U.S. Dollar Falls Amid Risk Appetite

23 Mayo 2022 - 5:58AM

RTTF2

The U.S. dollar dropped against its most major rivals in the

European session on Monday, as risk sentiment improved amid

potential easing of lockdowns in China and on U.S. President

Biden's remarks that he is likely to drop Trump-era trade tariffs

on China.

Biden announced that trade tariffs imposed on China by the

previous Trump administration will be reviewed after discussing

with Treasury Secretary Janet Yellen.

The U.S. President, who is in Japan, will attend a meeting of

the Indo-Pacific strategic alliance known as the Quad on

Tuesday.

China's financial hub of Shanghai moved ahead with plans to

resume part of its transportation network, taking another step

towards lifting of COVID-19 lockdown.

U.S. stocks rebounded following a sell-off last week led by

worries about an economic slowdown.

The greenback declined to near 4-week lows of 1.0688 against the

euro and 0.9627 against the franc, from its early highs of 1.0557

and 0.9751, respectively. The greenback is seen facing support

around 1.08 against the euro and 0.93 against the franc.

The greenback dropped to more than a 2-week low of 0.7127

against the aussie and near a 3-week low of 0.6492 against the

kiwi, after rising to 0.6390 and 0.7040, respectively in previous

deals. If the greenback drops further, 0.73 and 0.66 are possibly

seen as its next support levels against the aussie and the kiwi,

respectively.

The greenback depreciated to near a 3-week low of 1.2601 against

the pound, from a high of 1.2473 hit at 5 pm ET. Versus the loonie,

it moved down to near a 3-week low of 1.2773. Next key support for

the greenback is seen around 1.28 against the pound and 1.25

against the loonie.

In contrast, the greenback held steady against the yen, after

rebounding to 127.93 from the Asian session's 4-day low of 127.15.

At Friday's close, the pair was worth 127.90.

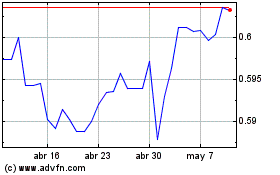

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

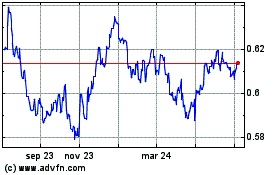

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024