TIDMCLDN

RNS Number : 8978O

Caledonia Investments PLC

06 October 2023

Caledonia Investments plc

Unaudited net asset value and portfolio update

Caledonia Investments plc (" Caledonia ") announces that its

unaudited diluted net asset value per share (" NAV ") as at 30

September 2023, calculated on a cum-income basis, was 5203p. This

incorporates the biannual revaluation of the Private Capital

portfolio.

The NAV total return (" NAVTR ") for the six months to 30

September 2023 was 3.7%. A final dividend of 49.2p per ordinary

share for the year ended 31 March 2023 was paid to shareholders on

3 August 2023, amounting to a payment of GBP27m.

This announcement provides a further update on Caledonia's

portfolio and should be read in conjunction with the factsheet

dated 30 September 2023 and released on 6 October 2023, a copy of

which is available at www.caledonia.com .

Summary

All three pools generated good, positive returns in the first

half of the year. The impact of foreign exchange rate movements was

limited, with Sterling weakening by 1.3% against the US dollar and

strengthening by 1.3% against the Euro in the period.

The Quoted Equity pool produced a return of 2.8%, reflecting the

mixed performance of global public equity markets. The Private

Capital portfolio produced a return of 5.9% following the biannual

revaluation of our holdings, reflecting the contractually agreed

disposal of Seven Investment Management ("7IM") and that most of

the investee businesses are performing well. The Funds portfolio

returned 4.6% based on modest valuation growth across both our

Asian and North American funds, although there has been a notable

slowdown in the level of fund distributions in the period

reflecting reduced market transaction activity.

Performance for the first half is summarised in the table

below.

Caledonia pool per f o rmance

Net asset value - Half Year to 30 September 20 23

GBPm NAV Net Capital Other NAV Income Total

31/3/23 investment gains 30/9/23 Return

/(disposal) /

(losses)

Quoted Equity 836.9 16.5 11.5 - 864.9 12.0 2.8%

Private Capital 824.0 156.7 44.2 2.1 1,027.0 11.6 5.9%

Funds 873.8 49.7 39.6 - 963.1 1.6 4.6%

--------- ------------- ---------- ------- --------- ------- --------

Portfolio 2,534.7 222.9 95.3 2.1 2,855.0 25.2

-------

Net Cash/(Debt) 221.6 (222.9) - (18.8) (20.1)

Other assets 41.7 - - (1.4) 40.3

Net assets 2,798.0 - 95.3 (18.1) 2,875.2 NAVTR 3.7%

--------- ------------- ---------- ------- --------- --------

Caledonia has continued to invest and dispose of assets, in line

with our active approach to portfolio management. The movement in

net debt in the first half of the year was GBP243m, largely

reflecting net investments made by all three pools and, most

significantly, the acquisition of a majority stake in the European

division of AIR-serv in April 2023 by Private Capital. The Quoted

Equity pool made significant additions to its holdings in three

companies, refined positions in a number of others and reduced

positions in two high performing stocks, creating a net investment

outflow of GBP17m. The Funds pool has seen an increased level of

drawdowns, including the purchase of secondary positions in two

Decheng funds at attractive levels of discount, and only modest

fund distributions, resulting in a net cash outflow of GBP50m in

the period.

There was a notable reduction in cash in the first half of the

year to support investment activity. However, with the bulk of the

company's bank facilities undrawn and the c.GBP255m proceeds of the

7IM disposal likely to be received in the second half of the year,

the total liquidity position remains healthy. Caledonia's GBP250m

banking facilities include GBP137.5m expiring in November 2027,

with the balance of GBP112.5m expiring in July 2025.

Caledonia Quoted Equity - Capital and Income portfolios (30% of

NAV)

The total return on the Quoted Equity pool was 2.8% over the

first half of the year. This outcome reflected the mixed

performance of major markets during the period with technology

stocks being in favour and US indices moving more positively than

the UK, together with muted performance in Asia.

The Capital portfolio delivered a return of 4.6%. Key stocks

Hill & Smith, Charter Communications, Microsoft, Oracle and

Watsco delivered very strong returns ranging from 10% to 30%, in

contrast to the first half of the previous financial year. However,

these gains were partially offset by notable price reductions for

Croda International, Spirax Sarco, Texas Instruments and Thermo

Fisher Scientific.

The Income portfolio delivered a return of -2.2% with the

majority of holdings recording adverse share price movements. These

adverse returns were partially offset by stronger performance from

RELX, Watsco and Sabre. The performance of Sabre reflects premium

growth following a difficult trading period last year.

Trading activity remained limited, in line with our long-term

investment approach, with increases in our holdings in Symrise,

Croda International and RELX. We sold down a portion of our

holdings in Oracle and Watsco, following a period of strong share

price appreciation. Other activity was restricted to refining

positions in existing investments resulting in our Income portfolio

moving closer to its target of GBP250m of invested cost.

Caledonia Private Capital (36% of NAV)

Caledonia's Private Capital portfolio is dominated by

significant positions in five UK-centric businesses and one private

European investment company. These six investments represent over

90% of the pool's value. Investee companies are revalued in March

and September each year. The portfolio generated a total return of

5.9% in the first half of the year. The five UK centric businesses

are well-established and have strong market positions. With the

exception of Cooke Optics, as outlined below, all are growing,

profitable and cash generative. Excluding 7IM, the remaining four

businesses are valued on an earnings multiple basis, with multiples

in the range 9 to 14 times current year earnings. Gearing levels

are modest, with net debt of approximately 2 times earnings before

interest, tax, depreciation and amortisation ("EBITDA").

In early September 2023, Caledonia announced that we had agreed

terms for the sale of our majority stake in 7IM, a vertically

integrated retail wealth management business, to Ontario Teachers'

Pension Plan Board. The transaction is subject to change in control

approval by the Financial Conduct Authority and is expected to

complete in late 2023 or early 2024. Subject to the exact timing of

completion, we expect to receive cash proceeds of c.GBP255m, net of

transaction expenses, for the sale of our ordinary and preference

shares in 7IM. The valuation at the end of September of GBP248m,

reflects expected cash proceeds less a 3% discount to equity value

in recognition of the very limited degree of transaction execution

risk. 7IM generated a return of 28.0% in the first half of the

year.

Cobepa, the Belgian based investment company, owns a diverse

portfolio of private global investments. The majority of the

businesses within the Cobepa portfolio continue to develop well,

with many delivering strong performance and valuation progression.

Two significant disposals, one of which completed in the period,

have been agreed which, together with progress from portfolio

companies, supported the overall modest uplift in valuation. The

valuation of Caledonia's holding of Cobehold, the holding company

of Cobepa, was GBP179m at the end September, a return of 3.1% for

the first half of the year.

Stonehage Fleming, the international multi-family office,

continues to deliver good earnings growth across both the Family

Office and Investment Management businesses. The former has seen a

positive combination of new client wins and increased activity

levels with existing clients; the latter has felt the benefit of

recovering equity markets. Valuation at the end of September was

GBP157m, a return of 11.7% for the first half of the year.

AIR-serv, a leading designer and manufacturer of air, vacuum and

jet wash machines, which it provides to fuel station forecourt

operators across the UK and Western Europe, was acquired in April

2023. The business is trading well with earnings slightly ahead of

expectations and demonstrating good year on year growth. The

valuation has been maintained at the equity purchase cost of

GBP143m, generating no return for the period. The position will be

reviewed in March 2024.

Liberation Group, an inns and drinks business with a pub estate

stretching from Southwest London to Bristol and the Channel

Islands, has traded slightly below expectations through the spring

and summer. It has been adversely impacted by the cost of living

crisis reducing consumer discretionary incomes, sustained cost

inflation (particularly UK energy costs) and poor UK weather

affecting peak early-summer trading months. However, the

integration of the Cirrus Inns business, whilst not complete, has

been progressing well. The valuation at the end of September was

GBP135m, a return of 2.3% for the first half of the year.

Cooke Optics, a leading manufacturer of cinematography lenses,

has been heavily impacted by the Hollywood writers' strike which

started in early May 2023 and the subsequent actors' strike. With

film and TV production severely affected, Cooke has seen a

subsequent fall in sales and a resulting reduction in earnings. We

anticipate that these industrial disputes will be resolved, with

the writers' strike appearing to have concluded recently, and

product demand will return. However, the timing and nature of a

recovery in financial performance is uncertain. This is reflected

in our valuation at the end of September of GBP102m, which includes

a 15% equity discount to reflect this matter. The equity return is

-22.7% for the first half of the year.

Caledonia Funds (33% of NAV)

The total return on the Funds portfolio was 4.6% for the first

half of the year, including a 1% favourable impact from exchange

rate movements. Underlying performance reflects modest valuation

growth from holdings across the pool in both North America and

Asia, with local currency returns of around 4% and 1%

respectively.

Caledonia's fund investments are principally in third party

managed private equity funds operating in North America and in

Asia. The North American based funds invest into the lower-mid

market, with a focus on small to medium sized, often owner-managed,

established businesses. These funds normally provide the first

institutional investment into these businesses, and support their

professionalisation and growth, both organically and through

M&A activity. The entry pricing levels are relatively modest

and there is a deep, robust market for future divestment, either

via trade sales or to other, larger private equity funds. The

portfolio is a combination of directly owned funds (45% of Funds

NAV), with a broad range of managers generally managing funds in

the range of US$250m to US$500m. The balance is in fund of funds

investments (13% of Funds NAV) with HighVista Strategies (formerly

Aberdeen) US private equity funds, our largest single manager

exposure, over five separate funds.

In contrast, our Asian based funds invest across a wide range of

sectors with a focus on businesses in the early years of

significant growth, having successfully developed their business

model. Whilst focused on local markets, a number, particularly

those with a healthcare focus, also invest into the US. The market

is less developed than in North America with divestments, in the

absence of a mature buyout market, mainly through an IPO or trade

sale. The portfolio is a combination of directly owned funds (24%

of Funds NAV), with a broad range of managers, some sourced through

our fund of funds relationships but mostly through our own

knowledge and contacts in the region. The balance (18% of Funds

NAV) is invested with Asia Alternatives, Axiom and Unicorn, all

fund of funds providers.

During the first half of the year, GBP52m was invested via

drawdowns, GBP13m was invested in the secondary purchase of two

Decheng funds positions and distributions of GBP15m, evenly

balanced between North America and Asia, were received. The level

of distributions has declined compared to the last two years,

reflecting more challenging market conditions. We anticipate, based

on feedback from our managers, something of a recovery in

distributions over the next six to eighteen months.

Company contacts

Caledonia Investments plc +44 20 7802 8080

Mat Masters

Chief Executive Officer

Rob Memmott

Chief Financial Officer

Media contacts

Teneo +44 20 7353 4200

Tom Murray

Robert Yates

caledonia@teneo.com

6 October 2023

Notes

Valuation approach and methodology

The valuation approach utilised for each asset portfolio is

summarised below.

Caledonia Quoted Equity : all listed companies are valued based

on the closing bid price on the relevant exchange as at 30

September 2023.

Caledonia Private Capital : the holdings are valued biannually,

principally on a normalised EBITDA x market multiple basis (in line

with the latest IPEV guidelines). This approach was applied to the

majority of significant assets in the portfolio on 30 September

2023. The exceptions to this approach were our holding in Cobehold,

where fair value was derived from the external valuation prepared

by Cobepa, and 7IM, where the valuation is derived from the

contractually agreed disposal announced in early September 2023. In

the case of Liberation Group, the earnings derived valuation was

supported by the underlying value of the principally freehold pub

estate plus the value of the drink production and distribution

business.

Caledonia Funds : the fund valuations are based on the most

recent valuations provided by the fund managers, subject to cash

movements from the valuation date. Valuations are received 60 to

180 days from the valuation date.

Caledonia Investments plc

Caledonia is a self-managed investment trust company. Our aim is

to grow net assets and dividends paid to shareholders, whilst

managing risk to avoid the permanent loss of capital. This is

achieved by investing in proven, well-managed businesses that

combine long-term growth characteristics with an ability to deliver

increasing levels of income. We hold investments in both listed and

private markets, covering a range of sectors and, particularly

through the listed and fund investments, have a global reach.

For additional information on Caledonia, please visit

www.caledonia.com .

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBIBDGCGGDGXU

(END) Dow Jones Newswires

October 06, 2023 02:00 ET (06:00 GMT)

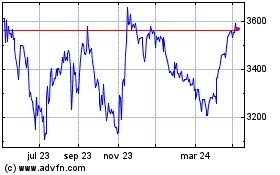

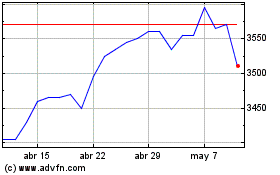

Caledonia Investments (LSE:CLDN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Caledonia Investments (LSE:CLDN)

Gráfica de Acción Histórica

De May 2023 a May 2024