TIDMAGFX

RNS Number : 2340M

Argentex Group PLC

13 September 2023

13 September 2023

Argentex Group PLC

("Argentex" or the "Group")

Interim results for the six-month period ended 30 June 2023

Record half year driven by continued execution of Group

strategy

Argentex Group PLC (AIM: AGFX), the service led, tech enabled

provider of currency management and payment services to

international institutions and corporates, today issues its results

for the six-month period ended 30 June 2023. (1)

Financial Highlights

-- Group revenue increased by 28% to GBP25.0m (H122: GBP19.5m)

with revenues from new products and geographies now representing

23% of revenues (H1 22 : 14%)

-- Operating profit increased by 16% to GBP5.2m (H122: GBP4.5m)

and adjusted operating profit(2) increased by 13% to GBP5.4m (H122:

GBP4.8m)

-- Group EBITDA margins maintained at 29% with a modest decrease

in operating margins to 21% (H1 22: 23%) as a result of planned

investment

-- Earnings per share (EPS) of 2.8p basic and 3.1p adjusted (H1

22: 2.4p basic and 2.7p adjusted)

-- Continued strong cash generation funding investment in growth

with GBP3m net increase in cash

-- Interim dividend of 0.75p per share reflecting strong

performance over the six-month period and confidence in the Group's

future prospects

(1) As previously announced, at the end of the last financial

year, the Group transitioned from a 31 March year end to a 31

December year end. Comparisons with H122 included in financial

highlights refer to the six-month period to 30 June 2022.

(2) Adjusted operating profit excludes one off costs in relation

to the set-up of overseas offices and any restructuring costs

incurred in the period, in line with accounting policy.

Operational Highlights

-- Continued delivery of our three-pillar diversification and

growth strategy, with enhanced higher-margin product mix and new

geographies contributing to volume and client growth:

o Despite an increasingly challenging macro-economic

environment, clients(3) trading increased by 8% to 1,493 (H1 22 :

1,381) with 305 new clients traded in the period (H1 22: 284)

o Wallet share increasing evidenced by 18% growth in average

revenue per client traded to GBP16.5k

o New business revenue growth indicative of enhanced client

quality driven by broader product offering, with average revenue

per new client traded up by 55% to GBP18.6k

o Investment in new higher margin products including Structured

Solutions now contributing meaningfully, accounting for 15% of

revenues (H1 22: 9%)

o Alternative Transaction Banking, which launched in late March,

is already outperforming management's expectations

3 Refers to clients as corporate or institutional, discounting

private clients.

-- Strong progress across Group's three strategic pillars:

o People

-- Number of full-time employees increased by 28 to 165 over the

period to support the Group strategy in either front office or

growth-related Argentepositions.

-- Further investment planned to support technology development,

international growth and anticipated market share gains

o Technology & Product

-- Digital revenues have increased 100% during the period with

16% of clients using the platform (H1 22 : 11%)

-- Phase two of our technology and product strategy and the

overall digital transformation programme continued with Alternative

Transaction Banking successfully launching in late March and

already trading ahead of expectations

-- Phase three is well underway, with the development of mass

payments and hedging analysis tools in addition to ongoing digital

transformation to support increased operational efficiency

-- Increase in Technology & Product investment to GBP2.6m

(H1 22: GBP1.7m)

o International expansion

-- Revenue contribution of Argentex Europe more than doubled to

GBP1.8m (H1 22: GBP0.8m), providing a gateway to Continental

Europe, with 24% of these revenues generated outside of The

Netherlands

-- Through leveraging the credible licence from the Dutch

National Bank, the Group has now launched its Alternative

Transactional Banking product in Europe

-- Argentex Australia continues to generate revenue, pending

grant of the wholesale Australian Financial Services License

-- As announced, Nigel Railton (previously Senior Independent

Director) was appointed Chair of Argentex on 1 September 2023. Lord

Digby Jones stepped down as Chair on 1 September 2023 and will

continue as a Non-Executive Director.

Outlook

Despite more challenging trading conditions post period end, the

Group continues to deliver double digit growth of 20%, with

revenues increasing to GBP35m to 05 September 2023 (same period

2022 - GBP29m). Whilst the core UK corporate currency management

business remained resilient, our Institutional and European

divisions have more recently experienced a greater season reduction

in market activity.

The Board has implemented a focused strategy to develop an

increasingly diversified business, underpinned by new higher margin

products and investment in technology. This strategy is helping to

drive improved customer adoption, which is abating the impact of

short-term macroeconomic fluctuations, meaning the Group remains

well positioned to deliver profitable growth through the cycle.

The Group continues to trade in-line with the Board's

expectations for the full year. Our approach to balancing cost

discipline with re-investment for growth remains unchanged, enabled

by a strong balance sheet and continued high levels of cash

generation.

Harry Adams, Chief Executive Officer, said:

"I am very pleased to announce another strong set of results for

Argentex, despite a continuation of the prevailing macro-economic

challenges, demonstrating significant progress in the

diversification and growth of our offering both by product and

geography. Our core business is driving double-digit revenue growth

supported by the return on investments across new technology and

product initiatives.

"Our business is attracting high quality corporates and

institutions looking for a trusted, service-led and tech-enabled

provider of currency management and payment services. The

performance of our newly launched Alternative Transaction Banking

product has exceeded initial expectations, demonstrating the

potential of new tech-enabled products to increase our share of

wallet while diversifying our revenue streams with new,

higher-margin products. Phase three of our technology and product

strategy provides further opportunity to enhance this trend, with a

pipeline of new products in development.

"Our people are a key differentiator to the Group. We know that

for our business to excel and deliver its ambition, the business

needs to attract and retain a high quality and diverse team. We

therefore place great value in investing in their wellbeing and our

culture, as the business continues to grow .

"Our focus remains to capitalise on the significant market

opportunities to grow wallet share across an increasing

international, high quality client base whilst prioritising a

sustainable model that delivers for all of our stakeholders.

"On behalf of everyone at Argentex, I would like to welcome

Nigel Railton into his new position as Chair, taking over from Lord

Digby Jones who left the role on 1 September with our thanks,

remaining a Non-Executive Director of the Group."

For further information please contact:

Argentex Group PLC

Harry Adams - CEO

Jo Stent - CFO

investorrelations@argentex.com

FTI Consulting LLP (Financial PR)

Ed Berry / Ambrose Fullalove / Jenny Boyd

07703 330 199

argentex@fticonsulting.com

Singer Capital Markets (Nominated Adviser and Broker)

Tom Salvesen / James Maxwell / Justin McKeegan

020 7496 3000

Analyst briefing

A meeting for analysts will be held virtually at 9.30am today,

13 September 2023. Analysts wishing to attend this event can

register via email to argentex@fticonsulting.com . Argentex's Half

Year results announcement will also be available today on the

Group's website at www.argentex.com .

Retail investor presentation

Management will additionally host a presentation for retail

investors via the Investor Meet Company platform at 16:00 on

Thursday 14 September 2023. The presentation is open to all

existing and potential shareholders. Questions can be submitted via

the Investor Meet Company dashboard up until 09:00 on the day

before the meeting, or at any time during the live

presentation.

Investors who already follow Argentex Group PLC on the Investor

Meet Company platform will automatically be invited. Those wishing

to sign up for free, and meet Argentex, can do so via

https://www.investormeetcompany.com/argentex-group-plc/register-investor

CEO review

Overview

I am pleased that the Group has maintained strong momentum over

the six-month period to June 2023, delivering a record performance

on the back of an exceptionally strong 2022. Despite a challenging

macroeconomic backdrop with clients adjusting to the higher

interest rate environment, the Group's continued delivery on its

strategic objectives to invest in People, Technology & Product

and International expansion is resulting in an exciting evolution

of our business and its capabilities as a leading tech-enabled

provider of currency management and payment services.

While the core business continues to strengthen, driving 28%

revenue growth to GBP25 million (H1 22 : GBP19.5m), it is the

contribution of our new products (including Alternative Transaction

Banking which launched late March) that enhanced our performance

over the period. These products are already outperforming

management's initial expectations which reinforces the potential of

our broader growth strategy and the significant opportunity as we

gain greater wallet share from both new and existing clients.

Client demand for our evolving proposition is clear as

demonstrated by the 8% increase in number of clients trading with

Argentex over the period to 1,493 clients (H1 22 : 1,381). The

business added 305 new clients in the first half of the financial

period, compared with 284 in H1 22. We are attracting higher

quality clients, which has resulted in an 18% increase in the

revenue per client traded and a 55% increase in the average revenue

per new client traded.

We remain focused on maintaining diversification by both client

type and client industry with 38% of revenue represented by the top

twenty customers (H1 22 : 36%). We are in the early stages of cross

selling these new products to our existing clients with revenue

contributing 15% in the six-month period (H1 22 : 9%).

The Group remains well-positioned to continue capitalising on

new opportunities immediately apparent in our markets, whilst

building a diversified business capable of outperformance and

profitable growth over the long-term.

Market backdrop

The period has been defined by stubbornly high global inflation

and while it appears that an anticipated global recession has been

averted, Central Bank policies have remained changeable amongst a

wave of monetary tightening as they take an agile approach to

managing their economies. To date, however, this has not translated

into significant moves in G7 currencies but has resulted in a

reduction in volatility with sterling trading in a tight range

against the euro and dollar for 2023.

Whilst these factors result in less favourable market

conditions, our increasingly diversified business has proven its

resilience, in continuing to win new and actively trading clients

and the adoption of our new, higher margin products creates less

reliance on short term macroeconomic fluctuations, meaning we are

well positioned to perform and grow through this cycle.

Financial performance

Argentex is the only UK listed non-bank that is regulated to

hold client money with both e-money and investment licences,

meaning that we attract high quality clients looking for a trusted,

service-led and tech-enabled provider. This is demonstrated by the

growth in traded clients, with an increased emphasis on quality as

evidenced by the 18% increase in average revenue per client to

GBP16.5k (H1 22 : GBP14k).

The Group has remained highly focused on the continued and

long-term investment into its three-pillar growth strategy whilst

maintaining a disciplined approach to cost control. Despite this

re-investment, we are pleased to have generated a 16% increase in

operating profit to GBP5.2 million (H1 22 : GBP4.5 million). This

includes contribution from the Group's new higher-margin products

in addition to improved efficiencies across the business.

As a result of the strong performance over the six-month period

and on account of the positive outlook for the prospects of the

Group, I, along with the Board of Directors am pleased to announce

an interim dividend of 0.75 pence per share.

Growth strategy

It is now two years since we initiated our three-pillar growth

strategy of People, Technology & Product and International

expansion and we are pleased to see revenues generated from new

products and new geographies represent 23% of total revenues in the

period (H1 22 : 14%).

As previously communicated, we are continuing to invest in

technology to drive growth and efficiencies with associated margin

benefits to come as these new products and geographies scale in

combination with driving associated operating leverage across the

business.

People

Whilst hiring at the senior level is substantially complete,

Argentex remains committed to the development of its global teams

with market-leading talent, increasing the number of full-time

employees by 28 to 165 over the period in support of the growth

strategy. We have sought opportunities to create new roles both in

the UK and in our overseas offices, reflecting the evolving nature

of our offering and business model, particularly as a result of our

continued investment in technology.

Technology & Product

Investment in technology remains central to the Group's digital

transformation and further product innovation while underpinning

the strength of our financial performance. GBP2.6 million was

invested in technology during the six-month period (H1 22 : GBP1.7

million) as our pipeline of innovative, 'right tech, right touch'

client solutions developed to help grow wallet share.

Phase one and two of our Technology & Product strategy

delivered GBP1.4m revenues in H1 23 representing 5% of total

revenue (H1 22 : 2%). Client adoption of these new products

increased by 62% to 396 clients (H1 22 : 244) as we progressed

phase two of our Technology & Product strategy. March 2023 saw

the launch of our Alternative Transaction Banking product, allowing

customers to take advantage of a compelling alternative to currency

accounts offered by traditional banks through our tech-enabled

product. This product, which allows clients to collect, hold, pay

and manage their currency exposure, has exceeded expectations in

the period with 43 new clients onboarded in Q2.

Phase three is well underway, with our new mass payments and

hedging analysis tools in advanced development, in-line with

expectations.

International Expansion

Our international expansion continues as we pursue opportunities

in new, highly regulated markets and pivot from a single-product,

single-office business to a multi-product, global business.

Argentex Europe continues to gain traction with revenues of

GBP1.8m in the period, more than double the same period last year

(H1 22 : GBP0.8m) as the subsidiary capitalises on the electronic

money licence which it was granted by the Dutch National Bank in

2022.

Argentex is now one of three non-bank providers of a Dutch

Virtual IBAN, which gives the Group significant growth

opportunities to roll out the Alternative Transaction Banking

product, providing access to clients and currency markets across

Europe.

Argentex Australia continues to generate revenue whilst we await

the grant of our wholesale Australian Financial Services licence.

We continue to explore further territories that represent strategic

growth opportunities, with similar market dynamics.

Outlook

Despite more challenging trading conditions post period end, the

Group continues to deliver double digit growth of 20%, with

revenues increasing to GBP35m to 05 September 2023 (same period

2022 - GBP29m). Whilst the core UK corporate currency management

business remained resilient, our Institutional and European

divisions have more recently experienced a greater season reduction

in market activity.

The Board has implemented a focused strategy to develop an

increasingly diversified business, underpinned by new higher margin

products and investment in technology. This strategy is helping to

drive improved customer adoption, which is abating the impact of

short-term macroeconomic fluctuations, meaning the Group remains

well positioned to deliver profitable growth through the cycle.

The Group continues to trade in-line with the Board's

expectations for the full year. Our approach to balancing cost

discipline with re-investment for growth remains unchanged, enabled

by a strong balance sheet and continued high levels of cash

generation.

Board changes

On behalf of everyone at Argentex, I would like to extend my

thanks to Lord Digby Jones, who leaves his role as Chairman of the

business after more than ten years, for his guidance and expertise

which oversaw our growth from inception to a sophisticated, public

company. He remains a Non-Executive Director on our Board. As

announced, we are delighted to welcome Nigel Railton as the Group's

new Chairman (previously Senior Independent Director) and look

forward to working closely with him on the next phase of our

development. Our search for two new Non-Executive Directors

continues and I look forward to updating the market in due

course.

Above all I would like to thank our team, our clients, and our

shareholders for their continued support and contribution to our

ongoing success.

Harry Adams,

Chief Executive Officer

Financial Review

Argentex delivered 28% revenue growth in H1 23 alongside

continuing to pursue its ambitious investment programme across all

three pillars of its growth strategy: People, Technology &

Product and International Expansion. Group EBITDA margins were

largely maintained at 29% with a planned modest decrease in

operating margins to 21% (H1 22 : 23%). Adjusted operating

profit(2) in the period increased by 13% to GBP5.4m, a 22% margin

(H1 22 : GBP4.8m / 25%). As a result of this strong performance

throughout the period and positive outlook for the growth prospects

of the Group, the Board is pleased to announce an interim dividend

of 0.75p per share.

FINANCIAL PERFORMANCE

Argentex generated revenues of GBP25m in the six months to 30

June 23, representing an increase of 28% compared to the same

period in the prior year. Revenues generated in the period were

driven by an increase in clients trading, increasing share of

wallet (18% increase in overall average revenue per client traded)

underpinned by an enhanced product mix across hedging solutions and

contributions from the Alternative Transaction Banking platform as

well as growth in our international operations.

Revenues generated from new products and geographies represent

23% of total revenues (H1 22 : 14%). This enhanced higher product

margin mix and geographical distribution has driven an increase in

wallet share and enhanced operating leverage to fund future

growth.

Clients traded increased by 8% to 1,493 (H1 22: 1,381), of which

305 (H1 22 : 284) were new clients trading in the period. Revenue

from new clients increased by 63% to GBP5.7m in H1 23 (H1 22

GBP3.5m) representing a 55% increase in average revenue per new

client traded in the period, demonstrating traction on growth

initiatives and investments made to date.

As with other companies that can operate an e-money licence,

Argentex benefited from interest income earned on these cash

balances. This interest is classified as Other Income and, while

the Group has benefited from this interest, it is not seen as a

core part of the Group's three-pillar diversification and growth

strategy.

The Group has maintained a disciplined approach to managing

costs through the half-year resulting in an operating profit of

GBP5.2m, an increase of 16% from the prior period. Adjusted

operating profit(2) in the half was GBP5.4m, or 22% margin (H1 22:

GBP4.8m / 25%). The planned and previously flagged decline in

operating margins compared to the prior period reflects the

previously communicated ambitious investment programme across all

three facets of Argentex's growth strategy. The investment

programme is on track, with 165 global employees in place at the

end of June 2023 with Technology & Product and International

Expansion developing in line with plan. Revenues in the prior

period were ahead of expectation and contributed towards a higher

than anticipated operating margin at this point in the investment

cycle. Operating margins in H1 23 are in line management

expectations.

People

In the six months to 30 June 2023 the average number of

employees grew to 153 (H1 22 : 106) with a period end headcount of

165 (December 2022 : 137). Front office/Back-office split

(excluding Senior Management) has shifted versus prior periods at

53%/47% (Dec 22 : 57%/43%) and reflects, in particular, the

investment in technology in support of the growth strategy and

further professionalisation in the support functions proportionate

to the maturation of the business as well as a continued balanced

approach to risk.

At 30/06/23 UK Overseas Total

Headcount Headcount Headcount

Front Office 61 21 82

Support 66 8 74

Directors and Exec LLP

Members 9 - 9

136 29 165

========== ========== ==========

At 31/12/22 UK Overseas Total

Headcount Headcount Headcount

Front Office 57 16 73

Support 50 5 55

Directors and Exec LLP

Members 9 - 9

116 21 137

========== ========== ==========

Of the 74 Support headcount, 16 were technology related (12 at

31 December 2022)

Technology & Product

Total investment in technology in the six-month period to 30

June 2023 was GBP2.6m (H1 22 : GBP1.7m). Of the GBP2.6m technology

spend, GBP0.8m was capitalised (H1 22 : GBP1.7m of which GBP1m

capitalised) with the impact on operating profit margins mitigated

by the fact that benefits of the technology development spend will

be realised in future periods and as such investment spend is

treated as capital investment and amortised over a three-year

period in line with accounting policy. Technology spend that is not

capitalised (H1 23 : GBP1.8m; H1 22 : GBP0.7m) or operating expense

in nature is embedded within operating cashflows and is in relation

to licences and other infrastructure support costs in support of

the growth strategy in addition to ongoing programme management

costs to manage execution risk.

International Expansion

Revenues generated from overseas operations totalled GBP2.0m in

the period, with revenues generated in Argentex Europe for the

six-month period to 30 June 2023 totalling GBP1.8m (H1 22:

GBP0.8m). Overseas regions are making a small contribution to the

overall cost base with Argentex Europe being the primary driver in

the period. The Netherlands will be the central hub for European

operations and licences granted and will act as a gold standard for

the region to create further opportunities in the coming years.

FINANCIAL POSITION

Argentex views its ability to generate cash from its trading

portfolio as a key indicator of performance within an agreed risk

appetite framework. Total cash and cash equivalents include client

balances pertaining to collection of any collateral and variation

margin in addition to routine operating cash balances. Further,

cash and cash equivalents does not include collateral placed with

financial counterparties. Collateral placed with financial

counterparties of GBP4.5m (FY 22 : GBP10.0m) is recorded in other

assets of the statement of financial position.

As at As at

June 23 Dec 22

Cash and Collateral GBPm GBPm

Cash at bank 32.6 29.0

Less: amounts payable to

clients (13.4) (12.8)

------- ------

Net cash 19.2 16.2

------- ------

Other assets 4.5 10.0

--------- ----

Excluding collateral held at financial counterparties, cash at

bank less amounts payable to clients increased by GBP3m to GBP19.2m

in the period (FY 22 : GBP16.2m). Other assets comprise collateral

held at institutional counterparties which decreased over the

period by GBP5.5m as a result of favourable movements in derivative

positions held.

Before movements in client balances held (increase of GBP0.6m in

the period) as shown in the Consolidated Financial Statements note

11, the Group generated GBP7.6m in cash from operating activities.

This amount is inclusive of any operating expenditure including the

aforementioned amounts in support of the growth strategy such as

technology (H1 23 : GBP1.8m ; H1 22 : GBP0.7m). Of the GBP7.6m in

cash generated from operating activities, a further GBP0.8m was

used to invest in technology, GBP2.8m was used to fund growth in

office footprints across London and The Netherlands and a further

GBP1m was used to fund ongoing lease obligations.

Cash generation from the Group's revenues is a function of i)

the composition of revenues (principally spot, forward option and

swap revenues in the period) and ii) the average duration of the FX

forwards in the portfolio. In the period, Argentex has generated

revenues in a ratio of approximately 45:55 between spot and forward

contracts outside of Structured Solutions, swaps and alternative

transaction banking revenues. While spot FX contracts attract a

smaller revenue spread, the inherent risk profile is much reduced,

and cash is generated almost immediately. As such, having this

proportion of revenues generated by spot trades with a minimal

working capital cycle creates a strong positive immediate cash flow

for the business compared to its operating cost base. Further, any

options premiums are typically paid upfront, and therefore options

revenues contribute positively toward maintaining healthy cash

conversion ratios.

Argentex continues to enjoy a high percentage of trades

converting to cash within a short time frame, which is a result of

almost 50% on average of revenue from trades outside of Structured

Solutions and swap trades being spot contracts in addition to

forward contracts carrying a relatively short tenor on average.

This in combination with premium on Structured Solutions contracts

typically being paid upfront has led to consistent healthy cash

conversion ratios for H1 23 :

CASH CONVERSION

6 months 6 months

to to

30/06/23 30/06/22

GBPm GBPm

Revenues 25.0 19.5

Revenues (swap adjusted S/A)

(A) 23.2 18.1

Less

Revenues settling beyond

3 months S/A (5.2) (3.7)

Net short-term cash generation

(B) 18.0 14.4

Short-term cash return (B/A) 77% 80%

---------- ----------

Derivative financial assets declined 13% in the period to

GBP58.1m with current element being GBP50.8m (87% of total

derivative financial assets). The Group diversifies liquidity

requirements across five liquidity providers, the largest providing

59% of liquidity required (62% at FY 22).

PORTFOLIO COMPOSITION

Argentex's client base continues to grow with an increase in

clients traded in the half year to 1,493 (H1 22 : 1,381), and 305

of these clients traded representing new business. Even when taking

growth into account however the composition of our client portfolio

remains consistent year-over-year, in that it consists of similar

businesses with exposures in the major currencies of sterling, euro

and US dollar. In line with prior year, the majority of the Group's

trading activity was comprised of trades in those currencies at 77%

(FY 22: 78%) and hence the Group's exposure to exotic currencies or

currencies with higher volatility and less liquidity remains

significantly limited. Further, client concentration has been

maintained with 38% of revenue represented by the top twenty

customers (H1 22 : 36%).

DIVID

As a result of this strong performance throughout the period and

positive outlook for the growth prospects of the Group, the Board

is pleased to announce an interim dividend of 0.75p per share. The

interim dividend will be payable on 13 November 2023 to

shareholders on the register at 13 October 2023. The ex-dividend

date will be 12 October 2023 .

Jo Stent

Chief Financial Officer

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND COMPREHENSIVE

INCOME

for the six months ended 30 June 2023

6 months 6 months

to to

30 June 2023 30 June

2022

GBPm GBPm

Revenue 25.0 19.5

Cost of sales (0.9) (1.2)

---------

Gross profit 24.1 18.3

Administrative expenditure (18.7) (13.5)

Adjusted operating profit 5.4 4.8

Non-adjusted expenditure - (0.2)

Share-based payments charge (0.2) (0.1)

---------------------------------- -------------- ---------

Operating profit 5.2 4.5

Finance costs (0.4) (0.2)

Profit before taxation 4.8 4.3

Taxation (1.6) (1.5)

Profit for the period and total

comprehensive income 3.2 2.8

CONSOLIDATED STATEMENT OF FINANCIAL POSITION as at 30 June

2023

Notes 30 June 31 December

2023 2022

GBPm GBPm

Non-current assets

Intangible assets 2.5 2.5

Property, plant and

equipment 6 16.1 7.9

Derivative financial

assets 10 7.3 8.8

Deferred tax asset 0.5 0.5

Total non-current

assets 26.4 19.7

Current assets

Cash and cash equivalents 8 32.6 29.0

Trade and other receivables 7 1.1 1.0

Other Assets 9 4.5 10.0

Derivative financial

assets 10 50.8 57.7

------------

Total current assets 89.0 97.7

-------- ------------

Current liabilities

Trade and other payables 11 (23.2) (25.9)

Derivative financial

liabilities 12 (35.2) (42.0)

Total current liabilities (58.4) (67.9)

Non-current liabilities

Trade and other payables 11 (11.3) (5.5)

Derivative financial

liabilities 12 (3.5) (5.2)

Total non-current liabilities (14.8) (10.7)

Net assets 42.2 38.8

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (continued)

as at 30 June 2023

30 June 31 December

2023 2022

GBPm GBPm

Equity

Share capital 13 0.1 0.1

Share premium 12.7 12.7

Share option reserve 0.7 0.5

Merger reserve 4.5 4.5

Retained earnings 24.2 21.0

Total equity 42.2 38.8

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the period ended 30 June 2023

Share Share Share Merger Retained Total

capital premium option reserve earnings equity

reserve

GBPm GBPm GBPm GBPm GBPm GBPm

Balance at 1

January 2022 0.1 12.7 0.3 4.5 14.3 31.9

Profit and total

comprehensive

income for the

period - - - - 2.8 2.8

Dividends paid - - - - (0.9) (0.9)

Share-based payments

charge - - 0.1 - - 0.1

--------- --------- --------- --------- ---------- --------

Balance at 30

June 2022 0.1 12.7 0.4 4.5 16.2 33.9

Balance at 1

January 2023 0.1 12.7 0.5 4.5 21.0 38.8

Profit for the

period - - - - 3.2 3.2

Dividends paid - - - - - -

Share-based payments

charge - - 0.2 - - 0.2

--------- --------- --------- --------- ---------- --------

Balance at 30

June 2023 0.1 12.7 0.7 4.5 24.2 42.2

CONSOLIDATED STATEMENT OF CASH FLOWS

6 months to 6 months to

30 June 2023 30 June 2022

GBPm GBPm

Profit before taxation 4.8 4.3

Taxation paid (1.1) (0.8)

Net finance expense 0.4 0.2

Depreciation of property, plant and

equipment 0.6 0.3

Depreciation of right of use assets 0.6 0.4

Amortisation of intangible assets 0.8 0.7

Share-based payments charge 0.2 0.1

(Increase) in receivables (0.6) (0.2)

(Decrease) in payables (3.0) (1.1)

Decrease/(increase) in derivative financial

assets 8.5 (7.9)

(Decrease)/increase in derivative financial

liabilities (8.5) 6.3

Decrease/(increase) in other assets 5.5 (5.1)

Net cash generated from/ (used in)

operating activities 8.2 (2.8)

Investing activities

Purchase of intangible assets (0.8) (1.0)

Purchase of plant and equipment (2.8) (0.1)

Net cash used in investing activities (3.6) (1.1)

Financing activities

Payments made in relation to lease

liabilities (1.0) (0.6)

Dividends paid - (0.9)

Net cash used in financing activities (1.0) (1.5)

Net increase/(decrease) in cash and

cash equivalents 3.6 (5.4)

Cash and cash equivalents at the beginning

of the period 29.0 37.9

Cash and cash equivalents at end of

the period 32.6 32.5

============== ==============

1 General information

Argentex Group PLC ("the Company") is a public limited company,

limited by shares, incorporated and domiciled in England and Wales.

The address of the registered office of the Company is 25 Argyll

Street, London, W1F 7TU. The Company's shares are listed on AIM,

the London Stock Exchange's market for small and medium size growth

companies. The Company is the ultimate parent company of the group

into which the results of its subsidiaries are consolidated.

2 Basis of preparation

The consolidated financial information contained within this

interim report is unaudited and does not constitute statutory

accounts within the meaning of Section 434 of the Companies Act

2006.

While the financial figures included in this interim report have

been prepared in accordance with IFRS applicable to interim

periods, this interim report does not contain sufficient

information to constitute an interim financial report as defined in

IAS 34. Financial information for the period ended 31 December 2022

has been extracted from the audited financial statements for that

period.

The financial information has been prepared using the

measurement bases specified by IFRS for each type of asset,

liability or expense. The accounting policies applied in

preparation of this interim report are consistent with the basis

that was adopted for the preparation of the audited accounts for

the 9 months ended 31 December 2022 and will be adopted for the

Group's next audited accounts for the year ended 31 December

2023.

Statutory accounts for the period ended 31 December 2022 have

been reported on by the Company's Independent Auditor and have been

delivered to the Registrar of Companies. The Independent Auditor's

Report on the Annual Report and Financial Statements for December

2022 was unqualified, and did not contain a statement under 498(2)

or 498(3) of the Companies Act 2006.

The interim report is prepared on a going concern basis as the

directors have satisfied themselves that, at the time of approving

the interim report, the Group has adequate resources to continue in

operational existence for at least the next twelve months from the

date of this report.

3 Accounting policies

The accounting policies adopted in this interim report are

identical to the those adopted in the Group's most recent annual

financial statements for the period ended 31 December 2022, which

are available from the Registrar of Companies and

www.argentex.com/investor-relations .

4 Earnings per share

The Group calculates basic earnings to be net profit

attributable to equity shareholders for the period. The Group also

calculates an adjusted earnings figure, which excludes the effects

of share based payments, and non-adjusted expenditure (net of a tax

adjustment). The calculation of diluted earnings per share assumes

conversion of all potentially dilutive ordinary shares, all of

which arise from share options.

Six months Six months

ended ended

30 June 2023 30 June 2022

Basic earnings per share 2.8p 2.4p

Diluted earnings per share 2.8p 2.4p

Underlying - basic 3.1p 2.7p

Underlying - diluted 3.1p 2.7p

The calculation of basic and diluted earnings per share is based

on the following number of shares:

Six months Six months

ended ended

30 June 2023 30 June 2022

m m

Basic weighted average shares 113.2 113.2

Contingently issuable shares 0.1 0.1

Diluted weighted average

shares 113.3 113.3

The earnings used in the calculation of basic, diluted and

underlying earnings per share are set out below:

Six months Six months

ended ended

30 June 2023 30 June 2022

GBPm GBPm

Earnings - basic and diluted 3.3 2.8

Non-underlying expenditure 0.0 0.2

Share-based payments 0.2 0.1

Earnings - underlying 3.5 3.1

5 Dividends

6 months ended 30 6 months ended 30 6 months ended 30 6 months ended 30

June 2023 June 2022 June 2023 June 2022

Pence per share Pence per share GBPm GBPm

Amounts recognised as distributions to equity holders

Interim dividend

recommended by

Directors - 0.75 - 0.9

---------------------- ---------------------- ---------------------- ----------------------

- 0.75 - 0.9

Dividends declared in the period

Final dividend

recommended by

Directors at

previous period end 2.25 - 2.5 -

---------------------- ---------------------- ---------------------- ----------------------

2.25 - 2.5 -

Dividends proposed in the period

Interim dividend for

year ended 31

December 2023 of

0.75p per share

(June 2022: nil per

share) 0.75 - 0.9 -

---------------------- ---------------------- ---------------------- ----------------------

0.75 - 0.9 -

A final dividend of 2.25p per share (GBP2.5m) was declared in

the period in respect of the period ended 31 December 2022. The

dividend payment date is 4 August 2023.

The Directors propose an interim dividend in respect of the year

ended 31 December 2023 of 0.75p (GBP0.9m).

6 Property, plant and equipment

Leasehold Right of Office equipment Computer Total

improvements use asset equipment

Cost GBPm GBPm GBPm GBPm GBPm

At 1 January 2023 1.8 7.3 1.3 0.7 11.1

Additions 2.0 11.8 0.4 0.4 14.6

Disposals - (7.3) - - (7.3)

-------------- ----------- ----------------- ----------- ------

At 30 June 2023 3.8 11.8 1.7 1.1 18.4

-------------- ----------- ----------------- ----------- ------

Depreciation

At 1 January 2023 0.4 2.1 0.2 0.5 3.2

Charge for the period 0.2 0.6 0.2 0.2 1.2

Disposals - (2.1) - - (2.1)

-------------- ----------- ----------------- ----------- ------

At 30 June 2023 0.6 0.6 0.4 0.7 2.3

-------------- ----------- ----------------- ----------- ------

Net book value

-------------- ----------- ----------------- ----------- ------

At 30 June 2023 3.2 11.2 1.3 0.4 16.1

-------------- ----------- ----------------- ----------- ------

At 31 December 2022 1.4 5.2 1.1 0.2 7.9

7 Trade and other receivables

30 June 31 December

2023 2022

GBPm GBPm

Current

Other receivables 0.5 -

Prepayments 0.6 1.0

1.1 1.0

8 Cash and cash equivalents

30 June 2023 31 December

2022

GBPm GBPm

Cash and cash equivalents

Cash and cash equivalents 32.6 29.0

32.6 29.0

Included within cash and cash equivalents are client held funds

relating to margins received and client balances payable. These

amounts are disclosed as amounts payable to clients of GBP13.4m

(December 2022: GBP12.8m) in note 11 and are not available for the

Group's own use. Client balances held as electronic money in

accordance with the Electronic Money Regulations 2011 are held in

accounts segregated from the firm's own bank balance.

The Directors consider that the carrying amount of these assets

is a reasonable approximation of their fair value. Cash is held at

authorised credit institutions and non-bank financial institutions

with robust credit ratings (where published) and sound regulatory

capital resources.

9 Other assets

30 June 2023 31 December

2022

GBPm GBPm

Other assets

Other assets 4.5 10.0

4.5 10.0

Other assets is made up of collateral with banking and brokerage

counterparties. Client margins received and disclosed within client

balances payable are used to service margin calls with

counterparties.

10 Derivative financial assets

30 June 2023 31 December

2022

GBPm GBPm

Non-Current

Derivative financial assets at fair

value 7.3 8.8

Current

Derivative financial assets at fair

value 50.8 57.7

11 Trade and other payables

30 June 2023 31 December

2022

GBPm GBPm

Non-Current

Lease liabilities 11.0 5.3

Provisions 0.3 0.2

------------- ------------

Trade and other payables 11.3 5.5

============= ============

Current

Amounts payable to clients 13.4 12.8

Corporation tax 1.1 0.7

Amounts due to members and former

members of Argentex LLP 0.8 4.4

Trade payables - 0.4

Accruals 6.6 6.1

Other taxation and social security 0.5 0.7

Lease liability 0.8 0.8

Trade and other payables 23.2 25.9

12 Derivative financial liabilities

30 June 2023 31 December

2022

Non-Current GBPm GBPm

Derivative financial assets at fair

value 3.5 5.2

Current

Derivative financial assets at fair

value 35.2 42.0

13 Share capital

Ordinary Management Nominal

shares shares value

Allotted and paid up No. (m) No. (m) GBP

Ordinary shares of GBP0.0001

each 113.2 - 11,321

Management shares issued

of GBP0.0025 each - 23.6 58,974

At 30 June 2023 113.2 23.6 70,295

========== ========== =========

There were no changes to share capital during the period from 1

January 2023 to 30 June 2023 .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUUABUPWPUP

(END) Dow Jones Newswires

September 13, 2023 02:00 ET (06:00 GMT)

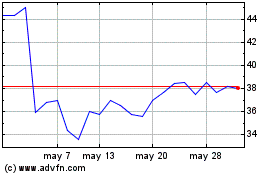

Argentex (LSE:AGFX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Argentex (LSE:AGFX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025