Stacks Activating Nakamoto Upgrade In 8 Days, Will STX Break $2?

21 Octubre 2024 - 5:30PM

NEWSBTC

Stacks Network, the Bitcoin layer-2, is one of the largest DeFi

protocols on the world’s most secure platform. DeFiLlama says the

platform manages over $109 million worth of assets. It continues to

expand and improve as decentralized financial services find

traction. Stacks Network Activating Nakamoto On October 29 Over

five years after launching, the network is preparing for one of its

most important upgrades: Nakamoto. Analysts and platform supporters

claim this update would have far-reaching implications, especially

for its ecosystem. Related Reading: Ripple At A Critical Juncture

Like Amazon In 1997, Says Investment Pro The team said the latest

update would go live on October 29. Most importantly, the

transition will introduce features that boost throughput and

security. On scalability, Stacks might be looking to march Ethereum

layer-2s that currently process transactions cheaply and can host

transaction-intensive dapps. Once the upgrade activates, Stacks

will decouple from the Bitcoin block production speed of roughly 10

minutes. The decoupling will see the platform process transactions

within seconds. The change means Stacks will handle more

transactions, process them faster, and improve the user experience.

However, the team said this decoupling won’t mean the end of the

relationship between stackers and Bitcoin miners. In the team’s

view, not only will the collaboration be enhanced, but Stacks as a

layer-2 will be more decentralized and, therefore, robust. Since

Stacks is a layer-2, relying on Bitcoin for security, all

transactions would still have to be confirmed on the base layer.

Accordingly, though its transaction mining will be decoupled from

the layer-1, all transactions will be finalized on the Bitcoin

mainnet. This confirmation will be irreversible, leading to better

security without the risk of transaction reversals. STX Moving

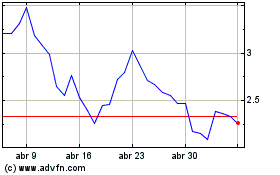

Inside A Mega Consolidation: Will Bulls Break $2? As bullish as the

Nakamoto upgrade may be, STX, the native token, is flatlining. From

the daily chart, the coin is stuck inside a mega consolidation from

early July. Related Reading: Solana Bulls Push Past $164 Barrier,

Momentum Signals More Gains STX prices are moving between $1.20 and

$2. The token has steadily recovered after crashing in early

August, adding nearly 60%. Nonetheless, for the uptrend to take

shape and buyers to initiate steps of peeling back March to July

losses, there must be a decisive breakout above $2. If this leg up

is with rising volume, it could trigger a wave of higher highs,

mirroring those from early Q4 2023 to mid-March. STX may soar to $4

in that event, nearly doubling from September highs. Feature image

from iStock, chart from TradingView

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024