PRESS RELEASE: NACON LAUNCHES RIGHTS ISSUE WITH PRE-EMPTIVE RIGHTS

NACON

THIS PRESS RELEASE MUST NOT BE PUBLISHED OR

DISTRIBUTED DIRECTLY OR INDIRECTLY IN THE UNITED STATES OF AMERICA,

AUSTRALIA, CANADA OR JAPAN. THIS PRESS RELEASE IS FOR INFORMATION

ONLY AND DOES NOT CONSTITUTE AN OFFER TO SELL OR AN INVITATION TO

BUY SECURITIES IN ANY JURISDICTION.

Press

releaseLesquin, 3 July 2024, 8.00 am

NACON LAUNCHES RIGHTS ISSUE WITH

PRE-EMPTIVE RIGHTS OF APPROXIMATELY €16.50 MILLION, WHICH MAY BE

INCREASED TO €19 MILLION IF THE EXTENSION OPTION IS EXERCISED IN

FULL

Main terms

- Issue with pre-emptive rights for

shareholders

- Subscription price: €1.10 per

share, representing a discount of 7.3% to the closing price on 1

July 2024

-

Subscription ratio: 47 pre-emptive rights give the right to

subscribe to 8 new shares

-

Subscription agreements: 80.79% of the issue is already secured by

subscription agreements from existing shareholders

-

Detachment period and listing of DPS: from 4 July to 18 July 2024

inclusive

-

Subscription period: from 8 July to 22 July 2024 inclusive

-

Investment eligible for Article 150-0 B of the French General Tax

Code (deferred taxation of capital gains) and the PEA PME-ETI tax

regime

Nacon (Euronext Paris - ISIN FR0013482791 –

NACON.PA) today announces the launch of a rights issue with

pre-emptive rights for shareholders of approximately €16.50

million, which may be increased to €19 million if the extension

option is exercised in full. More than 80% of the issue is already

secured by subscription agreements from existing shareholders.

1. Background and

purpose of the issue and use of proceedsNet proceeds from

the Rights Issue are estimated at around €18.5 million.

Net proceeds from the issuing of the New Shares

will add to the Company’s current financial resources and help to

support its growth, while also strengthening its equity (in respect

of both subscriptions for New Shares paid up in cash as well as the

subscription to be paid up by Bigben Interactive by means of the

offsetting of liabilities). Net proceeds from the issue will also

enable the Group to continue to develop new video games, which – on

account of their development cycle – it will be able to release in

the next three to four years.

The strengthening of the Company’s equity should

also enable it to obtain more favourable financing terms and

conditions from its usual financial partners.

Alain Falc, Chairman and Chief Executive

Officer of Nacon, comments:

“Since our initial public offering in February

2020, Nacon has successfully carried out most of its plans despite

a delay in the development of some games and under complex

circumstances. The Publishing division has since been reinforced

with the acquisition of around 10 studios, allowing us to release

between 10 and 15 games a year, with around 50 games continuously

under development. This strategy has also enabled us to build up a

solid back catalogue of games to be released over the next few

years, centred around four target ranges: Racing, Sport, Simulation

and Adventure. The back catalogue accounted for over 40% of games

revenue in 2023/24. Development of the “Accessories” range has

continued, driven by our ability to innovate and forge numerous

technological partnerships in order to offer gamers premium

products at an affordable price. This technological expertise will

enable us to converge our two business lines with the creation of a

single 360° business – combining editorial content and gaming

accessories – in the sim racing market.

Finally, we recently announced our 2023/24

results, with strong revenue growth to €167.7 million and a 20.5%

increase in operating income to €20.9 million.Thanks to a line-up

including 15 games to be released over the course of the year and

the launch of innovative premium accessories, we are confident that

we will be able to achieve further growth in 2024/25 coupled with

improvement in operating income.

The proceeds from this rights issue will enable

us to continue with our development plan, giving us additional

means to finance our editorial programme and consolidate our

position as a worldwide name in video games and premium

accessories.

We would like to thank our shareholders in

advance for continuing to put their trust in us, as well as our

longstanding shareholders, whose subscription agreements already

represent more than 80% of the total amount of the rights

issue.”

2. Main characteristics

of the rights issueThe Rights Issue will be carried out

with pre-emptive rights for shareholders, in accordance with the

14th and 16th resolutions of this combined general meeting of 21

July 2023, and will result in the issuing of a 14.992.440 new

ordinary shares which may be increased to a maximum of 17,241,306

new ordinary shares (the “New Shares”) if the

extension option is exercised in full, at a price of €1.10 per

share, to be paid up in full at the time of subscription,

representing gross proceeds, including additional paid-in capital,

of €18,965,436.60.

Each shareholder will receive one pre-emptive

right per share registered in their securities account at close of

trading on 5 July 2024, according to the indicative timetable. 47

pre-emptive rights will give the right to subscribe to 8 New Shares

with a par value of €1, at a price of €1.10 per share.

Shareholders will also be able to subscribe to

additional New Shares on a pro rata basis. Any New Shares not

absorbed by subscriptions as of right will be redistributed and

allocated to shareholders who have subscribed to additional shares

on a pro rata basis, the amount of which may be reduced.

In addition to the possibility of subscribing to

shares as of right and to additional shares on a pro rata basis in

accordance with the specified terms and conditions, any natural or

legal person will be free to subscribe to the Rights Issue whether

or not they hold pre-emptive rights. Anyone wanting to subscribe on

this basis will need to send their request to their accredited

financial intermediary at any time during the subscription period

and pay the corresponding subscription price. In accordance with

Article L. 225-134 of the French Commercial Code, subscriptions on

a free basis will only be taken into account if subscriptions as of

right and on a pro rata basis do not use up the entire Rights

Issue.

On the basis of Nacon’s closing share price on 1

July 2024 of €1.1860, the subscription price for the New Shares

presents a face value discount of 7.3%, the theoretical value of a

pre-emptive right is €0.0125 and the theoretical ex-rights price is

€1.1735 per share.

These values are without prejudice to the value

of pre-emptive rights during the subscription period, the ex-rights

value per share and discounts, as observed on the market.

The subscription period will be from 8 July to

22 July 2024 inclusive. Pre-emptive rights will be detached and

available for trading from 4 July 2024 to 18 July 2024 inclusive on

Euronext Paris, under ISIN code FR001400RBQ7, subject to the same

terms as the existing shares. Pre-emptive rights not exercised at

the end of the subscription period, i.e. 22 July 2024, shall become

null and void.

The Rights Issue will only be open to the public

in France.

Settlement and delivery is due to take place on

29 July 2024 and the New Shares will be admitted to trading on

Euronext Paris on the same day. The New Shares will be immediately

assimilated into existing shares. They will be traded under the

same code as the existing shares on Euronext Paris (ISIN:

FR0013482791).

3. Extension

optionPursuant to the authorisation granted by the

combined general meeting of 21 July 2023, at its meeting of 17 June

2024, the Board of Directors sub-delegated to the Company's Chief

Executive Officer the power, depending on demand, to decide to

increase the number of New Shares initially offered by a maximum of

15%, representing a maximum of 2,248,866 additional New Shares (the

“Extension Option”).

The Extension Option can only be used to fulfil

subscription orders on a pro rata basis from shareholders and/or

those transferring pre-emptive rights that could not be

fulfilled.

The decision to exercise the Extension Option

will be made by the Company no later than the date of the results

of the Rights Issue are published, planned for 25 July 2024

(according to the indicative timetable) and will be mentioned in

the press release issued by the Company and made available on the

Company’s website and in the notice issued by Euronext Paris

announcing the results of the Rights Issue.

4. Indicative timetable

for the rights issueIndicative timetable

|

17 June 2024 |

-

Meeting of the Board of Directors deciding in principle on the

Rights Issue with pre-emptive rights for shareholders, and

sub-delegation to the Chief Executive Officer of the power to carry

out the Rights Issue

|

|

2 July 2024 |

-

Decision by the Chief Executive Officer to launch the Rights

Issue

-

Approval of the Prospectus by the AMF

|

|

3 July 2024 |

-

Distribution of the Company press release announcing approval of

the Prospectus by the AMF and describing the main characteristics

of the Rights Issue and the means by which the Prospectus will be

made available

-

Prospectus made available on the website

-

Publication by Euronext Paris of the notice relating to the Rights

Issue announcing the listing of pre-emptive rights

-

Deadline for buying Existing Shares on the market giving the buyer

the right to the associated pre-emptive rights

|

|

4 July 2024 |

-

Detachment of pre-emptive rights and start of trading of

pre-emptive rights on Euronext Paris

|

|

5 July 2024 |

-

Publication of a BALO notice for beneficiaries of free shares in

the process of being bought issued by the Company

-

Deadline for registration in an account of existing shares

entitling the holder to pre-emptive rights

|

|

8 July 2024 |

- Start

of the subscription period for the Rights Issue

|

|

18 July 2024 |

- End of

the trading period for pre-emptive rights

|

|

22 July 2024 |

- End of

the subscription period for the Rights Issue

- Last

day of settlement and delivery of pre-emptive rights

|

|

24 July 2024 |

-

Results sent to the Company of the centralisation of subscriptions

relating to the exercise of pre-emptive rights

|

|

25 July 2024 |

-

Decision by the Chief Executive Officer setting out the definitive

characteristics of the Rights Issue and, if applicable, deciding to

award shares not subscribed as of right or exercise the Extension

Option in part or in full

-

Distribution of a press release by the Company announcing the

result of subscriptions

-

Publication by Euronext of the results of the issue and notice of

admission to trading of the New Shares, stating the final amount of

the Rights Issue and the ratio for subscriptions for excess shares

on a pro rata basis

|

|

29 July 2024 |

-

Issuing and admission to trading on Euronext Paris of the New

Shares

-

Settlement and delivery of the New Shares

|

5. Subscription

agreements and other commitments by Nacon’s main

shareholdersAs of the date of the Prospectus, the Company

has the following Subscription Agreements from some of its main

shareholders and Board members:

- Bigben

Interactive, which owns 56.04% of the Company’s share capital

before the Rights Issue, has agreed to subscribe as of right and on

a pro rata basis to an amount corresponding to 9,007,180 New Shares

for a total of €9,907,898, it being understood that the

subscription amount will be paid up in full by means of offsetting

against some liabilities;

- Nord

Sumatra 1, which owns 2.85% of the Company’s share capital before

the Rights Issue, has agreed to subscribe as of right and on a pro

rata basis to an amount corresponding to 909,090 New Shares for a

total of €999,999;

-

Bpifrance Investissements, which owns 2.06% of the Company’s share

capital before the Rights Issue, has agreed to subscribe as of

right and on a pro rata basis to an amount corresponding to

1,818,181 New Shares for a total of €1,999,999; and

- AF

Invest, which owns 1.86% of the Company’s share capital before the

Rights Issue, has agreed to subscribe as of right and on a pro rata

basis to an amount corresponding to 378,131 New Shares for a total

of €415,944.

Total Subscription Agreements amount to

€13,323,840 and represent 80.79% of the Rights Issue (excluding

exercise of the Extension Option).

6. Abstention

commitmentThe Company has agreed, as of the date of the

Prospectus and for a period ending 90 calendar days after the date

of the Rights Issue, not to issue, offer, sell, pledge, announce

its intention to or otherwise agree to issue or sell, sell options

or other purchase commitments, buy options or other purchase

commitments, grant options, rights or warrants with a view to

buying or otherwise transferring or assigning, directly or

indirectly, any shares of the Company or any other financial

security substantially similar to said shares, or any financial

security giving the right by means of conversion, exchange or

redemption to, or which represents the right to receive shares or

financial securities that are substantially similar to said shares,

not to enter into any transactions involving derivatives or other

transactions with a substantially equivalent economic effect

concerning the Company’s shares or other securities that are

substantially similar to the Company's shares, without the prior

agreement in writing of the Global Coordinator and the

Bookrunner.

This commitment is given subject to certain

exceptions, in particular:

- the awarding of pre-emptive rights

and the issuing of New Shares;

- any free share plans, any

profit-sharing schemes and any rights issues reserved for members

of the company savings plan and/or rights issues reserved for Group

employees implemented before this date or in future pursuant to the

resolutions passed at the general meeting or resolutions with the

same purpose that may be approved at the next annual general

meeting of the Company’s shareholders;

- any share buyback programmes

(including under a liquidity agreement); and

- the issuing, sale, transfer or

offering of the Company’s shares to pay for the acquisition by the

Company of shares or assets held by third parties, insofar as the

subsequent rights issue does not exceed, to date, 10% of the

Company's share capital, provided that this abstention commitment

is taken over by the buyer of the new shares or securities giving

access to the share capital.

7. Lock-up agreement

for Bigben InteractiveBigben Interactive has agreed, until

the end of a period of 90 calendar days after the settlement and

delivery date of the Rights Issue, without the prior agreement in

writing of the Global Coordinator and the Bookrunner, and subject

to any shares that may be delivered upon the exercising of bonds,

not to (i) issue, offer, sell, pledge as security, sell any option

or agreement to buy, buy any option or agreement to sell, grant any

option, right or warrant or otherwise transfer or assign, directly

or indirectly, the Company’s ordinary shares or other securities

that are substantially similar to the Company’s ordinary shares, or

securities that can be converted or redeemed, or exchanged for, or

that represent the right to receive ordinary shares in the Company

or substantially similar securities, (ii) make a short sale, enter

into a derivatives contract, hedging contract or any other

transaction with a substantially similar economic effect on the

Company’s ordinary shares or on these securities, (iii) enter into

any other agreement or transaction that transfers, in whole or in

part, directly or indirectly, ownership of any ordinary shares of

the Company or (iv) announce its intention to carry out one or more

of these transactions. This agreement is subject to the usual

exceptions for intragroup transactions, mergers, spin-offs or

public offers, as well as the exception allowing Bigben Interactive

to transfer pre-emptive rights by any means (see paragraph 5.2.2 of

the issue notice) and the right for it to provide security for a

portion of the Nacon shares it holds.

The above commitment by Bigben Interactive shall

end if the settlement and delivery of the Rights Issue does not

take place.

8. GuaranteeThe issuing of the

New Shares is not subject to a “completion guarantee” within the

meaning of Article L. 225-145 of the French Commercial Code or an

underwriting agreement.

However, it should be noted that this Issue is

subject to irrevocable Subscription Agreements, as of right and on

a pro rata basis, representing 80.79% of the amount of the Issue

(excluding the Extension Option), subject to the conditions

described in Section 5.2.2 of the Issue Notice.

9. DilutionAs

an indication, on a diluted basis, a shareholder holding 1% of

share capital before the Rights Issue and who does not participate

in the Rights Issue, will hold 0.84% after the New Shares are

issued and if all the New Shares are subscribed.

10. Availability of the

ProspectusThe prospectus (the

“Prospectus”) comprising (i) Nacon’s universal

registration document as filed with the AMF on 24 June 2024 under

number D.24-0543 (the “Universal Registration

Document”), (ii) an issue notice (including the summary of

the Prospectus) approved by the AMF under number 24-258 on 2 July

2024 (the “Issue Notice”) and (iii) the summary of

the Prospectus included in the Issue Notice, can be found on the

AMF website (www.amf-france.org) and the Company’s website

(https://corporate.nacongaming.com/). Copies of the Prospectus are

available free of charge from the Company’s head office (396-466,

Rue de la Voyette, CRT2, 59273 Fretin, France).

11. Financial

intermediaryFunds paid in respect of subscriptions will be

held centrally by Uptevia (90-110 Esplanade du Général de Gaulle,

92931 Paris La Défense Cedex, France), which will be responsible

for preparing the certificate of deposit of funds recording the

completion of the Rights Issue.

Securities services and financial services for

the Company's shares are provided by Uptevia (90-110 Esplanade du

Général de Gaulle, 92931 Paris La Défense Cedex, France).

12. Risk

factorsInvestors are also invited to take account of the

risk factors described in Section 3 “Risk factors” of the Universal

Registration Document and Section 2 “Risk factors” of the Issue

Notice before making their investment decision. If some or all of

these risks were to occur, this could have an adverse impact on the

Company’s activities, reputation, financial position, financial

results or achievement of its targets. In addition, other risks not

yet identified or not considered material by the Company as of the

date of the Prospectus could also have an adverse impact.

13. Partners

|

ABOUT

NACON |

|

2023/2024 IFRS

SALES:€167.7 million WORKFORCEMore

than 1,000 people INTERNATIONAL

PRESENCE23 subsidiaries and a distribution network in 100

countrieshttps://corporate.nacongaming.com/ |

NACON is part of the Bigben group and was formed in 2019 to

optimise its areas of expertise and generate synergies between them

in the video game market. Combining its 16 development studios, AA

video game publishing and the design and distribution of premium

gaming peripherals, NACON has 30 years of expertise in serving

gamers. This new unified business gives NACON a stronger position

in its market and enables it to innovate by creating new and unique

competitive advantages. Listed on Euronext Paris, compartment

B – Index: CAC Mid&SmallISIN: FR0013482791; Reuters: NACON.PA;

Bloomberg: NACON:FP). CONTACT:Cap Value –

Gilles Broquelet gbroquelet@capvalue.fr - +33 1 80 81 50

01 |

Disclaimer

This press release does not constitute and

should not be regarded as constituting an offer to the public, an

offer to subscribe or a solicitation of public interest in

connection with any offer to the public of Nacon securities.

A prospectus approved by the AMF under number

24-258 on 2 July 2024 is available on the AMF website

(www.amf-france.org) and the Company’s website

(https://corporate.nacongaming.com/).

Copies of the prospectus are available free of

charge from the Company’s head office (396-466, Rue de la Voyette,

CRT2, 59273 Fretin, France). The public’s attention is drawn to the

“Risk factors” sections of the prospectus.

This press release constitutes a promotional

communication and does not constitute a prospectus within the

meaning of Regulation (EU) 2017/1129 of the European Parliament of

14 June 2017 (the “Prospectus Regulation”).

Potential investors are invited to read the prospectus before

making an investment decision in order to fully understand the

potential risks and advantages associated with the decision to

invest in marketable securities.

The AMF’s approval of the prospectus should not

be regarded as a favourable opinion of the marketable securities

offered or admitted to trading on a regulated market.

As regards Member States of the European

Economic Area other than France and the United Kingdom (the

“Member States Concerned”), no action has been

taken or shall be taken to allow for an offer to the public of

Nacon securities requiring the publication of a prospectus in any

of the Member States Concerned. As a result, the Nacon shares may

be offered in the Member States Concerned only: (a) to legal

persons who are qualified investors as defined in the Prospectus

Directive; or (b) in other cases not requiring the Company to

publish a prospectus in accordance with the Prospectus

Regulation.In the United Kingdom, this document is sent to and

intended only for persons who are considered to be (i) “investment

professionals” (with professional investment experience) within the

meaning of Article 19(5) of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005, as amended (the

“Order”), (ii) persons who fall within the scope

of Article 49(2)(a) to (d) (high net worth companies,

unincorporated associations, etc.) of the Order, or (iii) persons

who may lawfully be invited or given an incentive to participate in

an investment activity (within the meaning of Article 21 of the

Financial Services and Markets Act 2000) within the framework of

the issuing or sale of financial securities (together referred to

as the “Persons Concerned”). In the United

Kingdom, this document is intended only for the Persons Concerned

and should not be used by anyone other than a Person Concerned.

This document does not constitute an offer to

sell Nacon shares in the United States. Nacon shares cannot be sold

in the United States without registration or exemption from

registration under the US Securities Act of 1933, as amended. Nacon

does not intend to register an offer in the United States or make

any offer of shares to the public in the United States.

Distribution of this press release in some

countries may constitute a breach of applicable legal requirements.

The information contained in this press release does not constitute

an offer of securities in the United States, Canada, Australia,

Japan or any other country. This press release must not be

published, released or distributed, directly or indirectly, in the

United States, Canada, Australia or Japan.

Finally, this press release may be written in

French and English. If there are any differences between the two

texts, the French version shall take precedence.

- Nacon - CP Lancement AK Diffusion English

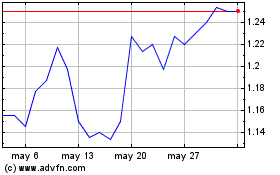

Nacon (EU:NACON)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Nacon (EU:NACON)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024