Stacks (STX) Drops 23%, But Recent Devs Might Slow The Trend

04 Agosto 2024 - 1:30AM

NEWSBTC

With the hostile market environment, Stacks (STX) has continued its

downward spiral as bears mount the pressure. According to

CoinGecko, the token is down nearly 23% since last week, worsened

by the current correction phase the market has entered. The latest

market data shows that major cryptocurrencies like Bitcoin and

Ethereum have shown a drop of 10% since last week, pulling the

market downward by 2%. However, several developments might help

slow the token’s drive downward. These developments show Stacks as

the prime layer-2 for the top cryptocurrency in the market.

Related Reading: Solana Rebound: SOL To Hit $260 Despite Continuous

Dip, Analyst Says Stacks: Big News For Investors And BTC

Enthusiasts Although the market is incredibly bearish, Stacks

remain attractive for both institutional and retail investors

alike. Ever since the first step of the Nakamoto upgrade

rolled out last April 22nd, the newly introduced role of ‘Signers’,

their self-made term for validators, significantly grew in size.

According to their blog post in August 1st, 39 blockchain

institutions signed up with Stacks to be a signer. Among the

signers is Xverse, a Bitcoin wallet provider that dabbles in the

BRC-20 standard. This major onboarding will result in a larger user

base, giving Stacks a big advantage as layer 2s on the Bitcoin

blockchain attract more attention. However, the partnership

announcement made between Stacks and Aptos during the Bitcoin

Builders Conference created some buzz for the two. According to

some key takeaways, Aptos will join Stacks as a signer, bumping

their total Signer count to 40, along with the start of a working

group for better collaboration between the two organizations.

Stacks 🤝 @Aptos live on stage at the Bitcoin Builders Conference! 🟧

@AptosLabs Head of Ecosystem Neil Harounian talked to @StacksOrg

Chairperson Brittany Laughlin about forming a working group, as

well as the Aptos Foundation becoming a Signer for Stacks. Learn

more 1/3 👇 pic.twitter.com/EFTsIntD6M — stacks.btc (@Stacks) July

31, 2024 Since the start of the onboarding for Signers, about 118

BTC has been handed out to the various institutions. This amount

totals over $7 million at the current spot price for Bitcoin at

$60.7k. Investors Should Watch Out For These Levels As of

writing, STX’s current position remains occupied by the bears as

the current market environment encourages selling rather than

buying. But the bulls are mounting a string defense around the

$1.460 price floor. Related Reading: Solana Rebound: SOL To

Hit $260 Despite Continuous Dip, Analyst Says This is huge for

investors bullish on STX as it gives the bulls strong support for a

possible movement upward. However, the possibility of a bullish

breakthrough remains uncertain. The market’s current downward trend

is supported by the fact that the major cryptocurrencies are still

bearish in the short to medium-term. If the bulls can defend

the $1.460 line, we can expect lesser volatility within the market

compared with today’s movements. If they’re successful, retaking

the May-June price levels will be easy. Investors and traders

should keep their eyes open for any market movement in favor of the

bulls. Featured image from Boxmining, chart from TradingView

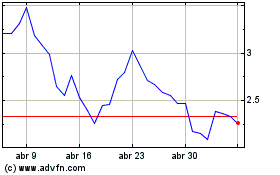

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024