Bitcoin Bull Market: Crypto Spot Trading Volumes Climb To 8-Month Highs

29 Octubre 2023 - 4:48AM

NEWSBTC

Bitcoin’s surge past $35,000 on the 24th and 25th of October took

the crypto world by surprise, as it indicated what might be the

beginning of a new bullish sentiment. Trading volumes for the

world’s largest cryptocurrency hit their highest levels since

March, showing that interest in Bitcoin is booming once more. The

entire crypto market saw an inflow of funds during the week,

leading to a surge in market cap. Data from CoinGecko shows that

the entire market cap increased from $1.184 trillion on Sunday,

October 22, to $1.312 trillion on Wednesday, October 25. Most of

this inflow went into Bitcoin, which saw its share of the

cryptocurrency market increase from 49.58% to 51.47 % during this

same time period. Related Reading: Injective (INJ) Rules

Weekend Top 50 Crypto Ranking With 60% Hike – Here’s Why Chart From

CoinGecko Daily Crypto Exchange Volumes Reach 8-Month High The

recent boom in Bitcoin and cryptocurrency prices pushed Bitcoin

daily trading volumes on crypto exchanges to their highest level

since March. According to The Block’s data dashboard, the seven-day

moving average for spot exchange volumes across multiple exchanges

hit $24.12 billion on Thursday and $23.98 billion on Friday,

respectively. In comparison, Bitcoin trading volume on exchanges

was at $11.02 billion on the first day of the month. Chart

from The Block A similar metric from IntoTheBlock shows Bitcoin

transactions reaching 1.4 million BTC as bulls looked to push

Bitcoin to $35,000. Chart from IntoTheBlock Trading volumes are an

important metric because higher volumes suggest greater interest

and activity in a market. It means more people are actively buying

and selling, leading to more liquidity and volatility. Whale

activity also increased during this time period, as indicated by

on-chain trackers. Whale transaction tracker Whale Alerts has shown

various BTC transactions amounting to millions of dollars to and

from crypto exchanges. 🚨 🚨 🚨 2,000 #BTC (68,255,228 USD)

transferred from #Coinbase to unknown wallethttps://t.co/SdIJ87ZxNT

— Whale Alert (@whale_alert) October 26, 2023 🚨 🚨 🚨 2,000 #BTC

(68,560,116 USD) transferred from unknown wallet to

#Coinbasehttps://t.co/MJNn4HwswP BTCUSD trading at $34,187 on the

weekend chart: TradingView.com — Whale Alert (@whale_alert) October

26, 2023 🚨 🚨 🚨 1,499 #BTC (51,276,429 USD) transferred from

#Binance to #Coinbenehttps://t.co/lVaDk8pYio — Whale Alert

(@whale_alert) October 27, 2023 What’s Next? More Bitcoin Movement?

Bitcoin has since formed a resistance level around $35,000 and is

now trading in a range. At the time of writing, Bitcoin is trading

at $34,150, still up by 14.47% in a 7-day timeframe. While price

action seems to be moving sideways at the moment, there are still

hopes of continued momentum from the bulls to push BTC past $35,000

in the new week. Related Reading: Aptos TVL Soars To A Record

$74 Million, Reflecting Growing Investor Confidence Matt Hougan,

CEO of crypto index fund manager Bitwise, has hinted at a further

inflow of money into Bitcoin. Hougan makes this prediction on spot

Bitcoin ETFs to project an inflow of around $50 billion within the

first five years of its launch. Others like crypto financial

services platform Matrixport have made more optimistic

claims. Data from analytics platform mempool.space has shown

a sustained increase in activity on the BTC network. If bulls

continue to maintain a strong push, we could see Bitcoin reach as

high as $45,000 in the early days of November. Featured image from

Shutterstock

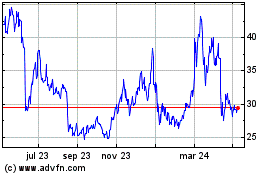

Dash (COIN:DASHUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Dash (COIN:DASHUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024