Yen Falls Amid Risk Appetite

21 Febrero 2024 - 7:05PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Thursday amid risk appetite, boosted by strong

gains in the technology sector after U.S. chipmaker Nvidia's upbeat

outlook on robust demand for AI related chips. Traders shrugged off

the U.S. Fed's latest monetary minutes, where officials remain wary

of cutting interest rates too quickly.

The minutes of the late-January meeting said participants

acknowledged risks to achieving the Fed's employment and inflation

goals were moving into better balance, but they remained highly

attentive to inflation risks.

However, the Fed said a couple of participants pointed to

downside risks to the economy associated with maintaining an overly

restrictive stance for too long.

Bets spurred among Japanese retail investors that further

declines on yen may prompt authorities to intervene in the

market.

The Japanese stock market is sharply higher on the day. The

Nikkei 225 is adding more than 600 points to move above the 38,900

level to fresh 34-year highs, with gains across most sectors led by

index heavyweights and technology stocks.

The benchmark Nikkei 225 Index closed the morning session at

38,913.84, up 651.68 points or 1.70 percent, after touching a

34-year high of 38,924.88 earlier.

In economic news, the manufacturing sector in Japan continued to

contract, and at a faster pace, the latest survey from Jibun Bank

revealed on Thursday with a manufacturing PMI score of 47.2. That's

down from 48.0 in January, and it moves further beneath the

boom-or-bust line of 50 that separates expansion from contraction.

The survey also showed that the services PMI eased from 53.1 in

January to 52.5 in February. Wednesday, the yen traded lower

against its major rivals. The yen started falling against the euro

and the pound from February 19th, 2023. Against the U.S. dollar and

the Swiss franc, the yen started sliding from 21st and 20th of this

month, respectively. In the Asian trading now, the yen fell to

nearly a 3-month low of 162.94 against the euro and an 8-1/2-month

low of 190.24 against the pound, from yesterday's closing quotes of

162.56 and 189.86, respectively. If the yen extends its downtrend,

it is likely to find support around 165.00 against the euro and

191.00 against the pound.

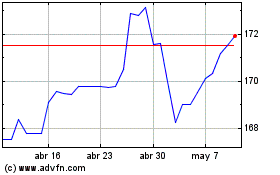

Against the U.S. dollar and the Swiss franc, the yen slid to a

6-day low of 150.47 and more than a 2-week low of 171.27 from

Wednesday's closing quotes of 150.28 and 170.81, respectively. The

yen may test support around 152.00 against the greenback and 172.00

against the franc.

Against Australia, the New Zealand and the Canadian dollars, the

yen slipped to more than a 10-year low of 98.69, more than a 9-year

low of 93.22 and a 6-day low of 111.58 from yesterday's closing

quotes of 98.43, 92.87 and 111.27, respectively. On the downside,

99.00 against the aussie, 94.00 against the kiwi and 112.00 against

the loonie are seen as the next support levels for the yen.

Looking ahead, PMI reports from various European economies and

U.K. for February and Eurozone CPI for January are slated for

release in the European session.

In the New York session, Canada retail sales data for December,

U.S. weekly jobless claims U.S. existing home sales data for

January and U.S. EIA crude oil data are set to be published.

At 7:30 am ET, the European Central Bank is scheduled to issue

the account of the monetary policy meeting of the governing council

held on January 24 and 25.

At 10:00 am ET, Federal Reserve Vice Chair Philip Jefferson will

deliver a speech on the U.S. economic outlook and monetary policy

before a Peterson Institute for International Economics webcast, in

Washington D.C., U.S.

At 3:15 pm ET, Federal Reserve Bank of Philadelphia President

Patrick Harker will speak on the economic outlook before an event

hosted by the University of Delaware Center for Economic Education,

in Newark, Delaware, U.S.

CHF vs Yen (FX:CHFJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CHF vs Yen (FX:CHFJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024