false000000209800000020982024-10-182024-10-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): October 18, 2024

ACME UNITED CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

Connecticut |

001-07698 |

06-0236700 |

(State or other jurisdiction of incorporation or organization) |

(Commission file number) |

(I.R.S. Employer Identification No.) |

1 Waterview Dr, Shelton, Connecticut |

|

06484 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (203) 254-6060

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $2.50 par value per share |

|

ACU |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On October 18, 2024, Acme United Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this current report.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(c) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

ACME UNITED CORPORATION |

|

|

|

By |

/s/ Walter C. Johnsen |

|

|

Walter C. Johnsen |

|

|

Chairman and |

|

|

Chief Executive Officer |

|

|

|

|

Dated: October 18, 2024 |

|

|

|

|

|

|

|

|

|

By |

/s/ Paul G. Driscoll |

|

|

Paul G. Driscoll |

|

|

Vice President and |

|

|

Chief Financial Officer |

|

|

|

|

Dated: October 18, 2024 |

ACME UNITED CORPORATION NEWS RELEASE

CONTACT: Paul G. Driscoll Acme United Corporation 1 Waterview Drive Shelton, CT 06484

Phone: (203) 254-6060

FOR IMMEDIATE RELEASE October 18, 2024

ACME UNITED REPORTS 3% INCREASE IN NET INCOME FOR

THIRD QUARTER OF 2024

SHELTON, CT – October 18, 2024 – Acme United Corporation (NYSE American: ACU) today announced that net sales for the quarter ended September 30, 2024 were $48.2 million compared to $50.4 million in the third quarter of 2023, a decrease of 4%. Excluding the impact of the Camillus and Cuda hunting and fishing product lines sold on November 1, 2023, net sales for the third quarter of 2024 increased 4% compared to the third quarter of 2023. Net sales for the nine months ended September 30, 2024 were $148.5 million compared to $149.6 million in the same period in 2023, a decrease of 1%. Excluding Camillus and Cuda, net sales for the nine months increased 5% compared to the same period in 2023.

Net income was $2.23 million, or $0.54 per diluted share, for the quarter ended September 30, 2024 compared to $2.15 million, or $0.58 per diluted share, for the same period in 2023, an increase of 3% in net income and a decrease of 7% in diluted earnings per share. Net income for the nine months ended September 30, 2024 was $8.31 million, or $2.03 per diluted share, compared to $6.59 million, or $1.83 per diluted share, for the same period in 2023, an increase of 26% in net income and 11% in diluted earnings per share.

Chairman and CEO Walter C. Johnsen said, “After a strong performance in the first half of 2024, sales of first aid products in the U.S. were soft in the third quarter due to customer timing and market conditions. Sales of our Westcott cutting tools and DMT sharpeners continued to be strong in the quarter, with increased placement in large mass market accounts.”

“During the quarter, we introduced the latest generation of industrial first aid kits with patented automatic replenishment capabilities. The use and expiration of components

in the kits are now monitored in real time, allowing the customer to order replacements automatically. First aid units with these capabilities facilitate compliance with OSHA, ANSI, and other regulations.”

For the three months ended September 30, 2024, net sales in the U.S. segment decreased 6% compared to the same period in 2023. Excluding Camillus and Cuda, net sales for the third quarter of 2024 increased 3% compared to the third quarter of 2023. For the nine months ended September 30, 2024, net sales in the U.S. segment decreased 1% compared to the same period in 2023. Excluding Camillus and Cuda, net sales for the nine months increased 5% compared to the same period in 2023. The sales increase for the nine-month period was due to market share gains across multiple product lines.

European net sales for the three months ended September 30, 2024 increased 10% in both U.S. dollars and local currency compared to the third quarter of 2023. Excluding Camillus and Cuda, net sales for the third quarter of 2024 increased 15% compared to the third quarter of 2023. Net sales for the nine months ended September 30, 2024 increased 6% in both U.S. dollars and local currency compared to the first nine months of 2023. Excluding Camillus and Cuda, net sales for the nine months increased 10% compared to the same period in 2023. The sales increase for both periods was due to market share gains in the office channel.

Net sales in Canada for the three months ended September 30, 2024 decreased 1% in U.S. dollars but increased 2% in local currency compared to the same period in 2023. Excluding Camillus and Cuda, net sales for the third quarter of 2024 increased 6% compared to the third quarter of 2023. Net sales for the nine months ended September 30, 2024 decreased 5% in U.S. dollars and 4% in local currency compared to the first nine months of 2023. Excluding Camillus and Cuda, net sales for the nine months were constant compared to the same period in 2023. Sales of first aid products were strong, however sales of school and office products continued to be adversely impacted by a soft economy.

Gross margin was 38.5% in the three months ended September 30, 2024 versus 38.7% in the comparable period last year. Gross margin was 39.4% for the nine-month period ended September 30, 2024 compared to 37.3% for the same period in 2023. The increase in the

nine-month period was primarily due to productivity improvements in the Company’s manufacturing and distribution facilities.

The Company’s bank debt less cash as of September 30, 2024 was $26.7 million compared to $38.2 million as of September 30, 2023. During the twelve-month period ended September 30, 2024, the Company paid approximately $6.1 million for the acquisition of the assets of Elite First Aid Inc., distributed $2.2 million in dividends on its common stock and generated approximately $6.2 million in free cash flow. Additionally, the Company realized net proceeds from the sale of the Camillus and Cuda product lines of approximately $13.0 million.

Conference Call and Webcast Information

Acme United will hold a conference call to discuss its quarterly results, which will be broadcast on Friday, October 18, 2024, at 12:00 p.m. ET. To listen or participate in a question and answer session, dial 877-407-0784. International callers may dial 201-689-8560. The confirmation code is 13748799. You may access the live webcast of the conference call through the Investor Relations section of the Company’s website, www.acmeunited.com. A replay may be accessed under Investor Relations, Audio Archives.

About Acme United

ACME UNITED CORPORATION is a leading worldwide supplier of innovative safety solutions and cutting technology to the school, home, office, hardware, sporting goods and industrial markets. Its leading brands include First Aid Only®, First Aid Central®, PhysiciansCare®, Pac-Kit®, Spill Magic®, Westcott®, Clauss®, DMT®, Med-Nap and Elite First Aid. For more information, visit www.acmeunited.com.

Forward Looking Statements

The Company may from time to time make written or oral “forward-looking statements” including statements contained in this report and in other communications by the Company, which are made in good faith pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements are based on our beliefs as well as assumptions made by and information currently available to us. When used in this document, words like “may,” “might,” “will,” “except,” “anticipate,” “believe,”

“potential,” and similar expressions are intended to identify forward-looking statements. Actual results could differ materially from our current expectations.

Forward-looking statements in this report, including without limitation, statements related to the Company’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties that may impact the Company’s business, operations and financial results.

These risks and uncertainties include, without limitation, the following: (i) changes in the Company’s plans, strategies, objectives, expectations and intentions, which may be made at any time at the discretion of the Company; (ii) the impact of uncertainties in global economic conditions, including the impact on the Company’s suppliers and customers; (iii) the continuing adverse impact of inflation, including product costs, and interest rates; (iv) potential adverse effects on the Company, its customers, and suppliers resulting from the conflicts in Ukraine and the Middle East; (v) additional disruptions in the Company’s supply chains, whether caused by pandemics, natural disasters, including trucker shortages, strikes, port closures or otherwise; (vi) labor related costs the Company has and may continue to incur, including costs of acquiring and training new employees and rising wages and benefits; (vii) currency; (viii) the Company’s ability to effectively manage its inventory in a rapidly changing business environment; (ix) changes in client needs and consumer spending habits; (x) the impact of competition; (xi) the impact of technological changes including, specifically, the growth of online marketing and sales activity; (xii) the Company’s ability to manage its growth effectively, including its ability to successfully integrate any business it might acquire; (xiii) international trade policies and their impact on demand for our products and our competitive position, including the imposition of new tariffs or changes in existing tariff rates; and (xiv) other risks and uncertainties indicated from time to time in the Company’s filings with the Securities and Exchange Commission.

# # #

|

|

|

|

|

|

|

|

|

ACME UNITED CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

|

THIRD QUARTER REPORT 2024 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

Amounts in 000's except per share data |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

48,166 |

|

|

$ |

50,384 |

|

Cost of goods sold |

|

|

29,602 |

|

|

|

30,881 |

|

Gross profit |

|

|

18,564 |

|

|

|

19,503 |

|

Selling, general, and administrative expenses |

|

|

15,638 |

|

|

|

15,846 |

|

Operating income |

|

|

2,926 |

|

|

|

3,657 |

|

Interest expense |

|

|

568 |

|

|

|

816 |

|

Interest income |

|

|

(33 |

) |

|

|

(32 |

) |

Interest expense, net |

|

|

535 |

|

|

|

784 |

|

Other (income) expense, net |

|

|

(17 |

) |

|

|

55 |

|

Income before income tax expense |

|

|

2,408 |

|

|

|

2,818 |

|

Income tax expense |

|

|

182 |

|

|

|

666 |

|

Net income |

|

$ |

2,226 |

|

|

$ |

2,152 |

|

|

|

|

|

|

|

|

Shares outstanding - Basic |

|

|

3,726 |

|

|

|

3,578 |

|

Shares outstanding - Diluted |

|

|

4,104 |

|

|

|

3,721 |

|

|

|

|

|

|

|

|

Earnings per share - Basic |

|

$ |

0.60 |

|

|

$ |

0.60 |

|

Earnings per share - Diluted |

|

|

0.54 |

|

|

|

0.58 |

|

|

|

|

|

|

|

|

|

|

ACME UNITED CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

|

THIRD QUARTER REPORT 2024 (cont.) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

Nine Months Ended |

|

Amounts in 000's except per share data |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

|

|

|

|

|

|

Net sales |

|

$ |

148,547 |

|

|

$ |

149,559 |

|

Cost of goods sold |

|

|

89,960 |

|

|

|

93,752 |

|

Gross profit |

|

|

58,587 |

|

|

|

55,807 |

|

Selling, general, and administrative expenses |

|

|

46,728 |

|

|

|

44,711 |

|

Operating income |

|

|

11,859 |

|

|

|

11,096 |

|

Interest expense |

|

|

1,622 |

|

|

|

2,595 |

|

Interest income |

|

|

(105 |

) |

|

|

(78 |

) |

Interest expense, net |

|

|

1,517 |

|

|

|

2,517 |

|

Other (income) expense, net |

|

|

(90 |

) |

|

|

9 |

|

Income before income tax expense |

|

|

10,432 |

|

|

|

8,570 |

|

Income tax expense |

|

|

2,117 |

|

|

|

1,984 |

|

Net income |

|

$ |

8,315 |

|

|

$ |

6,586 |

|

|

|

|

|

|

|

|

Shares outstanding - Basic |

|

|

3,686 |

|

|

|

3,558 |

|

Shares outstanding - Diluted |

|

|

4,087 |

|

|

|

3,596 |

|

|

|

|

|

|

|

|

Earnings per share - Basic |

|

$ |

2.26 |

|

|

$ |

1.85 |

|

Earnings per share - Diluted |

|

|

2.03 |

|

|

|

1.83 |

|

|

|

|

|

|

|

|

|

|

ACME UNITED CORPORATION |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

THIRD QUARTER REPORT 2024 |

|

(Unaudited) |

|

|

|

Amounts in 000's |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,702 |

|

|

$ |

5,567 |

|

Accounts receivable, net |

|

|

31,349 |

|

|

|

33,855 |

|

Inventories |

|

|

55,990 |

|

|

|

54,575 |

|

Prepaid expenses and other current assets |

|

|

5,733 |

|

|

|

3,779 |

|

Restricted cash |

|

|

- |

|

|

|

750 |

|

Total current assets |

|

|

98,774 |

|

|

|

98,526 |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

30,892 |

|

|

|

27,708 |

|

Operating lease right of use asset |

|

|

4,808 |

|

|

|

2,300 |

|

Intangible assets, less accumulated amortization |

|

|

22,810 |

|

|

|

19,546 |

|

Goodwill |

|

|

8,189 |

|

|

|

8,189 |

|

Total assets |

|

$ |

165,473 |

|

|

$ |

156,269 |

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity: |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

7,008 |

|

|

$ |

9,976 |

|

Operating lease liability - short term |

|

|

1,550 |

|

|

|

1,165 |

|

Mortgage payable - short term |

|

|

433 |

|

|

|

415 |

|

Other accrued liabilities |

|

|

13,403 |

|

|

|

13,873 |

|

Total current liabilities |

|

|

22,394 |

|

|

|

25,429 |

|

Long term debt |

|

|

22,018 |

|

|

|

32,934 |

|

Mortgage payable - long term |

|

|

9,970 |

|

|

|

10,393 |

|

Operating lease liability - long term |

|

|

3,357 |

|

|

|

1,279 |

|

Other non-current liabilities |

|

|

1,417 |

|

|

|

328 |

|

Total liabilities |

|

|

59,156 |

|

|

|

70,363 |

|

Total stockholders' equity |

|

|

106,317 |

|

|

|

85,906 |

|

Total liabilities and stockholders' equity |

|

$ |

165,473 |

|

|

$ |

156,269 |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

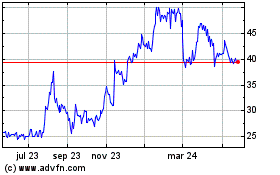

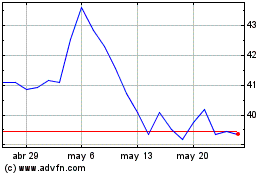

Acme United (AMEX:ACU)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Acme United (AMEX:ACU)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024