TIDMCLCO

RNS Number : 3076E

Cloudcoco Group PLC

29 June 2023

The information contained within this announcement is deemed by

CloudCoCo to constitute inside information pursuant to Article 7 of

EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

29 June 2023

CloudCoCo Group plc

("CloudCoCo", the "Company" or the "Group")

Interim Results

Solid trading performance and strong operational delivery

CloudCoCo (AIM: CLCO), a leading UK provider of Managed IT

services and communications solutions to private and public sector

organisations, is pleased announce its interim results for the six

months ended 31 March 2023 ("H1 2023").

Financial highlights:

-- Revenue increased by 11% to GBP 12.9 million (H1 2022:

GBP11.6 million), of which 70% was generated from recurring

contracts (H1 2022: 70%)

-- Gross profit increased by 13% to GBP4.3 million (H1 2022:

GBP3.8 million(1) ), a margin of 34% (2022: 3 3 %)

-- Trading Group EBITDA(2) increased by 70% to GBP0.9 million

(H1 2022: GBP0.53 million(1) )

-- E-commerce revenues from MoreCoCo increased 78% to GBP1.6

million (H1 2022: GBP0.9 million)

-- Cash at bank of GBP1.28 million at 31 March 2023 (H1

2022: GBP1.31 million)

Operational highlights:

-- Increased investment into the Group's sales and marketing

functions

-- 27 new "logo" customers added in the half (H1 2022: 21),

representing 70% of the number signed in the whole of

FY 2022, and growing pipeline

-- New multi-year customer wins including Gepp Solicitors,

Jensten Group and Marylebone Cricket Club

-- Launch of Multi-Cloud offering, enabling the Group to

attract larger, more complex organisations

-- Key senior leadership appointments across the Group including

new Head of Multi-Cloud

-- New strategic partnerships signed post-period with Abstract

Tech and Ingram Micro to enhance the Group's capabilities

and create new revenue opportunities

-- Continued focus on saving costs and increasing efficiency,

with considerable progress achieved in rationalising

the Group's suppliers

-- Improved customer satisfaction levels, aided by the unification

of our customer support operations across the Group into

a single team

(1) subsequent to the publication of the unaudited H1 2022

interim results, the accounting treatment for our onerous contracts

and data centre leases was assessed against the detailed criteria

of IFRS 16. This resulted in a reclassification of certain expense

items previously shown as costs of sales in the unaudited interim

results for H1 2022 as depreciation. The impact of the

reclassification on Trading Group EBITDA(2) for H1 2022 is shown on

the face of the Income Statement.

(2) profit or loss before net finance costs, tax, depreciation,

amortisation, plc costs, exceptional costs and share-based

payments

Mark Halpin, CEO of CloudCoCo, commented:

"We have delivered a solid H1 performance, winning new logo

customers and building our new business pipeline at a healthy rate

despite the challenges posed to organisations across the UK by the

economic backdrop. Our confidence in reaching our long-term growth

ambitions is underlined by the operational headway achieved during

the period. We have invested in expanding and optimising our teams,

including a significant elevation of talent across the Group

through a number of important hires in key strategic areas.

While conscious of the prevailing economic headwinds and the

impact on some of our customers, we are well placed to continue to

navigate them and are confident of making continued steady

strategic and commercial progress in the second half, ready to

accelerate when conditions permit. Alongside this, we continue to

actively explore opportunities to complement organic growth through

selective acquisitions. We are assessing our options to fund such

acquisitions and also to refinance our existing debt."

Contacts:

CloudCoCo Group plc Via Alma PR

Mark Halpin (CEO)

Darron Giddens (CFO)

Allenby Capital Limited - (Nominated Tel: +44 (0)20 3328

Adviser & Broker) 5656

Jeremy Porter / Daniel Dearden-Williams

- Corporate Finance

Tony Quirke / Amrit Nahal - Equity

Sales

Alma PR - (Financial PR) Tel: +44 (0)20 3405

David Ison 0205

Kieran Breheny cloudcoco@almapr.co.uk

Pippa Crabtree

About CloudCoCo

Supported by a team of industry experts and harnessing a diverse

ecosystem of partnerships with blue-chip technology vendors,

CloudCoCo makes it easy for private and public sector organisations

to work smarter, faster and more securely by providing a single

point of purchase for their Connectivity, Multi-Cloud,

Collaboration, Cyber Security, IT Hardware, Licencing, Support and

Professional Services.

CloudCoCo has headquarters in Leeds and regional offices in

Warrington, Sheffield and Bournemouth.

www.cloudcoco.co.uk

CHIEF EXECUTIVE'S REVIEW

Overview

Trading during the first half has been resilient, with growth

across both Managed IT Services and Value Added Resale (VAR). While

a handful of our customers responded to the increased cost of power

and ongoing economic headwinds by scaling back business with us,

this was more than offset by several lucrative new agreements made

possible by the enhanced breadth of our offering.

Now that the acquisitions in the prior year have been fully

integrated, we have established a solid platform to drive organic

growth. A key focus in the current financial year has been to

bolster our sales functions and reorganise our teams to ensure a

cohesive, unified approach across the Group. To this end we made

several key appointments across the four pillars of our strategy

(Connect, Multi-Cloud, Cyber and Collaboration) and are excited

about the value they will bring.

As previously announced, we are actively exploring strategic

partnerships to help us reach our growth ambitions faster.

Post-period, we signed agreements with Ingram Micro, the world's

largest global business-to-business wholesale provider of

technology products and supply chain management services, and

digital transformation services provider Abstract Tech. These

low-cost, mutually beneficial partnerships allow us to punch above

our weight in Multi-Cloud (the utilisation of Azure, AWS and Google

Cloud platforms) , an increasingly important requirement when

pursuing larger and more complex Managed Services contracts. These

partnerships open up a range of potential new revenue

opportunities.

Alongside our commercial efforts, we have maintained our focus

on removing unwanted costs and increasing efficiencies. To date, we

have successfully reduced the number of suppliers across the Group

in a meaningful way, leading to significant annualised savings, and

expect to make further progress in the second half.

Looking ahead, whilst the challenging economic backdrop is

likely to persist, we remain on course to deliver a year of solid

progress characterised by healthy commercial and operational

delivery. As conditions improve, the steps we are taking now to

enhance and optimise the Group will leave us well-positioned to

accelerate organic growth. M&A activity remains a focus and we

will continue to appraise potential acquisitions, only proceeding

with those we feel are a good strategic fit and available at the

right price.

Results

Revenues for H1 2023 represent an 11% increase on H1 2022 at

GBP12.9 million (H1 2022: GBP11.6 million), with gross profit up

13% to GBP4.3 million (H1 2022: GBP3.8 million). Trading Group

EBITDA(1) increased by 70% to GBP901k (H1 2022: GBP531k). New sales

orders generated by our sales team for H1 2023 amounted to total

contract value ("TCV") of GBP6.4 million, which despite being down

against the record value of GBP9.7 million recorded in H1 2022,

were up 7% against the H2 2022 value of GBP6.0 million reflecting

the improvement in the underlying sales performance. TCV measures

the total revenue that we expect to generate from new customer

contracts signed in the period over their contractual term.

The Group continues to prioritise larger, multi-year agreements.

Key recurring contracts signed in the period include contracts with

Tquila Automation Limited and Amedeo Services (UK) Limited enhanced

by our Multi-Cloud capability.

Unaudited Unaudited Unaudited Audited

6 months to 6 months to 6 months to Year to

31 March 30 September 31 March 30 September

2023 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------------- ------------- ------------- -------------

By operating segment

Managed IT Services 9,077 8,474 8,582 17,056

Valued Added Resale 3,846 4,075 3,062 7,137

----------------------- ------------- ------------- ------------- -------------

Total revenue 12,923 12,549 11,644 24,193

----------------------- ------------- ------------- ------------- -------------

Reflecting the process of reducing the liabilities inherited

from the acquisitions made in 2021, our cash reduced by GBP0.2

million to GBP1.3 million at 31 March 2023 (September 2022: GBP1.5

million).

Review of the period

The Group made significant operational strides in the first half

and post-period, with a view to accelerating organic growth

prospects, ensuring excellent levels of customer service and

reducing costs.

Solid commercial progress against a challenging backdrop

Despite the economic challenges facing the UK business

community, we are winning new logo customers at a healthy rate. In

H1 2023 we signed 27 new logo customers compared to 39 in the whole

of FY 2022, many of which we expect to continue to support revenue

growth for years to come. New logo customer wins in H1 2023 include

Gepp Solicitors, Jensten Group and Marylebone Cricket Club.

A key factor in this performance has been the investments into

and the reorganisation of our sales and marketing arms during

latter part of FY 2022. Programmes such as Project IGNITE have

assisted, and we continue to benefit from the increased scale and

capabilities derived from the acquisitions. The activity of our

telemarketing teams has increased substantially in H1 2023, and we

expect recent initiatives to deliver further commercial benefits

over time.

Our sales academy, launched in July 2022, continues to provide

the Group with a promising pool of talent. Members of the academy

have already made significant contributions to new business and,

now with a proven blueprint for how to onboard new colleagues and

nurture them to a high standard, we have plans to expand the

academy further in the next financial year.

We are observing a number of green shoot opportunities for

cross-selling across the customers of our acquired businesses,

particularly in selling Managed IT Services to customers who have

traditionally purchased data centre services and connectivity from

us. With our customers currently utilising only two of our 12 key

product areas on average, there is a scope to expand the range of

products we deliver to our existing customers alongside capturing

new business.

Following the launch of the new MoreCoCo website in FY 2022 as

our e-commerce business, we have seen an increase in sales from B2B

customers as well as consumers, enabled by the implementation of

several measures both to bring more visitors to the site and

increase conversion ratios. As a result, we have seen e-commerce

revenues from MoreCoCo increase from GBP0.9 million in H1 2022 to

GBP1.6 million in H1 2023.

Our post-period partnership with a global leader in the

purchase, restoration and sale of refurbished IT hardware,

announced in April 2023, will further support the growth of this

business line through the supply of more than 15,000 products,

while also improving our sustainability credentials.

Advances made in creating a leaner and more efficient Group

As reported at our FY 2022 results, following the acquisition,

integration and turnaround of the Group's Connect business, we have

embarked on a line-by-line process of reviewing customer

profitability at a granular level. This has resulted in us exiting

certain low-margin contracts and rationalising our spend with

suppliers with a view to achieving substantial cost savings. We

have continued this process during the period with excellent

results and expect to see the benefits filter through in H2 2023

and beyond.

We have also made progress with respect to the previously

reported onerous contract inherited from our acquisition of

CloudCoCo Connect, having strengthened our relationship with the

supplier involved.

Beyond Connect, we remain focused on driving efficiencies across

the Group to strengthen our financial position and improve

liquidity.

Growing momentum in Multi-Cloud

The launch of a dedicated Multi-Cloud practice is an important

step for the business. One of the pre-eminent trends in IT, it

enables the Group to attract a range of larger, more complex

organisations. To support our expansion in Multi-Cloud, in April

2023, we announced the appointment of Lee Thatcher to head up the

division, bringing a deep experience of Cloud to CloudCoCo

developed over nearly 20 years in technology positions.

In April 2023, we announced a partnership with Abstract Tech, a

Leeds-based consultancy which specialises in the delivery of large

scale, digital transformation projects. This partnership provides

CloudCoCo with the talent and expertise of Abstract's 150

technicians, enabling the Group to take on a broader range of

Multi-Cloud projects. Alongside this, the Group also announced the

signing of a partnership post-period with Ingram Micro, the world's

largest global business-to-business wholesale provider of

technology products and supply chain management services, for the

supply of Microsoft Azure and other cloud services. Through this

partnership, CloudCoCo's Multi-Cloud practice will leverage

Ingram's hundreds of in-built Cloud providers through a simplified

single portal.

Enhancements to customer support producing good results

We remain focused on making every interaction our customers have

with us a delight and, reflecting this, our current customer

satisfaction levels are exceptional. These have been enhanced by a

change to our customer service structure in H1 2023, which unified

our technical support operations, as well as investments into new

talent. As a result, we are pleased to report customer satisfaction

levels in excess of 97.5% for June 2023.

To further improve the experience of customers, the Group is

exploring ways to use artificial intelligence in our business

operations. Enabled by our partnership with Abstract Tech, these

capabilities will aid our customer support teams as well as

customers who approach us through our website.

Acquisition of senior talent to drive the business forwards

During the period we have added more skills and experience as

well as focusing on the development of our existing talent.

Alongside the key hire of Lee Thatcher in our Multi-Cloud division,

we have also made key hires across areas of the business including

cybersecurity, sales, new business, and technical support. These

hires complement the existing talent across our teams and will help

shape the direction of the Group as we continue to grow.

Expectation of continued, steady progress in the second half

The Group's trading in H2 2023 to date has been encouraging.

While wider economic headwinds persist and will continue to be a

factor in the decisions of customers, we will continue to navigate

them and our pipeline continues to grow.

As the second half develops, we expect to see the benefits of

our investments into sales and marketing begin to increase. We are

maintaining our focus on driving cost savings and efficiencies and

expect to see the results of the hard work carried out in the first

half have a positive impact on the bottom line at the full year. To

help us reach our goals faster, we are continuing to assess

opportunities to acquire complementary businesses we feel are a

good strategic fit. We are assessing our options to fund such

acquisitions and also to refinance our existing debt.

Despite the challenging current trading environment, with

favourable long-term market trends continuing, we are confident in

our ability to meet our long-term growth ambitions. Supported by

the solid foundations laid in previous years, the recent work done

to make the structure of the organisation leaner and more

efficient, the assembly of a team of incredibly talented and driven

individuals and the addition of valuable strategic partners, the

Board believes CloudCoCo is in a strong position to capitalise on

its opportunities.

Mark Halpin

CEO

29 June 2023

Consolidated income statement

for the six-month period ended 31 March 2023

Unaudited Unaudited Unaudited Audited

6 months 6 months 6 months

to to to Year to

31 March 30 Sept 31 March 30 Sept

Note 2023 2022 2022 2022

-------------------------------- ------

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ------ ---------- ------------ ------------ ------------

Continuing operations

Revenue 3 12,923 12,549 11,644 24,193

Cost of sales (8,580) (8,424) (7,822) (16,246)

-------------------------------- ------ ---------- ------------ ------------ ------------

Gross profit 4,343 4,125 3,822 7,947

GP% 34% 33% 33% 33%

Administrative expenses (5,130) (4,769) (5,015) (9,784)

-------------------------------- ------ ---------- ------------ ------------ ------------

Trading Group EBITDA(1) 901 1,063 531 1,594

Depreciation of IFRS16 data

centre right of use assets (400) (301) (229) (530)

-------------------------------- ------ ---------- ------------ ------------ ------------

Adjusted Trading Group EBITDA 501 762 302 1,064

Amortisation of intangible

assets 6 (643) (632) (654) (1,286)

Plc costs(2) (397) (425) (345) (770)

Depreciation of tangible

assets and other right of

use assets (86) (119) (45) (164)

Exceptional items 4 (99) (282) (280) (562)

Share-based payments (63) 52 (171) (119)

-------------------------------- ------ ---------- ------------ ------------ ------------

Operating loss (787) (644) (1,193) (1,837)

Interest receivable 1 1 - 1

Interest payable (438) (433) (339) (772)

================================ ====== ========== ============ ============ ============

Loss before taxation (1,224) (1,076) (1,532) (2,608)

Taxation 161 157 164 321

================================ ====== ========== ============ ============ ============

Loss and total comprehensive loss

for the year attributable to owners

of the parent (1,063) (919) (1,368) (2,287)

======================================== ============== ============ ============ =========

Loss per share

Basic and fully diluted 5 (0.15)p (0.13)p (0.19)p (0.32)p

================================ ====== ========== ============ ============ ============

(1) Profit or loss before net finance costs, tax, depreciation,

amortisation, plc costs, exceptional items and share-based payments

.

(2) Plc costs are non-trading costs relating to the Board of

Directors of the Parent Company, its listing on the AIM Market of

the London

Stock Exchange and its associated professional advisors.

Subsequent to the publication of the unaudited H1 2022 interim

results, the accounting treatment for our onerous contracts and

data centre leases was assessed against the detailed criteria of

IFRS 16. This resulted in a reclassification of certain expense

items previously shown as costs of sales in the unaudited interim

results for H1 2022 as depreciation. The impact of the

reclassification on Trading Group EBITDA(1) for H1 2022 is shown on

the face of the Income Statement.

Consolidated statement of financial position

as at 31 March 2023

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

================================= ===== ---------- ========== =========

Non-current assets

Intangible assets 6 11,937 13,212 12,580

Property, plant and equipment 189 56 128

Right of Use assets 1,147 648 814

================================= ===== ========== ========== =========

Total non-current assets 13,273 13,916 13,522

================================= ===== ========== ========== =========

Current assets

Inventories 100 223 165

Trade and other receivables 7 5,025 4,852 4,766

Contract assets 8 740 586 558

Cash and cash equivalents 1,275 1,312 1,516

================================= ===== ========== ========== =========

Total current assets 7,140 6,973 7,005

================================= ===== ========== ========== =========

Total assets 20,413 20,889 20,527

================================= ===== ========== ========== =========

Current liabilities

Trade and other payables 9 (7,406) (6,440) (6,890)

Contract liabilities (1,767) (2,303) (1,891)

Provision for onerous contracts (148) (154) (148)

Borrowings 10 (69) (69) (69)

Lease liability (676) (601) (733)

Total current liabilities (10,066) (9,567) (9,731)

================================= ===== ========== ========== =========

Non-current liabilities

Contract liabilities (542) (178) (601)

Provision for onerous contracts (850) (989) (927)

Borrowings 10 (5,112) (4,400) (4,723)

Lease liability (570) (252) (112)

Deferred tax liability (1,266) (1,525) (1,426)

================================= ===== ========== ========== =========

Total non-current liabilities (8,340) (7,344) (7,789)

================================= ===== ========== ========== =========

Total liabilities (18,406) (16,911) (17,520)

================================= ===== ========== ========== =========

Net assets 2,007 3,978 3,007

================================= ===== ========== ========== =========

Equity

Share capital 7,062 7,062 7,062

Share premium account 17,630 17,630 17,630

Capital redemption reserve 6,489 6,489 6,489

Merger reserve 1,997 1,997 1,997

Other reserve 521 510 458

Retained earnings (31,692) (29,710) (30,629)

================================= ===== ========== ========== =========

Total equity 2,007 3,978 3,007

================================= ===== ========== ========== =========

Consolidated statement of changes in equity

for the six-month period ended 31 March 2023

Share Share Capital Merger Other Retained Total

capital premium redemption reserve reserve earnings GBP'000

GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000

------------------------------ -------- -------- ----------- -------- -------- --------- --------

At 1 October 2021 7,062 17,630 6,489 1,997 339 (28,342) 5,175

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Loss and total comprehensive

loss for the period - - - - - (1,368) (1,368)

Share-based payments - - - - 171 - 171

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Total movements - - - - 171 (1,368) (1,197)

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Equity at 31 March 2022 7,062 17,630 6,489 1,997 510 (29,710) 3,978

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Share Share Capital Merger Other Retained Total

capital premium redemption reserve reserve earnings GBP'000

GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000

------------------------------ -------- -------- ----------- -------- -------- --------- --------

At 1 April 2022 7,062 17,630 6,489 1,997 510 (29,710) 3,978

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Loss and total comprehensive

loss for the period - - - - - (919) (919)

Share-based payments - - - - (52) - (52)

Total movements - - - - (52) (919) (971)

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Equity at 30 September 2022 7,062 17,630 6,489 1,997 458 (30,629) 3,007

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Share Share Capital Merger Other Retained Total

capital premium redemption reserve reserve earnings GBP'000

GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000

------------------------------ -------- -------- ----------- -------- -------- --------- --------

At 1 October 2022 7,062 17,630 6,489 1,997 458 (30,629) 3,007

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Loss and total comprehensive

loss for the period - - - - - (1,063) (1,063)

Share-based payments - - - - 63 - 63

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Total movements - - - - 63 (1,063) (1,000)

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Equity at 31 March 2023 7,062 17,630 6,489 1,997 521 (31,692) 2,007

------------------------------ -------- -------- ----------- -------- -------- --------- --------

Consolidated statement of cash flows

for the six-month period ended 31 March 2023

Unaudited Unaudited Unaudited Audited

6 months 6 months 6 months Year

to to to to

31 March 30 Sept 31 March 30 Sept

2023 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------- ---------- ---------- ---------- --------

Cash flows from operating activities

Loss before taxation (1,224) (1,076) (1,532) (2,608)

Adjustments for:

Depreciation - IFRS16 data centre

right of use assets 400 301 229 530

Depreciation - owned assets 33 21 29 50

Depreciation - right of use assets 53 98 16 114

Amortisation 643 632 654 1,286

Share-based payments 63 (52) 171 119

Net finance expense 437 432 339 771

Costs relating to acquisitions(1) - - 58 58

Movements in provisions (76) (153) - (153)

Increase in trade and other receivables (441) (44) (1,020) (1,064)

Decrease / (increase) in inventories 65 58 (137) (79)

Increase in trade payables, accruals

and contract liabilities 373 703 1,311 2,014

Net cash inflow from operating

activities before acquisition

costs 326 920 118 1,038

Costs relating to acquisitions(1) - - (58) (58)

----------------------------------------- ---------- ---------- ---------- --------

Net cash inflow from operating

activities 326 920 60 980

----------------------------------------- ---------- ---------- ---------- --------

Cash flows from investing activities

Purchase of property, plant and

equipment (94) (99) (16) (115)

Acquisitions net of cash acquired(1) - - 497 497

Payment of deferred consideration

relating to acquisitions (25) (25) (155) (180)

Interest received - - - -

----------------------------------------- ---------- ---------- ---------- --------

Net cash (outflow) / inflow from

investing activities (119) (124) 326 202

----------------------------------------- ---------- ---------- ---------- --------

Cash flows from financing activities

Repayment of COVID-19 bounce-back

loan (10) (9) (9) (18)

Payment of lease liabilities (418) (566) (247) (813)

Interest paid (20) (17) (1) (18)

----------------------------------------- ---------- ---------- ---------- --------

Net cash outflow from financing

activities (448) (592) (257) (849)

----------------------------------------- ---------- ---------- ---------- --------

Net (decrease) / increase in

cash (241) 204 129 333

Cash at bank and in hand at beginning

of period 1,516 1,312 1,183 1,183

----------------------------------------- ---------- ---------- ---------- --------

Cash at bank and in hand at

end of period 1,275 1,516 1,312 1,516

----------------------------------------- ---------- ---------- ---------- --------

Comprising:

Cash at bank and in hand 1,275 1,516 1,312 1,516

----------------------------------------- ---------- ---------- ---------- --------

(1) Relates to the acquisition of CloudCoCo Connect Limited

(formerly IDE Group Connect Limited) and Nimoveri Limited in

October 2021.

Notes to the consolidated interim financial statements

1. General information

CloudCoCo Group plc (the "Group") is a public limited company

incorporated in England and Wales under the Companies Act 2006. The

address of the registered office is 5 Fleet Place, London, EC4M

7RD. The principal activity of the Group is the provision of IT

Services to small and medium-sized enterprises in the UK. The

financial statements are presented in pounds sterling because that

is the currency of the primary economic environment in which each

of the Group's subsidiaries operates.

2. Basis of Preparation

2.1 Accounting Policies

The accounting policies used in the presentation of the

unaudited consolidated interim financial statements for the six

months ended 31 March 2023 are in accordance with applicable

International Financial Reporting Standards (IFRSs) as applied in

accordance with provisions of the Companies Act 2006. The principal

accounting policies of the Group have been consistently applied to

all periods presented unless otherwise stated.

2.2 Going concern

The Directors have prepared the financial statements on a going

concern basis which assumes that the Group will continue to meet

liabilities as they fall due.

The Directors have reviewed the forecast sales growth, budgets

and cash projections for the period to 30 June 2024, including

sensitivity analysis on the key assumptions such as the potential

impact of reduced sales or slower cash receipts for the next twelve

months and the Directors have reasonable expectations that the

Group and the Company have adequate resources to continue

operations for the period of at least one year from the date of

approval of these unaudited interim financial statements.

The Directors have not identified any material uncertainties

that may cast doubt over the ability of the Group and Company to

continue as a going concern and the Directors continue to adopt the

going concern basis in preparing these unaudited interim financial

statements.

3. Segment reporting

The executive directors of the Company and its subsidiaries

review the Group's internal reporting in order to assess

performance and to allocate resources. Profit performance is

principally assessed through adjusted profit measures consistent

with those disclosed in the Annual Report and Accounts. The Board

believes that the Group comprises a single reporting segment, being

the provision of IT managed services to customers. Whilst the

Directors review the revenue streams and related gross profits of

two categories separately (Managed IT Services and Value added

resale), the operating costs and operating asset base used to

derive these revenue streams are the same for both categories and

are presented as such in the Group's internal reporting.

The segmental analysis below is shown at a revenue level in line

with the internal assessment based on the following reportable

operating categories:

Managed IT Services

* This category comprises the provision of recurring IT

services which either have an ongoing billing and

support element or utilise the technical expertise of

our people.

Value added resale

* This category comprises the resale of one-time

solutions (hardware and software) from our leading

technology partners, including revenues from the

MoreCoCo e-commerce platform.

------------------- -----------------------------------------------------------------

No customer accounts for more than 10% of external revenues in

any reported period.

3.1 Analysis of continuing results

All revenues from continuing operations are derived from

customers within the UK. In order to simplify our reporting of

revenue, we have taken the decision to condense our reporting

segments into two new categories - Managed IT Services and Value

Added Resale. This analysis is consistent with that used internally

by the CODM and, in the opinion of the Board, reflects the nature

of the revenue. Trading EBITDA is reported as a single segment.

Unaudited Unaudited Unaudited Audited

6 months to 6 months to 6 months to Year to

31 March 30 September 31 March 30 September

2023 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------------- ------------- ------------- -------------

By operating segment

Managed IT Services 9,077 8,474 8,582 17,056

Valued Added Resale 3,846 4,075 3,062 7,137

----------------------- ------------- ------------- ------------- -------------

Total revenue 12,923 12,549 11,644 24,193

----------------------- ------------- ------------- ------------- -------------

4. Exceptional Items

Items which are material and non-routine in nature are presented

as exceptional items in the Consolidated Income Statement.

Unaudited Unaudited Unaudited Audited

6 months to 6 months to 6 months to Year to

31 March 30 September 31 March 30 September

2023 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------------- ------------- ------------- ------------- -------------

Costs relating to acquisitions(1) - - (58) (58)

Dilapidations costs (13) (46) - (46)

Run-off costs relating to discontinued data centre

services (36) (69) (69) (138)

Integration and restructure costs (50) (167) (153) (320)

----------------------------------------------------- ------------- ------------- ------------- -------------

Exceptional items (99) (282) (280) (562)

----------------------------------------------------- ------------- ------------- ------------- -------------

(1) Relates to the acquisition of CloudCoCo Connect Limited

(formerly IDE Group Connect Limited) and Nimoveri Limited in

October 2021.

5. Loss per share

Unaudited Unaudited Unaudited Audited

6 months to 6 months to 6 months to Year to

31 March 30 September 31 March 30 September

2023 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------------------------- ------------ ------------ ------------ ------------

Loss attributable to ordinary shareholders (1,063) (919) (1,368) (2,287)

Number Number Number Number

Weighted average number of Ordinary Shares in issue, basic and

diluted 706,215,686 706,215,686 706,215,686 706,215,686

Basic and diluted loss per share (0.15)p (0.13)p (0.19)p (0.32)p

-------------------------------------------------------------- ------------ ------------ ------------ ------------

6. Intangible assets

Intangible assets are non-physical assets which have been

obtained as part of an acquisition or research and development

activities, such as innovations, introduction and improvement of

products and procedures to improve existing or new products. All

intangible assets have an identifiable future economic benefit to

the Group at the point the costs are incurred. The amortisation

expense is recorded in administrative expenses in the Consolidated

Income Statement

Intangible assets are non-physical assets which have been

obtained as part of an acquisition or research and development

activities, such as innovations, introduction and improvement of

products and procedures to improve existing or new products. All

intangible assets have an identifiable future economic benefit to

the Group at the point the costs are incurred. The amortisation

expense is recorded in administrative expenses in the Consolidated

Income Statement

IT, billing

and website Customer

Goodwill systems Brand lists Total

Intangible assets GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- ------------- --------- --------- ---------

Cost

-------------------------------- --------- ------------- --------- --------- ---------

At 1 October 2021 10,088 361 2,127 9,421 21,997

Additions - acquisition of

CloudCoCo Connect Limited

in October 2021 1,193 - 256 2,024 3,473

--------------------------------- --------- ------------- --------- --------- ---------

At 31 March 2022, 30 September

2022 and

31 March 2023 11,281 361 2,383 11,445 25,470

--------------------------------- --------- ------------- --------- --------- ---------

Accumulated amortisation

-------------------------------- --------- ------------- --------- --------- ---------

At 1 October 2021 - (184) (1,032) (4,523) (5,739)

Charge for the year - (9) (63) (582) (654)

--------------------------------- --------- ------------- --------- --------- ---------

At 31 March 2022 - (193) (1,095) (5,105) (6,393)

--------------------------------- --------- ------------- --------- --------- ---------

Charge for the year - (9) (60) (563) (632)

--------------------------------- --------- ------------- --------- --------- ---------

At 30 September 2022 - (202) (1,155) (5,668) (7,025)

--------------------------------- --------- ------------- --------- --------- ---------

Charge for the year - (9) (61) (573) (643)

--------------------------------- --------- ------------- --------- --------- ---------

At 31 March 2023 - (211) (1,216) (6,241) (7,668)

--------------------------------- --------- ------------- --------- --------- ---------

Impairment

-------------------------------- --------- ------------- --------- --------- ---------

At 31 March 2022, 30 September

2022 and

31 March 2023 (4,447) - (225) (1,193) (5,865)

--------------------------------- --------- ------------- --------- --------- ---------

Carrying amount

At 31 March 2023 6,834 150 942 4,011 11,937

--------------------------------- --------- ------------- --------- --------- ---------

At 30 September 2022 6,834 159 1,003 4,584 12,580

--------------------------------- --------- ------------- --------- --------- ---------

At 31 March 2022 6,834 168 1,063 5,147 13,212

--------------------------------- --------- ------------- --------- --------- ---------

Average remaining amortisation 8.3 7.7 3.5 4.0

period years years years years

--------------------------------- --------- ------------- --------- --------- ---------

For the purposes of assessing impairment, assets are grouped at

the lowest levels for which there are independent cash inflows

(cash generating units). Goodwill is allocated to those assets that

are expected to benefit from synergies of the related business

combination and represent the lowest level within the Group at

which management monitors the related cash inflows. The directors

concluded that at 31 March 2023, there were four CGUs being

CloudCoCo Limited, CloudCoCo Connect Limited (formerly IDE Group

Connect Limited), Systems Assurance Limited and More Computers

Limited.

Each year, management prepares the resulting cash flow

projections using a value in use approach to compare the

recoverable amount of the CGU to the carrying value of goodwill and

allocated assets and liabilities. Any material variance in this

calculation results in an impairment charge to the Consolidated

Income Statement.

The calculations used to compute cash flows for the CGU level

are based on the Group's Board approved budget for the next twelve

months, and business plan, growth rates for the next five years,

weighted average cost of capital ("WACC") and other known

variables. The calculations are sensitive to movements in both WACC

and the revenue growth projections. The impairment calculations

were performed using post-tax cash flows at post-tax WACC of 13.25%

(H1 2022: 11.25%) for each CGU. The pre-tax discount rate (weighted

average cost of capital) was calculated at 18% per annum

(H1 2022:15%) and the revenue growth rate is 5% per annum (H1

2022: 5%) for each CGU for 5 years and a terminal growth rate of 2%

(H1 2022: 2%).

Sensitivities have been run on cash flow forecasts for the CGU.

Revenue growth rates are considered to be the most sensitive

assumption in determining future cash flows for each CGU.

Management is satisfied that the key assumptions of revenue growth

rates should be achievable and that reasonably possible changes to

those key assumptions would not lead to the carrying amount

exceeding the recoverable amount. Sensitivity analyses have been

performed and the table below summarises the effects of changing

certain other key assumptions and the resultant excess (or

shortfall) of discounted cash flows against the aggregate of

goodwill and intangible assets.

Sensitivity analysis Systems More CloudCoCo

GBP'000 CloudCoCo Assurance Computers Connect

Limited Limited Limited Limited

(1)

------------------------------------- ---------- ---------- ---------- ---------

Excess of recoverable amount over

carrying value:

Base case - headroom 2,010 315 476 3,676

Pre-tax discount rate increased

by 1% - resulting headroom 1,588 286 448 3,440

Revenue growth rate reduced in years

2 to 5 by 1% per annum - resulting

headroom 1,316 264 443 2,716

------------------------------------- ---------- ---------- ---------- ---------

Base case calculations highlight that the impairment review in

respect of CloudCoCo Limited is most sensitive to the discount rate

and growth rate. Headroom was also evident when applying a growth

rate of 2% in years 2 to 5 in each of the CGU's but would trigger

an impairment of GBP354,000 in CloudCoCo Limited.

7. Trade and other receivables

Unaudited Unaudited

31 March 2023 31 March 2022 Audited 30 September 2022

GBP'000 GBP'000 GBP'000

---------------------------- -------------- -------------- -------------------------

Trade receivables 3,217 3,043 2,936

Other debtors 2 07 1 11 244

Prepayments 1,601 1,698 1,586

---------------------------- -------------- -------------- -------------------------

Trade and other receivables 5,025 4,852 4,766

---------------------------- -------------- -------------- -------------------------

The Group reviews the amount of expected credit loss associated

with its trade receivables and contract assets under IFRS 9 based

on forward looking estimates that take into account current and

forecast credit conditions as opposed to relying on past historical

default rates. In adopting IFRS 9 the Group applied the Simplified

Approach applying a provision matrix based on number of days past

due to measure lifetime expected credit losses and after taking

into account customers with different credit risk profiles and

current and forecast trading conditions.

8. Contract assets

Unaudited Unaudited

31 March 2023 31 March 2022 Audited 30 September 2022

GBP'000 GBP'000 GBP'000

---------------- -------------- -------------- -------------------------

Contract assets 740 586 558

---------------- -------------- -------------- -------------------------

Contract assets relate to the Group's right to consideration in

respect of goods or services that the Group has transferred to a

customer. Contract assets are linked to recurring Managed IT

services revenues, which have increased as a result of an increase

in usage based services billed in arrears.

9. Trade and other payables

Unaudited Unaudited

31 March 2023 31 March 2022 Audited 30 September 2022

GBP'000 GBP'000 GBP'000

-------------------------------------- -------------- -------------- -------------------------

Trade payables 5,325 4,492 4,717

Accruals 1,424 1,210 1,448

Other taxes and social security costs 657 738 725

-------------------------------------- -------------- -------------- -------------------------

Trade and other payables 7,406 6,440 6,890

-------------------------------------- -------------- -------------- -------------------------

10. Borrowings

10.1 Current

Unaudited Unaudited

31 March 2023 31 March 2022 Audited 30 September 2022

GBP'000 GBP'000 GBP'000

----------------------------------------------------------- -------------- -------------- -------------------------

COVID-19 Bounce-back loan repayable - short-term element 19 19 19

Deferred consideration relating to the acquisition of

CloudCoCo Connect Limited (formerly

IDE Group Connect Limited) - short term element at Fair

Value 50 50 50

69 69 69

----------------------------------------------------------- -------------- -------------- -------------------------

10.2 Non-current

Unaudited Unaudited

31 March 2023 31 March 2022 Audited 30 September 2022

GBP'000 GBP'000 GBP'000

----------------------------------------------------------- -------------- -------------- -------------------------

Loan notes repayable in October 2024 4,932 4,224 4 ,558

COVID-19 Business Bounce-back loan repayable - long-term

element 54 73 63

Deferred consideration relating to the acquisition of

CloudCoCo Connect Limited (formerly

IDE Group Connect Limited) - long term element at Fair

Value 126 103 102

----------------------------------------------------------- -------------- -------------- -------------------------

5,112 4,400 4,723

----------------------------------------------------------- -------------- -------------- -------------------------

On 10 May 2020, the Company borrowed GBP50,000 from HSBC Bank UK

Plc, under the COVID-19 Business Bounce-back loan scheme. In

accordance with the UK Government's Business Interruption Payment

scheme, the interest on the loan for the first 12 months is covered

by the UK Government and the Company will repay the loan in 59

equal monthly instalments, commencing June 2021.

As part of the acquisition of More Computers Limited on 6

September 2021, the Company inherited a COVID-19 Business

Bounce-back loan of GBP50,000 between More Computers Limited and

NatWest Bank Plc. In accordance with the UK Government's Business

Interruption Payment scheme, the interest on the loan for the first

12 months is covered by the UK Government and the Company will

repay the loan in 59 equal monthly instalments, commencing March

2022.

10.3 Net debt - net debt comprises: 31 March Cash Other 31 March

2023 movements movements 2022

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ---------- ---------- --------

Loan notes 4,932 - 708 4,224

COVID-19 Bounce-back loans 73 (19) - 92

Deferred consideration relating to

the acquisition of CloudCoCo Connect

Limited (formerly IDE Group Connect

Limited) - Fair Value 176 (50) 73 153

Lease liabilities 1,246 (984) 1,377 853

Cash and cash equivalents (1,275) 37 - (1,312)

Total 5,152 (1,016) 2,158 4,010

-------------------------------------- ----------- ---------- ---------- --------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFIVRFITFIV

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

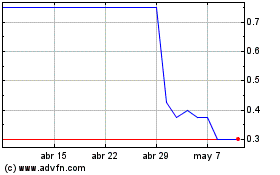

Cloudcoco (LSE:CLCO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cloudcoco (LSE:CLCO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024