TIDMALL

RNS Number : 6889A

Atlantic Lithium Limited

24 January 2024

24 January 2024

Completion of US$5m MIIF Subscription

Atlantic Lithium welcomes Ghana's sovereign minerals wealth

fund, the Minerals Income Investment Fund ("MIIF"), onto its

shareholder register following the completion of MIIF's US$5m

Subscription, part of its total US$32.9m Strategic Investment to

support the development of the Ewoyaa Lithium Project

Atlantic Lithium Limited (AIM: ALL, ASX: A11, OTCQX: ALLIF,

"Atlantic Lithium" or the "Company"), the African-focused lithium

exploration and development company targeting to deliver Ghana's

first lithium mine, is pleased to announce that, in line with the

non-binding Heads of Terms ("Strategic Investment") announced on 8

September 2023, the Minerals Income Investment Fund of Ghana

("MIIF") has completed a subscription for 19,245,574 Atlantic

Lithium shares ("Subscription") at a price of US$0.2598 (A$0.39 /

GBP0.20) per share ("Subscription Shares"), for a value of US$5

million (A$7.60m / GBP3.93m).

Highlights

- Atlantic Lithium welcomes Ghana's mineral sovereign wealth

fund, MIIF, as a new major, strategic shareholder and funding

partner, demonstrating the Ghana government's significant support

for the advancement of the Company's flagship Ewoyaa Lithium

Project ("Ewoyaa" or the "Project").

- MIIF's US$5m Subscription forms part of its agreed total

US$32.9 million Strategic Investment in the Company and its

Ghanaian subsidiaries to expedite the development of the Project

and the broader Cape Coast Lithium Portfolio in Ghana ("Ghana

Portfolio") towards production.

- Subscription Shares to be held in escrow, equating to 3% of

the total issued share capital of the Company.

- Under the agreed terms of the Subscription, MIIF is entitled

to nominate one person to the Company's Board of Directors and will

be granted 9,622,787 warrants at a price of US$0.3637.

- In addition to the US$5m Subscription, and subject to the

Company reaching a binding agreement with MIIF for its proposed

investment in the Ghana Portfolio, MIIF to invest a further

US$27.9m in the Company's Ghanaian subsidiaries to acquire a 6%

contributing interest in the Company's Ghana Portfolio, inclusive

of the Project, expected to complete in the coming months.

- MIIF's Strategic Investment to enhance the Company's cash

balance and contribute towards Project development expenditure,

reducing the Company's share of the total US$185m development

expenditure, as indicated by the Ewoyaa Definitive Feasibility

Study, further de-risking the advancement of the Project.

- MIIF's decision to invest in the Company serves as an

indication of the country's long-term green minerals ambitions with

Atlantic Lithium as the government's 'partner of choice', as well

as an endorsement of the Company's intrinsic value as an investment

opportunity.

Commenting, Neil Herbert, Executive Chairman of Atlantic

Lithium, said :

"I am delighted to welcome Ghana's sovereign wealth fund, MIIF,

onto the Atlantic Lithium register as a highly valued shareholder

and partner. MIIF's Strategic Investment recognises the

considerable, long-lasting benefits that the Company, through

lithium production at Ewoyaa and the broader Cape Coast Lithium

Portfolio, can bring to Ghana, while also being indicative of

Atlantic Lithium's significant value upside to existing and

prospective investors.

"As we near the commencement of construction at Ewoyaa later

this year, we expect to benefit greatly from MIIF's support.

Notably, this includes MIIF's contributing interest towards the

Project's development expenditure, which further de-risks the

success of the Project.

"We look forward to completing the deal and working alongside

MIIF as a partner in achieving Ghana's lithium production

ambitions."

Commenting, Edward Nana Yaw Koranteng, Chief Executive Officer

of the Minerals Income Investment Fund, said :

"MIIF has been at the forefront of leading co-investment

opportunities within the mining sector in Ghana. This provides a

de-risking mechanism for global investors such as Atlantic Lithium

and cements Ghana as an investment destination of choice in Africa.

Our strategy is to invest across the entire mining value chain of

every mineral, with lithium not being an exception. In this vein,

MIIF is prepared to invest in line with the Government of Ghana's

energy transition plan, including becoming the EV hub for

Africa.

"Atlantic Lithium's Ewoyaa Lithium Project has vast prospects

with comparatively minimal initial capital requirements. The

Project's proximity to the Takoradi port and other infrastructure

improves its profitability profile. We look forward to working with

all parties involved to deliver Ghana's first lithium mine,

cementing the country's position as a leading global minerals

destination."

Allotment and Admission

Application will be made to the London Stock Exchange and the

Australian Securities Exchange today for the Subscription Shares to

be admitted to AIM and the ASX.

It is expected that Admission of the Subscription Shares to AIM

will become effective on 30 January.

Total Voting Rights

Following Admission of the Subscription Shares, the Company's

enlarged issued share capital will comprise 649,669,053 Ordinary

Shares carrying voting rights in the Company. This figure may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change in the interest in, the share capital of

the Company under the FCA's Disclosure and Transparency Rules.

Summary of Strategic Investment Terms

MIIF has agreed to invest a total of US$32.9 million in the

Company to support the development of the Ewoyaa Lithium Project

and broader Cape Coast Lithium Portfolio in Ghana ("Ghana

Portfolio") towards production.

Subscription

As detailed in this announcement, and as part of its total

US$32.9 million total proposed investment, MIIF has completed a

subscription for 19,245,574 Atlantic Lithium shares

("Subscription") at a price of US$0.2598 (A$0.39 / GBP0.20) per

share ("Subscription Shares"), for a value of US$5 million (A$7.60m

/ GBP3.93m).

The Subscription Shares, which will be held in escrow, equate to

3% of the enlarged issued share capital of the Company.

In line with the Subscription, MIIF agrees not to sell any of

the Atlantic Lithium Shares for:

(1) in respect of 6.5 million Atlantic Lithium Shares, 24 months

from the date of issue;

(2) in respect of 6.5 million Atlantic Lithium Shares, 36 months

from the date of issue;

(3) in respect of 6,245,574 Atlantic Lithium Shares, 48 months

from the date of issue.

MIIF will also be granted 9,622,787 warrants at a price of

US$0.3637, which will expire after a period of 18 months. Any

shares issued on the exercise of the warrants will be held in

escrow for two years from the date of issue.

In addition, following the completion of the Subscription, MIIF

is entitled to nominate one person to the Company's Board of

Directors.

Ghana Portfolio Investment

Under the terms of the Strategic Investment, further to the

Subscription and subject to the Company reaching a binding

agreement with MIIF, MIIF has agreed to invest in the Company's

Ghanaian subsidiaries Barari DV Ghana Ltd, Green Metals Resources

Limited, Moda Minerals Limited and Joy Transporters Ltd, which hold

the Company's lithium tenements. MIIF will acquire a 6%

contributing interest of the Ghana Portfolio for a total

consideration of US$27.9 million, payable on completion of the

Strategic Investment. The contributing interest will take the form

of funding of development, exploration and studies expenditure

incurred via monthly cash calls.

The Company will be granted the right to buy back MIIF's

interest in the Company's Ghanaian subsidiaries if MIIF notifies of

its interest to sell.

Under the terms of the investment in the Ghana Portfolio, MIIF

will be entitled to nominate one person to be a director of each of

the Company's Ghana Portfolio subsidiaries.

The exchange rates used in the announcement are as follows:

USD - GBP: 0.79

USD - AUD: 1.52

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For any further information, please contact:

Atlantic Lithium Limited

Neil Herbert (Executive Chairman)

Amanda Harsas (Finance Director and Company Secretary)

www.atlanticlithium.com.au

IR@atlanticlithium.com.au

Tel: +61 2 8072 0640

SP Angel Corporate Finance Yellow Jersey PR Limited Canaccord Genuity Limited

LLP Charles Goodwin Financial Adviser:

Nominated Adviser Bessie Elliot Raj Khatri (UK) /

Jeff Keating atlantic@yellowjerseypr.com Duncan St John, Christian Calabrese (Australia)

Charlie Bouverat Tel: +44 (0)20 3004 Corporate Broking:

Tel: +44 (0)20 3470 9512 James Asensio

0470 Tel: +44 (0) 20 7523 4500

============================== ============================= ===================================================

Notes to Editors:

About Atlantic Lithium

www.atlanticlithium.com.au

Atlantic Lithium is an AIM and ASX-listed lithium company

advancing a portfolio of lithium projects in Ghana and Côte

d'Ivoire through to production.

The Company's flagship project, the Ewoyaa Project in Ghana, is

a significant lithium spodumene pegmatite discovery on track to

become Ghana's first lithium-producing mine.

The Definitive Feasibility Study for the Project indicates the

production of 3.6Mt of spodumene concentrate over a 12-year mine

life, making it one of the top 10 largest spodumene concentrate

mines in the world.

The Project, which was awarded a Mining Lease in October 2023,

is being developed under a funding agreement with Piedmont Lithium

Inc.

Atlantic Lithium holds 509km(2) and 774km(2) of tenure across

Ghana and Côte d'Ivoire respectively, comprising significantly

under-explored, highly prospective licences.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZGZMFFRGDZZ

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

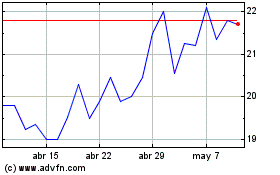

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025