CLASQUIN: H1 2024

25 Julio 2024 - 11:51AM

Business Wire

Growth in business (number of shipments up 7%) and gross

profit (up 4,7%)

Q2 2024

Volume growth boosted by air freight business Sea

freight gross profit down slightly

Regulatory News:

CLASQUIN (Paris:ALCLA):

Half-year

Quarters

H1 2024

H1 2023

Change

Like for like (lfl)***

Q2 2024/

Q2 2023

Q1 2024/

Q1 2023

CONSOLIDATED (unaudited)

Number of shipments**

174,674

163,301

+7.0%

+7.0%

+3.6%

+10.7%

Sales (€M) *

310.1

284.3

+9.1%

+4.0%

+10.8%

+7.3%

Gross profit (€m)

70.6

67.4

+4.7%

-0.8%

-3.9%

+15.4%

* Sales is not a relevant indicator of business in our sector,

as it is greatly impacted by changing air and sea freight rates,

fuel surcharges, exchange rates (particularly versus USD), etc.

Changes in the number of shipments, volumes shipped and, in

financial terms, gross profit are relevant indicators. ** The

number of shipments does not include the TIMAR acquisition. ***

Excluding Timar acquisitions (28/03/2023) and at constant exchange

rates

MARKET AND BUSINESS REVIEW

Disruptions to the sea freight market due to events in

the Red Sea led to longer transit times, which saturated market

capacity. These new circumstances also caused disruptions at ports

and in the management of container depots, which became even more

apparent from May onwards. Freight rates soared as a result,

increasing by a factor of 3.7 between December 2023 and June

2024.

The air freight market continued to benefit from the

transfer of some sea freight, due to loading issues and longer sea

freight transit times. Freight rates from China remained very high

(up 33% compared to H1 2023).

As a result, shipments carried out by the Group in Q2 were up

3.6% (excluding Timar*), driven by the air freight business (up

8.6%* excluding Timar*). While sea freight shipments were up

sharply compared to Q1 2024, they were virtually flat compared to

Q2 2023 due to an unfavourable basis of comparison. As in Q1, the

number of road brokerage shipments rose 5.3% (excluding

Timar*).

Unit margins stabilised in Q2, following a sharp

drop in Q1.

Consolidated gross profit was down 3.9% in Q2, impacted

by the following developments:

- A drop in unit margins compared to Q2 2023

- Less advantageous market conditions with North Africa

than in Q2 2023

- Strong growth in the Group’s “Global Accounts” business

(up 13%)

- Renewed capacity to grow market share (5% of H1 2024

gross profit)

It should also be noted that customers using “Live”

solution (the Group’s digital platform) generated 63% of the

Group’s gross profit in H1 2024.

* Timar: a Moroccan group specialising in the design of

innovative solutions in the fields of international transport,

logistics and customs, over which the Clasquin Group obtained

control on 28 March 2023.

BREAKDOWN BY BUSINESS LINE

NUMBER OF SHIPMENTS (excl.

Timar)

GROSS PROFIT (€m)

At current scope

and exchange rates

H1 2024

H1 2023

Change

H1 2024/

H1 2023

Change

Q2 2024/

Q2 2023

H1 2024

H1 2023

Change

H1 2024/

H1 2023

Change

Q2 2024/

Q2 2023

Sea freight

68,570

65,951

+4.0%

-0.5%

31.0

33.3

-7.0%

-7.3%

Air freight

47,707

42,595

+12.0%

+8.6%

19.7

18.2

+8.1%

+6.1%

Road Brokerage

39,217

37,245

+5.3%

+5.3%

14.0

12.1

+16.4%

-14.1%

Other*

19,180

17,510

+9.5%

+3.3%

5.8

3.8

+53.6%

+11.4%

TOTAL CONSOLIDATED

174,674

163,301

+7.0%

+3.6%

70.6

67.4

+4.7%

-3.9%

*: Other businesses: Rail/Customs/Logistics

VOLUMES

H1 2024

H1 2023

Change

H1 2024/

H1 2023

Change

Q2 2024/

Q2 2023

Sea freight

128,480 TEUs*

129,409 TEUs*

(0.7%)

-1.5%

Air freight

42,767T**

33,472T**

+27.8%

+29.0%

* Twenty-foot equivalent units ** Tons

Q2 2024 HIGHLIGHTS

Sale involving the acquisition of 42.06% of the share capital

of Clasquin by SAS Shipping Agencies Services Sàrl (“SAS”)

Reminder:

- On 28 March 2024, Yves REVOL, OLYMP and SAS Shipping Agencies

Services Sàrl (“SAS”), a MSC Mediterranean Shipping Company SA

subsidiary, signed a share purchase agreement under which SAS will

acquire 42.06% of Clasquin’s share capital, at €142.03 per

share.

- Completion of the transaction, which will be subject to

obtaining clearances from the competent regulatory authorities, is

expected to happen by year end.

- Upon completion of the transaction, SAS will file a tender

offer with the Autorité des Marchés Financiers (AMF) for the

remaining shares in the capital of Clasquin, at the same price of

EUR 142.03 per share. This draft offer will be submitted to the AMF

for approval. SAS intends to proceed with a squeeze-out should

applicable conditions be met upon closing of the Offer.

On 5 June 2024, on the recommendation of the ad hoc committee,

the Board of Directors of Clasquin SA appointed Accuracy as the

independent expert, in accordance with Article 261-1 I of the

General Regulation of the French Financial Markets Authority

(“AMF”). The appointment of the independent expert was

required in order to prepare a report on the financial terms of the

Offer and the squeeze-out, if implemented.

After reviewing this report, including the fairness opinion

issued by the independent expert, Clasquin’s Board of Directors

will issue a reasoned opinion on the Offer and its consequences for

Clasquin, its shareholders and its employees. This reasoned opinion

and the independent expert’s report will be made public in

connection with the draft reply document, whose filing with the AMF

will be announced in a future Clasquin press release.

TIMAR SA

Following the Mandatory Squeeze-Out Offer on TIMAR SA

shares closed on 27/03/24, the shares of this company were delisted

from the Casablanca Stock Exchange on 10/06/24, as planned.

2024 OUTLOOK

2024 market

- International trade by volume: up 3.3% (WTO – October

2023)

- Air freight by volume: up 6.9% (source: IATA June 2024)

- Sea freight by volume: up 2.1% on average between 2024 and 2028

(source: Global Sovereign Advisory – March 2024)

CLASQUIN 2024 Business (volumes): outperform market growth

UPCOMING EVENTS (publication after

market closure)

- Tuesday 17 September 2024

- Tuesday 29 October 2024

H1 2024 results

Q3 2024 business report

CLASQUIN is an air and sea freight forwarding

and overseas logistics specialist. The Group designs and manages

the entire overseas transport and logistics chain, organising and

coordinating the flow of client shipments between France and the

rest of the world and, more specifically, to and from Asia-Pacific,

North America, North Africa and sub-Saharan Africa. Its shares are

listed on EURONEXT GROWTH, ISIN FR0004152882, Reuters ALCLA.PA and

Bloomberg ALCLA FP. Read more at www.clasquin.com. CLASQUIN

confirms its eligibility for the share savings plan for MSCs

(medium-sized companies) in accordance with Article D. 221-113-5 of

the French Monetary and Financial Code established by decree number

2014-283 of 4 March 2014 and with Article L. 221-32-2 of the French

Monetary and Financial Code, which set the conditions for

eligibility (less than 5,000 employees and annual sales of less

than €1,500m or balance sheet total of less than €2,000m). CLASQUIN

is listed on the Enternext© PEA-PME 150 index. LEI:

9695004FF6FA43KC4764

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725178797/en/

CLASQUIN Philippe LONS – Deputy Managing Director/Group

CFO Domitille CHATELAIN – Group Head of Communication &

Marketing Tel.: +33 (0)4 72 83 17 00

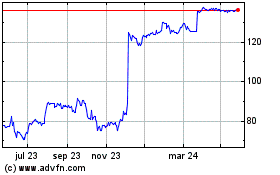

Clasquin (EU:ALCLA)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

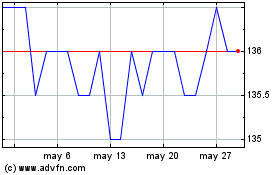

Clasquin (EU:ALCLA)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024