Bitcoin Capped Below $65,000 As RSI Falls Below 80 In Monthly Chart: Should You Worry?

25 Septiembre 2024 - 3:30PM

NEWSBTC

Bitcoin is firm at press time. According to CoinMarketCap data, the

world’s most valuable coin is changing hands above $63,500, steady

on the last day and up a decent 7% over the previous week of

trading. Technically, the uptrend remains as long as prices stay

above the support zone at around $58,000 and $60,000. Bitcoin Up

30% From August Lows, RSI Dips Below 80% Level In The Monthly Chart

At press time, traders are upbeat and optimistic, which could form

the base of another leg up. So far, since the dip in early August,

Bitcoin is up 30% and retesting August highs at around $65,000.

However, there are high expectations that buyers will push prices

above this level, marking another phase for confident bulls, a

development in the monthly chart is worth noting. Related Reading:

Bitcoin Could Top At $400,000 Based On This Model, Analyst Says

Taking to X, the analyst notes that as bulls struggle to break

above $65,000 and print a fresh 2-month high, the upside momentum

seems to be fading. At press time, the Relative Strength Index

(RSI) in the monthly chart is falling, recently breaking below the

80%. Typically, the zone between 80% and 100% marks the upper limit

of the oscillator, denoting that the coin is overvalued or in the

overbought territory. With the RSI falling, it can be interpreted

that the upside momentum is down, which is a net negative for

bulls. Since this is printed out in the monthly chart, it could

have serious consequences in the daily and lower time frames. It

can hint that cracks are forming, and sellers may be preparing to

push lower, especially if bulls fail to break above $65,000. There

Is Hope, BTC Will Likely Spike Once Prices Race Above $73,000

Bearish as this may be, there is hope. The analyst observes that

though the RSI is below the 80% mark, this is not the first time.

On multiple occasions, Bitcoin prices recover steadily when the RSI

falls to this level. Nonetheless, this doesn’t happen all the time.

As this is a concern, traders should closely monitor how price

action pans out in the coming days. A drop toward the $60,000 mark

will pour cold water into the current momentum, signaling the start

of a possible correction. Related Reading: Cardano (ADA) Reclaims

Top 10 Crypto Spot, Analysts Set New Targets Even with this

outlook, the analyst is bullish. In a separate post, the analyst

said if Bitcoin shakes off weakness and climbs towards $73,000, the

coin may rally strongly. When this happens, the analyst expects a

new influx of fresh liquidity, especially in the futures market.

The inflow, in turn, could drive prices to new levels, perhaps even

above all-time highs. All the same, before this happens, BTC needs

to gather momentum. This surge will happen, especially if there is

a decisive close above the $65,000 resistance line. Feature image

from DALLE, chart from TradingView

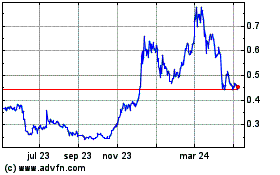

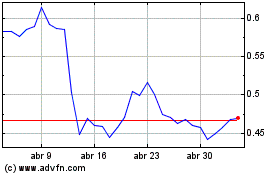

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024