TIDMBIRD

RNS Number : 3357L

Blackbird PLC

05 September 2023

5 September 2023

Blackbird plc

(the "Company")

Interim results

Blackbird plc (AIM: BIRD; OTCQX: BBRDF), the technology

licensor, developer and seller of the market-leading cloud video

editing platform, Blackbird(R) , announces its interim results for

the six months ended 30 June 2023.

Ian McDonough, CEO of Blackbird plc, commented:

"I am delighted to report that there is continued momentum

behind our strategic progression to scale the business and the

Company is well placed to execute on this with a strong balance

sheet. Since we raised funding in December 2021, we have

significantly progressed our Creator SaaS strategy and we see this

as an exciting route to expand our addressable market and

accelerate growth for the Company.

"Although revenue for the period was down 36% on the prior

period at GBP985k, the decrease can be predominantly explained by

two non-recurring items earned in H1 2022, being the EVS

development fees on our technology licensing deal and the revenues

from the global winter games.

"The recent cyclical and structural changes in the Media and

Entertainment industry (M&E) have been considerable and

impacted the professional Media and Entertainment part of our

business, most prominently our deal with A+E Networks, which, as

previously announced, was terminated at the end of June 2023. In

anticipation of market shifts, we successfully raised money in 2021

to build a product for the Creator space. Therefore, we have

reduced headcount in our UK sales and marketing team in order to

maximise return on resources by investing in software developers

and product specialists.

"Through our core streamlined Blackbird team, now physically

located closer to its target market, we are focusing on larger

deals and OEM partnerships. Following the delivery of our

technology licensing deal at the end of 2022, EVS announced strong

interest, at NAB, in their product "IPD VIA Create" which is

'Powered by Blackbird'. Through our deal structure, if this product

is successful, Blackbird will benefit from significantly increased

royalty payments.

"The development of the Creator SaaS platform, led by Chief

Product Officer, Sumit Rai, has made significant progress and will

launch in early 2024. The platform will align us closely with the

fast-growing Creator Economy via a self-service SaaS platform. We

have attracted world class talent to deliver on this strategy which

is underpinned by our proven core patented technology. We are well

funded to launch this platform.

"We are very excited about this product and are looking forward

to updating investors later this month at our Special Event for

investors on 13 September 2023.

Operational highlights (post period)

-- Special Event for investors scheduled for 13 September 2023

to update on the progress of our Creator SaaS platform

-- New deal signed with a football confederation for use on a

high profile regional tournament

-- Deal signed with Australian OTT provider for use at the US

Open on the back of successful deployments at other tennis majors

(see below)

Financial highlights (post period)

-- GBP1,813k* secured revenue for 2023 as at 31 August 2023,

down 32% vs prior year (2022 comparative: GBP2,684k)

-- Contracted but unrecognised revenues of GBP1,997k* as at 31

August 2023 (2022 comparative: GBP4,047k). GBP568k relates to 2023

and GBP815k revenue relates to 2024 and the remainder to 2025 and

beyond

* Subject to exchange rate fluctuations

Operational highlights (during the period)

-- Creator SaaS strategic validation through quantitative and

qualitative research undertaken by the Company

-- Direct annual cost savings of GBP0.5m from reduction of UK

based sales and marketing staff. Reinvestment of funds in software

development team and product specialists

-- Contract terminated by A+E Networks at end of June 2023

-- Deal signed with Argentinian station Telefe, part of the

Paramount Global group and introduced by the CBS sports team, for

football highlights

-- One year deal signed with a large Mexican broadcaster via our partner Simplemente

-- Deals signed with Australian OTT provider and subsequently

used at Roland Garros and then again at Wimbledon

-- Further successful renewals with Sky News Arabia, BT and Arsenal

-- Increased IP portfolio to 17 patents, with a further 12 pending

-- Guest exhibitor on Microsoft's stand at the NAB show in April 2023

Financial highlights (during the period)

-- Revenues of GBP985k for the 6 months to 30 June 2023, down

36% year on year (6 months to 30 June 2022: GBP1,547k). The

majority of the decrease arose from H1 2022 containing

non-recurring revenues, being: i) GBP426k from development services

for our first 'Powered by Blackbird' licensing deal; and ii) on the

global winter games

-- Contracted but unrecognised revenues down 36% year on year to

GBP2,120k as at 30 June 2023 (GBP3,331k as at 30

June 2022) due to the loss of A+E Networks contract and a year

less in the order book on the Company's larger deals

-- Increased operating costs, excluding LTIP charge, of

GBP2,422k (6 months to 30 June 2021: GBP2,113k), driven

predominantly by an increase in the team to work on our Creator

SaaS product, GBP142k non-recurring restructuring costs partially

offset by higher capitalised development costs

-- EBITDA loss of GBP1,523k (6 months to 30 June 2022: GBP385k)

due to lower revenues and higher operating costs, as described

above, and a GBP353k LTIP credit to the income statement in H1 2022

(2023: GBPnil) on finalisation of the last LTIP scheme partially

offset by a lower share option expense as a result of leavers in

the restructuring

-- Net loss before tax of GBP1,617k (6 months to 30 June 2021:

GBP604k) due to lower EBITDA partially offset by higher net

financial income

-- Cash burn, excluding proceeds from share issues and transfers

from short term investments, increased to GBP1,921k (6 months to 30

June 2022: GBP1,253k) due to lower revenues and higher staff costs

to work on our Creator SaaS product

-- Cash and short-term investments of GBP8,177k (30 June 2022: GBP11,586k) and no debt

Enquiries:

Blackbird plc Tel: +44 (0)20 8879

7245

Ian McDonough, Chief Executive Officer

Stephen White, Chief Operating and Financial

Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Broker) 5656

Nick Naylor/ Piers Shimwell (Corporate Finance)

Amrit Nahal (Sales and Corporate Broking)

About Blackbird plc

Blackbird plc operates in the fast-growing SaaS and cloud video

market. It has created Blackbird(R) , the world's most advanced

suite of cloud-native computing applications for video, all

underpinned by its lightning-fast codec. Blackbird plc's patented

technology allows for frame accurate navigation, playback, viewing

and editing in the cloud. Blackbird(R) underpins multiple

applications, which are used by rights holders, broadcasters,

sports and news video specialists, esports, live events and content

owners, post-production houses, other mass market digital video

channels and corporations.

Since it is cloud-native, Blackbird(R) removes the need for

costly, high-end workstations and can be used from almost anywhere

on almost any device. It also allows full visibility on

multi-location digital content, improves time to market for live

content such as video clips and highlights for digital

distribution, and ultimately results in much more effective

monetisation.

Blackbird plc is a licensor of its core video technology under

its "Powered by Blackbird" licensing model, enabling video

companies to accelerate their path to true cloud business models.

Licensees benefit from power and carbon reductions, cost and time

savings, lower hardware and bandwidth requirements and easy

scalability.

Blackbird(R) is a registered trademark of Blackbird plc.

Websites

www.blackbird.video

Social media

www.linkedin.com/company/blackbird-cloud

www.twitter.com/blackbirdcloud

www.facebook.com/blackbirdplc

Operational review

The Company started 2023 with momentum, specifically:

-- 2022 saw record revenues for the 5th consecutive year, up 38% on the previous year;

-- a strong balance sheet as a result of a successful

fundraising in December 2021, resulting in a 2023 opening cash

position of GBP10.1million;

-- successfully execution of the EVS contract with the jointly

created product, "IPD VIA Create", being rolled out to a US

broadcaster and used at a global sporting event at the end of

2022;

-- expansion of our addressable market to prosumers and

professional teams with a significant refocussing of the team and

key hires in Product, Engineering and Product Marketing to build

our Creator SaaS platform; and

-- being crowned 'IABM Broadcast / Media Company of the Year' for 2022.

During the period, we reduced headcount in the UK sales and

marketing areas in order to focus our resources on product

development and maximise the return on investment from our

technology. This was also partly driven by the continuing cyclical

and structural changes in the M&E industries. These led to

major media corporations seeking cost savings which has impacted

this part of our business, most prominently our deal with A+E

Networks, which, as we announced on 12 May 2023, terminated at the

end of June 2023. Through our streamlined team, now located closer

to this market, we are focusing on larger deals and OEM

partnerships.

The development of the Creator SaaS platform, led by our Chief

Product Officer, Sumit Rai, is progressing well. Early access is

scheduled for Q4 2023.

Commercial activity during the 6 months under review

included:

In OEM:

-- EVS announced strong interest in "IPD VIA Create", which is

'Powered by Blackbird', at NAB. As previously explained, our

commercial relationship lasts for five years where the Company will

financially benefit on the back of the success of the deployment of

the product, with the financials underpinned by minimum guarantees;

and

-- Blackbird was present on Microsoft's stand at NAB, which

highlights the pedigree and perception of the Company's brand and

product.

In direct deals:

-- deal signed with Argentinian station Telefe, part of the

Paramount Global group and introduced by the CBS sports team, for

football highlights;

-- one year deal signed with a large Mexican broadcaster via our partner Simplemente;

-- deal signed with Australian OTT platform for use on Roland

Garros. They also used us again at Wimbledon and the US Open (post

period); and

-- successful renewals with Sky News Arabia, BT and Arsenal.

Financial review

Revenue decreased by 36% to GBP985k for the six-month period

compared to the corresponding period last year (six months to 30

June 2022 GBP1,547k). The majority of the decrease can be explained

by two non-recurring items earned in H1 2022 - firstly GBP426k from

development services for our technology licensing deal with EVS,

and secondly the licence fees earned from the global winter games.

As described above, t he cyclical and structural changes within the

M&E industries have impacted growth in this area of the

business.

Contracted but unrecognised revenue was GBP2,130k at 30 June

2023, a decrease of 36% compared to 30 June 2022 due to the A+E

Networks termination and one year less in the order book on our

larger deals.

Operating costs, excluding LTIP charges, for the period grew to

GBP2,424k versus GBP2,113k in the corresponding period last year

reflecting an increase in: i) GBP965k costs associated with our

Creator SaaS platform (2021: GBP183k); and ii) non-recurring

restructuring costs of GBP142k offset by higher development costs

being capitalised during the period (GBP734 vs GBP176k in the prior

period) with the increase being predominantly driven by the

additional work on Creator SaaS compared to prior period. As

previously announced, the restructuring of the business that

occurred in the period will lead to annual savings of

c.GBP500k.

Adjusted EBITDA loss, excluding share option costs and LTIP

provision movement, of GBP1,513k (6 months to 30 June 2022:

GBP637k) from lower revenues and higher operating costs.

EBITDA loss of GBP1,523k (6 months to 30 June 2022: GBP385k) due

to the movement in Adjusted EBITDA loss, excluding share option

costs and no LTIP movement in the period (6 months to 30 June 2022:

LTIP credit of GBP353k on closure of the last LTIP period) and

GBP88k lower share option expense in the period compared to prior

year driven by the restructuring of the business.

The net loss for the period was GBP1,617k (2022: GBP603k). Lower

EBITDA was partially offset by increased net financial income from

higher interest rates compared to the prior period.

Cash burn in the period, excluding proceeds from share issues

and transfers from short-term investments, was GBP1,921k versus

GBP1,253k in the same period in 2022 driven by lower revenues and

higher staff costs including for Creator SaaS, as explained

above.

Outlook

There is continued momentum behind our strategic progression to

scale the business and the Company's balance sheet is strong with

GBP8,177k of cash and short-term investments and no debt at the end

of June 2023.

The Company continues to focus on large scale deals for the

Blackbird platform and 'Powered by Blackbird' with the aim of

producing a positive net contribution from this division.

Additionally, the demands of our existing and new customers will

continue to drive innovations in our technology.

Significant progress continues on our Creator SaaS platform, led

by a world class team. This builds on our core technology and will

expand our addressable market. This product represents an exciting

future for the Company and our strong balance sheet will enable us

to launch it. Regular updates will be provided to shareholders,

including a special event on 13 September 2023, ahead of an

expected launch in early 2024.

UNAUDITED AND CONDENSED STATEMENT OF COMPREHENSIVE INCOME FOR THE SIX MONTHSED 30 JUNE 2023

Unaudited Unaudited Audited

Half year Half year to Year to

to

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

CONTINUING OPERATIONS

Revenue 985,115 1,546,544 2,847,202

Cost of Sales (76,268) (70,886) (143,149)

--------------------------------- ------------- ------------- ------------

GROSS PROFIT 908,847 1,475,658 2,704,053

Operating costs excluding

LTIP provision (2,421,622) (2,112,728) (4,509,938)

--------------------------------- ------------- ------------- ------------

ADJUSTED EARNINGS BEFORE

INTEREST, TAXATION,

DEPRECIATION, AMORTISATION,

EMPLOYEE SHARE OPTION

COSTS AND LTIP PROVISION

(Adjusted EBITDA pre

LTIP) (1,512,775) (637,070) (1,805,885)

Decrease in LTIP provision - 350,431 350,431

Employee share option

costs(1) (10,028) (98,356) (168,981)

--------------------------------- ------------- ------------- ------------

EARNINGS BEFORE INTEREST,

TAXATION, DEPRECIATION,

AMORTISATION (EBITDA) (1,522,803) (384,995) (1,624,435)

Depreciation (87,358) (68,169) (144,677)

Amortisation (163,564) (192,542) (383,330)

------------- ------------- ------------

(250,922) (260,711) (528,007)

-------------------------------- ------------- ------------- ------------

OPERATING LOSS (1,773,725) (645,706) (2,152,442)

Net Finance income 156,275 42,015 141,414

LOSS BEFORE INCOME

TAX (1,617,450) (603,691) (2,011,028)

Income Tax - - 94,178

--------------------------------- ------------- ------------- ------------

LOSS FOR THE PERIOD (1,617,450) (603,691) (1,916,850)

TOTAL COMPREHENSIVE

LOSS FOR THE PERIOD (1,617,450) (603,691) (1,916,850)

================================= ============= ============= ============

Earnings per share

expressed

in pence per share:

Basic and diluted -

continuing and total

operations (0.44p) (0.16p) (0.52p)

UNAUDITED AND CONDENSED STATEMENT OF FINANCIAL POSITION AT 30

JUNE 2023

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

ASSETS GBP GBP GBP

NON-CURRENT

ASSETS

Other intangible

assets 1,904,198 1,178,891 1,270,231

Property, plant

and equipment 149,128 221,589 202,204

2,053,326 1,400,480 1,472,435

---------------------- ------------- ------------- -------------

CURRENT ASSETS

Trade and other

receivables 415,339 639,497 863,211

Current tax

assets 0 32,167 94,178

Short-term

investments 2,653,780 6,684,825 4,366,342

Cash and bank

balances 5,523,638 4,901,435 5,732,350

8,592,757 12,257,924 11,056,081

---------------------- ------------- ------------- -------------

TOTAL ASSETS 10,646,083 13,658,404 12,528,516

======================= ============= ============= =============

EQUITY

Issued share

capital 2,941,044 2,940,524 2,941,044

Share premium 34,038,746 34,034,228 34,038,746

Capital contribution

reserve 125,000 125,000 125,000

Retained earnings (27,512,196) (24,662,240) (25,904,774)

9,592,594 12,437,512 11,200,016

---------------------- ------------- ------------- -------------

NON-CURRENT

LIABILITIES

Lease & License - 85,543 29,783

- 85,543 29,783

---------------------- ------------- ------------- -------------

CURRENT LIABILITIES

Lease 77,100 91,572 106,162

Trade and other

payables 976,389 1,043,777 1,192,555

1,053,489 1,135,349 1,298,717

---------------------- ------------- ------------- -------------

TOTAL LIABILITIES 1,053,489 1,220,892 1,328,500

----------------------- ------------- ------------- -------------

TOTAL EQUITY

AND LIABILITIES 10,646,083 13,658,404 12,528,516

======================= ============= ============= =============

UNAUDITED AND CONDENSED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 30 JUNE 2023

Called Share premium Capital Retained earnings Total equity

up share contribution

capital reserve

GBP GBP GBP GBP GBP

Balance

at 1 January

2022 2,940,524 34,034,228 125,000 (24,156,905) 12,942,847

Issue of - -

share capital

Share based

payment - - - 98,356 98,356

Total comprehensive

income - - - (603,691) (603,691)

---------------------- ---------- -------------- -------------- ================== =============

Balance

at 30 June

2022 2,940,524 34,034,228 125,000 (24,662,240) 12,437,512

---------------------- ---------- -------------- -------------- ------------------ -------------

Changes

in equity

Issue of

share capital

(net of expenses) 520 4,518 - - 5,038

Share based

payment - - - 70,625 70,625

Total comprehensive

income - - - (1,313,159) (1,313,159)

====================== ========== ============== ============== ================== =============

Balance

at 31 December

2022 2,941,044 34,038,746 125,000 (25,904,774) 11,200,016

====================== ========== ============== ============== ================== =============

Changes

in equity

Issue of - - - - -

share capital

Share based

payment - - - 10,028 10,028

Total comprehensive

income - - - (1,617,450) (1,617,450)

====================== ========== ============== ============== ================== =============

Balance

at 30 June

2023 2,941,044 34,038,746 125,000 (27,512,196) 9,592,594

====================== ========== ============== ============== ================== =============

UNAUDITED AND CONDENSED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 30 JUNE 2023

Unaudited Unaudited Audited

Half year

Half year to to Year to 31

30 June 30 June December

2023 2022 2022

GBP GBP GBP

EBITDA (1,522,803) (384,995) ( 1,624,435 )

Decrease in LTIP provision - (350,431) (350,431)

Employee share option costs 10,028 98,356 168,981

(Increase) / Decrease in

working capital 290,204 (360,824) (388,841)

------------------------------------- ------------- ------------ ----------------

Cash used in operations (1,222,571) (997,894) (2,194,726)

------------------------------------- ------------- ------------ ----------------

Interest paid on lease liabilities (2,158) (4,363) (7,692)

Tax received 94,178 - 32,166

Net cash outflow from operating

activities (1,130,551) (1,002,257) (2,170,252)

------------------------------------- ------------- ------------ ----------------

Cash flows from investing

activities

Payments for intangible fixed

assets (809,906) (183,947) (470,200)

Payments for property, plant

and equipment (34,280) (33,103) (90,226)

Transfer from / (to) short-term

investments 1,712,562 (2,515,639) (197,156)

Interest received 102,089 14,651 82,041

Net cash inflow / (outflow)

from investing activities 970,465 (2,718,038) (675,541)

------------------------------------- ------------- ------------ ----------------

Cash flows from financing

activities

Share issue (net of expenses) - - 5,038

Payment of lease liabilities (48,626) (48,544) (97,169)

Net cash (outflow)/ inflow

from financing activities (48,626) (48,544) (92,131)

------------------------------------- ------------- ------------ ----------------

Decrease in cash and cash

equivalents (208,712) (3,768,839) (2,937,924)

Cash and cash equivalents

at beginning of period 5,732,350 8,670,274 8,670,274

Cash and cash equivalents

at end of period 5,523,638 4,901,435 5,732,350

===================================== ============= ============ ================

NOTES TO THE UNAUDITED AND CONDENSED CONSOLIDATED INTERIM

ACCOUNTS

FOR THE SIX MONTHS ENDED 30 JUNE 2023

1. Basis of preparation and accounting policies

These interim statements have been prepared on a basis

consistent with International Financial Reporting Standards (IFRS).

They do not contain all of the information required for full

financial statements and should be read in conjunction with the

financial statements of the Company as at and for the year ended 31

December 2022. These interim financial statements do not constitute

statutory accounts within the meaning of the Companies Act.

The interim financial information has not been audited. The

interim financial information was approved by the Board of

Directors on 4 September 2023. The information for the year ended

31 December 2022 is extracted from the statutory financial

statements for that year which have been reported on by the

Company's auditors and delivered to the Registrar of Companies. The

audit report was unqualified and did not contain a statement under

s498 (2) or 498(3) of the Companies Act 2006.

The accounting policies applied by the Company in these interim

financial statements are the same as those applied by the Company

in its financial statements for the year ended 31 December

2022.

2. Divisional breakdown

Enterprise Corporate Creator Total

SaaS

Unaudited Unaudited Unaudited Unaudited

Half year to Half year Half year Half year

to to to

30 June 2023 30 June 30 June 30 June 2023

2023 2023

GBP GBP GBP GBP

CONTINUING OPERATIONS

Revenue 985,115 - - 985,115

Cost of Sales (76,268) - - (76,268)

--------------------------- ------------- ----------- ---------- -------------

GROSS PROFIT 908,847 - - 908,847

Operating costs

excluding LTIP

provision (1,351,015) (566,219) (504,388) (2,421,622)

--------------------------- ------------- ----------- ---------- -------------

Adjusted EARNINGS

BEFORE INTEREST,

TAXATION, DEPRECIATION,

AMORTISATION,

EMPLOYEE SHARE

OPTION COSTS

AND LTIP PROVISION

(Adjusted EBITDA

before LTIP and

share option

costs) (442,168) (566,219) (504,388) (1,512,775)

LTIP Provision - - - -

Employee share

option costs - (10,028) - (10,028)

EARNINGS BEFORE

INTEREST, TAXATION,

DEPRECIATION,

AMORTISATION

(EBITDA) (442,168) (576,247) (504,388) (1,522,803)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUPUBUPWGMC

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

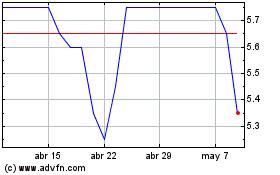

Blackbird (LSE:BIRD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Blackbird (LSE:BIRD)

Gráfica de Acción Histórica

De May 2023 a May 2024