP10.863 million (before expenses) comprised as set out

below.

A total of 488,157,516 new ordinary shares of 0.5 pence each in

the capital of the Company (the "New Ordinary Shares") were placed

by Cenkos with institutional and other investors at a price of 2.0

pence per Placing Share (the "Issue Price"), raising gross proceeds

of a GBP9.763 million.

Certain directors of the Company and others have also subscribed

for a total of 55,000,000 New Ordinary Shares at the Issue Price

raising further gross proceeds of GBP1.1 million.

At least GBP3.2 million of the Placing has been raised under the

Enterprise Investment Scheme and/or from Venture Capital

Trusts.

The New Ordinary Shares being issued represent, in aggregate,

circa 139.85 per cent. of Bidstack's issued ordinary share capital

immediately prior to the Fundraise.

The Fundraise is conditional on the approval by Shareholders of

resolutions granting authority for the Directors to issue the New

Ordinary Shares free of statutory pre-emption rights

("Resolutions") at a General Meeting to be held at 11:00 a.m. on 19

July 2021 at Plexal, 14 East Bay Lane, The Press Centre, Here East,

Queen Elizabeth Olympic Park, Stratford, London, E20 3BS ("General

Meeting"). A circular containing a notice convening the General

Meeting is expected to be issued by the Company today.

The New Ordinary Shares will, when issued, be subject to the

Company's articles of association. They will be credited as fully

paid and will rank pari passu in all respects with the existing

ordinary shares in issue in the capital of the Company, including

the right to receive all future dividends and distributions

declared, made or paid on or in respect of such ordinary shares by

reference to a record date falling after their date of issue.

The Fundraise is conditional upon, inter alia:

-- shareholder approval of the Resolutions at the General Meeting; and

-- Admission becoming effective not later than 8.00 a.m. (London

time) on 20 July 2021 (or such later time and/or date, being not

later than 8.00 a.m. (London time) on 31 July 2021, as Cenkos may

agree with the Company) and the Placing Agreement not being

terminated in accordance with its terms before that time.

Application will be made for the New Ordinary Shares to be

admitted to trading on AIM ("Admission"). Admission is expected to

become effective and trading will commence in the New Ordinary

Shares at 8 a.m. on or around 20 July 2021.

As part of the Subscription Donald Stewart, Chairman of

Bidstack, has subscribed for 1,500,000 New Ordinary Shares, John

McIntosh, Director, has subscribed for 1,000,000 New Ordinary, Lisa

Hau, Director, has subscribed for 1,000,000 New Ordinary Shares and

Bryan Neider, proposed non-Executive Director, has subscribed for

750,000 New Ordinary Shares. Following the Fundraise the holdings

of the Directors will be as follows:

Total number Proportion

Existing number Number of of Ordinary of the Enlarged

of Ordinary New Ordinary Shares following Share Capital

Director Shares Shares the Fundraise (%)

Donald Stewart 2,024,876 1,500,000 3,524,876 0.38%

James Draper 39,760,562 - 39,760,562 4.27%

Francesco Petruzzelli 5,750,000 - 5,750,000 0.62%

John McIntosh 950,000 1,000,000 1,950,000 0.21%

Lisa Hau 125,000 1,000,000 1,125,000 0.12%

Glen Calvert - - - -%

Bryan Neider - 750,000 750,000 0.08%

Total: 48,610,438 4,250,000 52,860,438 5.68%

Total Voting Rights

Following Admission becoming effective, the total number of

voting rights in the Company will be 931,531,573. No ordinary

shares of the Company are held in treasury. This figure may be used

by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

Capitalised terms used but not defined in this announcement have

the same meanings as set out in the Fundraise announcement of the

Company released at 5.15 p.m. (BST) on 1 July 2021.

James Draper, Chief Executive Officer, Bidstack commented:

"I would like to thank our existing shareholders for their

continued support and welcome new shareholders to the register. The

new funds raised through this successful and oversubscribed

fundraise will enable Bidstack to progress its growth strategy. We

look forward to updating shareholders on our continued progress in

due course."

Contacts

Bidstack Group Plc

James Draper, CEO via Buchanan

Cenkos Securities Plc (Bookrunner & joint

broker) +44 (0) 20 7397

Michael Johnson / Dale Bellis (Sales) 1933 / +44 (0) 20

7397 1928

Giles Balleny (Corporate Finance) (0) 207 397 8951

SPARK Advisory Partners Limited (Nomad) +44 (0) 203 368

Mark Brady / Neil Baldwin / James Keeshan 3550

Stifel Nicholas Europe Limited (Joint

Broker) +44 (0) 20 7710

Fred Walsh / Luisa Orsini Baroni 7600

Buchanan Communications Limited

Chris Lane / Stephanie Watson / Kim van

Beeck +44 (0) 20 7466

bidstack@buchanan.uk.com 5000

IMPORTANT NOTICE

Neither this Announcement, nor any copy of it, may be taken or

transmitted, published or distributed, directly or indirectly, in

or into the United States, Australia, Canada, Japan, or the

Republic of South Africa or to any persons in any of those

jurisdictions or any other jurisdiction where to do so would

constitute a violation of the relevant securities laws of such

jurisdiction. This Announcement is for information purposes only

and does not constitute an offer to sell or issue, or the

solicitation of an offer to buy, acquire or subscribe for any

shares in the capital of the Company in the United States,

Australia, Canada, Japan or the Republic of South Africa or any

other state or jurisdiction in which such offer or solicitation is

not authorised or to any person to whom it is unlawful to make such

offer or solicitation. Any failure to comply with these

restrictions may constitute a violation of securities laws of such

jurisdictions.

The Placing Shares and the Subscription Shares have not been,

and will not be, registered under the US Securities Act of 1933, as

amended (the "US Securities Act"), or under any securities laws of

any state or other jurisdiction of the United States and may not be

offered, sold, resold, transferred or delivered, directly or

indirectly, in or into the United States except pursuant to an

applicable exemption from the registration requirements of the US

Securities Act and in compliance with the securities laws of any

state or other jurisdiction of the United States. There is no

intention to register any portion of the Placing or the

Subscription in the United States or to conduct any public offering

of securities in the United States or elsewhere.

Notice to all investors - disclaimers

Cenkos Securities Plc ("Cenkos") is authorised and regulated in

the United Kingdom by the FCA. Cenkos is acting exclusively as

joint broker and bookrunner to the Company in connection with the

Placing and will not regard any other person (whether or not a

recipient of this Announcement) as a client in relation to the

Placing and will not be responsible to anyone other than the

Company for providing the protections afforded to their respective

clients or for providing advice in relation to the Placing or any

transaction, matter or arrangement described in this

announcement.

SPARK Advisory Partners Limited ("SPARK"), which is authorised

and regulated in the United Kingdom by the Financial Conduct

Authority, is acting as nominated adviser to the Company in

relation to the Fundraise and is not acting for any other persons

in relation to the Fundraise. SPARK Advisory Partners Limited is

acting exclusively for the Company and for no one else in relation

to the matters described in this announcement and is not advising

any other person and accordingly will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of SPARK Advisory Partners Limited, or for providing advice

in relation to the contents of this announcement or any matter

referred to in it.

Apart from the responsibilities and liabilities, if any, which

may be imposed upon Cenkos and SPARK by the Financial Services and

Markets Act 2000, as amended ("FSMA") or the regulatory regime

established thereunder, neither Cenkos nor SPARK nor any of their

affiliates, directors, officers, employees, agents or advisers

accepts any responsibility whatsoever, and no representation or

warranty, express or implied, is made or purported to be made by

any of them, or on their behalf, for or in respect of the contents

of this Announcement, including its accuracy, completeness,

verification or sufficiency, or concerning any other document or

statement made or purported to be made by it, or on its behalf, in

connection with the Company, the New Ordinary Shares, the Placing

and the Subscription, and nothing in this announcement is, or shall

be relied upon as, a warranty or representation in this respect,

whether as to the past or future. Each of Cenkos and SPARK and

their affiliates, directors, officers, employees, agents and

advisers disclaim, to the fullest extent permitted by law, all and

any liability whether arising in tort, contract or otherwise which

they might otherwise be found to have in respect of this

announcement or any such statement.

No person has been authorised to give any information or to make

any representations other than those contained in this Announcement

and, if given or made, such information or representations must not

be relied on as having been authorised by the Company or Cenkos or

SPARK. Subject to the AIM Rules, the Prospectus Regulation Rules

and the Disclosure Guidance and Transparency Rules of the FCA, the

issue of this Announcement shall not, in any circumstances, create

any implication that there has been no change in the affairs of the

Company since the date of this Announcement or that the information

in it is correct as at any subsequent date.

Information to Distributors

Solely for the purposes of Article 9(8) of Commission Delegated

Directive 2017/593 (the "Delegated Directive") regarding the

responsibilities of manufacturers under the product governance

requirements contained within: (a) EU Directive 2014/65/EU on

markets in financial instruments, as amended ("MiFID II"); (b)

Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593

supplementing MiFID II; and (c) local implementing measures

(together, the "MiFID II Product Governance Requirements"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the MiFID II Product Governance Requirements) may otherwise have

with respect thereto, the Placing Shares have been subject to a

product approval process, which has determined that such Placing

Shares are: (i) compatible with the target market for the Placing

of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined

in MiFID II; and (ii) eligible for distribution through all

eligible distribution channels for dissemination of the Placing

Shares, each as set out in this Announcement, as are permitted by

MiFID II (the "Target Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Placing. Furthermore, it is noted that, notwithstanding the

Target Market Assessment, the Joint Bookrunners will only procure

investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIUPUQWMUPGURP

(END) Dow Jones Newswires

July 02, 2021 04:38 ET (08:38 GMT)

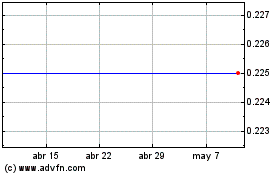

Bidstack (LSE:BIDS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Bidstack (LSE:BIDS)

Gráfica de Acción Histórica

De May 2023 a May 2024