Emerson Radio Corp. Reports Fiscal 2014 Third Quarter Results

HACKENSACK, NJ--(Marketwired - Feb 14, 2014) - Emerson Radio

Corp. (NYSEMKT: MSN) today reported financial results for its third

quarter and nine month period ended December 31, 2013.

As reported by the Company in a Form 8-K filed with the SEC on

October 19, 2012, the Company was informed by one its major

customers, that, commencing with the Spring of 2013, this customer

would discontinue purchasing from Emerson two microwave oven

products that had been sold by the Company to this customer.

Emerson continued shipping these two products throughout the

remainder of Fiscal 2013 (the year ended March 31, 2013), with

sales of such products declining through the fourth quarter of

Fiscal 2013. During Fiscal 2013, these two microwave oven products

comprised, in the aggregate, approximately $36.1 million, or 29.7%,

of the Company's net product sales. Emerson anticipates that the

full impact of this customer's decision will be realized by the

Company in Fiscal 2014, which began on April 1, 2013. As previously

disclosed by the Company, the complete loss of, or significant

reduction in, business with either of the Company's key customers

will have a material adverse effect on the Company's business and

results of operations. Accordingly, this customer's decision has

had a material adverse effect on the Company's business and results

of operations in the quarter ended December 31, 2013. There can be

no assurance that the Company will be able to increase sales of any

products at levels sufficient to offset the adverse impact of this

customer's decision, if at all.

As a result of the above, during the third quarter and nine

month periods of fiscal 2014, sales of these two products by the

Company were nil as compared to approximately $8.0 million and

$32.0 million during the third quarter and nine month periods of

fiscal 2013, respectively.

Net revenues for the third quarter of fiscal 2014 were $20.9

million, a decrease of $3.8 million, or 15.4%, as compared to the

third quarter of fiscal 2013 net revenues of $24.7 million. The

decline in year-over-year net revenues was driven by lower

year-over-year net product sales, slightly offset by higher

year-over-year licensing revenues.

Net product sales for the third quarter of fiscal 2014 were

$18.4 million, as compared to $22.6 million for the third quarter

of fiscal 2013, a decrease of $4.2 million, or 18.4%. The lower

year-over-year net product sales were principally driven by a $4.0

million, or 18.4%, decline in net sales of houseware products,

which was the result of lower year-over-year sales of microwave

ovens and wine coolers, partly offset by higher year-over-year

sales of compact refrigerators. Emerson continues to confront

increasing pricing pressure, which is a trend that management

expects to continue.

Licensing revenue in the third quarter of fiscal 2014 was $2.4

million, as compared to $2.0 million in the third quarter of fiscal

2013, an increase of $0.4 million, or 18.0%, principally on higher

year-over-year licensing revenue earned from the Company's largest

licensee.

Net revenues for the nine month period of fiscal 2014 were $63.8

million, a decrease of $41.6 million, or 39.4%, as compared to the

nine month period of fiscal 2013 net revenues of $105.4 million.

The decline in year-over-year net revenues was caused by lower

year-over-year net product sales and lower year-over-year licensing

revenues.

Net product sales for the nine month period of fiscal 2014 were

$59.2 million, as compared to $99.8 million for the nine month

period of fiscal 2013, a decrease of $40.6 million, or 40.7%. The

lower year-over-year net product sales were principally driven by a

$40.1 million, or 41.5%, decline in net sales of houseware

products, which was the result of lower year-over-year sales of all

products offered by the Company in the category, which is comprised

of microwave ovens, compact refrigerators and wine coolers.

Licensing revenue in the nine month period of fiscal 2014 was

$4.7 million, as compared to $5.6 million in the nine month period

of fiscal 2013, a decrease of $0.9 million, or 16.7%, principally

on lower year-over-year licensing revenue earned from the Company's

largest licensee due to lower year-over-year sales of products by

this licensee bearing the Emerson ® brand name.

Operating income for the third quarter of fiscal year 2014 was

$1.1 million, a decrease of $0.9 million, or 46.0%, from operating

income of $2.0 million for the third quarter of fiscal year 2013,

due to the lower year-over-year net revenue and higher

year-over-year SG&A expenses, primarily due to higher legal

fees resulting from a lawsuit that was settled by the Company in

December 2013.

Operating income for the nine month period of fiscal year 2014

was $2.6 million, a decrease of $6.0 million, or 69.6%, from

operating income of $8.6 million for the nine month period of

fiscal year 2013, due to the lower year-over-year net revenue,

higher year-over-year SG&A expenses, primarily due to higher

legal fees and tax consulting fees, partially offset by lower

compensation costs and the impairment write-down in September 2012

of a non-strategic trademark.

Net loss for the third quarter of fiscal 2014 was $1.4 million,

as compared to net income $1.7 million for the third quarter of

fiscal 2013, a decrease of $3.1 million, or 181.6%, due primarily

to the payment of a $4 million settlement by the Company in

December 2013 of a lawsuit, and the year-over-year decrease in

operating income. Net income for the nine month period of fiscal

2014 was $0.4 million, as compared to $7.5 million for the nine

month period of fiscal 2013, a decrease of $7.1 million, or 95.0%,

due primarily to the year-over-year decrease in operating income

and the settlement by the Company in December 2013 of a lawsuit.

Diluted loss per share for the third quarter of fiscal year 2014

was $0.05, as compared to diluted earnings per share of $0.06 for

the third quarter of fiscal year 2013, a decrease of $0.11 per

diluted share, or 183.3%. Diluted earnings per share for the nine

month period of fiscal year 2014 were $0.01, as compared to $0.28

for the nine month period of fiscal year 2013, a decrease of $0.27

per diluted share, or 96.4%.

Duncan Hon, Chief Executive Officer of Emerson Radio, commented,

"Our third quarter and nine month fiscal 2014 revenues and net

income declined significantly as compared to the prior year due

primarily to the decision by one of our major customers to

discontinue purchasing, effective Spring 2013, from the Company two

microwave oven products sold throughout fiscal year 2013 by the

Company to this customer, the last shipments of which were made in

February and March 2013, the payment of a $4 million settlement by

the Company in December 2013 of a lawsuit and intense competition

within all of our product categories. We expect these factors to

affect our year-over-year comparisons throughout the remainder of

fiscal 2014. The Company continues to seek to implement pricing and

product strategy initiatives to improve the Company's results of

operations, although there can be no assurance that such

initiatives will be successfully implemented or have the desired

effects on the Company's results of operations and financial

condition."

About Emerson Radio

Corp. Emerson Radio Corp. (NYSEMKT: MSN), incorporated in

1994, is headquartered in Hackensack, N.J. The Company designs,

sources, imports and markets a variety of houseware and consumer

electronic products, and licenses its trademarks to others on a

worldwide basis for a variety of products. For more information,

please visit Emerson Radio's web site at www.emersonradio.com.

Forward Looking

Statements This release contains "forward-looking

statements" made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements reflect management's current knowledge, assumptions,

judgment and expectations regarding future performance or events.

Although management believes that the expectations reflected in

such statements are reasonable, they give no assurance that such

expectations will prove to be correct and you should be aware that

actual results could differ materially from those contained in the

forward-looking statements. Forward-looking statements are subject

to a number of risks and uncertainties, including the risk factors

detailed in the Company's reports as filed with the Securities and

Exchange Commission. The Company assumes no obligation to update

the information contained in this news release.

| |

| |

| EMERSON RADIO CORP. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| (In thousands, except earnings per share data) |

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2013 |

|

|

2012 |

|

2013 |

|

|

2012 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product sales |

|

$ |

18,443 |

|

|

$ |

22,608 |

|

$ |

59,182 |

|

|

$ |

99,783 |

| Licensing revenue |

|

|

2,414 |

|

|

|

2,046 |

|

|

4,665 |

|

|

|

5,597 |

| Net revenues |

|

|

20,857 |

|

|

|

24,654 |

|

|

63,847 |

|

|

|

105,380 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

15,986 |

|

|

|

20,484 |

|

|

52,605 |

|

|

|

88,759 |

| Other operating costs and expenses |

|

|

361 |

|

|

|

253 |

|

|

683 |

|

|

|

1,046 |

| Selling, general and administrative expenses |

|

|

3,216 |

|

|

|

1,926 |

|

|

7,729 |

|

|

|

5,671 |

| Impairment of trademark |

|

|

219 |

|

|

|

-- |

|

|

219 |

|

|

|

1,326 |

| |

|

|

19,782 |

|

|

|

22,663 |

|

|

61,236 |

|

|

|

96,802 |

| Operating income |

|

|

1,075 |

|

|

|

1,991 |

|

|

2,611 |

|

|

|

8,578 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on settlement of litigation |

|

|

(4,000 |

) |

|

|

-- |

|

|

(4,000 |

) |

|

|

-- |

| Interest income, net |

|

|

98 |

|

|

|

132 |

|

|

441 |

|

|

|

230 |

| (Loss) income before income taxes |

|

|

(2,827 |

) |

|

|

2,123 |

|

|

(948 |

) |

|

|

8,808 |

| (Benefit) provision for income taxes |

|

|

(1,446 |

) |

|

|

430 |

|

|

(1,324 |

) |

|

|

1,328 |

| Net (loss) income |

|

$ |

(1,381 |

) |

|

$ |

1,693 |

|

$ |

376 |

|

|

$ |

7,480 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

(0.05 |

) |

|

|

0.06 |

|

|

0.01 |

|

|

|

0.28 |

| |

Diluted |

|

|

(0.05 |

) |

|

|

0.06 |

|

|

0.01 |

|

|

|

0.28 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

27,130 |

|

|

|

27,130 |

|

|

27,130 |

|

|

|

27,130 |

| |

Diluted |

|

|

27,130 |

|

|

|

27,130 |

|

|

27,130 |

|

|

|

27,130 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EMERSON RADIO CORP. AND SUBSIDIARIES |

|

| CONSOLIDATED BALANCE SHEETS (Unaudited) |

|

| (In thousands except share data) |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

12/31/13 |

|

|

3/31/13 |

|

| |

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

18,698 |

|

|

$ |

21,412 |

|

| Restricted cash |

|

|

-- |

|

|

|

70 |

|

| Short term investments |

|

|

37,226 |

|

|

|

45,235 |

|

| Accounts receivable, net |

|

|

10,278 |

|

|

|

7,883 |

|

| Other receivables |

|

|

1,735 |

|

|

|

969 |

|

| Due from affiliates |

|

|

-- |

|

|

|

1 |

|

| Inventory |

|

|

5,683 |

|

|

|

3,454 |

|

| Prepaid expenses and other current assets |

|

|

2,603 |

|

|

|

1,873 |

|

| Deferred tax assets |

|

|

1,567 |

|

|

|

1,685 |

|

| |

|

|

|

|

|

|

|

|

| |

Total

Current Assets |

|

|

77,790 |

|

|

|

82,582 |

|

| Property, plant, and equipment, net |

|

|

210 |

|

|

|

258 |

|

| Trademarks, net |

|

|

-- |

|

|

|

219 |

|

| Deferred tax assets |

|

|

2,579 |

|

|

|

1,121 |

|

| Other assets |

|

|

19 |

|

|

|

104 |

|

| |

|

|

|

|

|

|

|

|

| |

Total

Assets |

|

$ |

80,598 |

|

|

$ |

84,284 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Current maturities of long-term borrowings |

|

|

43 |

|

|

|

43 |

|

| Accounts payable and other current liabilities |

|

|

4,701 |

|

|

|

7,790 |

|

| Accrued sales returns |

|

|

1,106 |

|

|

|

965 |

|

| Income taxes payable |

|

|

169 |

|

|

|

1,281 |

|

| |

|

|

|

|

|

|

|

|

| |

Total

Current Liabilities |

|

|

6,019 |

|

|

|

10,079 |

|

| Capital lease obligations |

|

|

15 |

|

|

|

30 |

|

| Deferred tax liabilities |

|

|

207 |

|

|

|

194 |

|

| |

|

|

|

|

|

|

|

|

| |

Total

Liabilities |

|

|

6,241 |

|

|

|

10,303 |

|

| Shareholders' Equity: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Preferred shares -$.01 par value, 10,000,000 shares

authorized at December 31, 2013 and March 31, 2013, respectively;

3,677 shares issued and outstanding at December 31, 2013 and March

31, 2013, respectively; liquidation preference of $3,677,000 at

December 31, 2013 and March 31, 2013, respectively |

|

|

3,310 |

|

|

|

3,310 |

|

| |

|

|

|

|

|

|

|

|

| Common shares -- $.01 par value, 75,000,000 shares

authorized, 52,965,797 shares issued at December 31, 2013 and March

31, 2013, respectively; 27,129,832 shares outstanding at December

31, 2013 and March 31, 2013, respectively |

|

|

529 |

|

|

|

529 |

|

| Additional paid-in capital |

|

|

98,785 |

|

|

|

98,785 |

|

| Accumulated deficit |

|

|

(4,043 |

) |

|

|

(4,419 |

) |

| Treasury stock, at cost, 25,835,965 shares |

|

|

(24,224 |

) |

|

|

(24,224 |

) |

| |

|

|

|

|

|

|

|

|

| |

Total

Shareholders' Equity |

|

|

74,357 |

|

|

|

73,981 |

|

| |

|

|

|

|

|

|

|

|

| |

Total

Liabilities and Shareholders' Equity |

|

$ |

80,598 |

|

|

$ |

84,284 |

|

| |

|

|

|

|

|

|

|

|

CONTACT: Investor Relations: Barry Smith Investor Relations

Manager (973) 428-2004

EMERSON RADIO CORP. 3 University Plaza, suite 405 Hackensack, NJ

07601

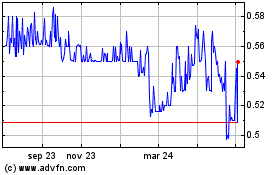

Emerson Radio (AMEX:MSN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

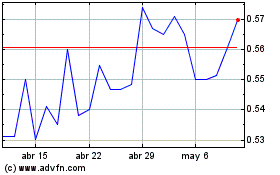

Emerson Radio (AMEX:MSN)

Gráfica de Acción Histórica

De May 2023 a May 2024