Bitcoin Shows Resilience In Dollar-Driven Bloodbath | BTCUSD September 26, 2022

26 Septiembre 2022 - 2:54PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis videos, we

examine the recent resilience in Bitcoin compared to traditional

assets like gold, oil, and the S&P 500. We also compare BTC to

the DXY Dollar Currency Index and past crypto bear market bottoms.

Take a look at the video below: VIDEO: Bitcoin Price Analysis

(BTCUSD): September 26, 2022 After last Friday’s market close

and extreme bearish sentiment last week following the Fed meeting,

most investors and traders braced for a very bloody Monday open.

But Bitcoin continues to show resilience compared to other markets.

In this video, we put BTC head-to-head with traditional markets and

more. Related Reading: Can Bitcoin Withstand Continued Dollar

Strength? | BTCUSD September 22, 2022 Comparing Bitcoin With Gold,

Oil, S&P 500, And DXY Here we can see that Bitcoin peaked

before other asset classes, and has held up better in recent days

compared to gold, oil, and the S&P 500. Considering how strong

the dollar has been, Bitcoin standing up this strong here is

significant. Through the DXY comparison, we can also see that BTC

held up well against the USD side of its trading pair compared to

other top world currencies like the pound, euro, and yen that make

up the DXY index. BTC compared to other asset classes | Source:

BTCUSD on TradingView.com Bottom Signals Stack Up As Former

Resistance Holds As Support Last night we also had a weekly close

in Bitcoin, which has caused the Relative Strength Index-based

moving average to slightly turn upward. In the past, this was all

that was necessary to change the tide in the overall trend from

bear to bull. Weekly momentum continues to get shockingly close to

a bullish crossover. The repeated failure to cross bullish, yet no

new lows being made is also notable. Price continues to grind

and test former all-time high resistance turned support.

Several weekly indicators could suggest the bottom is in | Source:

BTCUSD on TradingView.com Related Reading: Bitcoin Reacts To 75

Basis Point Fed Rate Hike | BTCUSD September 21, 2022 The Return Of

Adam & Eve In Crypto Market Bitcoin price action could be

working on forming an Adam and Eve double bottom. The same bottom

formation put in the 2018 bear market bottom. The lead into

the pattern, volume trend, and various conditions of validating the

formation are present, and the only thing that is missing is

confirmation with a close above $25K. Is the Bitcoin forming an

Adam and Eve bottom? | Source: BTCUSD on TradingView.com How Far

Will The Unstoppable Dollar Trend Extend? A bottom being in has

more to do with the dollar at this point, but even the DXY is

showing some signs of being overextended. The DXY has

essentially went completely vertical. Such trends aren’t

sustainable at this angle, and are bound to correct sharply.

Superimposing Bitcoin behind the DXY and the DXY behind the 2017

BTCUSD chart could provide some clues to what might happen next. On

the right, the DXY made a higher high, before collapsing. The DXY

bottom turned out to be the top in the 2017 Bitcoin bull run.

Looking at the DXY chart with BTC behind it, the same sort of

higher high setup ultimately resulted in a rejection and breakdown.

The first level of support was swept, and at the second level, a

bottom was found. If the anti-correlation continues between

the dollar and Bitcoin, then if the DXY tops out, the next crypto

bull run could follow. Is the DXY forming an ending diagonal? |

Source: BTCUSD on TradingView.com Learn crypto technical analysis

yourself with the NewsBTC Trading Course. Click here to access the

free educational program. Follow @TonySpilotroBTC on Twitter or

join the TonyTradesBTC Telegram for exclusive daily market

insights and technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from

TradingView.com

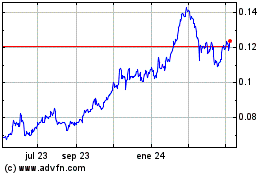

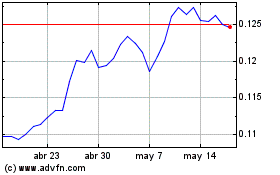

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024