Buying The Ethereum Dip? New Address Tied To Crypto Mogul Justin Sun Purchases 16,000 ETH

06 Agosto 2024 - 12:00AM

NEWSBTC

The cryptocurrency market has been rocked by a seismic sell-off

over the past 24 hours, with the two largest digital assets,

Bitcoin (BTC) and Ethereum (ETH), plummeting over 20% in value. At

the epicenter of the chaos is one of the industry’s biggest names –

Justin Sun, the founder of the TRON blockchain. On-chain data

suggests that Sun may have used the pullback to scoop up millions

of dollars worth of Ethereum at discounted prices. Market Meltdown

Wipes Out $600 Billion According to a Fortune report, this market

upheaval unfolded against a backdrop of widespread stock market

sell-offs triggered by a disappointing jobs report and perceived

inaction by the Federal Reserve (Fed). Despite recent

positive developments in the crypto sector, such as the launch of

Ethereum ETFs in the US in July, digital assets mirrored the stock

market downturn. The total crypto market cap tumbled from over $2.5

trillion on July 28 to approximately $1.9 trillion on Monday,

marking the most substantial loss since 2022. Related

Reading: Bitcoin RSI Goes Bearish For The First Time Since August

2023, Will It Crash Below $40,000? Crypto market maker Wintermute,

described the crypto plunge to Fortune as “unexpected,” and

attributed it to the US jobs report. The firm noted liquidations

surpassing $1 billion in digital asset positions overnight, along

with a $57 billion decline in altcoin market capitalization.

Noteworthy was a selloff from Jump Trading, a Chicago-based trading

firm that had played a significant role in the crypto industry

before scaling back amid collapses and regulatory scrutiny.

On-chain data by Spot On Chain indicate Jump moving $47 million

worth of Ethereum to centralized exchanges (CEXs), though

Wintermute cautioned against oversimplifying market movements by

attributing them solely to Jump’s actions. Sun’s Ethereum Shopping

Spree Amid this market turmoil, attention turned to Justin

Sun, the founder of the TRON blockchain. Reports surfaced of a

suspicious address linked to Sun buying 16,236 ETH with 37 million

USDT stablecoin, as ETH plummeted to $2,112 on Monday, with an

average purchase price of $2,279. The address, created three

hours prior, allegedly withdrew 38 million USDT from the HTX

exchange before acquiring the ETH tokens. It is further alleged

that this address belongs to Sun due to its behavior mirroring

previous ETH purchases by him. Related Reading: Why Is The

Shiba Inu Price Crashing Today? Notably, Sun reportedly holds over

700,000 ETH, with recent data showing a substantial loss of around

$280 million as Ethereum’s value dropped by 20%. Since February 8,

2024, Sun allegedly accumulated 377,590 ETH across three wallets,

costing an estimated $1.15 billion. Despite Ethereum trading well

below his average buying price of $3,051, Sun has denied rumors of

liquidation. In a social media post, Sun stated: The rumors about

our positions being liquidated are false. We rarely engage in

leveraged trading strategies because we believe such trades do not

significantly benefit the industry. Instead, we prefer to engage in

activities that provide greater support to the industry and

entrepreneurs, such as staking, running nodes, working on projects,

and helping project teams provide liquidity. At the time of

writing, ETH has managed to bounce back to the $2,460 level, with a

346% increase in trading volume over the past 24 hours, amounting

to $76 billion, according to CoinGecko data. Featured image

from Shutterstock, chart from TradingView.com

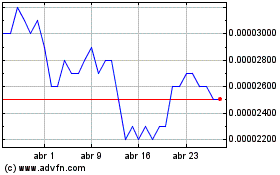

SHIBA INU (COIN:SHIBUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

SHIBA INU (COIN:SHIBUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024