Regulatory News:

Veolia Environnement (Paris:VIE)

- Record 2023 results, above guidance

- 2023 demonstrates Veolia's ability to grow its results thanks

to its unique positioning and strict operational

discipline

- Efficiency and synergies objectives exceeded

- Decrease in net financial debt and leverage of 2.7x,

only 2 years after Suez acquisition

- Great confidence for 2024: another year of strong

results growth expected

Very strong organic Revenue growth of +9%(1) to €45,351m, and

+4.4%(1) excluding energy price impact

- Solid growth in our 3 businesses

- Favorable impact of tariff indexations and of

our strict pricing policy

Strong EBITDA organic growth of +7.8%(1) to €6,543m, above

the guidance range of +5% to +7%:

- €389m of efficiency gains above the annual

objective of €350m

- €168m of synergies, above annual target, and

€315m cumulated

Current EBIT of €3,346m(2), strong organic growth of

+13.7%(1) Current net income of €1,335m(2), up +14.9%(3),

above our target of €1.3bn ROCE back to pre-covid and

pre-Suez levels, at 8.3% after tax

The increase in Free Cash Flow to €1,143m enables a reduction

in net financial debt to €17,903m, with a leverage of 2.74x

Proposal to increase the Dividend to €1.25 per share

Ambitious 2024 guidance:

- Solid organic revenue growth(1)(4)

- Organic growth(1) of EBITDA between +5% and

+6%

- Current net income group share above

€1.5bn(2)

- Leverage ratio maintained below 3x(2)

(1) At constant scope and forex (2) Excluding Suez purchase

price allocation (3) At current exchange rates (4) Excluding energy

prices

Estelle Brachlianoff, CEO of the group, commented: “The

year 2023 will have been another record year for Veolia, exceeding

our targets, with sales of 45 billion euros, EBITDA up 7.8% and

current net income up 14.9% to 1,335 million euros, double that of

2018. These excellent results are the fruit of our unique

positioning in the buoyant ecological transformation market, as

well as of our ongoing efforts to maintain strict operational

control.

Demand for our services has never been so high, with, for

example, a full and fast-growing order book for our Water

Technologies business, at €5.3 billion, a sign that water scarcity

and quality have become one of the primary consequences of climate

change for cities and industries alike.

We have also continued to focus on efficiency, achieving savings

of €389 million, in addition to the benefits of the Suez

acquisition in the form of €168 million in cost synergies, which

exceeded our targets.

2023 is the 7th consecutive year of earnings growth. During this

period, Veolia, the world leader in ecological transformation, will

have absorbed a series of major economic, health, geopolitical and

energy shocks. This uninterrupted growth demonstrates not only our

resilience and capacity to adapt, but also the relevance of our

positioning in the dynamic market of ecological transformation, and

our unique geographic footprint with almost 40% of sales outside

Europe.

We look forward to 2024 with great confidence, perfectly poised

for another year of strong earnings growth, and in particular a

target of current net income above €1.5 billion.”

Impact 2023 strategic plan objectives achieved

In March 2020, as part of its Impact 2023 strategic plan, the

group established a series of financial and extra-financial

objectives for 2023. These objectives have been largely achieved,

including:

- Employee engagement rate of 89%, on target to

exceed 80%, with 7.5% of Group capital held by employees, who are

now our largest shareholder

- 15.4 million tonnes of CO2 avoided

- Net income before non-recurring items in 2023

of €1,335 million (against a target of €1 billion), a doubling

since 2018

- 400 million m3 of water saved by improving

water network efficiency, to 76% by 2023

Detailed results at 31st December 2023

Revenue for 2023 is €45,351 million, up 9% at constant exchange

rates, and +4.4% excluding energy prices.

- The evolution of revenue by effect is as follows:

- The exchange rate effect was -€1,187 million (-2.8%) and

mainly reflects the change in the Argentinian, Australian, US, UK

and Chinese currencies, partially offset by an improvement in the

Polish and Czech currencies(1) .

- Scope effect was -€217 million (-0.5%) and mainly

reflects the disposal of Suez's waste business in the United

Kingdom in November 2022, offset by the full-year consolidation of

Suez assets and the first-time consolidation of Lydec

(Morocco).

- The Commerce/Volumes/Works effect was +€774 million

(+1.8%) thanks to strong sales momentum, as well as growth in

construction and in the Water Technologies business.

- The climate effect was -€232 million (-0.5%). The Energy

business in Central and Eastern Europe was impacted by a milder

winter than in 2022, as well as unfavorable weather conditions in

France, Spain and the United States, which impacted water

consumption over the summer months.

- The impact of energy and recyclate prices amounted to

+€1,579 million (+3.7%), driven by the increase in heat and

electricity tariffs (+€1,978 million) mainly in Central and Eastern

Europe. This increase was partially offset by a fall in recyclate

prices, which affected all recycled materials and mainly Northern

Europe, France and Germany.

- Price effects were very favorable, at +€1,749 million,

mainly due to price indexation mechanisms and increases in the

price of the group's services of +5.2% on average in Waste and

+4.4% in Water.

(1) Main forex impacts by currency : argentinian peso (-€647 M),

australian dollar (-€145 M), US dollar (-€133 M), chinese yuan

(-€87 M), and sterling pound (-€59 M), offset by polish zloty (+€94

M) and czech koruna (+€51 M).

Revenue at 31st December 2023 progressed across all operating

segments compared to 31st December 2022

- Revenue in France and Special Waste Europe amounted to

9,726 million euros, and showed organic growth of +1.4%

compared to 31st December 2022:

- Water France revenue increased by +1.0% to 3,006 million

euros, mainly due to tariff indexations of +6.2%, which offset the

re-municipalization of the Lyon water contract, and lower volumes

by -2.8% due to unfavorable weather.

- The French Waste business grew by +0.7% to 2,909 million

euros: lower recyclate prices and lower volumes were offset by

higher service prices and electricity revenue. Excluding the price

of recyclates, sales rose by 5.4%.

- The Hazardous Waste business in Europe reached 2,125

million euros, slightly down by -0.8% impacted mainly by the fall

in the price of recycled oils, but offset by increased pricing in

the hazardous waste treatment and sanitation businesses.

- SADE revenue grew by +5.2%, thanks to strong commercial

momentum in France.

- Revenue in Europe excluding France reached €19,000

million at 31st December 2023, with organic growth of

+11.6%.

- In Central and Eastern Europe, revenue rose by +19.1% to

11,360 million euros. The region's business was particularly

buoyant, driven by rising electricity prices and tariff revisions

obtained for heating (Poland, Hungary, Czech Republic, Slovakia and

Germany), despite an unfavorable weather effect (-159 million

euros).

- In Northern Europe, revenue of €4,043 million

increased by 5.2%. This increase was mainly due to revenue in the

United Kingdom, up +5.5% on a like-for-like basis, notably thanks

to rate indexation and the favorable effect of electricity prices

on incineration, as well as good business development in waste

collection.

- In Iberia, revenue of 2,603 million euros increased by

+6.6%, mostly due to Water in Spain, driven by good construction

activity, tariff increases, partially offset by lower volumes

(-0.8% vs. 2022), due to unfavorable weather.

- In Italy, revenue of 994 million euros decreased by

-12.5%, mainly due to lower energy prices, with no impact on

margins due to the parallel fall in energy purchase costs.

- Revenue in Rest of the World reached €11,907

million, up 10.0% at constant scope and forex, with

solid growth in all geographies:

- Revenue reached 1,832 million euros in Latin America, up

+30.3%, driven mostly by hyperinflation in Argentina, as well as by

Water in Chile thanks to tariff increases.

- In Africa Middle-East, business grew by +10.0%, to 2,213

million euros, driven mainly by new waste contracts (Istanbul,

Turkey), the start-up of new water facilities (Jeddah, Saudi

Arabia), growth in energy services in the Middle East, and the

progress of water contracts in Morocco, benefiting from slightly

higher volumes.

- In North America, sales came to 3,347 million euros, up

+5.8%. The Hazardous Waste business had a very good year, with

revenue up 6.4% thanks to higher volumes and increased rates. The

Water business benefited from tariff increases, which more than

offset a 1.7% drop in volumes in the "regulated water" business,

impacted by unfavorable weather conditions (with no impact on

margins).

- Sales in Asia amounted to 2,540 million euros, up +4.6%,

driven mainly by Hong Kong (+16.1%), Taiwan (+11.9%) and Japan

(+4.8%). China stabilizes.

- In the Pacific region, sales of €1,975 million were up

+6.4%, mainly due to the effect of tariff revisions and commercial

gains in the Waste business (in particular the city of Goldcoast),

as well as a good commercial performance in industrial

maintenance.

- The Water Technologies business generated sales of 4,707

million euros, up +12.1%, driven by growth at WTS in the

Engineering Systems and Chemical Solutions businesses, as well as

by growth at VWT in its Services and Technologies businesses. Order

intake for the Water Technologies business at December 31st, 2023

(for projects and products, excluding services) amounts to 3,490

million euros, up sharply on December 31st, 2022 (2,662 million

euros), an increase of 31.1%.

By business, at constant scope and exchange rates, the

evolution of revenue is as follows:

- Water revenue rose by 7.5% to €18,409m

- Water Operations rose by +5.9% to €12,627m, with price

increases across all geographies, strong sales growth in Africa

Middle-East, and a good level of construction activity, despite

volumes impacted by unfavorable weather conditions in France, Spain

and the United States.

- Water Technology and Construction rose by +10.8%

to €5,782m, driven mainly by the Water Technologies

businesses.

- Waste sales rose by +3.4% on a like-for-like basis to

€14,683 million, and by +5.9% excluding changes in recyclate

prices. It benefited from favorable price revisions (+5.2%), which

offset the impact of lower recycled materials prices (-2.5% on

sales) in France, Germany and Northern Europe. The

Commerce/Volumes/Works effect was positive (+0.1%), with resilient

volumes, with a decline in Europe (notably in France and Germany)

offset by the rest of the world, and good commercial activity in

Australia and the United Kingdom.

- Energy sales rose by +19.9%. Strong sales growth was

driven by positive price effects (+18.5%), mainly in Central and

Eastern Europe. The unfavorable climate effect on sales for 2023

amounted to -1.5%.

Strong EBITDA growth, to €6,543m vs. €6,196m at 31st December

2022, up +7.8% at constant scope and exchange rates

- The impact of exchange rates on EBITDA amounted to -133

million euros (-2.2%). This mainly reflects a depreciation of the

Argentinean, American, Australian, Chinese and British currencies,

partially offset by a rise in the Polish and Czech currencies.

- Scope effect was almost neutral, at -4 million

euros.

- Commerce/Volumes/Works impact was favorable by +117

million euros.

- Weather impact was -83 million euros.

- Energy and recycled materials prices had a net favorable

impact on EBITDA of +160 million euros, mainly due to higher energy

selling prices net of higher purchasing costs, which offset the

unfavorable impact of recycled materials prices (-88 million euros)

in France, Northern Europe and Germany.

- Efficiency net of gains shared with customers, contract

renegotiations and cost pass-through lag effects came to 122

million euros. The efficiency plan contributed 389 million euros by

2023, above the annual target of 350 million euros.

- Synergies from the integration of Suez amounted to 168

million euros in 2023, ahead of target.

Compared with 31st December 2022, 2023 EBITDA evolution by

segment was as follows:

- France and Special Waste Europe achieved an EBITDA of

€1,338 million, down -5.2% compared with December 31st, 2022, due

to lower recyclate prices, an unfavorable weather effect on water

volumes, partly offset by operating efficiency action plans.

- EBITDA for Europe excluding France totaled €2,599

million. It posted an organic growth of +13.7% compared with

December 31st, 2022, driven by high energy prices and gains in

flexibility and support services in energy in Central and Eastern

Europe, and by tariff increases in water.

- The Rest of the World EBITDA reached 1,925 million

euros, an organic growth of 7.1% compared with December 31st, 2022,

driven by North America, Africa Middle-East and the Pacific.

- The Water Technologies division generated an EBITDA of

534 million euros, with an organic growth of +17.0% compared with

December 31st, 2022, driven by its Engineering Systems Chemical

Solutions and Services & Technologies businesses.

The main changes in EBITDA by business at constant scope and

exchange rates can be analyzed as follows:

- EBITDA for the Water division totaled 3,122 million

euros. It is up +5.4% at constant scope and exchange rates compared

with December 31st, 2022, driven mainly by the Water Technologies

business. In Water Operations, EBITDA benefited from the efficiency

gains and synergies generated in 2023, which more than offset the

impact of weather conditions on volumes.

- EBITDA for the Waste business reached 1,924 million

euros, up +1.0% at constant scope and exchange rates compared with

December 31st, 2022, excluding changes in recyclate prices,

benefiting from efficiency gains and synergies generated over

2023.

- EBITDA for the Energy business reached 1,497 million

euros, a very strong growth of 35.3% at constant scope and exchange

rates compared with December 31st, 2022, benefiting from higher

energy prices and improved energy efficiency at cogeneration

facilities.

Strong current EBIT growth of +13.7% at constant scope and

forex to €3,346m.

- Currency movements weighed by -€72m on

current EBIT.

- The increase in recurring EBIT on a like-for-like basis

(€420m) breaks down as follows:

- Strong EBITDA growth (€+485m at constant scope and exchange

rates).

- Depreciation and amortization (including repayments of

operating financial assets) up 60 million euros at constant scope

and exchange rates.

- Lower industrial capital gains net of asset impairments (44

million euros in 2023 vs. 68 million euros in 2022) due to lower

industrial capital gains.

- Stable share of current net income of JV and associates at 123

million euros, but up +21 million euros at constant scope and

exchange rates.

Current net income group share reached €1,335 million at 31st

December 2023, vs. €1,162 million at 31st December 2022

(+14.9%)

- Financial result was -966 million euros at 31st December

2023 vs. -1,023 million euros at 31st December 2022.

- It includes the cost of net financial debt, down by 81

million euros to -626 million euros at December 31st, 2023,

compared with -707 million euros a year earlier.

- Other financial income and expenses (including capital

gains and losses on financial disposals) amounted to €-350m,

compared with €-386 at December 31st, 2022. This change is due in

particular to the reduction in the fair value of the debt of the

Aguas Andinas subsidiary in Chile (indexed to inflation).

- Taxes totaled -€599 million, reflecting the rise in

pre-tax income from ordinary activities. The current tax rate was

26.5%.

- Minority interests amounted to -€446 million, compared

with -€363 million at December 31st, 2022.

Net income group share was €937 million vs. €716 million at

31st December 2022 (+31%)

Decrease in net Financial debt to €17,903m at 31st December

2023. Free Cash Flow of €1,143m.

Net financial debt stood at €17,903 million (excluding PPA),

compared with €18,138 million at December 31st, 2022. Compared with

December 31st, 2022, the change in net financial debt is mainly due

to the increase in Free Cash Flow to €1,143 million, up €111

million.

Proposal of a dividend increase to €1.25 per share.

The Board of Directors will propose to the Annual General

Meeting of April 25th, 2024 the payment of a dividend of €1.25 per

share in respect of the 2023 financial year, payable in cash. The

ex-dividend date will be May 8th. Dividends for 2023 will be paid

from May 10th, 2024.

Objectives 2024

In view of the very strong 2023 results

and the good start to the year, we can look forward to 2024 with

confidence, and announce ambitious targets.

- Solid organic growth of

revenue(1)(2)

- Efficiency gains above €350m complemented

by additional synergies for a cumulated amount of more than €400m

end 2024, in line with the €500m cumulated objective

- Organic growth of EBITDA between +5% and

+6%(1)

- Current net income group share above

€1.5bn(3)

- Leverage ratio expected below 3x(3)

- Dividend growth in line with current EPS

growth

(1) At constant scope and forex / (2)

Excluding energy prices / (3) Excluding Suez PPA

Agenda

- 18th April 2024: Deep dive USA (New

York & Houston)

- Fall 2024: Deep dive Water

Technologies and Innovation

ABOUT VEOLIA

Veolia group aims to become the benchmark company for ecological

transformation. Present on five continents with nearly 213,000

employees, the Group designs and deploys useful, practical

solutions for the management of water, waste and energy that are

contributing to a radical turnaround of the current situation.

Through its three complementary activities, Veolia helps to develop

access to resources, to preserve available resources and to renew

them. In 2023, the Veolia group provided 113 million inhabitants

with drinking water and 103 million with sanitation, produced 42

million megawatt hours of energy and recovered 63 million tonnes of

waste. Veolia Environnement (Paris Euronext: VIE) achieved

consolidated revenue of 45.3 billion euros in 2023.

www.veolia.com

IMPORTANT DISCLAIMER

As the changes in the health crisis are difficult to estimate,

we draw your attention to the “forward-looking statements” that may

appear in this press release and relating to the consequences of

this crisis which may affect the future performance of the

Company.

Veolia Environnement is a corporation listed on the Euronext

Paris. This press release contains “forward-looking statements''

within the meaning of the provisions of the U.S. Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including but not limited to: the risk of suffering

reduced profits or losses as a result of intense competition, the

risk that changes in energy prices and taxes may reduce Veolia

Environnement’s profits, the risk that governmental authorities

could terminate or modify some of Veolia Environnement’s contracts,

the risk that acquisitions may not provide the benefits that Veolia

Environnement hopes to achieve, the risks related to customary

provisions of divestiture transactions, the risk that Veolia

Environnement’s compliance with environmental laws may become more

costly in the future, the risk that currency exchange rate

fluctuations may negatively affect Veolia Environnement’s financial

results and the price of its shares, the risk that Veolia

Environnement may incur environmental liability in connection with

its past, present and future operations, as well as the other risks

described in the documents Veolia Environnement has filed with the

Autorité des Marchés Financiers (French securities regulator).

Veolia Environnement does not undertake, nor does it have, any

obligation to provide updates or to revise any forward-looking

statements. Investors and security holders may obtain from Veolia

Environnement a free copy of documents it filed (www.veolia.com)

with the Autorités des marchés financiers.

This document contains "non‐GAAP financial measures". These

"non‐GAAP financial measures" might be defined differently from

similar financial measures made public by other groups and should

not replace GAAP financial measures prepared pursuant to IFRS

standards.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240228194396/en/

GROUP MEDIA RELATIONS Laurent Obadia - Evgeniya

Mazalova Anna Beaubatie - Aurélien Sarrosquy Tel.+ 33

(0) 1 85 57 86 25 presse.groupe@veolia.com

INVESTOR RELATIONS Ronald Wasylec - Ariane de

Lamaze Tél. + 33 (0) 1 85 57 84 76 / 84 80

investor-relations@veolia.com

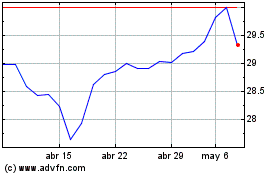

Veolia Environnement (EU:VIE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Veolia Environnement (EU:VIE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024