Bitcoin Supply On Exchanges Hit 4-Year Low, But Why Is Price Crashing?

20 Marzo 2024 - 7:00AM

NEWSBTC

Certain Bitcoin fundamentals suggest the flagship crypto token is

well primed for further growth in this bull market. However, its

recent price decline has sparked concerns about the reason for this

downward trend despite everything pointing to a sustained upward

movement. Bitcoin Supply On Exchanges Hit 4-Year Low Data

from the on-chain analysis platform CryptoQuant highlighted that

the supply of Bitcoin on exchanges has seen nearly a 40% drop in 4

years and is reducing ahead of the Bitcoin halving. This

underscores the bullish sentiment around the Bitcoin ecosystem as

the decreasing supply on supply suggests that most investors have

no plans to sell their holdings anytime soon. Related

Reading: Is Ripple Behind The XRP Price Crash? Massive Selling

Spree Sparks Concern The CryptoQuant data also noted that Bitcoin’s

demand is outpacing its supply, which is said to have been the

prevailing trend since 2020. This development offers a bullish

narrative as it can continue to increase Bitcoin’s value since

“scarcity boosts perceived value.” This trend is also expected to

be sustained once the Halving occurs since miners’ supply will be

cut in half. Interestingly, the imbalance between Bitcoin’s

demand and supply has led crypto analysts like MacronautBTC to

believe that BTC’s price could rise to as high as $237,000. As

such, there are still high expectations for Bitcoin despite the

crypto token hitting a new all-time high (ATH) of $73,750.

Why Bitcoin’s Price Is Crashing Crypto analyst Alex Kruger has

outlined different reasons why Bitcoin’s price is crashing despite

its strong fundamentals. The first reason he alluded to was the

fact that crypto traders in the derivatives market look to be

overleveraged, possibly because greed seems set to be setting in

with traders deploying more capital in anticipation of further

price surges. Kruger mentioned that the ETH could also be

dragging the market down with the hopes of the SEC (Securities and

Exchange Commission) approving the Spot Ethereum ETFs waning.

Bitcoinist recently reported that the approval odds for these

investment funds have plummeted immensely in the past few months,

dropping to an alarming 35%. Related Reading: Dogecoin Growth

Hits Roadblock As Holder Activity Enters Dreaded Period Of

Stagnancy The third reason that Kruger mentioned is the negative

Bitcoin ETF inflows, which have become a trend lately. Interest in

these Bitcoin funds has cooled off, with investors opting to take

profit instead. On March 19, BitMEX Research revealed that these

ETFs saw a record net outflow of $326m. Crypto trader and

analyst Rekt Capital also suggested that Bitcoin is already in the

‘Final Pre-Halving Retrace.’ Therefore, significant price

corrections can be expected ahead of the Halving event, which is

set to take place in April. At the time of writing, Bitcoin

is trading at around $63,000, down in the last 24 hours, according

to data from CoinMarketCap. BTC rises above $64,000 | Source:

BTCUSD on Tradingview.com Featured image from Financial Commission,

chart from Tradingview.com

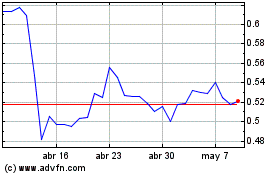

Ripple (COIN:XRPUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ripple (COIN:XRPUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024