Acme United Corporation (NYSE American: ACU) today announced that

net sales for the quarter ended March 31, 2024 were $45.0 million

compared to $45.8 million for the quarter ended March 31, 2023, a

decrease of 2%. Excluding the impact of the Camillus and Cuda

hunting and fishing product lines sold on November 1, 2023, sales

for the first quarter of 2024 increased 1% compared to the first

quarter of 2023.

Net income was $1.6 million, or $0.39 per

diluted share, for the quarter ended March 31, 2024, compared to

$1.0 million, or $0.28 per diluted share, for the comparable period

last year, an increase of 65% in net income and 39% in diluted

earnings per share.

Chairman and CEO Walter C. Johnsen said, “Acme United had very

strong earnings in the first quarter due to productivity

improvements in manufacturing and distribution. We also experienced

reduced inbound shipping costs and lowered our selling and general

expenses.”

Mr. Johnsen added, “Although the sale of our Cuda and Camillus

lines in November reduced revenues, we are generating new revenues

under initiatives in our principal business lines. These

initiatives include additional distribution of first aid kits and

components in the hardware and drug store markets, new craft and

cutting tool planograms in the mass market, additional sales of

spill clean-up products to large mass market retailers, and new

sharpening tools for the kitchen.”

Mr. Johnsen added, “We intend to continue and expand these

initiatives and I am excited about the sales growth that we

anticipate in the coming quarters.”

For the first quarter of 2024, net sales in the

U.S. segment declined 2% compared to the same period in 2023.

Excluding Camillus and Cuda, sales for the first quarter of 2024

increased 1% compared to the first quarter of 2023.

European net sales for the first quarter of 2024

increased 5% in U.S. dollars and 4% in local currency compared to

the first quarter of 2023. Excluding Camillus and Cuda, sales for

the first quarter of 2024 increased 7% in local currency compared

to the first quarter of 2023.

Net sales in Canada for the first quarter of

2024 decreased 7% in U.S. dollars and 6% in local currency compared

to the same period in 2023. Excluding Camillus and Cuda, sales for

the first quarter of 2024 increased 1% in local currency compared

to the first quarter of 2023.

Gross margin was 38.7% in the first quarter of

2024 versus 35.5% in the comparable period last year. The increase

was primarily due to the continuing impact of productivity

improvements implemented late in 2022.

The Company’s bank debt less cash on March 31,

2024 was $31.5 million compared to $48.4 million on March 31, 2023.

During the twelve-month period ended March 31, 2024, the Company

paid $2.1 million in dividends on its common stock and generated

approximately $5.4 million in free cash flow. Additionally, the net

proceeds from the sale of the Camillus and Cuda product lines

amounted to approximately $13.0 million.

Conference Call and Webcast

InformationAcme United will hold a conference call to

discuss its quarterly results, which will be broadcast on Friday,

April 19, 2024, at 12:00 p.m. ET. To listen or participate in a

question and answer session, dial 877-407-0784. International

callers may dial 201-689-8560. The confirmation code is 13745527.

You may access the live webcast of the conference call through the

Investor Relations section of the Company’s website,

www.acmeunited.com. A replay may be accessed under Investor

Relations, Audio Archives.

About Acme UnitedACME UNITED

CORPORATION is a leading worldwide supplier of innovative

safety solutions and cutting technology to the school, home,

office, hardware, sporting goods and industrial markets. Its

leading brands include First Aid Only®, First Aid Central®,

PhysiciansCare®, Pac-Kit®, Spill Magic®, Westcott®, Clauss®, DMT®,

Med-Nap and Safety Made. For more information, visit

www.acmeunited.com.

Forward Looking StatementsThe Company may from

time to time make written or oral “forward-looking statements”

including statements contained in this report and in other

communications by the Company, which are made in good faith

pursuant to the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. Such statements are based on our

beliefs as well as assumptions made by and information currently

available to us. When used in this document, words like “may,”

“might,” “will,” “except,” “anticipate,” “believe,” “potential,”

and similar expressions are intended to identify forward-looking

statements. Actual results could differ materially from our current

expectations.

Forward-looking statements in this report, including without

limitation, statements related to the Company’s plans, strategies,

objectives, expectations, intentions and adequacy of resources, are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Investors are cautioned

that such forward-looking statements involve risks and

uncertainties that may impact the Company’s business, operations

and financial results.

These risks and uncertainties include, without limitation, the

following: (i) changes in the Company’s plans, strategies,

objectives, expectations and intentions, which may be made at any

time at the discretion of the Company; (ii) the impact of

uncertainties in global economic conditions, including the impact

on the Company’s suppliers and customers; (iii) the continuing

adverse impact of inflation, including product costs, and interest

rates; (iv) potential adverse effects on the Company, its

customers, and suppliers resulting from the conflicts in Ukraine

and the Middle East; (v) additional disruptions in the Company’s

supply chains, whether caused by pandemics, natural disasters,

including trucker shortages, port closures or otherwise; (vi) labor

related costs the Company has and may continue to incur, including

costs of acquiring and training new employees and rising wages and

benefits; (vii) currency fluctuations including, for example, the

fluctuation of the dollar against the euro; (viii) the Company’s

ability to effectively manage its inventory in a rapidly changing

business environment; (ix) changes in client needs and consumer

spending habits; (x) the impact of competition; (xi) the impact of

technological changes including, specifically, the growth of online

marketing and sales activity; (xii) the Company’s ability to manage

its growth effectively, including its ability to successfully

integrate any business it might acquire; (xiii) international trade

policies and their impact on demand for our products and our

competitive position, including the imposition of new tariffs or

changes in existing tariff rates; and (xiv) other risks and

uncertainties indicated from time to time in the Company’s filings

with the Securities and Exchange Commission.

|

ACME UNITED CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

|

FIRST QUARTER REPORT 2024 |

|

(Unaudited) |

| |

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Amounts in 000's except per share data |

March 31, 2024 |

|

March 31, 2023 |

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Net sales |

$ |

44,956 |

|

|

$ |

45,838 |

|

| Cost of goods

sold |

|

27,560 |

|

|

|

29,557 |

|

| Gross

profit |

|

17,396 |

|

|

|

16,281 |

|

| Selling, general and

administrative expenses |

|

14,838 |

|

|

|

14,093 |

|

| Operating

income |

|

2,558 |

|

|

|

2,188 |

|

| Interest

expense |

|

476 |

|

|

|

919 |

|

| Interest

income |

|

(33 |

) |

|

|

(17 |

) |

|

Net interest expense |

|

443 |

|

|

|

902 |

|

| Other income,

net |

|

(44 |

) |

|

|

(23 |

) |

| Income before income

tax expense |

|

2,159 |

|

|

|

1,309 |

|

| Income tax

expense |

|

523 |

|

|

|

319 |

|

| Net

income |

$ |

1,636 |

|

|

$ |

990 |

|

| |

|

|

|

|

|

|

Shares outstanding - basic |

|

3,650 |

|

|

|

3,541 |

|

|

Shares outstanding - diluted |

|

4,213 |

|

|

|

3,541 |

|

| |

|

|

|

|

|

| Earnings per share -

basic |

$ |

0.45 |

|

|

$ |

0.28 |

|

| Earnings per share -

diluted |

|

0.39 |

|

|

|

0.28 |

|

| |

|

|

|

|

|

|

|

|

ACME UNITED CORPORATION |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

FIRST QUARTER REPORT 2024 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| Amounts in

$000's |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

March 31, 2024 |

|

March 31, 2023 |

| Assets |

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

2,443 |

|

|

$ |

2,764 |

|

|

Accounts receivable, net |

|

32,966 |

|

|

|

32,972 |

|

|

Inventories |

|

56,887 |

|

|

|

58,488 |

|

|

Prepaid expenses and other current assets |

|

6,110 |

|

|

|

4,960 |

|

| Total current

assets |

|

98,406 |

|

|

|

99,184 |

|

| |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

28,860 |

|

|

|

26,397 |

|

|

Operating lease right of use asset |

|

5,530 |

|

|

|

2,675 |

|

|

Intangible assets, less accumulated

amortization |

|

18,396 |

|

|

|

20,273 |

|

|

Goodwill |

|

8,189 |

|

|

|

8,189 |

|

|

Other assets |

|

- |

|

|

|

750 |

|

| Total

assets |

$ |

159,381 |

|

|

$ |

157,468 |

|

| |

|

|

|

|

|

|

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

7,907 |

|

|

$ |

10,597 |

|

|

Operating lease liability - short term |

|

1,599 |

|

|

|

1,216 |

|

|

Mortgage payable - short term |

|

424 |

|

|

|

405 |

|

|

Other current liabilities |

|

11,931 |

|

|

|

11,815 |

|

| Total current

liabilities |

|

21,861 |

|

|

|

24,033 |

|

| |

|

|

|

|

|

|

|

|

Long-term debt |

|

23,294 |

|

|

|

40,135 |

|

|

Mortgage payable - long term |

|

10,179 |

|

|

|

10,597 |

|

|

Operating lease liability - long term |

|

4,041 |

|

|

|

1,628 |

|

|

Other non-current liabilities |

|

914 |

|

|

|

959 |

|

| Total

liabilities |

|

60,289 |

|

|

|

74,352 |

|

| Total stockholders'

equity |

|

99,092 |

|

|

|

80,116 |

|

| Total liabilities and

stockholders' equity |

$ |

159,381 |

|

|

$ |

157,468 |

|

| |

|

|

|

|

|

|

|

|

CONTACT: |

|

Paul G. Driscoll |

|

Acme United CorporationPhone: (203) 254-6060 |

|

1 Waterview Drive |

|

Shelton, CT 06484 |

|

|

|

|

|

|

|

|

|

|

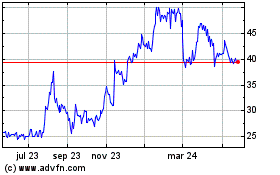

Acme United (AMEX:ACU)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

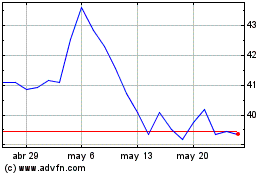

Acme United (AMEX:ACU)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025