UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

January 15, 2024

Commission File No. 0001-34184

SILVERCORP

METALS INC.

(Translation of registrant’s name into English)

Suite 1750 - 1066 West Hastings

Street

Vancouver, BC Canada V6E 3X1

(Address of principal executive office)

[Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ ] Form

40-F [ X ]

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

| Dated:

January 15, 2024 |

SILVERCORP METALS INC. |

| |

|

| |

/s/ Derek Liu |

| |

Derek Liu |

| |

Chief Financial Officer |

EXHIBIT INDEX

| |

|

| EXHIBIT |

DESCRIPTION OF EXHIBIT |

Exhibit 99.1

Silvercorp Reports Operational Results and Financial

Results Release Date for Third Quarter, Fiscal 2024

| Trading Symbol: |

TSX: SVM |

| |

NYSE AMERICAN: SVM |

VANCOUVER, BC, Jan. 15, 2024 /CNW/ - Silvercorp

Metals Inc. ("Silvercorp" or the "Company") (TSX: SVM) (NYSE American: SVM) reports production and sales figures

for the third quarter ended December 31, 2023 of fiscal year 2024 ("Q3 Fiscal 2024"). The Company expects to release its Q3

Fiscal 2024 unaudited financial results on Thursday, February 8, 2024 after market close.

Q3 Fiscal 2024 Operational Results

- Gold

production of 1,342 ounces, an increase of 22% over Q3 Fiscal 2023;

- Silver

equivalent (only silver and gold)1 production of approximately 1.8 million ounces;

- Zinc

production of approximately 7.4 million pounds, an increase of 6% over Q3 Fiscal 2023; and

- Lead production of approximately

16.8 million pounds, a decrease of 16% over Q3 Fiscal 2023.

| |

|

Third Quarter Fiscal 2024 |

|

Third Quarter Fiscal 2023 |

| |

|

Ying Mining

District |

GC |

Consolidated |

|

Ying Mining

District |

GC |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Production Data |

|

|

|

|

|

|

|

| |

Ore Mined (tonnes) |

245,606 |

99,667 |

345,273 |

|

206,854 |

89,196 |

296,050 |

| |

Ore Milled (tonnes) |

|

|

|

|

|

|

|

| |

Gold ore |

12,726 |

- |

12,726 |

|

- |

- |

- |

| |

Silver ore |

201,475 |

98,299 |

299,774 |

|

213,830 |

89,612 |

303,442 |

| |

|

214,201 |

98,299 |

312,500 |

|

213,830 |

89,612 |

303,442 |

| |

|

|

|

|

|

|

|

|

| |

Head Grades |

|

|

|

|

|

|

|

| |

Silver (gram/tonne) |

235 |

68 |

|

|

262 |

75 |

|

| |

Lead (%) |

3.5 |

1.1 |

|

|

4.0 |

1.4 |

|

| |

Zinc (%) |

0.7 |

2.7 |

|

|

0.7 |

2.8 |

|

| |

|

|

|

|

|

|

|

|

| |

Recovery Rates |

|

|

|

|

|

|

|

| |

Silver (%) |

94.9 |

80.3 |

|

|

95.7 |

83.0 |

|

| |

Lead (%) |

94.8 |

90.9 |

|

|

95.4 |

90.3 |

|

| |

Zinc (%) |

71.4 |

90.1 |

|

|

66.4 |

90.1 |

|

| |

|

|

|

|

|

|

|

|

| Metal production |

|

|

|

|

|

|

|

| |

Gold (ounces) |

1,342 |

- |

1,342 |

|

1,100 |

- |

1,100 |

| |

Silver (in thousands of ounces) |

1,511 |

173 |

1,684 |

|

1,674 |

179 |

1,853 |

| |

Silver equivalent (in thousands of ounces) |

1,622 |

173 |

1,795 |

|

1,770 |

179 |

1,949 |

| |

Lead (in thousands of pounds) |

14,552 |

2,211 |

16,763 |

|

17,647 |

2,412 |

20,059 |

| |

Zinc (in thousands of pounds) |

2,153 |

5,251 |

7,404 |

|

2,082 |

4,892 |

6,974 |

| |

|

|

|

|

|

|

|

|

| Metals sold |

|

|

|

|

|

|

|

| |

Gold (ounces) |

1,342 |

- |

1,342 |

|

1,100 |

- |

1,100 |

| |

Silver (in thousands of ounces) |

1,536 |

167 |

1,703 |

|

1,675 |

185 |

1,860 |

| |

Lead (in thousands of pounds) |

14,194 |

2,054 |

16,248 |

|

16,969 |

2,304 |

19,273 |

| |

Zinc (in thousands of pounds) |

2,215 |

5,105 |

7,320 |

|

2,143 |

4,976 |

7,119 |

At the Ying Mining District, 245,606 tonnes of ore

were mined, up 19% over Q3 Fiscal 2023, and 214,201 tonnes of ore were milled, a slight increase over Q3 Fiscal 2023. Approximately 1.5

million ounces of silver, 1,342 ounces of gold (or 1.6 million ounces of silver equivalent), 14.6 million pounds of lead, and 2.2 million

pounds of zinc were produced, representing increases of 22% and 3%, respectively in gold and zinc, and decreases of 10%, 8% and 18%, respectively,

in silver, silver equivalent and lead over Q3 Fiscal 2023.

The decrease in silver and lead production was mainly

due to i) lower head grades achieved due to mining sequences; ii) 60,095 tonnes of ores were stockpiled and will be processed in

the fourth quarter during the Chinese New Year; and iii) 12,700 tonnes of gold ores were mined and processed with grades of 1.9 grams

per tonne ("g/t") gold, 74 g/t silver, 1.0% lead, and 0.1% zinc to produce gravity gold concentrates, silver-gold-lead

(copper) concentrate, and zinc concentrate in Q3 Fiscal 2024. The gold recovery rate for gold ores processed was 91.2%.

At the GC Mine, 99,667 tonnes of ore were mined, up

12% over Q3 Fiscal 2023, and 98,299 tonnes of ore were milled, up 10% over Q3 Fiscal 2023. Approximately 173 thousand ounces of silver,

2.2 million pounds of lead, and 5.3 million pounds of zinc were produced, representing decreases of 3% and 8%, respectively, in silver

and lead, and an increase of 7% in zinc, over Q3 Fiscal 2023. The decrease in silver and lead production was mainly due to lower head

grades achieved due to mining sequences.

Nine Months Ended December 31, 2023 and 2022 Consolidated Operational

Results

| |

|

Nine months ended December 31, 2023 |

|

Nine months ended December 31, 2022 |

| |

|

Ying Mining

District |

GC |

Consolidated |

|

Ying Mining

District |

GC |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Production Data |

|

|

|

|

|

|

|

| |

Ore Mined (tonnes) |

679,990 |

241,968 |

921,958 |

|

636,819 |

250,316 |

887,135 |

| |

Ore Milled (tonnes) |

|

|

|

|

|

|

|

| |

Gold ore |

36,419 |

- |

36,419 |

|

- |

- |

- |

| |

Silver ore |

599,459 |

232,824 |

832,283 |

|

642,147 |

251,114 |

893,261 |

| |

|

635,878 |

232,824 |

868,702 |

|

642,147 |

251,114 |

893,261 |

| |

|

|

|

|

|

|

|

|

| |

Head Grades |

|

|

|

|

|

|

|

| |

Silver (gram/tonne) |

241 |

72 |

|

|

262 |

73 |

|

| |

Lead (%) |

3.5 |

1.2 |

|

|

3.9 |

1.3 |

|

| |

Zinc (%) |

0.7 |

2.7 |

|

|

0.7 |

2.8 |

|

| |

|

|

|

|

|

|

|

|

| |

Recovery Rates |

|

|

|

|

|

|

|

| |

Silver (%) |

95.0 |

81.8 |

|

|

95.7 |

82.5 |

|

| |

Lead (%) |

95.1 |

90.7 |

|

|

95.0 |

89.6 |

|

| |

Zinc (%) |

70.7 |

90.2 |

|

|

62.3 |

90.1 |

|

| |

|

|

|

|

|

|

|

|

| Metal production |

|

|

|

|

|

|

|

| |

Gold (ounces) |

5,352 |

- |

5,352 |

|

3,400 |

- |

3,400 |

| |

Silver (in thousands of ounces) |

4,614 |

440 |

5,054 |

|

5,027 |

484 |

5,511 |

| |

Silver equivalent (in thousands of ounces) |

5,080 |

440 |

5,520 |

|

5,318 |

484 |

5,802 |

| |

Lead (in thousands of pounds) |

44,952 |

5,692 |

50,644 |

|

50,566 |

6,564 |

57,130 |

| |

Zinc (in thousands of pounds) |

6,463 |

12,363 |

18,826 |

|

5,986 |

13,900 |

19,886 |

| |

|

|

|

|

|

|

|

|

| Metals sold |

|

|

|

|

|

|

|

| |

Gold (ounces) |

5,352 |

- |

5,352 |

|

3,400 |

- |

3,400 |

| |

Silver (in thousands of ounces) |

4,665 |

431 |

5,096 |

|

5,083 |

481 |

5,564 |

| |

Lead (in thousands of pounds) |

43,471 |

5,282 |

48,753 |

|

49,316 |

6,350 |

55,666 |

| |

Zinc (in thousands of pounds) |

6,510 |

12,308 |

18,818 |

|

6,060 |

13,927 |

19,987 |

About Silvercorp

Silvercorp is a Canadian mining company producing

silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company's strategy is to create shareholder

value by 1) focusing on generating free cashflow from long life mines; 2) organic growth through extensive drilling for discovery; 3)

ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG. For more information,

please visit our website at www.silvercorpmetals.com.

For further information

Silvercorp Metals Inc.

Lon Shaver

President

Phone: (604) 669-9397

Toll Free 1(888) 224-1881

Email: investor@silvercorp.ca

Website: www.silvercorpmetals.com

CAUTIONARY DISCLAIMER - FORWARD-LOOKING STATEMENTS

Certain of the statements and information in this

news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform

Act of 1995 and "forward-looking information" within the meaning of applicable Canadian and US securities laws (collectively,

"forward-looking statements"). Any statements or information that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words

or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects",

"estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts",

"objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain

actions, events or results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking

statements. Forward-looking statements relate to, among other things: the price of silver and other metals; the accuracy of mineral

resource and mineral reserve estimates at the Company's material properties; the sufficiency of the Company's capital to finance the Company's

operations; estimates of the Company's revenues and capital expenditures; estimated production from the Company's mines in the Ying Mining

District and the GC Mine; timing of receipt of permits and regulatory approvals; availability of funds from production to finance the

Company's operations; and access to and availability of funding for future construction, use of proceeds from any financing and development

of the Company's properties.

Actual results may vary from forward-looking statements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual

events or results to differ from those reflected in the forward-looking statements, including, without limitation, risks relating to:

global economic and social impact of COVID-19; fluctuating commodity prices; calculation of resources, reserves and mineralization and

precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development

programs; feasibility and engineering reports; permits and licences; title to properties; property interests; joint venture partners;

acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company;

timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions

into the Company's existing operations; competition; operations and political conditions; regulatory environment in China and Canada;

environmental risks; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; key personnel; conflicts of

interest; dependence on management; internal control over financial reporting; and bringing actions and enforcing judgments under U.S.

securities laws.

This list is not exhaustive of the factors that may

affect any of the Company's forward-looking statements. Forward-looking statements are statements about the future and are inherently

uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the

forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to

in the Company's Annual Information Form under the heading "Risk Factors" and in the Company's Annual Report on Form 40-F, and

in the Company's other filings with Canadian and U.S. securities regulators. Although the Company has attempted to identify important

factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated,

estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements.

The Company's forward-looking statements are based

on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by

applicable securities laws, the Company does not assume any obligation to update forward-looking statements if circumstances or management's

assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements. Assumptions may

prove to be incorrect and actual results may differ materially from those anticipated. Consequently, guidance cannot be guaranteed. For

the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Additional information related to the Company, including

Silvercorp's Annual Information Form, can be obtained under the Company's profile on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov,

and on the Company's website at www.silvercorpmetals.com.

_______________________

| 1

Silver equivalent is calculated by converting the gold metal quantity to its silver equivalent using the ratio between the

net realized selling prices of gold and silver achieved, and then adding the converted amount expressed in silver ounces to the ounces

of silver. |

View original content to download multimedia:https://www.prnewswire.com/news-releases/silvercorp-reports-operational-results-and-financial-results-release-date-for-third-quarter-fiscal-2024-302035100.html

SOURCE Silvercorp Metals Inc

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2024/15/c3557.html

%CIK: 0001340677

CO: Silvercorp Metals Inc

CNW 17:15e 15-JAN-24

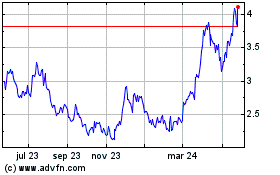

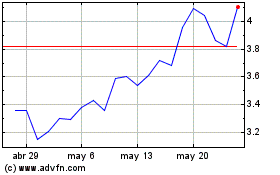

Silvercorp Metals (AMEX:SVM)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Silvercorp Metals (AMEX:SVM)

Gráfica de Acción Histórica

De May 2023 a May 2024