TIDMCIZ

RNS Number : 9139N

Cizzle Biotechnology Holdings PLC

28 September 2023

28 September 2023

Cizzle Biotechnology Holdings Plc

("Cizzle", the "Company" or the "Group")

Interim results for the six months ended 30 June 2023

Cizzle Biotechnology Holdings PLC (LSE: CIZ), the UK based

diagnostics developer, is pleased to announce its interim results

for the six months ended 30 June 2023.

Highlights

-- On 24 April 2023 the Group announced a new 12 month agreement

with the University of York running until 25 September 2024, which

builds on successful outcomes of the current research programme,

including meeting key milestones for monoclonal antibody

characterisation and assay platform optimization. This agreement

also extended access to state of the art facilities and world

leading scientists to support new solutions for early cancer

diagnostics and therapeutic tools.

-- On 12 June 2023 the Group announced that it had raised gross

proceeds of GBP350,000 at an issue price of 2.1p per share. A

variation to the Company's GBP500,000 loan facility agreement was

announced whereby repayment of any drawdown on this facility now

being satisfied by the issue of new ordinary shares in the Company

at a fixed price of 2.1p per share. This facility was extended

until 8 December 2024.

Post Period Highlights

-- The Company has a put option to sell its 5% economic interest

and royalty sharing agreement in the AZD 1656 asset to treat

inflammatory pulmonary and cardiovascular disease ("Option") to

Conduit Pharmaceuticals ("Conduit"), to be satisfied through the

issuance of new shares in Conduit (the "Option"). Conduit became a

publicly traded company on NASDAQ in the USA on 25 September 2023.

Cizzle exercised its Option on 26 September 2023 and once this has

been settled, the Company is expected to hold 395,460 shares in the

NASDAQ listed business with no restrictions.

-- On 10 August 2023 the Group announced an expansion of its

current research programme with the University of York to develop

its CIZ1B biomarker technology for early stage cancer diagnosis,

and other potential applications in cancer therapy. This follows

significant progress in isolating additional new and specific

monoclonal antibodies to the CIZ1B biomarker and incorporating

these into a new high-throughput clinical diagnostic immunoassay

platform. The recent developments meet key milestones to begin

commercial clinical trials. The Company is now engaged in clinical

trials design to support the validation and accreditation of the

CIZ1B test prior to commercial launch.

-- On 19 September 2023 the Group and Bio-Techne Corporation, a

NASDAQ Tech listed company, announced progress evaluating specific

monoclonal antibodies for Cizzle's CIZ1B cancer biomarker. Cizzle

has successfully completed an evaluation programme aimed at

assessing the feasibility of using the Simple Western platform from

ProteinSimple (a Bio-Techne brand) for high throughput detection of

the CIZ1B cancer biomarker which may be useful in the detection of

early-stage lung cancer.

Commenting Allan Syms, Chairman of Cizzle Biotechnology, said

:

"The Group continued to make excellent progress during the first

half of 2023 as key milestones were met in the development of our

proprietary assay for the CIZ1B biomarker which is highly

associated with early stage lung cancer. About 5,000 people die of

lung cancer every day which in part is due to the lack of simple

tests that can detect cancer early and as a result lead to

diagnosis when the disease is more advanced and survival rates are

poor.

"We have now expanded our range of specific monoclonal

antibodies for CIZ1B and as recently reported we are now deploying

these on a high throughput laboratory platform provided by

Bio-Techne, a $12 billion market capitalised life science and

biomedical research group. Bio-Techne have worked closely with Prof

Coverley's research team at the University of York and, having

completed a successful evaluation programme, we are now able us to

accelerate our clinical trials programme, initially in the USA.

" Our goal remains to develop simple, inexpensive, blood tests

for early cancer detection that can help save lives. The priority

will be to complete clinical trials and achieve LDT (Laboratory

Developed Test) accreditation and then to expand the use of our

CIZ1B antibodies for use in a lateral flow format, such as that now

commonly used for COVID antigen detection which will provide a

familiar test format with an established global distribution

infrastructure."

"We have also previously reported on our ambitions to expand our

target customer base in the pharmaceutical industry through

building a portfolio of early cancer detection tests, companion

diagnostics and royalty bearing stakes in significant drug assets.

We were therefore, pleased to report in the past few weeks the

positive development arising from the merger of our partners

Conduit Pharmaceuticals with Murphy Canyon Acquisition Corp.

resulting in Conduit becoming a NASDAQ listed company. The

Company's put option to sell its 5% economic interest and royalty

sharing agreement in Conduit's AZD 1656 asset to treat inflammatory

pulmonary and cardiovascular disease to Conduit for a total

consideration of GBP3.25 million, would be satisfied through the

issuance of new shares in the NASDAQ listed merged business."

Executive Chairman's Statement

Operational and strategic overview

The Group has focussed on realising and commercialising, through

systematic development, Cizzle's technology for the early detection

of cancer.

Research and Development Progress

Cizzle is developing a blood test for the early detection of

lung cancer. Its technology is based on the ability to detect a

stable plasma biomarker, a variant of CIZ1 known as CIZ1B. CIZ1 is

a naturally occurring cell nuclear protein involved in DNA

replication, and the targeted CIZ1B variant is highly correlated

with early-stage lung cancer.

On 24 April 2023 the Group announced a new 12 month agreement

with the University of York, running until 25 September 2024, that

builds on successful outcomes from the current research programme

and meeting key milestones for monoclonal antibody characterisation

and assay platform optimization. This agreement extended access to

state of the art facilities and world leading scientists to support

new solutions for early cancer diagnostics and therapeutic

tools.

On 10 August 2023 the Group announced an expansion of its

research programme with the University of York to . This followed

significant further progress in isolating additional new and

specific monoclonal antibodies to the CIZ1B biomarker and

incorporating these into a new high-throughput clinical diagnostic

immunoassay platform. The recent developments meet key milestones

to begin commercial clinical trials. The Company is now engaged in

clinical trials design to support the validation and accreditation

of the CIZ1B test prior to commercial launch.

On 19 September 2023 the Group and Bio-Techne Corporation, a

NASDAQ Tech listed company, announced progress evaluating specific

monoclonal antibodies for Cizzle's CIZ1B cancer biomarker. Cizzle

has successfully completed an evaluation programme aimed at

assessing the feasibility of using the Simple Western platform from

ProteinSimple (a Bio-Techne brand) for high throughput detection of

the CIZ1B cancer biomarker which may be useful in the detection of

early-stage lung cancer.

Funding

In June 2023 the Company completed a fund raising providing

gross proceeds of GBP350,000 by way of a subscription for its

shares. The funds will be used to provide working capital for the

Company and to continue development of a laboratory-developed test

("LDT") accredited service for the early detection of lung cancer

and taking the Company's proprietary CIZ1B biomarker blood test

through to UKCA, CE marking and/or FDA 510(k) clearance.

On 21 Sept 2023 the Group announced an update on its Option with

Conduit and noted shareholder approval for Conduit-Murphy merger

and NASDAQ listing. The Company has a put option to sell its 5%

economic interest and royalty sharing agreement in the AZD 1656

asset to treat inflammatory pulmonary and cardiovascular disease to

Conduit, to be satisfied through the issuance of new shares in

Conduit (the "Option"). The merger completed and Conduit became a

publicly traded company on NASDAQ in the USA on 25 September 2023.

Cizzle exercised its Option on 26 September 2023 and once this has

been settled, the Company is expected to hold 395,460 shares in the

NASDAQ listed business with no restrictions.

Financial overview

During the six months ended 30 June 2023, the Company continued

its focus on being a healthcare diagnostics developer. The Group

consists of Cizzle Biotechnology Holdings PLC as the parent company

with wholly owned subsidiaries, Cizzle Biotechnology Ltd ("CBL")

and Cizzle Biotech Ltd (formerly Enfis Ltd). The current Group

structure was formed when the Company completed the acquisition of

CBL on 14 May 2021 and was admitted to trading on the standard list

of the Main Market of the London Stock Exchange.

The financial results for the six months to 30 June 2023 are

summarised as follows:

-- Corporate expenses, before exceptional items: GBP342,000 (H1 2022: GBP345,000).

-- Non-cash corporate expenses relating to a share option

charge: GBP115,000 (H1 2022: GBP70,000)

-- Taxation credit: GBP26,000 (H1 2022: GBP25,000)

-- Total comprehensive loss of GBP431,000 (H1 2022, Loss GBP390,000).

-- Loss per share 0.12p, (H1 2022, Loss of 1.43p).

-- Cash balances as at 30 June 2023: GBP451,000 (30 June 2022: GBP444,000).

Responsibility Statement

We confirm that to the best of our knowledge:

-- the interim financial statements have been prepared in

accordance with International Accounting Standards 34, Interim

Financial Reporting;

-- give a true and fair view of the assets, liabilities,

financial position and loss of the Company;

-- the Interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- the Interim report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The interim report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by

Allan Syms on 27 September 2023.

Enquiries:

Cizzle Biotechnology Holdings Via IFC Advisory

plc

Allan Syms (Executive Chairman)

Allenby Capital Limited +44(0) 20 33285656

John Depasquale

George Payne

Novum Securities Limited +44(0) 20 7399 9400

Colin Rowbury

Jon Bellis

IFC Advisory Limited +44(0) 20 3934 6630

Tim Metcalfe

Florence Chandler

About Cizzle Biotechnology

Cizzle Biotechnology is developing a blood test for the early

detection of lung cancer. Cizzle Biotechnology is a spin- out from

the University of York, founded in 2006 around the work of

Professor Coverley and colleagues . Its proof-of-concept prototype

test is based on the ability to detect a stable plasma biomarker, a

variant of CIZ1 known as CIZ1B. CIZ1 is a naturally occurring cell

nuclear protein involved in DNA replication, and the targeted CIZ1B

variant is highly correlated with early-stage lung cancer.

For more information please see

https://cizzlebiotechnology.com

You can also follow the Company through its twitter account

@CizzlePlc and on LinkedIn.

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Group Group Group

Six months Six months Year ended

ended ended

30 June 2023 30 June 2022 31 December

2022

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Revenue - - -

Cost of Sales - - -

Gross Profit - - -

Administrative Expenses

-on going administrative expenses (342) (345) (823)

-share option charge (115) (70) (140)

Total administrative expenses

including exceptional items (457) (415) (963)

---------------------------- ---------------------------- -------------

Operating Loss and loss before

income tax (457) (415) (963)

Income tax 3 26 25 51

---------------------------- ---------------------------- -------------

Loss and total comprehensive

income for the period

attributable

to the equity shareholders

of the parent (431) (390) (912)

---------------------------- ---------------------------- -------------

Earnings per share Loss-

basic and diluted - pence 4 (0.12)p (1.43)p (0.3)p

Consolidated Statement of Financial Position

as at 30 June 2023

Group Group Group

30 June 30 June 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Non-Current Assets

Intangible asset 2,080 2,080 2,080

Total Non-Current Assets 2,080 2,080 2,080

------------ ---------- ---------

Current Assets

Trade and other receivables 223 87 227

Cash and cash equivalents 451 444 478

------------ ---------- ---------

Total Current Assets 674 531 705

------------ ---------- ---------

Total Assets 2,754 2,611 2,785

------------ ---------- ---------

Equity

Ordinary shares 3,504 3,495 3,502

Share premium 35,330 33,564 34,917

Share capital reduction reserve 10,081 10,081 10,081

Share option reserve 314 405 199

Shares to be issued - 880 115

Reverse acquisition reserve (40,021) (40,021) (40,021)

Retained losses (6,584) (5,907) (6,153)

Total equity 2,624 2,497 2,640

------------ ---------- ---------

Liabilities

Current liabilities

Trade and other payables 130 114 145

Total current liabilities 130 114 145

------------ ---------- ---------

Total equity and liabilities 2,754 2,611 2,785

------------ ---------- ---------

Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

Group Group Group

6 Months 6 Months 6 Months

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Operating loss before tax (457) (415) (963)

Adjustment for:

Share option charge 115 70 140

Share based payment to former director - - 8

------------ ------------ -------------------------

Operating cash flow before working

capital movements (342) (345) (815)

Decrease in trade and other receivable 30 18 16

Decrease in trade and other payables (15) (104) (73)

------------ ------------ -------------------------

Net cash used in operating activities (327) (431) (872)

------------ ------------ -------------------------

Cash flow from investing activities

Purchase of Put Option - - (120)

------------ ------------ -------------------------

Net cash inflow outflow from investing

activities - - (120)

------------ ------------ -------------------------

Cash flow from financing activities

Proceeds from the issue of ordinary

shares (net of issue costs) 300 - 480

Proceeds from shares to be issued - - 115

Net cash inflow from financing activities 300 - 595

------------ ------------ -------------------------

Net decrease in cash and cash equivalents (27) (431) (397)

Cash and cash equivalents at the

start of the period 478 875 875

------------ ------------ -------------------------

Cash and cash equivalents at the

end of the period 451 444 478

------------ ------------ -------------------------

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023 (unaudited)

Ordinary Capital Share Shares Reverse

Share Share Redemption Option to be Acquisition Retained

Group Capital Premium Reserve Reserve issued Reserve Losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2023 3,502 34,917 10,081 199 115 (40,021) (6,153) 2,640

-------- -------- ------------ -------- --------- --------------------------- --------- --------

Issue of shares for

cash 2 465 - - (115) - - 352

Share issue costs - (52) - - - - - (52)

Share option charge - - - 115 - - - 115

-------- -------- ------------ -------- --------- --------------------------- --------- --------

Total transactions with

owners 2 413 - 115 (115) - - 415

Comprehensive Loss for

the Period - - - - - - (431) (431)

At 30 June 2023 3,504 35,330 10,081 314 - (40,021) (6,584) 2,624

-------- -------- ------------ -------- --------- --------------------------- --------- --------

For the six months ended 30 June 2022

Capital Deferred

Ordinary Redemption Share consideration Reverse

Share Share Reserve Option - shares Acquisition Retained

Group Capital Premium Reserve to be issued Reserve Losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 3,493 32,566 10,081 335 - (40,021) (5,517) 937

---------- ----------- --------------- ---------- ----------------- ----------------------------- ----------- ----------

Issue of shares for

the acquisition of

intangible asset 2 998 - - - - - 1,000

Deferred consideration

arising on the

acquisition

of an intangible asset - - - - 880 - - 880

Share option charge - - - 70 - - - 70

Total transactions

with owners 2 998 - 70 880 - - 1,950

Comprehensive Loss

for the Period - - - - - - (390) (390)

---------- ----------- --------------- ---------- ----------------- ----------------------------- ----------- ----------

At 30 June 2022 3,495 33,564 10,081 405 880 (40,021) (5,907) 2,497

---------- ----------- --------------- ---------- ----------------- ----------------------------- ----------- ----------

Consolidated Statement of Changes in Equity (continued)

For the year ended 31 December 2022 (Audited)

Capital

Shares Redemption

Ordinary to Reserve Share Reverse

Share Share be Option Acquisition Retained

Capital Premium issued Reserve Reserve Losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 3,493 32,566 - 10,081 335 (40,021) (5,517) 937

---------- -------- --------- ------------ -------- --------------------------- --------- --------

Issue of shares

for

acquisition of

AZD 1656

intangible

asset 5 1,875 - - - - - 1,880

Issue of shares

for

cash 4 500 - - - - - 504

Cost of share

issue - (80) - - - - - (80)

Share options

exercised - 56 - - (276) - 276 56

Shares to be

issued - - 115 - - - - 115

Share option

charge - - - - 140 - - 140

---------- -------- --------- ------------ -------- --------------------------- --------- --------

Total transactions

with owners 9 2,351 115 - (136) - 276 2,615

Comprehensive Loss

for the year - - - - - - (912) (912)

At 31 December

2022 3,502 34,917 115 10,081 199 (40,021) (6,153) 2,640

---------- -------- --------- ------------ -------- --------------------------- --------- --------

Notes to the financial statements

For the six months ended 30 June 2023 (unaudited)

1. Basis of preparation

These condensed interim financial statements have been prepared

in accordance with IAS 34 - Interim Financial Reporting using the

recognition and measurement principles of UK-adopted International

Accounting Standards and should be read in conjunction with the

audited consolidated financial statements of the Group for the year

ended 31 December 2022.

The principal accounting policies used in preparing these

condensed interim financial statements are those expected to apply

to the Group's Consolidated Financial Statements for the year

ending 31 December 2023.

The results for the six-months ended 30 June 2023 are the Group

results.

The financial information for the six months ended 30 June 2023

is unaudited and does not constitute statutory financial statements

for those periods. The financial information for the year ended 31

December 2022 has been extracted from the audited financial

statements for this period. The financial information has been

prepared in accordance with accounting policies consistent with

those set out in the Group financial statements for the year ended

31 December 2022.

2. Continuing and discontinued operations

The Group is considered to have one class of business which is

focused on the early detection of lung cancer via the development

of an immunoassay test for the CIZ1B biomarker.

3. Income Tax

The Income tax credit of GBP26,000 for the six months ended 30

June 2023 relates to accrued income for the recovery of tax on

qualifying research and development expenditure. For the six months

ended 30 June 2022 there was income tax credit of GBP25,000 and a

credit of GBP51,000 for the year ended 31 December 2022.

4. Earnings per share

Group Group Group

6 months 6 months Year

ended ended ended

31 December

30 June 2022 30 June 2022 2022

Basic loss per share:

Total comprehensive loss

- GBP'000 (431) (390) (912)

Weighted number of Ordinary

Shares - '000 347,765 271,956 291,323

Loss per share - operations

- pence (0.12p) (1.43p) (0.3p)

As the Group result for the six months ended 30 June 2023, 30

June 2022 and year ended 31 December 2022 is a loss, any exercise

of share options or warrants would have an anti-dilutive effect on

earnings per share. Consequently earnings per share and diluted

earnings per share are the same, as potentially dilutive share

options have been excluded from the calculation.

5. Copies of Interim Report

Copies of this interim report are available upon request to

members of the public from the Company Secretary, SGH Company

Secretaries Limited, 6(th) Floor, 60 Gracechurch Street, London,

EC3V 0HR. This interim report can also be viewed on the Group's

website: https://cizzlebiotechnology.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DGGDCGUDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

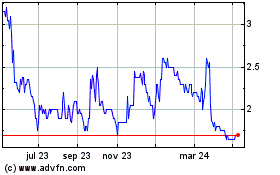

Cizzle Biotechnology (LSE:CIZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

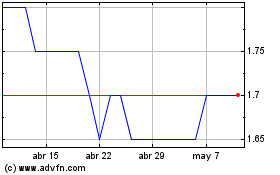

Cizzle Biotechnology (LSE:CIZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024