TIDMBLOE

RNS Number : 6952X

Block Energy PLC

22 December 2023

22 December 2023

Block Energy plc

("Block" or the "Company")

Corporate Update and Project III Farm Out Process

Block Energy plc, the development and production company focused

on Georgia, is pleased to provide the following corporate

update.

Background

The Company's four-part project strategy is evolving to

accelerate the significant commercial opportunity offered by

Project III, focused on the multi-TCF undeveloped gas resource

within the Lower Eocene and Upper Cretaceous reservoirs of Blocks

XIB and XIF to which internal estimates attribute 984 BCF 2C

Contingent Resources.

Following continued development during 2023, Project III was

declared a gas resource of strategic importance by the State of

Georgia, and Block has concluded it is now ready to support a

farm-out at the asset level. Until now the Project has been funded

organically through cashflows from Project I. The accelerated

development of Project III has a good chance of success and

promises to have a material impact on its Net Asset Value.

The disciplined implementation of Project I during 2023, and

Block's focus on improving its overall margin through reducing its

operational cost structure ensures the Company will be well funded

to execute this high-impact strategy through 2024, based on current

production, oil prices and expected natural decline rates. Block

will, however, consider drilling additional Project I wells next

year as the Company progresses its farm-out strategy.

Project III update

During 2023, the Company completed an integrated full field

development study of the Lower Eocene and Upper Cretaceous

reservoirs , identifying gas-bearing natural fracture systems of

one and a half kilometres thick, spanning the Company's XIB and XIF

blocks across three fields, which included reinterpreting two 3D

seismic surveys, well design and planning, third-party conceptual

development engineering and cost estimation of a pilot scheme and

full field processing facilities. Block also signed an MoU with the

State of Georgia to support commercialisation of the Company's

Project III gas resources. The Company is also currently completing

a study on what promises to be a world-class Carbon Capture and

Storage (CCS) project throughout XIB, integrated into Project III

development plans, thus supporting the Company's longer-term

sustainability goals.

Project III Farmout process

Work undertaken in 2023 has informed the design of a staged

appraisal and development plan which is being used to facilitate

discussions with possible partners regarding the broader

development of our assets in Georgia, including a farm-out of

Project III. These discussions, supported by the Government of

Georgia, are taking place within the context of Georgia's continued

integration with the global economic community this year, including

the country's acceptance as an EU candidate nation and its entry

into a strategic partnership with China.

Growing industry interest in Georgia is also spurring an

increase in exploration activity. OMV is planning to acquire 3D

seismic in the Black Sea, and China's commitment to the country has

been underlined by the presence of a private Chinese firm using

services supplied by CNPC, the Chinese state-owned integrated

energy group, in an onshore location between the Black Sea and

Block's Project III.

CNPC has been contracted to deliver a firm work programme

comprising two deep wells, using a modern rig and a full suite of

integrated services. Positive results from this work programme

would have an instant read-through to the value of Project III,

which stands to benefit from access to a drilling rig and

integrated services capable of drilling deep directional wells

promising to reduce mobilisation and demobilisation time and

costs.

Reporting process:

Given Block's strategy has evolved in-line with the development

of its assets, the Company is revising its reporting process.

Rather than providing updates each quarter Block will publish

shareholder updates in-line with specific news on strategic and

operating activity, and to observe financial reporting

requirements. The Company believes news of its initiatives and

operating developments no longer conform to a quarterly news cycle

and therefore risk compromising strategic and commercial

discussions with potential farm-in candidates.

Block Energy plc's Chief Executive Officer, Paul Haywood,

said:

"I would like to thank the entire Block team for their continued

effort and focus, which has supported the safe delivery of this

year's plan and ensured we remained cashflow positive while

allocating capital to advance our high-impact Projects III and

IV.

" Our strategy is now evolving to accelerate the delivery of

value from the Company's high-impact projects which, in addition to

Projects III and IV, include Project II, where the team continues

to advance plans for secondary recovery that promise to trigger yet

another high-impact and near-term CF farm-out process, supported by

a CCS pilot programme. This shift in focus also allows us to

restructure our cost base and set our Project I programme within

the context of our wider strategy.

"The Company remains focussed on delivering a quantum leap for

our shareholders and has an extremely busy first quarter planned in

2024, when we will continue to implement our strategy , which is

being funded by current cashflows. In the meantime, I wish you all

a Merry Christmas and look forward to reporting on our progress

early in the New Year".

Stephen James BSc, MBA, PhD (Block's Subsurface Manager) has

reviewed the reserve, resource and production information contained

in this announcement. Dr James is a geoscientist with over 40 years

of experience in field development and reservoir management.

**S**

THIS ANNOUNCEMENT CONTAINS INFORMATION PREVIOUSLY DEEMED BY THE

COMPANY TO BE INSIDE INFORMATION AS STIPULATED UNDER THE UK VERSION

OF THE MARKET ABUSE REGULATION NO 596/2014 WHICH IS PART OF ENGLISH

LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL) ACT 2018, AS AMED. WITH

THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION

SERVICE, SUCH INFORMATION IS CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

For further information please visit

http://www.blockenergy.co.uk/ or contact:

Paul Haywood Block Energy plc Tel: +44 (0)20

(Chief Executive 3468 9891

Officer)

Neil Baldwin Spark Advisory Partners Tel: +44 (0)20

(Nominated Adviser) Limited 3368 3554

Peter Krens Tennyson Securities Tel: +44 (0)20

(Corporate Broker) 7186 9030

P hilip Dennis C elicourt Communications Tel: +44 (0)20

/ M ark Antelme 7770 6424

/ Ali AlQahtani

(Financial PR)

Notes to editors

Block Energy plc is an AIM-listed independent oil and gas

company focused on production and development in Georgia, applying

innovative technology to realise the full potential of previously

discovered fields.

Block has a 100% working interest in Georgian onshore licence

blocks IX and XIB. Licence block XIB is Georgia's most productive

block. During the mid-1980s, production peaked at 67,000 bopd and

cumulative production reached 100 MMbbls and 80 MMbbls of oil from

the Patardzeuli and Samgori fields, respectively. The remaining 2P

reserves across block XIB are 64 MMboe, comprising 2P oil reserves

of 36 MMbbls and 2P gas reserves of 28 MMboe. (Source: CPR Bayphase

Limited: 1 July 2015). Additionally, following an internal

technical study designed to evaluate and quantify the undrained oil

potential of the Middle Eocene within the Patardzeuli field, the

Company has estimated gross unrisked 2C contingent resources of 200

MMbbls of oil.

The Company has a 100% working interest in licence block XIF

containing the West Rustavi onshore oil and gas field. Multiple

wells have tested oil and gas from a range of geological horizons.

The field has so far produced over 75 Mbbls of light sweet crude

and has 0.9 MMbbls of gross 2P oil reserves in the Middle Eocene.

It also has 38 MMbbls of gross unrisked 2C contingent resources of

oil and 608 Bcf of gross unrisked 2C contingent resources of gas in

the Middle, Upper and Lower Eocene formations (Source: CPR

Gustavson Associates: 1 January 2018).

Block also holds 100% and 90% working interests respectively in

the onshore oil producing Norio and Satskhenisi fields.

Project I is focused on developing oil production from the

Middle Eocene reservoir of the West Rustavi/Krtsanisi field.

Project II aims to redevelop the Middle Eocene reservoir of the

Patardzeuli and Samgori fields.

Project III is focused on the undeveloped gas-bearing natural

fracture system within the Lower Eocene and Upper Cretaceous

reservoirs - each more than a kilometre thick - spanning the XIB

and XIF blocks.

Project IV is focused on exploring the full potential of our

licences, including licence IX and Didi Lilo where we have

identified significant prospectivity.

The Company offers a clear entry point for investors to gain

exposure to Georgia's growing economy and the strong regional

demand for oil and gas.

Glossary

-- bbls: barrels. A barrel is 35 imperial gallons.

-- Bcf: billion cubic feet.

-- boe: barrels of oil equivalent.

-- boepd: barrels of oil equivalent per day.

-- bopd: barrels of oil per day.

-- Mbbls: thousand barrels.

-- Mboe: thousand barrels of oil equivalent.

-- Mcf: thousand cubic feet.

-- MD: measured depth.

-- MMbbls: million barrels.

-- MMboe: million barrels of oil equivalent.

-- MMcf: million cubic feet.

-- TVD: True Vertical Depth.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFESFUFEDSEDE

(END) Dow Jones Newswires

December 22, 2023 02:00 ET (07:00 GMT)

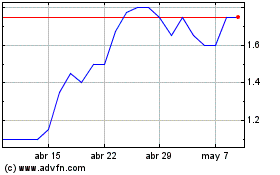

Block Energy (LSE:BLOE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Block Energy (LSE:BLOE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024