Bitcoin Price Targets $46,000 As DXY Receives Kiss Of Death

07 Noviembre 2023 - 6:45AM

NEWSBTC

In a striking dual analysis, the financial charts paint contrasting

futures for the US Dollar Index (DXY) and Bitcoin (BTC). Gert van

Lagen, a technical analyst, has provided a bearish prognosis for

the DXY, while simultaneously highlighting a bullish setup for

Bitcoin that could see it aiming for a $46,000 target. DXY Receives

Kiss Of Death The DXY has been in an upward trend since July, as

shown by the blue ascending trend line on the daily chart. However,

this line was broken to the downside on October 9, indicating a

change in market sentiment. Van Lagen explains, “Blue uptrend since

July has been broken too. Time to continue down.” This sentiment is

reinforced by the price action within the black channel from the

beginning of October till recently, where a period of consolidation

is visible, succeeded by a strong downward move. The DXY dropped by

1.2% last Friday, November 3, to 104.92 and is currently undergoing

a retest of the channel, a common technical pattern where the price

moves back to the breakdown point before continuing in the

direction of the initial direction. Related Reading: Why Ark

Invest’s Cathie Wood Picks Bitcoin Over Cash And Gold A third

bearish argument for the DXY is the rejection at the highlighted

red zone on the chart which signifies a high timeframe Fibonacci

resistance area. The Fibonacci retracement is a popular tool among

traders to identify potential reversal levels. The DXY’s price

action shows a “clear rejection” at this level, where the index

attempted to rise but was pushed back down, reinforcing the bearish

stance. Bitcoin Price Targets $46,000 Amidst the weakness of the

DXY, the inverse correlation with Bitcoin becomes a focal point for

crypto investors. Gert van Lagen provides insight into Bitcoin’s

potential trajectory, observing a bullish pattern emerging on its

6-hour chart. “BTC [6h] – Bullish pennant in play targeting $46k.

The pennant is part of the shown ascending channel,” remarked van

Lagen. The chart displays Bitcoin’s price consolidating in a

pennant structure, a continuation pattern that signals a pause in a

strong upward or downward trend before the next move. The pennant

is delineated by converging trend lines which have been formed by

connecting the sequential highs and lows of price action,

converging to a point indicative of an imminent breakout. Related

Reading: Expert Predicts Date For Next Bitcoin Cycle High Of

$130,000 In this case, the pennant follows a significant upward

trend, suggesting that the breakout is likely to continue in the

bullish direction. The ascending channel, highlighted by two

parallel upward-sloping lines, encompasses the entire bullish

movement of Bitcoin on the chart, including the pennant formation.

This channel serves as a guide for the price trend, indicating

where support and resistance levels are anticipated at the moment.

Van Lagen’s analysis posits a targeted price of $46,000 upon the

resolution of the pennant, a level that is determined by the height

of the prior move that preceded the pennant, projected upward from

the point of breakout. The dashed lines on the chart illustrate the

potential path Bitcoin’s price could take following the breakout.

An important detail in van Lagen’s chart is the ‘Invalidation’

level marked below the pennant. This level at $34,103 is critical

as it signifies where the bullish hypothesis would be considered

incorrect, serving as a stop-loss point for traders acting on this

pattern. At press time, BTC traded at $34,625. Featured image from

Dmytro Demidko / Unsplash, chart from TradingView.com

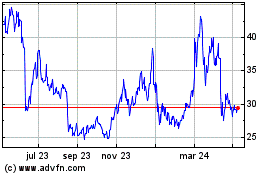

Dash (COIN:DASHUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Dash (COIN:DASHUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024