UK House Price Rise For First Time In More Than A Year: Nationwide

29 Febrero 2024 - 10:13PM

RTTF2

UK house prices increased for the first time in more than a year

in February as the decline in borrowing costs helped to bring an

upturn in the housing market, the Nationwide Building Society said

on Friday.

House prices posted an annual increase of 1.2 percent, in

contrast to the 0.2 percent decrease in January.

Prices were forecast to climb only by 0.3 percent. The increase

marked the first time upturn since January 2023.

Month-on-month, house prices rose 0.7 percent, the same rate as

seen in January.

"House prices are now around 3% below the all-time highs

recorded in the summer of 2022, after taking account of seasonal

effects," Nationwide's Chief Economist Robert Gardner said.

Gardner said industry data sources suggested a noticeable

increase in mortgage applications, while surveyors reported a rise

in new buyer enquiries.

Nonetheless, the economist said the near-term prospects remain

highly uncertain partly due to ongoing uncertainty about the future

path of interest rates. "Borrowing costs remain well below the

highs recorded last summer but, if the recent upward trend is

sustained, it threatens to restrain the pace of any housing market

recovery," said Gardner.

Further, the economist observed that the squeeze on household

budgets is easing with wage growth outstripping inflation by a

healthy margin.

However, it will take time to make up for the ground lost over

the past few years as consumer confidence remains fragile.

Data released on the Thursday also signaled an improvement in

the property market. Mortgage approvals for house purchases rose to

55,200 in January from 51,500 in December.

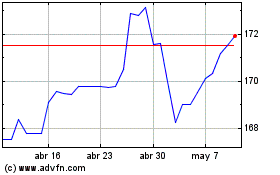

CHF vs Yen (FX:CHFJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CHF vs Yen (FX:CHFJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024