Sterling Faces Renewed Falls on UK Fiscal Plans

0859 GMT - Sterling should resume its weakening trend following

its recent rebound after U.K. Prime Minister Liz Truss dampened

hopes for further changes to the government's fiscal policy, MUFG

Bank says. Truss on Wednesday confirmed a U-turn on plans to scrap

the highest rate of income tax but said the government would press

ahead with other planned tax cuts. Without further fiscal

tightening, the U.K. faces even higher government bond yields which

undermines the already weak economic growth outlook, MUFG currency

analyst Lee Hardman says in a note. "Now the dust is beginning to

settle after the pound's recent volatile price action, we expect

the bearish trend to resume." GBP/USD is steady at 1.1305, while

EUR/GBP gains 0.3% to 0.8759. (renae.dyer@wsj.com)

Companies News:

Diageo Backs Medium-Term Guidance Amid Challenging Operating

Backdrop

Diageo PLC said Thursday that it has had a good start to fiscal

2023 and that it remains well-positioned to deliver its medium-term

guidance despite expecting the operating environment to remain

challenging.

---

RS Group 1H Revenue Rose; Expects Full Year to Slightly Beat

Market Views

RS Group PLC said Thursday that like-for-like revenue for the

first half of fiscal 2023 rose 16%, with strong growth across all

three regions, and that it expects to slightly beat full-year

market expectations for profit and revenue.

---

Imperial Brands Launches Buyback of Up to GBP1 Bln; FY 2022

Performance in Line With Views

Imperial Brands PLC said Thursday that it is launching a

share-buyback program of up to one billion pounds ($1.13 billion),

and that its performance for the year ended Sept. 30 was in line

with expectations.

---

Halma Buys Germany's WEETECH for EUR57.5 Mln

Halma PLC said Thursday that it has acquired the German

safety-critical electrical testing technology company WEETECH

Holding GmbH.

---

Shell PLC Sees Rise in 3Q Marketing Results; Fall in Integrated

Gas Trading

Shell PLC said Thursday that it expects integrated gas trading

and optimization results to fall on quarter, but for market results

to rise.

---

Motorpoint 1H Revenue Rose But Pretax Profit Slipped on Higher

Investment

Motorpoint Group PLC said Thursday that its revenue for the

first half of fiscal 2023 rose significantly, helped by vehicle mix

and price inflation, though pretax profit is expected to slip on

increased investment.

---

Chemring 11-Month Performance on Track; FY 2022 in Line With

Views

Chemring Group PLC said Thursday that its performance in the 11

months to Sept. 30 was on track despite a challenging macroeconomic

environment, and that its result for fiscal 2022 was expected to be

in line with expectations.

---

CMC Markets' 1H Net Trading Revenue Rose; On Track to Achieve

Three-Year Growth Plans

CMC Markets PLC said Thursday that leveraged net trading revenue

for the first half of fiscal 2023 rose 27%, and that it is on track

to deliver its three-year growth plans.

---

AIQ Nonexecutive Chairman Steps Down; New Chairman Appointed

AIQ Ltd. said Thursday that Nonexecutive Chairman Graham Duncan

is stepping down to pursue other interests and that Aditya Chathli

has been appointed as chairman.

---

Eckoh Sees FY 2023 Profit, Revenue Increase Boosted By US

activity

Eckoh PLC said Thursday that it expects significant revenue and

profit growth in fiscal 2023 as it benefits from a robust order

book boosted by renewed activity in U.S.

---

Volution FY 2022 Profit, Revenue Rose on Regional Growth; FY

2023 Started Well

Volution Group PLC said Thursday that pretax profit and revenue

rose significantly in fiscal 2022, driven by growth in the U.K.,

continental Europe and Australia, and that fiscal 2023 has started

well.

---

BATM Advanced Communications CEO to Step Down; Successor

Appointed

BATM Advanced Communications Ltd. said Thursday that Chief

Executive Officer Zvi Marom has decided to step down and that Chief

Financial Officer Moti Nagar will be promoted to CEO.

---

N. Brown Expects 2H Product Revenue Decline; Shares Fall

Shares of N. Brown Group PLC fell Thursday after it said that it

expects product revenue in the second half of fiscal 2023 to

decline at a rate similar to the second quarter's, and that

first-half pretax profit fell on lower product revenue due to

softer market conditions.

---

Seeing Machines to Collaborate With Magna International; Shares

Rise

Seeing Machines Ltd. shares rose Thursday after it said it has

agreed to collaborate with Magna International Inc., with the

latter providing an investment of up to $65 million through an

exclusivity arrangement and convertible note.

---

Tern Raises GBP1.6 Mln via Discounted Subscription

Tern PLC said Thursday that it has raised 1.6 million pounds

($1.8 million) via a discounted retail offer and subscription.

---

Shell PLC Sees Fall in 3Q Integrated Gas Trading, Rise in

Marketing Results -- Update

Shell PLC said Thursday that it expects integrated gas trading

and optimization results to fall on quarter, along with refining

margins, but for market results to rise.

---

Image Scan Says FY 2022 Revenue, Profit, to Be Below Views;

Shares Fall

Shares in Image Scan Holdings PLC fell Thursday after the

company said revenue and profit for the year ended Sept. 30 will be

below market expectations.

---

Mila Resources to Raise GBP696,000 for Australian Gold

Exploration

Shares in Mila Resources PLC rose Thursday after the company

said it had conditionally raised around 696,000 pounds ($788,360)

via a share placing, and that it will use the proceeds to continue

its gold exploration activity in Australia.

---

Mobile Streams to Raise GBP1.2 Mln to Fund Further NFT Deals

Mobile Streams PLC said Thursday that it is seeking to raise 1.2

million pounds ($1.4 million) via a share placing to fund further

non-fungible token contracts, including several expected to be

signed this month.

Market Talk:

RS Group Has Shown Resilience Amid Economic Turbulence

0933 GMT - Shares in RS Group rise 2% after the electronics

distributor formerly known as Electrocomponents reported higher

like-for-like first-half revenue and forecast full-year profit and

revenue modestly above expectations. "This is the second time RS

Group has raised its guidance, having already forecasted back in

July that full-year profit and revenue would come in ahead of

consensus," Interactive Investor's Head of Investment Victoria

Scholar writes. "RS shares have done very little over the last

year, trading modestly lower by a few percent, a slight

under-performance versus the FTSE 100 and outperforming the FTSE

250. This is a company that has demonstrated its resilience amid

the challenging backdrop of inflation, a slowing economic

trajectory and supply-chain disruption."

(philip.waller@wsj.com)

Diageo's Cautious Outlook May Disappoint Investors

0929 GMT - Shares in Diageo pare earlier modest gains, down 0.5%

even as the spirits group reported a good start to its 2022/23

financial year and said it remains well-positioned to achieve

medium-term guidance despite a tough outlook. Overall, the update

matched guidance given by the company in its 2021/22 full-year

results in July, Citigroup says. "However, given elevated investor

expectations for a bullish Q1-23 trading message, the lack of new

data points and cautious outlook tone may be viewed as slightly

disappointing," Citi analysts say in a note.

(philip.waller@wsj.com)

Imperial Brands Gains as Investors Welcome Buyback

0922 GMT - Imperial Brands shares rise 3.7% after the tobacco

group announced a share-buyback program of up to one billion pounds

($1.13 billion) and said trading in the year ended Sept. 30 matched

expectations. Imperial's investors are likely to welcome news of

the buyback, which results from the company's efforts in the last

two years to get a tight grip on capital allocation and increase

focus on core business areas, Hargreaves Lansdown says. Meanwhile,

debt has reached levels supportive of increased shareholder

returns, HL says. "Markets were unsurprisingly happy to hear the

news, given shareholder returns for tobacco companies are really

the only material case for investing for now," HL analyst Matt

Britzman says in a note. (philip.waller@wsj.com)

Shell Faces Margin Pressure as Demand Outlook Softens

0845 GMT - Shares in Shell drop 3.7% after the oil major said it

expected lower margins to negatively affect third-quarter adjusted

earnings in its chemical and product business versus the second

quarter. "Shell enjoyed record profits in the first and second

quarter spurred by a surge in underlying oil and gas prices

following Russia's invasion of Ukraine," Interactive Investor Head

of Investment Victoria Scholar writes. "However, since June, oil

has posted four consecutive months of declines, with Brent crude

down by around 25% even after this week's counter-trend rally. In

what is a notoriously cyclical business, Shell is grappling with a

dysfunctional and volatile gas market, as well as expectations of

softening oil demand, particularly from China as the global economy

cools." (philip.waller@wsj.com)

Contact: London NewsPlus; paul.larkins@wsj.com

(END) Dow Jones Newswires

October 06, 2022 06:00 ET (10:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

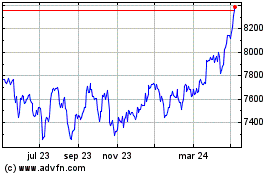

FTSE 100

Gráfica de índice

De Mar 2024 a Abr 2024

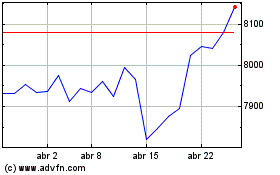

FTSE 100

Gráfica de índice

De Abr 2023 a Abr 2024