Hidden Driver Of Bitcoin’s Rally: Coinbase Dominance Fades, Binance Takes The Lead

11 Diciembre 2024 - 9:00PM

NEWSBTC

While Bitcoin (BTC) has previously shown significant momentum in

this market cycle, recent insights suggest that liquidity sources

beyond Coinbase may be driving the trend. A CryptoQuant analyst,

Mignolet, specifically provided a detailed analysis of Bitcoin’s

market, shedding light on the role of major exchanges like Coinbase

and Binance in the ongoing bull cycle. Related Reading: Anthony

Scaramucci Foresees China Bitcoin Strategic Reserve In 2025

Shifting Liquidity Dynamics And Exchange Roles In a recent post on

the CryptoQuant QuickTake platform titled “Coinbase Dominance

Remains Low,” Mignolet examined the trajectory of Coinbase’s

influence on Bitcoin’s price movements. The analyst highlighted

that while Coinbase played a crucial role in the initial stages of

this year’s Bitcoin rally, its dominance has since diminished. This

shift indicates a broader distribution of liquidity across the

market, with Binance emerging as a significant player in sustaining

the bullish momentum. Coinbase dominance remains low “However, just

before the rise in September-October, Coinbase dominance actually

declined and has not significantly increased even now (red box).” –

By @mignoletkr More details 👇https://t.co/nmnPGuz3WK

pic.twitter.com/mBSImH8MwD — CryptoQuant.com (@cryptoquant_com)

December 11, 2024 Mignolet’s analysis points to a critical

observation: Coinbase’s dominance in spot trading has notably

declined during the second phase of Bitcoin’s current rally. His

analysis revealed that Bitcoin exchange-traded funds (ETFs) were

approved earlier this year, spurring a surge in Coinbase’s trading

activity. This influx of liquidity was instrumental in driving

Bitcoin prices upward and disrupting the traditional halving cycle

expectations. However, as the rally progressed, Coinbase’s

influence waned. The analyst emphasized that while Coinbase remains

a pivotal source of liquidity, Binance has assumed a more prominent

role in the current market phase. Mignolet wrote: Let me reiterate:

I’m not saying that Coinbase liquidity is unimportant or

insignificant. It’s incredibly important. What I am highlighting is

that there’s an even more critical source of liquidity at play. =

Binance Notably, Binance’s growing dominance suggests that

liquidity flows from a wider array of participants, contributing to

a somewhat decentralized and strong market structure. This

redistribution could indicate broader institutional and retail

interest in Bitcoin as traders and investors diversify their

platforms. Bitcoin Sees Sharp Rebound Following a few days of

correction dropping below the $95,000 price mark, Bitcoin has now

seen a sudden rebound. Related Reading: As Bitcoin Trades Above

$100K—Analysts Reveal What Could Be Next Particularly, at the time

of writing, the asset has reclaimed the $100,000 price mark with a

current trading price of $100,625, marking a 4% increase in its

price. This increase in Bitcoin’s price has now brought the asset

to a mere 3.6% decrease away from its all-time high above $103,000

established earlier this month. Featured image created with DALL-E,

Chart from TradingView

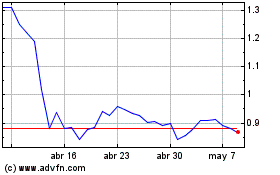

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024