TIDMAAU

RNS Number : 8128U

Ariana Resources PLC

28 November 2023

28 November 2023

AIM: AAU

DRILLING COMPLETED AT KIZILCUKUR

A strong set of results from the Kizilcukur drilling

programme

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

mineral exploration and development company with gold mining

interests in Europe, is pleased to announce positive results from a

recent drilling programme at the Kizilcukur Project ("Kizilcukur"

or "the Project") of the Kiziltepe Sector. Kizilcukur is part of

Zenit Madencilik San. ve Tic. A.S. ("Zenit"), in partnership with

Proccea Construction Co. and Ozaltin Holding A.S. and is 23.5%

owned by Ariana.

Highlights:

-- Resource infill and extension drilling programme has been

completed , testing all three main zones of mineralisation,

identifying potential extension zones.

-- Initial results of drilling include:

6.0m @ 4.75g/t Au + 135.2g/t Ag

7.3m @ 2.43g/t Au + 36.3g/t Ag

4.5m @ 3.76g/t Au + 17.7g/t Ag

-- Process metallurgical testwork of the Kizilcukur

mineralisation yields an average gold recovery of 97%,

significantly higher than Kiziltepe.

-- A rock-chip sampling programme designed to test the

extensions to outcropping zones returned grades up to 15.47g/t

Au.

-- Re-analysis of historic core samples confirms the historic gold grades.

Dr. Kerim Sener, Managing Director, commented:

"This is a great set of results from the Kizilcukur drilling

programme. The vein system has now been sufficiently well tested

for the Zenit mining team and the incoming data is continuing to

demonstrate the continuity of gold and silver mineralisation in

many of the areas tested. The Zenit team have commenced the

detailed work to bring Kizilcukur into the Kiziltepe Sector mining

plan.

"At this stage, we are confident that Kizilcukur will yield a

small, high-grade resource capable of being converted to a reserve,

which will augment the ongoing operations at Kiziltepe.

Metallurgically the ore performs very well with exceptionally high

gold recovery, which is in part the result of nuggety free-gold. We

expect Kizilcukur will be operated as a satellite mine to Kiziltepe

within the next eighteen months."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

Drilling Programme

This drilling programme was designed to increase the confidence

in the resource, and upgrade the classification, in addition to

further testing along known mineralised structures, both at depth

and along strike ( Figure 1 ). In particular, the vein systems at

Ziya and Zafer were targeted, which had previously received only

limited drill testing. In addition, in-fill drilling at depth and

along strike was completed at the Zeki main vein system.

From the end of July through to November 2023, Ariana and Zenit

exploration teams completed the HQ diamond drilling programme of 56

holes, totalling 3,563.8m. At the peak of the programme, two drill

rigs were operating simultaneously. The average depth for all

drilling was approximately 63 metres, with a minimum depth of 28.6

meters and a maximum depth of 118.8 metres. The dip angles were

planned from 45deg to 77deg to test the extents of the

mineralisation.

Figure 1: Map showing historic and new drill collars at the

Kizilcukur Project, with quartz veins mapped at surface shown in

red. Holes for which assays have been received are shown in dark

blue and holes for which data is still to be received are shown in

light blue.

Results have returned for 20 holes to date (Table 1), with the

most significant intercepts within the expected target zones

including:

-- KCR-D01-23 : 6.0m @ 4.75g/t Au + 135.2g/t Ag

o including 1.0m @ 5.95g/t Au + 268.8g/t Ag

o including 1.1m @ 6.42g/t Au + 7.6g/t Ag

-- KCR-D02-23 : 7.3m @ 2.43g/t Au + 36.3g/t Ag

-- KCR-D19-23: 4.5m @ 3.76g/t Au + 17.7g/t Ag

-- KCR-D20-23: 2.3m @ 4.55g/t Au + 78.4g/t Ag

Table 1: Significant gold and silver intercepts calculated for

all 2023 drilling to date, using a 0.5g/t Au minimum cut-off and

allowing for up to 1m internal dilution. Intercepts calculated

using KML data.

Hole ID From (m) To (m) Length (m) Au (g/t) Ag (g/t)

KCR-D01-23 20.9 26.9 6.0 4.75 135.2

--------- ------- ----------- --------- ---------

incl. 20.9 23.8 1.0 5.95 268.8

--------- ------- ----------- --------- ---------

incl. 25.8 26.9 1.1 6.42 7.6

--------- ------- ----------- --------- ---------

KCR-D02-23 0.0 2.1 2.1 1.54 125.3

--------- ------- ----------- --------- ---------

13.2 20.5 7.3 2.43 36.3

--------- ------- ----------- --------- ---------

31.4 32.7 1.3 0.72 13.5

--------- ------- ----------- --------- ---------

KCR-D04-23 39.7 41.5 1.8 0.66 89.1

--------- ------- ----------- --------- ---------

KCR-D05-23 55.7 56.6 0.9 0.52 4.5

--------- ------- ----------- --------- ---------

79.3 81.5 2.2 1.89 88.0

--------- ------- ----------- --------- ---------

KCR-D06-23 77.6 78.6 1.0 0.50 0.3

--------- ------- ----------- --------- ---------

82.6 83.6 1.0 1.13 22.2

--------- ------- ----------- --------- ---------

KCR-D07-23 63.4 65.2 1.8 0.90 208.6

--------- ------- ----------- --------- ---------

KCR-D08-23 58.7 59.7 1.0 0.73 98.1

--------- ------- ----------- --------- ---------

60.4 60.9 0.5 0.62 47.9

--------- ------- ----------- --------- ---------

KCR-D09-23 74.0 78.9 4.9 0.82 46.2

--------- ------- ----------- --------- ---------

KCR-D10-23 15.9 17.7 1.8 2.25 62.0

--------- ------- ----------- --------- ---------

KCR-D13-23 43.4 44.7 1.3 0.77 172.5

--------- ------- ----------- --------- ---------

57.3 59.3 2.0 0.50 38.2

--------- ------- ----------- --------- ---------

60.5 61.7 1.2 0.52 5.3

--------- ------- ----------- --------- ---------

KCR-D14-23 55.5 56.5 1.0 1.29 16.3

--------- ------- ----------- --------- ---------

KCR-D15-23 2.0 3.0 1.0 4.30 30.0

--------- ------- ----------- --------- ---------

8.0 12.3 4.3 1.58 50.6

--------- ------- ----------- --------- ---------

15.3 16.3 1.0 0.81 2.1

--------- ------- ----------- --------- ---------

23.0 24.0 1.0 0.56 65.2

--------- ------- ----------- --------- ---------

KCR-D16-23 0.0 1.0 1.0 0.57 27.8

--------- ------- ----------- --------- ---------

KCR-D18-23 20.0 22.9 2.9 2.91 2.7

--------- ------- ----------- --------- ---------

78.7 79.7 1.0 3.33 16.6

--------- ------- ----------- --------- ---------

KCR-D19-23 94.1 98.6 4.5 3.76 17.7

--------- ------- ----------- --------- ---------

KCR-D20-23 10.3 12.6 2.3 4.55 78.4

--------- ------- ----------- --------- ---------

incl. 11.5 12.6 1.1 6.42 85.8

--------- ------- ----------- --------- ---------

KCR-D51-23 25.0 26.0 1.0 1.06 1.9

--------- ------- ----------- --------- ---------

39.5 42.9 3.4 1.07 126.3

--------- ------- ----------- --------- ---------

The drilling programme also highlighted the complex multi-phase

mineralisation characteristic of the Kizilcukur deposit (Figure 2).

Three different mineralisation phases have been identified and will

be evaluated following the receipt of all assay results. These

represent epithermal quartz veins, manganese rich zones, and a

deeper sulphidic lead and zinc zone, which are suggestive of a low

to intermediate sulphidation type system.

Figure 2: An example of the mineralised zones seen at

Kizilcukur.

A total of 90.30m drill core from 5 selected historic drill

holes have been re-analysed for gold, silver and multi-elements to

check the results, which all returned results within reasonable

confidence intervals. The results of the highest grade re-analysed

zone are seen below in Table 2. Photon assay is being considered as

a check analysis for core samples as a potential nugget effect has

been noted.

Table 2: Original and repeat assay results for historic

hole.

Hole ID From To Interval Au g/t Ag g/t

m m m

Original Repeat Original Repeat

--------- ------- --------- -------

KDTD013 109.65 111.00 1.35 14.50 30.21 39.0 35.1

------- ------- --------- --------- ------- --------- -------

111.00 111.52 0.52 0.40 0.26 66.5 37.5

------- ------- --------- --------- ------- --------- -------

111.52 112.50 0.98 26.50 35.03 70.5 60.0

------- ------- --------- --------- ------- --------- -------

112.50 113.60 1.10 0.10 0.29 22.6 20.5

------- ------- --------- --------- ------- --------- -------

Metallurgical Testwork

Two HQ diamond holes were drilled to twin the best

representative mineralisation intervals of the 2015 RC and 2019

diamond drilling programmes. The whole core representing 2.90m and

3.20m were sampled with average grades of 5.17g/t and 2.20g/t Au,

respectively. Both samples were crushed and sieved to -106 micron

and subjected to NaCN leach tests. The average recovery of gold was

97%, following 72 hours leach time. Silver showed recoveries of up

to 75% after 72 hours.

Rock-chip Sampling

A total of 66 rock-chip samples were collected to sample the

untested subparallel and extensional zones of the known Kizilcukur

vein system (Figure 3). The highest gold grade from this sampling

programme is 15.47g/t, proving that the new zones are potential

targets for further gold mineralisation and will be used to define

new drill targets. Areas to the NW of Zeki and to the SE of Zafer,

in addition to a parallel vein system to Ziya, are of particular

interest.

Figure 3: Results of the Kizilcukur rock-chip sampling, with

highest grades labelled.

Project Summary

The Kizilcukur Project consists of one operational licence

located in Balikesir Province in Western Turkey. The property lies

22km to the northeast (straight line) and 70km by road from the

Kiziltepe Mine. The Kizilcukur Project is one of the 3 satellite

projects which have been sold to Zenit (see announcement of 2

December 2020).

The Project covers an area containing a series of sub-parallel

quartz veins hosted by ophiolitic (dominantly basaltic) units that

trend northwest and extend for about two kilometres. The veins

exhibit classic low-sulfidation epithermal textures and attain a

maximum true width of 8m. The Zeki Vein extends over a strike

length of 820m. Composite rock-chip sampling of 80m strike along

this quartz vein returned encouraging assay results of 6m at 3.3g/t

Au, 2m at 9.6g/t Au and 1m at 7.2g/t Au prior to drill testing. The

peak rock-chip assay result in this area was 152g/t Au and 1,320g/t

Ag, suggesting the potential for substantial near-surface

enrichment.

The Mineral Resource Estimate for Kizilcukur is c. 21,100oz gold

(Au) and 0.62Moz silver (Ag) contained metal on three main veins

(see announcement of 11 May 2020). 85% of the tonnage is in

Measured and Indicated (M+I) categories: 218,317t @ 2.72g/t Au and

77.04g/t Ag. 46% of the M+I tonnage is located within the

higher-grade Zeki Main Vein, with a grade of 3.62g/t Au and

82.54g/t Ag, upon which trial mining operations have been

undertaken previously.

Trial mining was completed within the central part of the Zeki

Pit in 2017. This pit is the largest and highest grade of the three

pits defined following Whittle optimisation of the Kizilcukur

resource in 2016. The General Directorate of Mining Affairs

approved blasting operations on the licence as part of the Mining

Permit (see announcement of 18 November 2015).

Sampling and Assaying Procedures

All diamond drill core is currently being processed at the

Kiziltepe mine site and analysed at the Kiziltepe Mine Laboratory

("KML"). Results are assessed systematically and are grouped

according to project.

HQ-size drill-core samples from the drilling programme at

Kizilcukur were cut in half by a diamond saw and sent for analysis

in batches in line with the Company's quality control procedures.

Core recovery for all drilling conducted at Kizilcukur during this

campaign was 90%. A total of 3,621 samples (including 762 QA/QC

samples) were submitted to KML, of which results for 1,615 samples

have been received. Samples to be sent to ALS Global, Izmir as an

external laboratory check to add confidence to KML results, have

been selected and are awaiting dispatch.

QA/QC sample insertion rates vary depending on the batch size

accepted by the laboratory. Ariana sampling protocol requires

insertion of 4 QA/QC samples per batch to include 1 blank, 1 CRM, 1

field duplicate and 1 pulp duplicate to assess the accuracy and

precision of all stages of the sampling and analysis. During this

drilling programme, Zenit QA/QC protocol required 1 blank, 1 CRM, 1

field duplicate, and 1 pulp duplicate per batch of 19 samples and

over 10% samples analysed at external laboratory.

Between 2020 and 2021, KML has undergone an extensive expansion

to meet the significant demands for sample assaying, from both the

mining and exploration teams. This expansion is complete with the

onsite laboratory, now housing seven furnaces, two ICP-OES

instruments, two Atomic Absorption spectrometers (AAS), three

drying ovens, three crushers and three pulverisers. The laboratory

upgrades have allowed for a doubling of sampling throughput (70

samples per day to 135). The two major upgrades for 2021 included

the addition of 1) a multi-element ICP-OES (Perkin Elmer Avio 550)

analyser, and 2) an Elementrac CS-I sulphur-carbon analyser. The

ICP-OES provides the team with a full suite of elements on selected

samples (as opposed to just gold and silver).

However, new operating procedures are currently being internally

reviewed and calibrations of the new instruments are being

assessed. As part of this, the laboratory team are sending in

excess of 10% of their crushed rejects from selected drill core

samples to ALS Global in Izmir for check assays. Zenit's internal

QA/QC data and sample duplicates have been reviewed, and are

considered approved for Ariana's reporting purposes. In addition,

since October 2022 KML has been accredited by the Turkish

Accreditation Agency (TÜRKAK) with 'TS EN ISO/IEC 17025:2017

General Requirements for the Competence of Experimental and

Calibration Laboratory.'

All samples were assayed for gold using a 30g fire assay.

Reviews of the assay results have determined that all Quality

Control and Quality Assurance samples (blanks, standards, and

duplicates) passed the required quality control checks established

by the Company, with duplicate samples showing excellent

correlation. Laboratory sample preparation, assaying procedures and

chain of custody are appropriately controlled. Zenit maintains an

archive of half-core samples and a photographic record of all cores

for future reference.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited (Nominated Tel: +44 (0) 20 7628 3396

Adviser)

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited (Joint Tel: +44 (0) 20 7886 2500

Broker)

John Prior / Hugh Rich / Atholl

Tweedie

WHIreland Limited (Joint Broker) Tel: +44 (0) 207 2201666

Harry Ansell / Katy Mitchell /

George Krokos Tel: +44 (0) 7983 521 488

Yellow Jersey PR Limited (Financial

PR)

Dom Barretto / Shivantha Thambirajah arianaresources@yellowjerseypr.com

/

Bessie Elliot

Editors' Note:

The information in this announcement that relates to exploration

results is based on information compiled by Dr. Kerim Sener BSc

(Hons), MSc, PhD, Managing Director of Ariana Resources plc. Dr.

Sener is a Fellow of The Geological Society of London and a Member

of The Institute of Materials, Minerals and Mining and has

sufficient experience relevant to the styles of mineralisation and

type of deposit under consideration and to the activity that has

been undertaken to qualify as a Competent Person as defined by the

2012 edition of the Australasian Code for the Reporting of

Exploration Results, Mineral Resources and Ore Reserves (JORC Code)

and under the AIM Rules - Note for Mining and Oil & Gas

Companies. Dr. Sener consents to the inclusion in the report of the

matters based on his information in the form and context in which

it appears.

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at February 2022).

The joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 222,000 ounces gold and 3.8 million ounces silver (as at

February 2022). The mine has been in pro table production since

2017 and is expected to produce at a rate of c.20,000 ounces of

gold per annum to at least the mid-2020s. A Net Smelter Return

("NSR") royalty of 2.5% on production is being paid to

Franco-Nevada Corporation.

The Tavsan Gold Mine is located in western Turkey and contains a

JORC Measured, Indicated and Inferred Resource of 307,000 ounces

gold and 1.1 million ounces silver (as at November 2022). Following

the approval of its Environmental Impact Assessment and associated

permitting, Tavsan is being developed as the second gold mining

operation in Turkey and is currently in construction. A NSR royalty

of up to 2% on future production is payable to Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Gold eld, which contains the "Hot Gold

Corridor" comprising several signi cant gold- copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana owns 100% of Australia-registered Asgard Metals Fund

("Asgard"), as part of the Company's proprietary Project Catalyst

Strategy. The Fund is focused on investments in high-value

potential, discovery-stage mineral exploration companies located

across the Eastern Hemisphere and within easy reach of Ariana's

operational hubs in Australia, Turkey, UK and Zimbabwe.

Ariana owns 75% of UK-registered Western Tethyan Resources Ltd

("WTR"), which operates across south-eastern Europe and is based in

Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition. WTR is being funded through a

ve-year Alliance Agreement with Newmont Mining Corporation (

www.newmont.com ) and is separately earning-in to up to 85% of the

Slivova Gold Project.

Ariana owns 58% of UK-registered Venus Minerals Ltd ("Venus")

which is focused on the exploration and development of copper-gold

assets in Cyprus which contain a combined JORC Indicated and

Inferred Resource of 17Mt @ 0.45% to 1.10% copper (excluding

additional gold, silver and zinc.

Panmure Gordon (UK) Limited and WH Ireland Limited are brokers

to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana, you are invited to visit the

Company's website at www.arianaresources.com .

Glossary of Technical Terms:

"Au" gold;

"Ag" silver;

"g/t" grams per tonne;

"JORC" the Joint Ore Reserves Committee;

"km" Kilometres;

"m" Metres;

"Moz" Million ounces;

"oz" Troy ounces;

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLFEWFMWEDSEIF

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

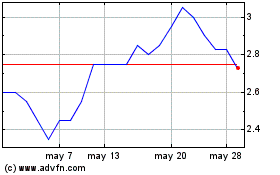

Ariana (AQSE:AAU.GB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Ariana (AQSE:AAU.GB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025