TIDMBILN

RNS Number : 8207M

Billington Holdings PLC

19 September 2023

19 September 2023

Billington Holdings Plc

("Billington", the "Group" or the "Company")

Interim Results for the six months to 30 June 2023

A record first half performance by the Group

Billington Holdings Plc (AIM: BILN), one of the UK's leading

structural steel and construction safety solutions specialists, is

pleased to announce its unaudited interim results for the six

months ended 30 June 2023.

Unaudited Unaudited six Percentage

six months months to 30 Movement

to 30 June June 2022

2023

Revenue GBP60.15m GBP46.19m 30.2%

------------ -------------- -----------

EBITDA* GBP5.67m GBP2.35m 141.3%

------------ -------------- -----------

Adjusted profit before

tax** GBP4.96m GBP1.47m 237.4%

------------ -------------- -----------

Profit before tax GBP4.60m GBP1.30m 253.8%

------------ -------------- -----------

Cash and cash equivalents GBP10.82m GBP5.31m 103.8%

------------ -------------- -----------

Return on Capital Employed

(ROCE)*** 38.3% 13.2% 190.2%

------------ -------------- -----------

Basic Earnings per share

(EPS) 28.8p 8.7p 231.0%

------------ -------------- -----------

* Earnings before interest, tax, depreciation and

amortisation

** before share based payments of GBP0.36 million (H1 2022:

GBP0.17 million)

*** annualised operating profit divided by average net assets,

adjusted for cash and defined benefit pension scheme

Highlights

-- Revenue increased by 30.2 per cent to GBP60.15 million

(H1 2022: GBP46.19 million), representing record first

half revenues for the Group

-- Adjusted profit before tax** increased by 237.4 per cent

to GBP4.96 million (H1 2022: GBP1.47 million), an excellent

performance achieved by the Group

-- Continuing strong cash and cash equivalents balance of

GBP10.82 million as at 30 June 2023 (31 December 2022:

GBP11.63 million and 30 June 2022: GBP5.31 million). Disciplined

cash management with inventories and contract work in

progress increasing to GBP20.44 million (30 June 2022:

GBP16.28 million) and trade and other receivables increasing

to GBP17.56 million (30 June 2022: GBP13.17 million),

primarily as a result of the increased volume of work

being undertaken by the Group

-- The Group delivered a very strong performance in the period

across all its business units and is currently trading

ahead of the Board's previous expectations for the full

financial year. Significant work in progress, a good current

order book and a positive pipeline of opportunities provides

confidence for a continued strong performance in the second

half of the year

Mark Smith, Chief Executive Officer of Billington,

commented:

" The first half of 2023 saw Billington achieve record first

half revenues and good profits, with a strong performance across

all its business units. The Group has been successful in securing a

number of significant contracts and has a very healthy pipeline of

current and potential business, with significant work in progress.

The Group is benefiting from its investment in its capabilities,

facilities and people to strengthen its market position and secure

contracts at more attractive margins. Whilst we remain mindful of

continuing inflationary pressures and an uncertain macroeconomic

outlook, we anticipate a robust performance in the second half of

the year for the Group.

"I believe that Billington is very well positioned to deal with

market challenges and I now expect the Group to deliver profits for

the full year ahead of previous Board expectations."

For further information please contact:

Billington Holdings Plc Tel: 01226 340 666

Mark Smith, Chief Executive Officer

Trevor Taylor, Chief Financial

Officer

Tel: 020 7220 0500

Cavendish Capital Markets Ltd

- Nomad and Broker

Ed Frisby / Charlie Beeson - Corporate

Finance

Andrew Burdis / Barney Hayward

- ECM

IFC Advisory Limited Tel: 020 3934 6630

Tim Metcalfe billington@investor-focus.co.uk

Graham Herring

Zach Cohen

About Billington Holdings Plc

Billington Holdings Plc (AIM: BILN), one of the UK's leading

structural steel and construction safety solutions specialists, is

a UK based Group of companies focused on structural steel and

engineering activities throughout the UK and European markets.

Group companies pride themselves on the provision of high technical

and professional standards of service to niche markets with

emphasis on building strong, trusted and long-standing partnerships

with all of our clients. https://billington-holdings.plc.uk/

Investor Presentation

Billington's CEO, Mark Smith, and CFO, Trevor Taylor, will be

hosting an interactive presentation on the Investor Meet Company

platform at 3.00 p.m. today, Tuesday 19 September 2023. The

presentation is open to all existing and potential shareholders.

Questions can be submitted at any time during the live

presentation. Investors can sign up to Investor Meet Company for

free and add to meet Billington via:

https://www.investormeetcompany.com/billington-holdings-plc/register-investor

Investors who already follow Billington on the Investor Meet

Company platform will automatically be invited.

Change of Name of Nominated Adviser and Broker

The Company also announces that its Nominated Adviser and Broker

has changed its name to Cavendish Capital Markets Ltd following

completion of its own corporate merger.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

CHIEF EXECUTIVE STATEMENT

Introduction

The first half of 2023 saw a further recovery in the market

following the Covid-19 pandemic disruptions and the Group achieved

record first half revenues and profits. The Group's revenues

increased by 30.2 per cent to GBP60.15 million for the period (H1

2022: GBP46.19 million) and despite margin pressures remaining

across the industry, profit before tax increased by 253.8 per cent

to GBP4.60 million (H1 2022: GBP1.30 million), the highest ever

first half level achieved by the Group . The Group is also now debt

free, having repaid the remaining outstanding debt in January

2023.

The Group has been successful in securing a number of

significant contracts at improved margin levels and has a healthy

pipeline of current and potential business, with significant work

in progress. Whilst we remain mindful of continuing inflationary

pressures and an uncertain macroeconomic outlook, we anticipate a

continued strong performance in the second half of the year.

Group Companies

Billington Structures and Shafton Steel Services

Billington Structures is one of the UK's leading structural

steelwork contractors with a highly experienced workforce capable

of delivering projects from simple building frames to complex

structures in excess of 10,000 tonnes. With two facilities in

Barnsley and a further facility in Bristol and with a heritage

dating back over 75 years, the business is well recognised and

respected in the industry with the capacity to process over 50,000

tonnes of steel per annum.

The Shafton facility operates in two distinct business areas.

The first undertakes activities for Billington Structures. The

second, Shafton Steel Services offers a complete range of steel

profiling services to many diverse external engineering and

construction companies, providing further opportunities for growth

as well as allowing for the supply of value added, complementary

products and services enhancing the comprehensive offering of the

Group.

Although the market continues to be unsettled, with a number of

projects being deferred or cancelled, during the first half of the

year the Group's structural steel businesses continued to operate

at near full capacity, with benefits being seen from increases to

capacity following recent efficiency and process improvements,

driven by the Group's investment in capital equipment and people.

Furthermore, some modest softening in some of the Company's primary

raw material prices in the period has aided the enhancement of

margin on some projects.

Many of the projects undertaken were at higher margins than

those achieved in 2022 and the business continues to serve a wide

variety of markets, with a good spread of customers. Particularly

strong demand is being seen in the energy from waste, high-tech

manufacturing, infrastructure and data centre areas. Whilst large

office developments remain limited and industrial warehousing

development has slowed, Billington Structures continued to secure

contracts in these areas.

Billington Structures has a healthy order book, providing good

visibility into 2024, and this allows us to look forward with

cautious optimism to a continued strong performance.

Specialist Protective Coatings

In March 2022 the Group announced the formation of a new

subsidiary , Specialist Protective Coatings Ltd ("SPC"), focussed

on surface preparation and the application of protective coatings

for products across a variety of sectors including rail, highways,

defence, petrochemical, energy, structural steel and

infrastructure. SPC was formed following the Company's acquisition

of the trading assets of Orrmac Coatings Ltd ("Orrmac Coatings"), a

specialist painting company based in Sheffield, UK.

Since Billington acquired the trading assets of Orrmac Coatings,

based in a 55,000 square foot facility in Sheffield, it has

undergone a substantial refurbishment and an investment programme

to ensure the facility is able to effectively service the most

demanding of projects, including shotblasting and lifting

capabilities for steel assemblies that are amongst the largest in

the UK.

The business has made excellent progress since its formation and

it is now fully integrated within the Group, servicing both

internal Billington work and external customers. During the period

SPC operated at near full capacity and is now trading profitably.

In addition, the Group has expanded its dedicated on-site painting

service to enable SPC to be a one-stop-shop for the painting

requirements of the structural steel sector.

Peter Marshall Steel Stairs

Based in Leeds, Peter Marshall Steel Stairs is a specialist

designer, fabricator and installer of bespoke steel staircases,

balustrade systems and secondary steelwork. It has the capability

to deliver stair structures for the largest construction projects

and operates in sectors spanning retail, data, commercial offices,

education, healthcare, rail and many more.

Peter Marshall Steel Stairs continued its strong performance in

the period, maintaining robust margins and undertaking substantial

work as part of contracts with Billington Structures and for third

parties. During the period the business received orders from a

variety of sectors and enjoys a secure market position, as one of

the largest companies in its sector, in what is a fragmented

market. The outlook for Peter Marshall Steel Stairs continues to be

positive and the business has a strong order book for the remainder

of 2023 and into 2024.

Easi-Edge

Easi-Edge is a leading site safety solutions provider of

perimeter edge protection and fall prevention systems for hire

within the construction industry. Health and safety is at the core

of the business which operates in a legislative driven market.

Easi-Edge remains a significant and consistent contributor to

Group profits, although the business continued to experience lower

than pre-Covid-19 pandemic utilisation rates for its solutions in

the first half. This is primarily as a result of the continued

limited number of commercial office developments currently being

undertaken, as these types of projects require a greater amount of

product when compared to most other types of projects, such as

distribution warehouses.

However, Easi-Edge does continue to secure opportunities in

those buoyant market sectors where new developments are being

undertaken.

Hoard-it

Hoard-it produces a specialised range of re-usable temporary

hoarding solutions which are environmentally sustainable and

available on both a hire and sale basis tailored to the

requirements of its customers.

Hoard-it again enjoyed a very strong performance in the first

half of 2023, with significant growth, as new projects were

secured, and others resumed following the delays experienced due to

the Covid-19 pandemic. Hoard-it further expanded its graphics

capability, Brand-it, which was introduced in 2021. This is a value

added, margin enhancing product, that has also been a catalyst for

the strong H1 performance. Brand-it's offering is being utilised on

both Hoard-it's own products and on those produced by others.

Whilst material price inflation continued to be experienced in

the early part of the year, a recent softening of material costs,

in particular timber, gives further confidence that margins can be

maintained. Hoard-it has also benefited from its investment in

stock levels in advance of anticipated demand, enabling rapid

deployment of its solutions.

Financial Results

Revenue and Profit Before Tax

Group revenue increased by 30.2 per cent in the period to

GBP60.15 million (H1 2022: GBP46.19 million), a record first half

performance for Billington, as the Group successfully executed a

number of significant contracts at improved margin levels. This led

to profit before tax for the period improving to GBP4.60 million

(H1 2022: GBP1.30 million), an increase of 253.8 per cent on H1

2022.

Basic Earnings per Share (EPS)

Basic earnings per share for the first half of the year

increased by 231.0 per cent to 28.8 pence (H1 2022: 8.7 pence).

Liquidity and Capital Resources

Continuing strong cash and cash equivalents balance of GBP10.82

million as at 30 June 2023 (31 December 2022: GBP11.63 million and

30 June 2022: GBP5.31 million). Disciplined cash management with

inventories and contract work in progress increasing to GBP20.44

million (30 June 2022: GBP16.28 million) and trade and other

receivables increasing to GBP17.56 million (30 June 2022: GBP13.17

million), primarily as a result of the increased volume of work

being undertaken by the Group.

Capital Expenditure

During the period the Group continued its planned capital

expenditure programme to facilitate efficiency improvements,

increase certain manufacturing capacities and to replace obsolete

equipment. The largest project undertaken in the period was the

delivery and installation of a new saw and drill line at Billington

Structures' Bristol facility, which was fully operational by the

period end.

The Group will continue to actively invest in appropriate areas,

whilst being mindful of the returns achievable from capital

investment in light of ongoing equipment price inflation.

Production Resources

Billington, alongside the wider steel industry has faced

challenges with the recruitment of sufficient skilled production

labour at its facilities. In order to address these issues the

Group has focussed its activities in two key areas; the recruitment

of overseas labour and the enhancement of locally based training,

in particular to increase the recruitment of skilled fabricators

and welders.

In the first half of 2023 the Group completed the initial phase

of its overseas recruitment programme and has now welcomed 37 new

staff members from overseas. These new staff members, who comprise

approximately 10% of the total Group workforce, have already

provided a valuable contribution to the Group's capabilities,

allowing capacity to be increased and demand to be serviced.

Billington has assisted these new recruits to settle in the UK and

is providing certain ongoing assistance with housing.

The Group continues to recognise the importance of training and

developing skilled labour locally, working in partnership with a

number of education providers. In particular, Billington, in

combination with Betterweld, a specialist training provider, has

finalised an agreement with Barnsley College to set up a regional

training centre to provide fabrication/welding training at the

Group's Shafton facility. This training centre is expected to be

operational from October 2023 and will provide the Group ongoing

access to an increased number of trained personnel for the Group's

two Barnsley based facilities.

Dividend

In the first half of 2023 Billington declared a final dividend

in relation to the year ended 31 December 2022 of 15.5 pence per

share amounting to GBP2.00 million, which was 2.52 times covered by

2022 underlying earnings. This dividend represented the largest

ever dividend declared by the Company. No interim dividend for 2023

has been declared (2022: nil), a policy consistent with prior

years.

Market and Economic Outlook

During the period a degree of stability returned on the supply

side and the Group experienced none of the supply issues seen over

the last few years. There was some softening in steel prices, which

has assisted margins in the short term and energy costs were lower

than anticipated at the start of the year. This stability is

expected to remain over the next 12 months.

The Group continues to benefit from significant projects in

energy from waste, high-tech manufacturing, infrastructure and data

centre facilities. However, some of the markets in which Billington

operates continue to see reduced levels of activity from historic

levels, particularly large office developments, and industrial

warehousing development, with less speculative development being

undertaken.

We are conscious that a number of the main construction

contractors continue to operate under significant pressure and the

Group has experienced deferred and cancelled contracts. The Group

insures its exposures with the maximum available cover, in a

continuing difficult credit insurance market, and focuses on

projects with the more robust larger contractors that can deliver

an appropriate margin. We have a robust process in place to assess

the risks associated with individual projects on a case-by-case

basis to reduce and mitigate the associated risks where

possible.

Prospects and Outlook

The first half of the year was a period of significant growth

across the Group, with record first half sales and profits being

delivered. Whilst the macroeconomic background remains uncertain,

we have a significant level of work in progress, are seeing a

consistent stream of opportunities at attractive margins and have a

very healthy order book. Billington is a robust business, with a

strong market position, and debt free.

I am very pleased with the performance across the Group in the

first half of 2023 and I would like to thank Billington's Board,

employees, shareholders and all stakeholders for their continued

support.

I believe that Billington is very well positioned to deal with

any market challenges and I now expect the Group to deliver profits

for the full year ahead of previous Board expectations.

Mark Smith

Chief Executive

19 September 2023

Condensed consolidated interim income statement

Six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Twelve months

to 30 June to 30 June to 31 December

Total

2023 2022 2022

GBP'000 GBP'000 GBP'000

Revenue 60,154 46,189 86,614

=========== =========== ===============

Raw material and consumables (37,712) (30,581) (51,277)

Other external charges (2,660) (2,277) (4,792)

Staff costs (11,675) (9,280) (19,566)

Depreciation (1,100) (1,023) (2,044)

Other operating charges (2,437) (1,702) (3,024)

----------- ----------- ---------------

(55,584) (44,863) (80,703)

----------- ----------- ---------------

Operating profit 4,570 1,326 5,911

Net finance charge/(income) 29 (27) (82)

Profit before tax 4,599 1,299 5,829

Tax (1,081) (247) (1,095)

Profit for the period attributable

to equity holders of the parent

company 3,518 1,052 4,734

=========== =========== ===============

Basic earnings per share 28.8p 8.7p 39.1p

=========== =========== ===============

Diluted earnings per share 27.0p 8.7p 37.8p

=========== =========== ===============

Condensed consolidated interim statement of

comprehensive income

Six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Twelve months

to 30 June to 30 June to 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Profit for the period 3,518 1,052 4,734

Other comprehensive income

Remeasurement of net defined benefit

surplus - - (486)

Movement on deferred tax relating

to pension liability - - 122

----------- ------------- -----------------

Other comprehensive income, net

of tax - - (364)

Total comprehensive income for the

period attributable to equity holders

of the parent company 3,518 1,052 4,370

=========== ============= =================

Condensed consolidated interim balance

sheet

As at 30 June 2023

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Assets

Non current assets

Property, plant and equipment 20,023 16,581 19,264

Investment property 464 - 464

Pension asset 2,174 2,673 2,174

Total non current assets 22,661 19,254 21,902

---------- ---------- ------------

Current assets

Inventories 2,039 2,635 3,334

Contract work in progress 18,398 13,645 13,548

Trade and other receivables 17,557 13,167 10,258

Current tax receivable - 233 -

Cash and cash equivalents 10,821 5,306 11,634

Total current assets 48,815 34,986 38,774

---------- ---------- ------------

Total assets 71,476 54,240 60,676

---------- ---------- ------------

Liabilities

Current liabilities

Current portion of long term borrowings - 250 250

Trade and other payables 31,384 20,849 22,044

Lease liabilities 153 48 143

Current tax payable 369 - 69

Total current liabilities 31,906 21,147 22,506

---------- ---------- ------------

Non current liabilities

Long term borrowings - 625 500

Lease liabilities 1,721 1,106 1,798

Deferred tax liabilities 1,525 1,108 1,525

Total non current liabilities 3,246 2,839 3,823

---------- ---------- ------------

Total liabilities 35,152 23,986 26,329

---------- ---------- ------------

Net assets 36,324 30,254 34,347

========== ========== ============

Equity

Share capital 1,293 1,293 1,293

Share premium 1,864 1,864 1,864

Capital redemption reserve 132 132 132

Other reserve (761) (770) (761)

Accumulated profits 33,796 27,735 31,819

Total equity 36,324 30,254 34,347

========== ========== ============

Condensed consolidated interim statement of changes in

equity

(Unaudited)

Share Share Capital Other Accumulated Total

capital premium redemption components profits equity

account reserve of equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 1,293 1,864 132 (770) 26,873 29,392

Equity dividends - - - - (363) (363)

Credit related to

equity-settled share

based payments - - - - 173 173

Transactions with

owners - - - - (190) (190)

-------- -------- ----------- ----------- ------------ --------

Profit for the six

months to 30 June

2022 - - - - 1,052 1,052

Total comprehensive

income for the period - - - - 1,052 1,052

-------- -------- ----------- ----------- ------------ --------

At 30 June 2022 1,293 1,864 132 (770) 27,735 30,254

======== ======== =========== =========== ============ ========

At 1 July 2022 1,293 1,864 132 (770) 27,735 30,254

Dividends - - - - 142 142

Credit related to

equity-settled share

based payments - - - - 633 633

ESOT movement in period - - - 9 (9) -

Transactions with

owners - - - 9 766 775

-------- -------- ----------- ----------- ------------ --------

Profit for the six

months to 31 December

2022 - - - - 3,682 3,682

Other comprehensive

income

Actuarial losses recognised

in the pension scheme - - - - (486) (486)

Income tax relating

to components of other

comprehensive income - - - - 122 122

Total comprehensive

income for the period - - - - 3,318 3,318

-------- -------- ----------- ----------- ------------ --------

At 31 December 2022 1,293 1,864 132 (761) 31,819 34,347

======== ======== =========== =========== ============ ========

At 1 January 2023 1,293 1,864 132 (761) 31,819 34,347

Dividends - - - - (1,899) (1,899)

Credit related to

equity-settled share

based payments - - - - 358 358

Transactions with

owners - - - - (1,541) (1,541)

-------- -------- ----------- ----------- ------------ --------

Profit for the six

months to 30 June

2023 - - - - 3,518 3,518

Total comprehensive

income for the period - - - - 3,518 3,518

-------- -------- ----------- ----------- ------------ --------

At 30 June 2023 1,293 1,864 132 (761) 33,796 36,324

======== ======== =========== =========== ============ ========

Condensed consolidated interim cash

flow statement

Six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Twelve months

to 30

June to 30 June to 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Group profit after tax 3,518 1,052 4,734

Taxation (paid)/received (780) 199 192

Interest received 70 6 26

Depreciation on property, plant and

equipment 1,100 1,023 2,044

Share based payment charge 358 173 806

Profit on sale of property, plant

and equipment (177) (105) (309)

Taxation charge recognised in income

statement 1,081 247 1,095

Net finance (income)/charge (29) 27 82

Increase in inventories and contract

work in progress (3,555) (4,129) (4,731)

(Increase)/decrease in trade and other

receivables (7,299) (951) 1,958

Increase/(decrease) in trade and other

payables 7,441 (969) 709

Net cash flow from operating activities 1,728 (3,427) 6,606

----------- ----------- ---------------

Cash flows from investing activities

Purchase of property, plant and equipment (1,887) (1,602) (4,516)

Purchase of investment property - - (404)

Proceeds from sale of property, plant

and equipment 205 118 348

Net cash flow from investing activities (1,682) (1,484) (4,572)

----------- ----------- ---------------

Cash flows from financing activities

Interest paid (42) (13) (95)

Repayment of bank and other loans (750) (125) (250)

Capital element of leasing payments (67) (27) (74)

Dividends paid - - (363)

----------- ----------- ---------------

Net cash flow from financing activities (859) (165) (782)

----------- ----------- ---------------

Net (decrease)/increase in cash and

cash equivalents (813) (5,076) 1,252

----------- ----------- ---------------

Cash and cash equivalents at beginning

of period 11,634 10,382 10,382

Cash and cash equivalents at end

of period 10,821 5,306 11,634

=========== =========== ===============

Total cash and cash equivalents 10,821 5,306 11,634

=========== =========== ===============

Notes to the interim accounts - as at 30 June 2023

Segmental Reporting

The Group trading operations of Billington Holdings plc are in

Structural Steelwork and Safety Solutions, and all are continuing.

The Structural Steelwork segment includes the activities of

Billington Structures Limited, Peter Marshall Steel Stairs Limited

and Specialist Protective Coatings Limited, and the Safety

Solutions segment includes the activities of Easi-Edge Limited and

Hoard-It Limited. The Group activities, comprising services and

assets provided to Group companies and a small element of external

property rentals and management charges, are shown in Other. All

assets of the Group reside in the UK.

Unaudited Unaudited Audited

Six months Six months Twelve months

to 30th to 30th

June June to 31st December

2023 2022 2022

GBP000 GBP000 GBP000

Analysis of revenue

Structural Steelwork 54,702 40,975 75,977

Safety Solutions 5,452 5,214 10,637

Other - - -

Consolidated total 60,154 46,189 86,614

=============== =========== =================

Analysis of operating profit before finance

income

Structural Steelwork 4,309 612 4,400

Safety Solutions 646 739 1,902

Other (385) (25) (391)

Consolidated total 4,570 1,326 5,911

=============== =========== =================

Basis of preparation

These consolidated interim financial statements are for the six

months ended 30 June 2023. They have been prepared with regard to

the requirements of IFRS. The financial information set out in

these consolidated interim financial statements does not constitute

statutory accounts as defined in S434 of the Companies Act 2006.

They do not include all of the information required for full annual

financial statements and should be read in conjunction with the

consolidated financial statements of the Group for the year ended

31 December 2022 which contained an unqualified audit report and

have been filed with the Registrar of Companies. They did not

contain statements under S498 of the Companies Act 2006.

These consolidated interim financial statements have been

prepared under the historical cost convention. The accounting

policies have been applied consistently throughout the Group for

the purposes of preparation of these consolidated interim financial

statements.

Dividends

In the first half of 2023 Billington Holdings Plc declared a

final dividend of 15.5 pence (2022: 3.0 pence) per share amounting

to GBP2,005,000 (2021: GBP388,000) to its equity shareholders.

Dividends are recorded as declared and are accrued within creditors

at the period end. The dividend was subsequently paid in July 2023.

No interim dividend for 2023 has been declared (2022: nil).

These results were approved by the Board of Directors on 18

September 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKNPFFLDEFA

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

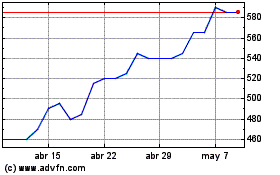

Billington (LSE:BILN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Billington (LSE:BILN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024