Synthetix’s Request To Spend 900,000 ARB Rejected: Will Arbitrum Price Recover?

17 Septiembre 2024 - 10:00PM

NEWSBTC

Synthetix, a popular DeFi protocol, is facing challenges regarding

its plans for Arbitrum, a layer-2 platform for Ethereum. According

to the recent voting results, the community voted against its plans

to extend its Long-Term Incentive Program (LTIP) grant. Arbitrum

Holders Vote Against Synthetix Proposal The goal was to support the

launch of Multi-Collateral Perps. The feature would have permitted

traders to trade using margin with ETH, BTC, and USDx acting as

collateral when initiating perpetual futures on Arbitrum via

Synthetix perpetuals. Related Reading: LayerZero Surges over 7% As

Bulls Ignite Fresh Rally, A $4.5 Breakout Looms? If the Arbitrum

community had agreed, it would have allowed Synthetix to distribute

900,000 ARB as trading fee rebates. According to the Synthetix

proposal, they intended to incentivize users and, thus, boost the

active trading volume of Synthetix on the layer-2 platform. While

novel and a net positive for Synthetix, the ARB community deemed

the extension, which would have started from September 16 through

November 16, unnecessary. Subsequently, 66% of all ARB votes were

against this extension, and 9% supported this proposal. Now that

ARB holders have rejected the extension, the launch of the

Multi-Collateral Perps feature will face delays. For this reason,

Synthetix users on Arbitrum would have to wait longer to trade

trustless perpetual with the freedom to use various margin assets.

At the same time, there are now reduced incentives to

engage. Fewer users will be willing to trade on Arbitrum

using Synthetix perpetual without the extension. Accordingly, this

would negatively impact the DeFi trading portal.

Combining the above, engagement on Arbitrum would be impacted as

Synthetix traders, angling for the fee rebates sent from the

900,000 ARB, would withdraw. What’s Next? Will ARB Recover From

Record Lows? In the future, it remains to be seen how Synthetix

will proceed on Arbitrum, the largest Ethereum layer-2 by trading

volume. As it is, the protocol might now have to explore other

strategies to incentivize traders and launch the crucial

Multi-Collateral Perps feature. Related Reading: FTM Rockets 17%

Amid Growing Interest In Fantom Ecosystem Though SNX prices might

suffer, ARB might find support now that supply will be lowered.

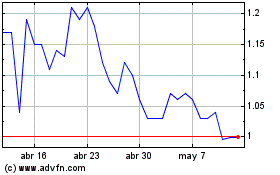

Looking at the daily chart of the ARBUSDT, sellers are in

control. After peaking in January 2024, ARB has been

plunging lower, sliding by as much as 80% to spot rates. The token

finds itself in critical support. If bears take over, ARB will

fall, printing fresh all-time lows. Feature image from iStock,

chart from TradingView

Arbitrum (COIN:ARBUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Arbitrum (COIN:ARBUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024