Start Selling Bitcoin When This Happens, This Quant Says

01 Abril 2024 - 1:30PM

NEWSBTC

A quant has explained that the past pattern in the Bitcoin taker

buy-sell ratio metric may suggest the best window to start selling

the asset. Bitcoin Taker Buy Sell Ratio May Reveal Selling

Opportunities In a CryptoQuant Quicktake post, an analyst discussed

the trend in the Bitcoin “taker buy sell ratio.” This indicator

keeps track of the ratio between the Bitcoin taker buy and taker

sell volumes. When the value of this metric is greater than 1, the

investors are willing to purchase coins at a higher price right

now. Such a trend implies a bullish sentiment is the dominant force

in the market. Related Reading: Traders Not Showing Dogecoin FOMO,

Good Sign For Rally? On the other hand, the indicator being under

the mark suggests the selling pressure may be higher than the

current buying pressure in the sector. As such, the majority may

share a bearish mentality. Now, here is a chart that shows the

trend in the 30-day moving average (MA) Bitcoin taker buy-sell

ratio over the last few years: The 30-day MA value of the metric

appears to have been going down in recent days | Source:

CryptoQuant As the above graph shows, the 30-day MA Bitcoin taker

buy-sell ratio has recently fallen below the 1 level. The quant has

highlighted in the chart the region of the metric where the bull

run peaks in 2021 formed. The indicator would appear to dip below

0.97 during both the heights registered in that bull run. According

to the analyst, such indicator values suggest the euphoria phase of

the market where the smart money starts to sell. Still, the prices

continue to hold on as the retail investors continue to FOMO into

the asset. So far, the indicator has approached the 0.98 level in

its latest decline, implying that it’s not yet at the levels where

the possibility of a top might become significant if the pattern of

the previous bull run is anything to go by. The Bitcoin taker buy

sell ratio may also be used as a buying signal, with the 1.02 level

being an important level. The quant notes, however, that the metric

is better at showing an overbought market than it is for

pinpointing oversold conditions. Related Reading: What’s A Simple

Strategy For Buying & Selling Bitcoin? This Analyst Answers In

other news, as an analyst pointed out in a post on X, all the

Bitcoin investor groups have accumulated a net amount of 95,000 BTC

($6.5 billion at the current exchange rate) over the past month.

The trend in the monthly balance change for all BTC cohorts |

Source: @jvs_btc on X This rapid accumulation suggests that the

Bitcoin investor groups have been buying up significantly more than

the miners have produced. The chart shows that an accumulation

streak of similar levels followed the recent rally in the asset, so

this latest one can also be bullish for the asset. BTC Price At the

time of writing, Bitcoin is trading at around $68,600, up more than

3% over the past week. Looks like the price of the coin has

registered a sharp drop in the past 24 hours | Source: BTCUSD on

TradingView Featured image from iStock.com, Glassnode.com,

CryptoQuant.com, chart from TradingView.com

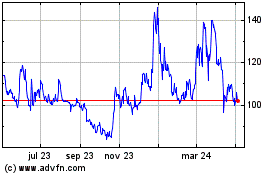

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

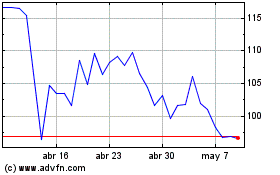

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De May 2023 a May 2024