BNB Weekly Active Addresses Surge Over 6% – Is A Rally On The Way?

10 Septiembre 2024 - 7:00PM

NEWSBTC

Since March, the price of BNB, previously also known as Binance

Coin, has barely fallen below $500, despite the broader crypto

market downturn. Following heavy losses from major

cryptocurrencies, BNB has shown some impressive resistance to the

price drop, supported by strong demand. Related Reading: Vitalik

Buterin Withdraws 760 ETH As Market Turmoil Strikes Ethereum

Despite this strength, the latest BNB price forecast by CoinCodex

still estimates the coin could rise by 25% and reach $650 by

October 10, 2024. Meanwhile, investor sentiment is bearish, and the

Fear & Greed Index also stands at 33, reflecting that

uncertainty in the market. This mixed outlook brings up questions

about BNB’s near-term trajectory. While there might be a

possibility of growth in the long run, short-term conservatism is

required, more so from the recent coin volatility and broader

market dynamics. BNB’s Sideways Movement And Strong Demand Since

March, BNB has moved within a sideways pattern that posts heavy ups

and downs. However, after every fall, BNB has strongly rebounded

above $500, meaning that there is strong demand for the coin. For

instance, on September 6, it fell as low as $470 but later

rebounded to trade at $520 at press time. This is also in line with

the rising expectations of an altseason, as a decline in Bitcoin

dominance tends to boost altcoins like BNB. Investors seem

confident that BNB might continue profiting from this trend in a

way that it always has historically when stronger demand for

alternative cryptocurrencies was triggered. On-Chain Data: Activity

And Network Demand Recent on-chain data from Dune Analytics points

to both some promising and concerning trends in BNB. The number of

active addresses on the Binance Smart Chain increased by 6%

week-over-week, indicating that more people are interested in

getting on the network. This increase in active addresses did not,

however, reflect a similar uptick in transaction volumes, which

declined 1.1% over the week, hinting that increased participation

has not yet translated into strong network activity. The decline in

network fees also reflects reduced activity, which may have an

effect on the path that the BNB price may take. To be sure, high

network usage has always seen relatively high demand for the BNB

historically, and its prolonged depressed activity can cap the

upside potential of the coin. A Rally Around The Corner? Some

analysts think it could be set up for a run, despite the bearish

sentiment and recent price swings, particularly once altseason

starts to heat up. Usually, when Bitcoin dominance weakens, that

allows other assets to capture market attention and capital, which

is where altcoins, especially BNB, tend to do well. While the

projection for a 25% gain in price by CoinCodex could be the sort

of thing that might suggest that BNB will continue to rise, the

short-term prospects for the token remain uncertain. Related

Reading: Ether Liquidity Plummets 40% On Exchanges After ETF Debut

While the coin did manage to post green days of 47% over the last

month, the price volatility of 4.62% still showed risks. The

bearish sentiment and market fear, along with mixed network

activity, all imply prudence by investors in the immediate future.

BNB may very well persist with its resilience and probably grow

even more. This crypto asset is one to keep an eye on. But with

mixed signals in on-chain data and markets feeling their way

cautiously, the risks involved should be considered first before

investors dabble into the digital asset. While a rally is most

definitely possible, the market has not ended fluctuations just

yet, and that short-term volatility may still be an issue. Featured

image from Zipmex, chart from TradingView

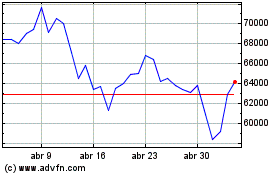

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Bitcoin (COIN:BTCUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024