As Crypto Storage is Still a Major Problem, Can NFT integration Solve the Issue?

03 Octubre 2022 - 11:22AM

NEWSBTC

Now a trillion-dollar market, the crypto ecosystem has withered

some of the toughest conditions within its period of existence.

However, like any other technological innovation, it is not short

of native challenges. This ‘lucrative’ market faces a myriad of

shortcomings, including criticisms from regulators and

long-standing financial institutions. But the most significant

hurdles are currently attributed to the underlying infrastructures.

In a recent interview during the Paris Blockchain Week, Binance CEO

Changpeng Zhao identified crypto custody as one of the hardest

challenges that remains unsolved. According to CZ, the inaccessible

and complex nature of crypto wallets is undoubtedly hindering mass

adoption in the digital asset space. He was also keen to highlight

that this one of problems he would prioritize given an opportunity,

“If I had no financial pressure, I would want to solve the most

difficult problem that is blocking adoption. That would be the

problem I would try to solve.” The Loophole in Crypto Custody

Anyone who has interacted with crypto long enough understands there

is a thin line when it comes to storing the newly found wealth.

Stakeholders have in the past lost huge sums of money as result of

wallet breaches or forgetting one’s seed phrase. As it stands, 20%

of the BTC in supply cannot be accessed due to lost private keys.

Is this efficient for an ecosystem touted as the future of finance?

While Rome wasn’t built in a day, the issue of crypto wallets needs

to be addressed sooner than later. Some crypto diehards would argue

that non-custodial wallets are a long term solution. However, the

complexities involved in securing one’s seed phrase paint a

different picture. “But today, most people cannot store their

private keys securely. The wallets require them to be technical.

Your computer cannot get a virus. If your computer gets a virus,

there’s all kinds of problems that will happen. You will lose your

money.” added CZ Binance. Even worse, the current infrastructure of

most non-custodial wallets does not feature a solution for passing

heritage to future generations. It is quite unfair to invest in an

industry where there is no guarantee that one’s offspring will

benefit in the event of their death. After all, this is standard

practice in the traditional finance scope. Unfortunately, custodial

wallets offered by crypto exchanges are not any better; while they

might feature a heritage structure, users are not in control of

their private keys. In the event of a breach such as the infamous

Mt Gox hack, chances are high that any investor holding funds with

the affected exchange will have to incur significant losses. So,

what is the ultimate solution to a secure crypto storage ecosystem?

The perfect answer would be it’s neither white nor black, but the

emergence of Non-fungible tokens (NFTs) seems to be paving way for

tamper-proof and heritage-designed Web 3.0 wallets. NFTs; The

Future of Crypto Wallet Infrastructures The NFT hype has taken the

crypto industry by a storm, with digital creatives such as Beeple

cashing big on their work. Though a relatively new area of

innovation, the indistinguishable (unique) nature of NFTs could be

a game-changer in the development of non-custodial crypto wallets.

Emerging DApps such as Serenity Shield are implementing NFT

technology to introduce a strongbox solution that addresses seed

recovery and heritage issues. Launched in 2021, this Web 3.0

project features a fully encrypted solution for storing digital

assets. Ideally, Serenity shield allows crypto natives to create an

account where they can securely store their seed recovery phrases.

Serenity’s strongbox then partitions the sensitive information into

three unique NFT keys. The first NFT is allocated to the account

owner, the second to a prospective heir while the final key is

stored in the Serenity Shield smart contract. To unlock the

information in the strongbox, one requires at least two of the NFT

keys, making it possible for a user to recover sensitive

information or transfer ownership to an heir. Going by the trends

in NFT integrations, the value stretches beyond play-to-earn and

the metaverse economies. There is a wide range of crypto

applications that could benefit from scaling through NFT

infrastructure. Most notably, this upcoming crypto niche provides a

building base for secure DApps, ultimately solving pertinent issues

such as seed recovery and digital asset heritage. Conclusion

Cryptocurrencies might have come of age but there is a lot to be

done to ensure that investors sleep comfortably knowing their

assets are safe. As highlighted in the introduction, it is still a

murky world for crypto wallets, whether custodial or non-custodial.

This is not to say that existing issues cannot be solved; newer

technologies like NFTs present an opportunity to tackle a majority

of the underlying problems.

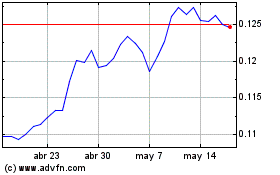

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

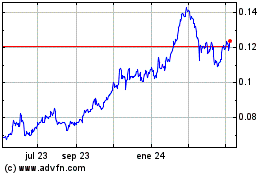

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024