false

0001893448

0001893448

2023-11-03

2023-11-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 3, 2023

STRONG

GLOBAL ENTERTAINMENT, INC.

(Exact

name of registrant as specified in its charter)

| British

Columbia, Canada |

|

001-41688 |

|

N/A |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

5960

Fairview Road, Suite 275

Charlotte,

NC |

|

28210 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (704) 471-6784

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Voting Shares, without par value |

|

SGE |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

On

November 3, 2023, Strong Global Entertainment, Inc. (the “Company”), Strong Technical Services, Inc., a wholly-owned subsidiary

of the Company (the “Purchaser”), Innovative Cinema Solutions, LLC (the “Seller”), and Seller’s members

(the “Members”) entered into an asset purchase agreement (the “Asset Purchase Agreement”). Pursuant to the Asset

Purchase Agreement, in exchange of certain assets of the Seller, (i) the Purchaser paid $100,000, (ii) the Purchaser will pay $100,000

on the date that is nine (9) months from the closing date, and (iii) the Company issued an aggregate of 115,607 Class A common voting

shares (the “Common Shares”) to the Members, based on $200,000 divided by the closing market price of the shares as of November

2, 2023 of $1.73 per share.

In

addition, the Purchaser agreed to assume the obligation from Seller to Think Audio Video, LLC, a third party, in the approximate principal

amount of $465,000 in the form of a promissory note (the “Note”). The Note

bears interest at the rate of five percent (5.0%) per annum.

The Purchaser shall pay this Note in twenty-four (24) consecutive equal monthly payments of principal, plus accrued interest thereon

commencing December 3, 2023 and continuing until the Note is paid in full.

The

transactions contemplated by the Asset Purchase Agreement were closed on November 3, 2023.

The

foregoing description of the Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to

the Asset Purchase Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K, and which is incorporated herein by reference.

| Item

2.01 |

Completion

of Acquisition or Disposition of Assets. |

The

disclosure set forth in Item 1.01 above is incorporated into this Item 2.01 by reference, as applicable. On November 3, 2023, pursuant

to the Asset Purchase Agreement, the Company completed the acquisition of certain assets of the Seller through the Purchaser.

| Item

3.02 |

Unregistered

Sales of Equity Securities. |

On

November 3, 2023, pursuant to the Asset Purchase Agreement, the Company issued 115,607 Common Shares. The Common Shares were issued in

a private placement exempt from registration pursuant to Section 4(a)(2) and/or Regulation D of the Securities Act of 1933, as amended.

| Item

7.01 |

Regulation

FD Disclosure. |

On

November 7, 2023, the Company issued a press release regarding the asset purchase from the Seller, described above, which is attached

hereto as Exhibit 99.1.

The

press release included as Exhibit 99.1 will be deemed to be “furnished” rather than “filed,” pursuant to the

rules of the Commission.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

†

Exhibits and schedules to this Exhibit have been omitted pursuant to Regulation S-K Item 601(a)(5). The Registrant agrees to furnish

supplementally a copy of any omitted schedule or exhibit to the SEC upon request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

STRONG

GLOBAL ENTERTAINMENT, INC. |

| |

|

| Date:

November 7, 2023 |

By: |

/s/

Todd R. Major |

| |

Name: |

Todd

R. Major |

| |

Title: |

Chief

Financial Officer |

Exhibit

10.1

[Exhibits

and schedules to this Exhibit have been omitted pursuant to Regulation S-K Item 601(a)(5). The Registrant agrees to furnish supplementally

a copy of any omitted schedule or exhibit to the SEC upon request.]

ASSET

PURCHASE AGREEMENT

THIS

ASSET PURCHASE AGREEMENT (the “Agreement”) is made and entered into effective this 3rd day of November, 2023 by and

between INNOVATIVE CINEMA SOLUTIONS, LLC, a Kansas limited liability company (the “Seller”), PAMELA S. OSTERMANN,

BEN NOEL, JILL SUMMERSCALES, and KRISTOPHER BECKLOFF (collectively, the “Members”) and Strong Technical Services,

Inc., a Nebraska corporation (“Purchaser”), and Strong Global Entertainment, Inc., a British Columbia corporation

(“Parent” and collectively with Purchaser, the “Buyer Entities”). (the Seller, the Purchaser, the

Parent and the Members, each a “Party” and collectively the “Parties”).

RECITALS

WHEREAS,

the Seller is engaged in the business of the sale and design of sound and video products, the design and development of products and

systems for the cinema industry and the technical support and field services associated with the same. (the “Business”);

WHEREAS,

the Seller is the owner of all of the assets of the Business;

WHEREAS,

the Members listed above collectively owns all of the membership interests in Seller; and

WHEREAS,

Purchaser wishes to purchase from the Seller and the Seller wishes to sell to Purchaser, the Purchased Assets (as defined below), subject

to the Assumed Liabilities (as defined below), upon the terms and conditions of this Agreement.

NOW

THEREFORE, in consideration of the premises and the mutual covenants and agreements hereinafter contained, and for good and valuable

consideration, the receipt, sufficiency and adequacy of which are hereby acknowledged, and intending to be legally bound, the parties

hereby agree as follows:

Section

1

Sale

of Assets

1.1

Purchased Assets. Subject to the terms and conditions of this Agreement, on the Closing Date (as defined in Section 4.1) the Seller

shall sell, transfer, convey, assign and deliver (“Transfer”) to the Purchaser, and the Purchaser shall purchase and

acquire from the Seller, all of the Seller’s right, title and interest in and to all of the assets constituting the Business of

every kind and description, whether tangible or intangible, real, personal or mixed, accrued or

contingent (including goodwill, but excluding the Excluded Assets), wherever located and whether now existing or hereafter acquired prior

to the Closing Date, as more particularly set forth below (hereinafter collectively referred to as the “Purchased Assets”),

free and clear of all Liens (as defined in Section 5.3(b)):

(a)

All bank accounts and cash balances

(b)

All trade accounts receivable and amounts due from customers

(c)

all inventories, including, without limitation, inventories of raw materials, work-in-progress, storehouse stocks, materials, supplies,

finished goods and consigned goods, owned by the Seller or in which the Seller has any interest (including the right to use), whether

located on the premises of the Seller, in transit to or from such premises, in storage facilities or otherwise of the Seller (“Inventories”);

(d)

all machinery, equipment, vehicles, furniture, trade fixtures, computers, supplies, spare parts, tools, stores and other tangible personal

property owned by the Seller, leased by the Seller or in which the Seller has any other interest (including the right to use), other

than the Inventories and the Books and Records of the Seller (“Tangible Personal Property”);

(e)

all trademarks, copyrights, patents, tradenames, licenses and company logos used by the Seller in connection with the Business set forth

on Exhibit A;

(f)

all contracts (including purchase orders, sales or services contracts, license agreements, contracts with customers, suppliers, distributors

or retail establishments) licenses and leases associated with the Business, including but not limited to those contracts listed on Exhibit

A (“Assumed Contracts”);

(g)

all rights of the Seller under express or implied warranties from the suppliers of the Seller with respect to the Purchased Assets, to

the extent assignable;

(h)

all of the Seller’s claims, causes of action, choses in action, rights of recovery and rights of set-off of any kind;

(i)

all of the Seller’s right to receive mail and other communications with vendors, customers and business associates of Seller, including,

without limitation, all telephone and facsimile numbers and electronic mail addresses of the Seller;

(j)

all goodwill of the Business as a going concern; and

(k)

all other properties, tangible and intangible, not otherwise referred to above which are owned by the Seller or in which it has any interest.

1.2

Excluded Assets. The Seller shall retain all of its right, title and interest in and to all of, and shall not Transfer

to the Purchaser any of, the assets, rights and properties of the Seller or of the Business (the “Excluded Assets”)

set forth below:

(a)

all books and records, ledgers, employee records, customer lists, files, correspondence, computer data bases, accounting information

and other records of every kind, whether written, computerized or maintained in any other medium, which are owned by the Seller or in

which the Seller has any interest (“Books and Records”), provided, however, that Seller shall provide Purchaser with access

to the same as reasonably needed in connection with the purchase of the assets of Seller;

(b)

the organizational documents, minute books, ledgers, tax returns, books of account or other records having to do with the corporate organization

of the Seller;

(c)

all insurance policies of the Seller and all rights to applicable claims and proceeds thereunder;

(d)

any leases, contracts or agreements or other assets unrelated to the Business and not set forth above as Purchased Assets;

(e)

all federal, state, local and foreign income tax deposits paid by the Seller in excess of liabilities for such taxes paid in connection

with the income or operations of the Business with respect to any period ending on or before the Closing Date;

(f)

any refunds of all or any portion of any insurance premiums paid by the Seller prior to the Closing Date relating to the Purchased Assets

or the Business;

(g)

Mercedes automobile, VIN 4JGDF6EE8HA928650.

1.3

Assumed Liabilities. As further consideration for the purchase and sale of the Purchased Assets, Purchaser shall, from and after

the Closing, assume, perform, discharge and pay when due those obligations and liabilities (the “Assumed Liabilities”)

of the Seller relating to the Business which are specifically set forth on Schedule 1.3. To the extent that a liability exists for inventory

or services performed that is inadvertently not listed on Schedule 1.3, the Purchaser shall assume those vendor liabilities to the extent

in the normal course of business within the past 60 days (“Incurred but not Reported”).

Additionally,

Purchaser agrees to assume the obligation from Seller to Think Audio Video, LLC (“TAV”) in the approximate principal amount

of $465,000 in the form of a promissory note (the “Note”). All such obligations are being assumed by the Purchaser and will

be repaid to Think Audio Video LLC in equal monthly installments over a period of 24 months.

Excluded

Liabilities. Except for the Assumed Liabilities in the amounts listed on Schedule 1.3, Purchaser shall not assume or be liable for

any liabilities or obligations of the Seller, direct or indirect, fixed, contingent or otherwise, known or unknown, which exist at the

Effective Time or which arise thereafter as a result of any act, omission or circumstance taking place prior to the Effective Time, and

whether or not the same are reflected on the Seller’s financial statements. Furthermore, notwithstanding anything to the contrary

stated in Section 1.3, Purchaser shall not assume or be liable for any of the following liabilities or obligations:

(a)

any of the Seller’s liabilities or obligations under any contract which is not an Assumed Contract, or under any oral contract,

whether or not assigned to Purchaser hereunder, or under any Assumed Contract to the extent such liabilities or obligations arise prior

to the Closing;

(b)

any of the Seller’s liabilities or obligations relating to the employment of its employees, employment contracts or relating to

any Seller benefit plan;

(c)

any of the Seller’s federal, state, or city tax liability;

(d)

any liability arising from or related to any compliance or noncompliance on or prior to the Closing Date with any Law applicable to the

Seller, the Business or the Purchased Assets;

(e)

any liability arising from or related to any Action against the Seller, the Business or the Purchased Assets pending as of the Closing

Date or based upon any action, event, circumstance or condition arising as of or prior to the Closing Date;

(f)

any liability or obligation relating to an Excluded Asset, whether arising prior to or after the Closing Date; and

(g)

any other liabilities or obligations of the Seller.

Section

2

Consideration

and Payment

2.1

Purchase Price. The aggregate purchase price (the “Purchase Price”) to be paid for the Purchased Assets by

the Purchaser shall be Two Hundred Thousand Dollars ($200,000) in Cash and $200,000 value of shares of Class A Common Shares of Strong

Global Entertainment.

2.2

Payment of Purchase Price. The Purchase Price shall be paid to Seller as follows:

(a)

at the Closing, $100,000 by wire transfer of immediately available funds to the account(s) specified by the Seller (“Closing

Cash Payment”);

(b)

at the Closing, the issuance of sufficient shares of Class A Common Shares of Parent (the “Parent Shares”) which will

have a value of Two Hundred Thousand Dollars ($200,000.00). The number of Class A Common Shares will be based on $200,000 divided by

the closing market price of the shares as of November 2, 2023 of $1.73 per share or 115,607 Class A Common Shares.

(c)

on the date that is nine (9) months from the Closing Date, $100,000 by wire transfer of immediately available funds to the account(s)

specified by the Seller.

2.3

Allocation of Purchase Price. Tax Treatment; Allocation of Purchase Price. The Parties agree that the Purchase Price and the Assumed

Liabilities (plus other relevant items included as consideration for federal income Tax purposes) (the “Tax Consideration”)

shall be allocated among the Purchased Assets in accordance with Section 1060 of the Code and the Treasury regulations thereunder (and

any similar provision of state, local, or non-U.S. Law, as appropriate). Following the Closing Date, the Purchaser shall provide the

Seller with an allocation of the Tax Consideration to the Purchased Assets for all purposes (including Tax and financial accounting)

(the “Purchase Price Allocation”). The Purchaser shall permit the Seller to review and comment on the Purchase Price

Allocation and shall consider in good faith any reasonable revisions requested by the Seller. The Purchaser and the Seller shall file

all Tax Returns (including IRS Form 8594, amended returns and claims for refund) and information reports in a manner consistent with

the Purchase Price Allocation. In any proceeding related to the determination of any Tax, neither the Purchaser nor the Seller shall

contend or represent that such allocation is not a correct allocation.

Section

3

Closing

3.1

The closing (the “Closing”) of the transactions contemplated by this Agreement will be held on the date hereof (the

“Closing Date”) remotely via exchange of documents and signatures (or in such other manner as the parties may designate

in writing).

3.2

Seller’s Closing Deliverables. At Closing, the Seller shall deliver to Purchaser the following (collectively the “Seller’s

Closing Deliverables”):

(a)

an executed bill of sale for the Purchased Assets duly executed by the Seller;

(b)

Consents from third parties (if any are required) listed in Schedule 3.2(b) that are required for the execution of this Agreement and

the consummation of the transactions contemplated hereby, including under any Assumed Contract;

(c)

a duly executed certificate of an officer of the Seller certifying as to (i) the certificate of formation and limited liability company

agreement of the Seller; and (ii) resolutions of the managers and members of the Seller authorizing the transactions contemplated by

this Agreement;

(d)

assignment of all intellectual property rights of the Seller to Purchaser pursuant to the assignment agreement transferring rights thereunder

to Purchaser, duly executed by the Seller;

(e)

a certificate of good standing for the Seller as of a date no more than five days prior to the Closing Date, issued by the Secretary

of State or equivalent officer of the state of its formation; and

(f)

such other bills of sale, assignments and other instruments of assignment, transfer or conveyance, in form and substance reasonably satisfactory

to Purchaser, as the Purchaser may reasonably request or as may be otherwise necessary or desirable to evidence and effect the sale,

assignment, transfer, conveyance and delivery of the Purchased Assets to Purchaser and to put the Purchaser in actual possession or control

of the Purchased Assets, duly executed by the Seller.

3.3

Purchaser’s Closing Deliverables. At Closing, the Purchaser shall deliver to the Seller the following (collectively the

“Purchaser’s Closing Deliverables”):

(a)

Closing Cash Payment;

(b)

the Parent Shares; and

(c)

such other documents and instruments, in form and substance reasonably satisfactory to the Seller, as the Seller may reasonably request,

duly executed by the Purchaser.

3.4

Further Assurances. From time to time after the Closing, the Seller shall execute and deliver such other instruments of conveyance,

assignment, transfer and delivery, and take such other actions as the Purchaser may reasonably request in order to effectuate or evidence

the Transfer of the Purchased Assets to the Purchaser.

3.5

Transfer Taxes. Buyer shall pay all transfer, sales and excise taxes, registration and transfer fees, if any, incurred in connection

with the transactions contemplated by this Agreement. Except as hereinabove provided, the Party hereto that is responsible under applicable

Law shall bear and pay in their entirety all other taxes, if any, payable by reason of the Transfer of the Purchased Assets pursuant

to this Agreement. Each Party shall provide reasonable cooperation regarding any tax filing (other than with respect to income taxes)

required in connection with the Transfer of the Purchased Assets.

Section

4

Representations

and Warranties of the Seller and Members

Each

of the Seller and Members hereby represents, warrants and agrees as follows:

4.1

Corporate Existence. The Seller is a limited liability company duly organized, validly existing and in good standing under the

Laws of the State of Kansas and has full power and authority to conduct its Business as it is now being conducted. The Seller is duly

qualified and in good standing in every jurisdiction where the nature and extent of its Business or the ownership of its assets makes

such qualification necessary and the Seller has all material licenses, authorizations, consults and approvals, necessary to carry on

its Business as now being conducted.

4.2

Corporate Power and Authority. The Members are the record and beneficial holder of one hundred percent (100%) of the issued and

outstanding membership interests of the Seller. There are no agreements, options, warrants or other instruments of any nature pursuant

to which any other person or entity may acquire any equity securities of the Seller. The Seller has full right, power, authority and

capacity to enter into this Agreement and to carry out the transactions contemplated hereby. This Agreement has been duly executed and

delivered by the Seller and, assuming due execution and delivery by the Purchaser, this Agreement constitutes the legal, valid and binding

obligations of the Seller, enforceable against the Seller in accordance with its respective terms, except as enforcement may be limited

by applicable Laws such as bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally

and by general principles of equity (regardless of whether considered in a proceeding in equity or at Law).

4.3

Securities Representations and Warranties.

| |

a) |

In

connection with, and in consideration of, the issuance of the Shares to Seller, Seller represent that each Member is an “accredited

investor” within the meaning of Rule 501 of Regulation D promulgated under the Securities Act of 1933 (“Securities

Act”), and hereby makes the additional representations set forth on Exhibit B attached hereto with respect to the Parent

Shares, such that the Parent may rely on them in issuing the Parent Shares. |

| |

|

|

| |

b) |

Members

understand acknowledge, and agree that Parent’s grant and issuance to Members of the Parent Shares has not been registered

under the Securities Act because Parent believes, relying in part on Members’ representations in this document, that an exemption

from such registration requirement is available for such grant and/or issuance. Members acknowledge and agree that the availability

of this exemption depends upon the truthfulness and accuracy of the representations Members are making to Parent in this document. |

| |

|

|

| |

c) |

Except

for transfers not involving a change in beneficial ownership, Members agree not to make any sale, assignment, transfer, pledge or

other disposition of all or any portion of the Parent Shares, or any beneficial interest therein, unless and until (i) there is then

in effect a registration statement under the Securities Act covering such proposed disposition and such disposition is made in accordance

with such registration statement; or (ii) such disposition will not require registration of the Parent Shares under the Securities

Act. |

| |

|

|

| |

d) |

Members

understand and agrees that Parent shall cause the legends set forth below, or substantially equivalent legends, to be placed upon any

certificate(s) evidencing ownership of the Parent Shares, together with any other legends that may be required by Parent or by applicable

state or federal securities laws: |

THE

SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR QUALIFIED

UNDER ANY STATE SECURITIES LAWS AND MAY NOT BE OFFERED FOR SALE, SOLD, PLEDGED, HYPOTHECATED OR OTHERWISE TRANSFERRED OR ASSIGNED UNLESS

(I) A REGISTRATION STATEMENT COVERING SUCH SECURITIES IS EFFECTIVE UNDER THE ACT AND IS QUALIFIED UNDER APPLICABLE STATE LAW OR (II)

THE TRANSACTION IS EXEMPT FROM THE REGISTRATION AND PROSPECTUS DELIVERY REQUIREMENTS UNDER THE ACT AND THE QUALIFICATION REQUIREMENTS

UNDER APPLICABLE STATE LAW. AS EVIDENCED, IF PARENT SO REQUESTS, BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE

SUBSTANCE OF WHICH SHALL BE ACCEPTABLE TO THE COMPANY.

| |

e) |

Shareholder

understands that the Parent Shares are “restricted securities” under the federal securities laws, inasmuch as they are

being acquired from Parent inasmuch as they are being acquired from Parent in a transaction not involving a public offering and that,

under such laws and applicable regulations, such securities may be resold without registration under the Securities Act only in certain

limited circumstances. |

4.4

No Violation. Neither the execution and delivery of this Agreement nor the performance by the Seller of its obligations hereunder

nor the consummation of the transactions contemplated hereby will: (a) contravene any provision of the certificate of formation or limited

liability company agreement of the Seller; (b) violate, or be in conflict with, or constitute a default under, permit the termination

of, or cause the acceleration of the maturity of any debt or obligation of the Seller under, require the consent of any other party to,

constitute a breach of, create a loss of a material benefit under, or result in the creation or imposition of any Lien upon any property

or assets of the Seller under any mortgage, indenture, lease, agreement, instrument or commitment to which the Seller is a party or by

which the Seller or any of its assets or properties may be bound; or (c) to the knowledge of the Seller, its Members, officers or managers

(“Seller’s knowledge”), violate any Law to which the Seller is subject or by which it or any of its assets or properties

are bound.

4.5

Title to Assets; Encumbrances. The Seller has good and marketable title to all of the Purchased Assets and is transferring good

and marketable title to the Purchaser to the Purchased Assets free and clear of any Liens. When used in this Agreement, “Lien”

or “Liens” shall mean any mortgage, pledge, security interest, conditional sale or other title retention agreement,

debt obligation, encumbrance, lien, easement, claim, right, covenant, restriction, right of way, warrant, option or charge of any kind.

4.6

Litigation. There is no action, claim or proceeding pending or, to the Seller’s knowledge, threatened against the Seller,

the Members, or any of the Purchased Assets before any court, arbitrator or administrative or governmental body, that questions or challenges

the validity of this Agreement or any action taken or proposed to be taken by the Seller or the Members pursuant to this Agreement, nor

is there any basis known to the Seller for any such action. The Seller is not in default under any order, writ injunction or decree of

any federal state, municipal administrative or governmental court, agency or authority, whether domestic or foreign.

4.7

Intellectual Property Rights. Exhibit A contains a true and complete list of all intellectual property rights, customer

lists, websites, copyrights, trademarks, domain names, logos, and other intangible personal property and assets included in the Purchased

Assets as of the date hereof that are necessary for the operation of the Business (the “Intellectual Property Rights”).

The Seller owns all right, title, and interest in and to the Intellectual Property Rights free and clear of any Liens (other than the

terms of applicable off the shelf software license agreements). The Seller has not been sued or charged in writing with or been a defendant

in any claim that involves a claim of infringement of any intellectual property and no written notice has been provided to the Seller

alleging infringement by the Seller against any intellectual property. To the Seller’s knowledge, the current use by the Seller

of the Intellectual Property Rights does not infringe the intellectual property of any other person in any manner.

4.8

Compliance with Laws. The Seller has complied with all material Laws applicable to or, relating to the operation and conduct of

the Business and the employment of its employees and personnel, and has not received notice or have reason to believe that there has

been any material violation by the Seller of any such Laws.

4.9

Adverse Changes. Since January 1, 2023, there has not been: (a) any occurrence, or event that has had a material adverse effect

on the Business, assets or results of operations of the Seller; (b) any contingent obligation respecting the Business incurred by the

Seller or by way of guaranty, endorsement, indemnity, warranty or otherwise; or (c) any damage, destruction or loss by fire or other

casualty, whether or not covered by insurance, affecting the Business or the Purchased Assets.

4.10

Taxes. All income and other tax return required to be filed by or with respect to the Seller or the Business have been properly

prepared and timely filed, and all such tax returns are true, complete and correct in all material respects. All income and other taxes

owed by or with respect to the Seller or the Business have been or will be fully paid when due by the Seller (whether or not shown on

any tax return), and the Seller has made adequate provision for any such Taxes that are not yet due and payable, for all taxable periods,

or portions thereof, ending on or before the date hereof. There is no tax proceeding by any governmental entity now pending or, to the

best of Seller’s knowledge, threatened with respect to any tax due from or with respect to the Seller or the Business. There are

no Liens for taxes on the assets of the Seller, including the Purchased Assets, except for statutory Liens for current taxes not yet

due and payable. The Seller has withheld, as applicable, from its employees, independent contractors, creditors, equity holders and third

parties and timely paid to the appropriate governmental entity proper and accurate amounts in all respects in compliance with all tax

withholding and remitting provisions of applicable Law and has complied with all tax information reporting provisions of all applicable

Laws.

4.11

No Encumbrances. The Seller does not have any debts, liabilities or other obligations of any nature that (with or without the

passage of time, the giving of notice, or both) would create a Lien on the Purchased Assets or otherwise encumber the Business, and the

Seller has not knowingly taken any action creating any liability or obligation on behalf of the Seller or otherwise creating a Lien or

other encumbrance against the Business or the Purchased Assets; nor, to the best of the Seller’s knowledge, is the Seller aware

of any facts or circumstances which could create a Lien or other encumbrance against the Business or the Purchased Assets.

4.12

Broker. Neither the Seller nor the Members has dealt with, or owe a finder’s fee or other fee or commission, to any broker

or finder in connection with the transactions contemplated by this Agreement.

4.13

Representations Accurate. No representation or warranty by the Seller in this Agreement (including, without limitation, the Schedules

and Exhibits hereto) contains any knowingly untrue statement of a material fact or omits to state any material fact necessary to make

the statements herein not misleading.

4.14

Residency. None of the Sellers or their designated parties to receive the Parent Shares is a Canadian resident.

Section

5

Representations

and Warranties of the Purchaser

The

Purchaser hereby represents and warrants to the Seller as follows:

5.1

Corporate Existence. The Purchaser is a corporation duly incorporated, validly existing and in good standing under the laws of

its incorporation and has full power and authority to conduct its business as it is now being conducted.

5.2

Corporate Power and Authority. The Purchaser has full right, power and authority to enter into this Agreement, perform its obligations

hereunder, acquire and own the Purchased Assets, and carry out the transactions contemplated hereby. The execution and delivery of this

Agreement, the performance by the Purchaser of its obligations hereunder and the consummation of the transactions contemplated hereby

have been duly authorized by all requisite limited liability company action on the part of the Purchaser. This Agreement has been duly

executed and delivered by the Purchaser and, assuming the due authorization, execution and delivery of this Agreement by the Seller,

this Agreement constitutes a legal, valid and binding obligation of the Purchaser, enforceable against the Purchaser in accordance with

its terms.

5.3

No Violation. Neither the execution and delivery of this Agreement nor the performance by the Purchaser of its obligations hereunder

nor the consummation of the transactions contemplated hereby will: (a) contravene any provision of the Certificate of Incorporation or

bylaws of the Purchaser; (b) violate, or be in conflict with, or constitute a default under, permit the termination of, or cause the

acceleration of the maturity of any debt or obligation of the Purchaser under, require the consent of any other party to, constitute

a breach of, create a loss of a material benefit under, or result in the creation or imposition of any Lien (as defined in Section 5.3(b))

upon any property or assets of the Purchaser under any mortgage, indenture, lease, agreement, instrument or commitment to which the Purchaser

is a party or by which the Purchaser or any of its assets or properties may be bound; or (c) to the knowledge of Purchaser, violate any

statute or law or any judgment, decree, order, regulation or rule of any court or governmental authority to which the Purchaser is subject

or by which it or any of its assets or properties are bound.

5.4

Broker. The Purchaser has not dealt with, and does not owe a finder’s fee or other fee or commission, to any broker or finder

in connection with the transactions contemplated by this Agreement.

5.5

Representations Accurate. No representation or warranty by the Purchaser in this Agreement (including, without limitation, the

Schedules and Exhibits hereto) contains or will contain any untrue statement of a material fact or omits or will omit to state any material

fact necessary to make the statements herein or therein not misleading.

Section

6

Certain

Post Closing Covenants and Obligations.

6.1

Restrictive Covenants

(a)

Noncompetition. For a period of 12 months after the Closing Date (the “Restricted Period”), each of the Seller

and the Members, for itself or himself, as applicable, and on behalf of their affiliates, shall not, directly or indirectly, engage in,

own any interest in, manage, operate, control or participate, consult with or render services to, or in any manner be connected with

any business located in the United States of America that engages in the Business. Upon such default being cured, the Restricted Period

shall resume and shall be extended by the amount of time for which the Restricted Period was suspended. For purposes of this Section

6.1(a), the ownership by the Seller or the Members of less than a one percent (1%) interest in any publicly traded company shall not

by itself be deemed a violation of this Section 6.1(a).

(b)

Non-Solicitation. Each of the Seller and the Members for itself or himself, as applicable, and on behalf of their affiliates,

shall not, during the Restricted Period, directly or indirectly through any other person:

| |

(i) |

(A)

employ, solicit or induce any person who is, or was at any time during the [X months/years] period prior to the Closing Date, an

employee or consultant of the Seller, (B) attempt to cause such person to terminate or refrain from renewing or extending his or

her employment or consulting relationship with the Purchaser or (C) attempt to cause such person to become employed by or enter into

a consulting relationship with any other person; or |

| |

|

|

| |

(ii) |

solicit,

persuade or induce any customer to terminate, reduce or refrain from renewing or extending his, her or its contractual or other relationship

with the Purchaser in regard to any purchase of services marketed, performed or sold by the Purchaser or the Business, or to become

a customer of or enter into any contractual or other relationship with any direct or indirect competitor of the Purchaser or the

Business. |

(c)

Injunctive Relief; Severability and Modification. The Seller agrees that the provisions of Section 6.1 hereof represent independent

separate covenants, that the remedy at Law for any breach of its provisions will be inadequate, and that Purchaser shall be entitled

to injunctive relief with respect thereto in addition to any other remedies the Purchaser may have at Law, in equity, by statute or otherwise,

which rights and remedies shall be cumulative. The Parties agree that if it is determined by a court of competent jurisdiction that the

provisions contained in this Section 6.1 are illegal or unenforceable, it is the intent of the Parties that the scope of such provisions

be modified to conform to the requirements of Law.

6.2

Use of Innovative Cinema Solutions Name. All rights to the name Innovative Cinema Solutions shall pass to the Purchaser.

6.3

Hiring of Employees. The Seller shall terminate the employment of all of its employees as of Closing Date (the “Employees”),

and shall be responsible for any obligations or liabilities associated with the prior employment of the employees and the termination

thereof. The Purchaser shall offer employment to all persons who were employed by the Seller at the time of the Closing, prior to Closing.

Notwithstanding the foregoing, nothing contained herein shall be interpreted or construed to confer upon the Employees any right with

respect to continuance of employment by the Purchaser after the initial hiring, nor shall this Agreement interfere in any way with the

right of the Purchaser to terminate any employee’s employment at any time.

6.4

Employment Agreement for Thomas Ostermann. Thomas Ostermann is a key employee of Seller and has been significantly involved in the operations

of Seller. Purchaser desires that Thomas Ostermann continue employment with the Purchaser after Closing, the terms and conditions of

which shall be set forth in an Employment Agreement mutually agreeable to Purchaser and Thomas Ostermann.

Purchaser

understands that Tom Ostermann owns and is actively involved in a business that is primarily in the video conferencing and audio video

systems business. TAV currently is a party to an agreement with a national distributor to provide products and/or services related to

the same to the third party’s customer base. Such business will continue post-closing.

Section

7

Indemnification.

7.1

Indemnity by the Seller. The Seller and the Members, jointly and severally, shall indemnify, defend, protect and hold the Purchaser

and its members, managers, officers, employees, agents and affiliates harmless from and against all losses, damages, debts, liabilities,

obligations, deficiencies, penalties, interest, amounts paid in connection with claims, amounts paid in settlement, costs (including

court costs) and expenses, including reasonable attorneys’ and other professionals’ fees and disbursements and other amounts

paid or incurred in connection with the enforcement of rights (whether by Law or pursuant to this Agreement) to recover any loss, except

for losses that are punitive damages (other than punitive damages included in claims by third parties) (“Losses”), incurred

or suffered by the Purchaser arising out of, relating to, or resulting from (a) any breach of a representation or warranty made by the

Seller in this Agreement, (b) any breach of the covenants or agreements made by the Seller in this Agreement, (c) any obligations and

liabilities of the Seller relating to any default existing prior to the Closing Date by the Seller under any agreement to which the Seller

and/or Members are a party, (d) any claims by any third parties with respect to the Seller’s operation of the Business prior to

the Closing Date (including breach of contract claims and violations of warranties), (e) the violation of any Laws in connection with

or with respect to the operation of the Business prior to the Closing Date, or (f) any Excluded Asset or Excluded Liability. The indemnity

obligations of the Seller and the Members with respect to all representations and warranties contained in this Agreement shall survive

the Closing Date for a period of twelve (12) months following the Closing Date; provided that the Seller’s obligations related

to Section 4.1 (Corporate Existence), Section 4.2 (Corporate Power and Authority), 4.4 (Title to Assets) and Section 4.12 (Broker) (collectively,

the “Seller Fundamental Representations”) shall survive indefinitely.

7.2

Indemnity by the Purchaser. The Purchaser shall indemnify, defend, protect and hold the Seller and the Members harmless from and

against all Losses, incurred or suffered by the Seller or the Members arising out of, relating to, or resulting from (a) any breach of

a representation or warranty made by the Purchaser in this Agreement, (b) any breach of the covenants or agreements made by the Purchaser

in this Agreement, (c) any breach of any contracts occurring on after the Closing Date by Purchaser, (d) any claims by any third parties

with respect to Purchaser’s operation of the Business after the Closing Date (including breach of contract claims and violations

of warranties), and (e) the violation of any Laws in connection with or with respect to the operation of the Business after the Closing

Date. The indemnity obligations of Purchaser with respect to all representations and warranties contained in this Agreement shall survive

the Closing Date for a period of twelve month (12) following the Closing Date; provided that Purchaser’s obligations related to

Section 5.1 (Corporate Existence), Section 5.2 (Power and Authority), and Section 5.4 (Broker) (collectively, the “Purchaser

Fundamental Representations”) shall survive until the expiration of the applicable statute of limitations.

7.3

Conditions of Indemnification. The respective obligations and liabilities of the Seller, the Member and the Purchaser (herein

sometimes called the “indemnifying party”) to the other (herein sometimes called the “party to be indemnified”)

under Sections 7.1 and 7.2 hereof with respect to claims resulting from the assertion of liability by third parties shall be subject

to the following terms and conditions: within ten (10) days after receipt of notice of commencement of an action or the assertion of

any claim by a third party, the party to be indemnified shall give the indemnifying party written notice thereof together with a copy

of such claim, process or other legal pleading (provided that failure to so notify the indemnifying party of the assertion of a claim

within such period shall not affect its indemnity obligation hereunder except as and to the extent that such failure shall adversely

affect the defense of such claim), and the indemnifying party shall have the right to undertake the defense thereof by representatives

of its own choosing; in the event that the indemnifying party, by the thirtieth (30th) day after receipt of notice of any such claim

(or, if earlier, by the tenth (10th) day preceding the day on which an answer or other pleading must be filed in order to prevent judgment

by default in favor of the person asserting such claim), does not elect to defend against such claim, the party to be indemnified will

(upon further notice to the indemnifying party) have the right to undertake the defense, compromise or settle such claim on behalf of

and for the account and risk of the indemnifying party, subject to the right of the indemnifying party to assume the defense of such

claim at any time prior to settlement, compromise or final determination thereof; in connection with any such indemnification, the indemnified

party will cooperate in all reasonable respects with the indemnifying party; and the indemnifying party shall be obligated to indemnify,

defend and hold harmless the party to be indemnified from and against Losses suffered by the indemnified party.

7.4

Treatment of Indemnification Payments. The Purchaser and the Seller agree to treat any indemnification payment made pursuant to

this Agreement as an adjustment to the Purchase Price for all purposes, unless otherwise required by Law.

Section

8

Miscellaneous

Provisions.

8.1

Public Announcements. The Parties have agreed upon the form of notification to be sent jointly to customers after the Closing

Date. Except as required by Law or the roles of any national exchange, and except as the other Party hereto shall authorize in writing

or as provided under this Section 8.1, the Parties hereto shall not, and shall cause their respective officers, directors, managers,

employees, affiliates and advisors not to, disclose any matter or matters relating to this transaction to any Person not an officer,

director, manager, employee, affiliate or advisor of such Party or to a lender, prospective lender, or prospective purchaser or investor

in of the business of a Party.

8.2

Amendment; Waiver. Neither this Agreement, nor any of the terms or provisions hereof, may be amended, modified, supplemented or

waived, except by a written instrument signed by the Parties hereto (or, in the case of a waiver, by the Party granting such waiver).

No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any other provision hereof (whether

or not similar), nor shall such waiver constitute a continuing waiver.

8.3

Fees and Expenses. Except as otherwise provided in this Agreement, each of the Parties hereto shall bear and pay its own costs

and expenses incurred in connection with the origin, preparation, negotiation, execution and delivery of this Agreement and the agreements,

instruments, documents and transactions referred to in or contemplated by this Agreement (whether or not such transactions are consummated)

including, without limitation, any fees, expenses or commissions of any of its advisors, attorneys, agents, finders or brokers.

8.4

Notices. All notices, requests, demands and other communications required or permitted under this Agreement shall be in writing

and shall be delivered personally, by certified or registered mail with postage prepaid, or by overnight mail:

If

to the Seller, to:

Innovative

Cinema Solutions, LLC

4416

W. 112th Terrace

Leawood,

KS 66211

Attn:

Pamela S. Ostermann

with

a copy to (which shall not constitute notice to):

Jodde

Olsen Lanning

Payne

& Jones, Chartered

PO

Box 25625

Overland

Park, KS 66225

jlanning@paynejones.com

If

to the Purchaser, to:

Strong

Technical Services, Inc.

c/o

Strong Global Entertainment Inc.

5960

Fairview Road, Suite 275

Charlotte,

North Carolina 28210

Attention:

Mark Roberson

with

a copy to (which shall not constitute notice to):

Loeb

& Loeb LLP

345

Park Avenue

New

York, NY 10154

Attention:

Ronelle Porter (rporter @loeb.com)

All

notices and other communications required or permitted under this Agreement that are addressed as provided in this Section 8.4

if delivered personally against proper receipt, shall be effective upon delivery and if delivered (A) by certified or registered mail

with postage prepaid, or (B) by Federal Express or similar courier service with courier fees paid by the sender, shall be effective two

(2) business days following the date when mailed or couriered, as the case may be. Any Party may from time to time change its address

for the purpose of notices to that Party by a similar notice specifying a new address, but no such change shall be deemed to have been

given until it is actually received by the Party sought to be charged with its contents.

8.5

Assignment. This Agreement and all of the provisions hereof shall be binding upon and inure to the benefit of the Parties hereto

and their respective successors and permitted assigns. Neither this Agreement nor any of the rights, interests or obligations hereunder

may be assigned by the Parties hereto without the prior written consent of the other Party. Any assignment that contravenes this Section

8.5 shall be void and without effect.

8.6

Governing Law and Venue. This Agreement and the rights, obligations, and legal relations between the Parties hereto shall be governed

by and construed in accordance with the internal laws of the State of Kansas without regard to conflicts of laws principles. The Parties

hereby consent to personal jurisdiction, service of process and venue in the federal or state courts of the State of Kansas, for any

dispute arising out of or related to this Agreement, or in the case of a third party claim subject to indemnification hereunder, in the

court where such claim is brought.

8.7

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of

which taken together shall constitute one and the same instrument.

8.8

Headings. The headings contained in this Agreement are for convenience of reference only and shall not constitute a part hereof

or define, limit or otherwise affect the meaning of any of the te1ms or provisions hereof.

8.9

Entire Agreement. This Agreement (which defined term includes the Schedules and Exhibits to this Agreement) embodies the entire

agreement and understanding among the Parties hereto with respect to the subject matter of this Agreement and supersedes all prior agreements,

commitments, arrangements, negotiations or understandings, whether oral or written, between the Parties with respect thereto. There are

no agreements, covenants, undertakings, representations or warranties with respect to the subject matter of this Agreement other than

those expressly set forth or referred to herein.

8.10

Severability. Each term and provision of this Agreement constitutes a separate and distinct undertaking, covenant, term and/or

provision hereof. In the event that any term or provision of this Agreement shall be determined to be unenforceable, invalid or illegal

in any respect, such unenforceability, invalidity or illegality shall not affect any other term or provision of this Agreement, but this

Agreement shall be construed as if such unenforceable, invalid or illegal term or provision had never been contained herein. Moreover,

if any term or provision of this Agreement shall for any reason be held to be excessively broad as to time, duration, activity or subject,

it shall be construed, by limiting and reducing it, so as to be enforceable to the extent permitted under applicable law as it shall

then exist.

8.11

No Third Party Beneficiaries. Nothing in this Agreement is intended, nor shall anything in this Agreement be construed, to confer

any rights, legal or equitable, in any Person (other than the Parties hereto and their respective heirs, dist1ibutees, beneficiaries,

executors, successors and assigns), including, without limitation, any employee of the Seller or the Purchaser or any beneficia1y of

such employee.

IN

WITNESS WHEREOF, the Parties hereto have caused this Agreement to be duly executed as of the day and year first above written.

| |

THE

SELLER: |

| |

INNOVATIVE

CINEMA SOLUTIONS, LLC |

| |

|

|

| |

By: |

/s/

Pamela S. Ostermann |

| |

Name: |

Pamela

S. Ostermann |

| |

Title: |

Manager |

| |

MEMBERS |

| |

|

| |

/s/

Pamela S. Ostermann |

| |

Pamela

S. Ostermann |

| |

|

| |

/s/

Ben Noel |

| |

Ben

Noel |

| |

|

| |

/s/

Jill Summerscales |

| |

Jill

Summerscales |

| |

|

| |

/s/

Kristopher Beckloff |

| |

Kristopher

Beckloff |

| |

PURCHASER: |

| |

STRONG

TECHNICAL SERVICES, INC. |

| |

|

|

| |

By: |

/s/

Todd Major |

| |

Name: |

Todd

Major |

| |

Title: |

Treasurer

and Secretary |

| |

|

|

| |

PARENT: |

| |

STRONG

GLOBAL ENTERTAINMENT, INC. |

| |

|

|

| |

By: |

/s/

Mark Roberson |

| |

Name: |

Mark

Roberson |

| |

Title: |

CEO |

SCHEDULE

1.3

Assumed

Assets & Liabilities

[***]

SCHEDULE

3.2(B)

Consents

(if any are required)

[***]

EXHIBIT

A

Intellectual

Property and Contracts

[***]

EXHIBIT

B

SECURITIES

REPRESENTATIONS AND WARRANTIES

1.

Purchasing for Own Investment; Accredited Investor. Shareholder has not been formed for the purpose of acquiring the Parent Shares

and holds assets in addition to the Parent Shares. Shareholder is acquiring the Parent Shares solely for investment purposes, and not

for further distribution. Shareholder’s entire legal and beneficial ownership interest in the Parent Shares is being acquired and

shall be held solely for Shareholder’s account. Shareholder is not a party to, and does not presently intend to enter into, any

contract or other arrangement with any other person or entity involving the resale, transfer, grant of participation with respect to

or other distribution of any of the Parent Shares.

2.

Ability to Protect Own Interests. Shareholder and its directors and beneficial owners are knowledgeable investors and can properly

evaluate the merits and risks of an investment in the Parent Shares and can protect Shareholder’s own interests in this regard.9

3.

Informed About Parent. Shareholder is sufficiently aware of Parent’s business affairs and financial condition to reach an

informed and knowledgeable decision to acquire the Parent Shares.

4.

Economic Risk. Shareholder realizes that an investment in the Parent Shares involves a high degree of risk, and that Parent’s

future prospects are uncertain. Shareholder is able to hold the Parent Shares indefinitely if required, and is able to bear the loss

of Shareholder’s entire investment in the Parent Shares.

Exhibit

99.1

Strong

Global Entertainment, Inc. Acquires Innovative Cinema Solutions

Acquisition

Enhances Company’s Service Offerings

Innovative

Cinema Solutions Recorded $6 Million in 2022 Revenue

Charlotte,

N.C., November 7, 2023: Strong Global Entertainment, Inc. (NYSE American: SGE) (“SGE” or the “Company”)

today announced that the Company entered into an asset purchase agreement on November 3, 2023, with Innovative Cinema Solutions, LLC

(“ICS”), a full service provider of technical services and solutions to national cinema chains. The operations of ICS will

be rolled into SGE’s wholly-owned subsidiary, Strong Technical Services, Inc. (“STS”), which provides comprehensive

managed service offerings with 24/7/365 support nationwide to ensure solution uptime and availability.

ICS

provides on-site and remote managed services and support, system engineering and design services, system integration, product procurement,

and event management and rentals. In 2022, ICS recorded $6 million in revenue and its current run rate is in excess of those levels.

Blake

Titman, Senior Vice President and General Manager of STS, commented, “We have known Tom and the team at ICS for many years and

are beyond pleased to have them join the Strong team. Much like Strong, the ICS team has built long-standing relationships in the cinema

industry and are a great addition to our current team.”

Tom

Ostermann, Owner and Vice President of System Sales for ICS, stated, “We are thrilled to join the Strong family. This is an industry

where relationships and trust are critical to success, and Strong is the right partner to help take our business to the next stage of

growth.”

Mark

Roberson, CEO of SGE, added, “The acquisition of ICS marks our second acquisition since going public in May of this year. We believe

this acquisition not only adds meaningful revenue and scale but is also highly synergistic to our service offerings and customer relationships.”

About

Strong Global Entertainment, Inc.

Strong

Global Entertainment, Inc. (the “Company”), a subsidiary of FG Group Holdings Inc. (NYSE American: FGH), is a leader in the

entertainment industry, providing mission critical products and services to cinema exhibitors and entertainment venues for over 90 years.

The Company manufactures and distributes premium large format projection screens, provides comprehensive managed services, technical

support and related products and services primarily to cinema exhibitors, theme parks, educational institutions, and similar venues.

In addition to traditional projection screens, the Company manufactures and distributes its Eclipse curvilinear screens, which are specially

designed for theme parks, immersive exhibitions, as well as simulation applications. It also provides maintenance, repair, installation,

network support services and other services to cinema operators, primarily in the United States. The Company also owns Strong Studios,

Inc., which develops and produces original feature films and television series.

About

Fundamental Global®

Fundamental

Global® is a private partnership focused on long-term strategic holdings. Fundamental Global® was co-founded

by former T. Rowe Price, Point72 and Tiger Cub portfolio manager Kyle Cerminara and former Chairman and CEO of TD Ameritrade, Joe Moglia.

Its current holdings include FG Financial Group Inc., FG Group Holdings Inc., BK Technologies Corp., GreenFirst Forest Products, Inc.,

iCoreConnect, Inc., FG Acquisition Corp., OppFi Inc., Hagerty Inc., and FG Communities, Inc.

The

FG® logo is a registered trademark of Fundamental Global®.

Forward

Looking Statements

This

press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements,

other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements

contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,”

“could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,”

“plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,”

“will,” “would,” or the negative of these words or other similar expressions, although not all forward-looking

statements contain these words. For example, this press release is using forward-looking statements when it discusses ICS’s growth.

Forward-looking statements are based on STS’s and the Company’s current expectations and are subject to inherent uncertainties,

risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future

events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk

Factors” in the final prospectus related to the initial public offering of the Company filed with the SEC. Forward-looking statements

contained in this announcement are made as of this date, and STS and the Company undertake no duty to update such information except

as required under applicable law.

Strong

Global Entertainment Contact:

Mark

Roberson

Strong

Global Entertainment, Inc. - Chief Executive Officer

(704)

471-6784

IR@strong-entertainment.com

John

Nesbett/Jennifer Belodeau

IMS

Investor Relations

(203)

972-9200

sge@imsinvestorrelations.com

v3.23.3

Cover

|

Nov. 03, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 03, 2023

|

| Entity File Number |

001-41688

|

| Entity Registrant Name |

STRONG

GLOBAL ENTERTAINMENT, INC.

|

| Entity Central Index Key |

0001893448

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Address, Address Line One |

5960

Fairview Road

|

| Entity Address, Address Line Two |

Suite 275

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28210

|

| City Area Code |

(704)

|

| Local Phone Number |

471-6784

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Voting Shares, without par value

|

| Trading Symbol |

SGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

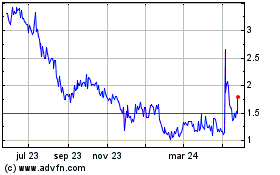

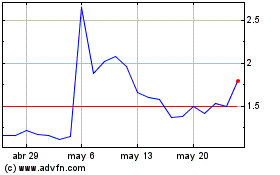

Strong Global Entertainm... (AMEX:SGE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Strong Global Entertainm... (AMEX:SGE)

Gráfica de Acción Histórica

De May 2023 a May 2024