Market update - February 5

05 Febrero 2024 - 12:30AM

Market update - February 5

Paris, France – February 5,

2024

Following the update made on January 3, 2024,

Atos SE (“Atos” or the “Company”)

informs the market about its refinancing plan and its contemplated

disposals.

Refinancing plan

Atos has entered into discussions with its banks

with a view to reaching a refinancing plan for its financial

debt.

Following these initial discussions, it appeared

pertinent to request the appointment of a mandataire ad hoc in

order to frame these discussions and facilitate a rapid outcome.

The mandataire ad hoc is an independent third party whose mission

would be to assist the Company in its discussions, in order to

converge on an appropriate financial solution as soon as possible,

in the Company’s corporate interests.

The mandat ad hoc is an amicable procedure

allowing negotiations to be conducted within a confidential

framework. The mandat ad hoc would only concern the financial debt

of the Company and would have no impact on the employees, customers

and suppliers of the group.

Furthermore, as announced on January 3, 2024,

the first 6-month extension of the €1.5 billion term loan A took

effect on January 29, 2024.

Contemplated disposals and capital

increase

As indicated at the Market Update on January 3,

2024:

- Discussions with

EPEI on the sale of Tech Foundations continue (including required

conditions to release their commitment to participate in a reserved

capital increase), there is no certainty that these negotiations

will result in an agreement.

- The Company is

in due diligence phase with Airbus in connection with the potential

sale of its BDS (Big Data & Security) business.

Also, and given the changes in market

environment, the conditions of the initially planned €720m rights

issue are no longer applicable and the standby underwriting

commitment provided by BNP Paribas and J.P. Morgan is no longer in

effect.

Atos will inform the market in due course of the

progress of the discussions with its banks, its new refinancing

plan, its contemplated disposals, as well as the possible changes

in its capital structure which could result in a dilution of the

existing shareholders, depending on the agreement on the

refinancing structure.

***

About Atos

Atos is a global leader in digital

transformation with c. 105,000 employees and annual revenue of c. €

11 billion. European number one in cybersecurity, cloud and

high-performance computing, the Group provides tailored end-to-end

solutions for all industries in 69 countries. A pioneer in

decarbonization services and products, Atos is committed to a

secure and decarbonized digital for its clients. Atos is a SE

(Societas Europaea), and listed on Euronext Paris.

The purpose of Atos is to help design the

future of the information space. Its expertise and services support

the development of knowledge, education and research in a

multicultural approach and contribute to the development of

scientific and technological excellence. Across the world, the

Group enables its customers and employees, and members of societies

at large to live, work and develop sustainably, in a safe and

secure information space.

Investors: David Pierre-Kahn -

david.pierre-kahn@atos.net - +33 6 28 51 45 96

Individual shareholders: 0805

65 00 75

Press contact:

globalprteam@atos.net

- PR-Atos-Market update-05-February-2024

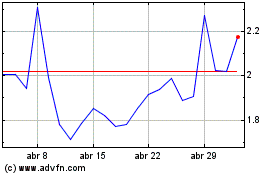

Atos (EU:ATO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Atos (EU:ATO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024