Ethereum Poised For A Bullish Q1 2025? Here’s What Experts Say

30 Diciembre 2024 - 11:00PM

NEWSBTC

Ethereum (ETH) – the second-largest cryptocurrency by market

capitalization – may finally seize its moment in Q1 2025. Crypto

experts have taken to X to share their analyses of a potentially

bullish start to the new year for ETH. Ethereum Bullish Price

Action In Q1 2025? Although Ethereum is up by almost 43% on a

year-to-date (YTD) basis, its performance pales in comparison to

Bitcoin (BTC) which has appreciated by more than 115% in the same

period. In addition, various alternative Layer-1 blockchains, such

as Solana (SOL) and SUI have vastly outperformed ETH throughout

2024. Related Reading: Ethereum Spot ETFs Witness Unbroken 16-Day

Inflow Streak: New ETH ATH Soon? However, the momentum may soon

shift in ETH’s favor, as experts suggest that Q1 2025 could mark a

bullish phase for the world’s leading smart contract platform.

According to crypto analyst Crypto Bullet, ETH appears to be

forming a bullish pennant on the daily chart, with a potential

breakout to $6,000 expected by March 2025. Similarly,

cryptocurrency expert Anup Dhungana highlighted another bullish

pattern forming on the weekly chart. He pointed to an inverse

head-and-shoulders pattern – a widely recognized bullish indicator

that suggests an impending price surge. Based on Dhungana’s

analysis, ETH could soar to as high as $8,000 by May 2025. However,

he also warned that the digital asset may first experience a dip to

$2,800 before reaching new all-time highs (ATH). Veteran crypto

analyst Quinten Francois also shared an interesting perspective. He

noted that ETH has historically recorded exceptional gains during

Q1 of the year following a US presidential election. If this

historical pattern holds, Q1 2025 could be extraordinarily bullish

for Ethereum. ETH Staking To Create Supply Crunch? In addition,

Galaxy Research shared some price predictions about Ethereum

heading into 2025, saying that the digital asset will trade above

$5,500 in 2025 due to potentially favorable regulations surrounding

staking and decentralized finance (DeFi). Related Reading: Ethereum

Jumps 10% As DeFi Sentiment Rebounds With Trump’s Victory Galaxy

Research also projected that Ethereum’s staking rate will surpass

50%, creating a supply crunch that could trigger a sharp price

increase. The firm explained: The Trump administration is likely to

offer greater regulatory clarity and guidance for the crypto

industry in the U.S. Among other outcomes, it is likely that

spot-based ETH ETPs will be allowed to stake some percentage of the

ETH they hold on behalf of shareholders. Demand for staking will

continue to rise next year, and likely exceed half of Ethereum

circulating supply by the end of 2025, which will prompt Ethereum

developers to more seriously consider changes to network monetary

policy. Additionally, Galaxy Research suggested that the ETH/BTC

trading pair will close 2025 trading above 0.06, buoyed by

anticipated regulatory tailwinds. A rise in this trading pair from

its current lows of approximately 0.03 could serve as a catalyst

for the much-awaited altseason. Recent analysis by crypto analyst

Carl Runefelt also foresees a big move for ETH at the beginning of

the new year. At press time, ETH trades at $3,345, down 0.7% in the

past 24 hours. Featured image from Unsplash, Charts from X and

TradingView.com

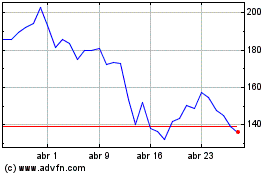

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025