TIDMCMB

RNS Number : 8332G

Cambria Africa PLC

31 March 2022

Cambria Africa Plc

("Cambria" or the "Company")

Audited FY 2021 Results ("the Results"):

Earnings per Share of 0.02 US cents and NAV of 1.16 US cents

(0.89p GBP)

Cambria Africa Plc ( AIM: CMB ) ("Cambria" or the "Company")

announces its audited results for the year ended 31 August 2021

("FY 2021"). Audited Financial Statements are available on the

Company's website ( www.cambriaafrica.com ) and will be sent to

shareholders tomorrow.

Profit Attributable to Cambria Shareholders of $82,000 (0.02 US

cents per share) was recorded for FY 2021. The Company's

subsidiaries in Zimbabwe continued to operate above breakeven in

both EBITDA and accounting profit despite shrinkage in its revenue

footprint by 8% from US $1.32 million in 2020 to US $1.22 million

in 2021. Based on the current trajectory, the Company's

subsidiaries are expected to continue reporting at breakeven levels

in FY 2022. The Company's FY 2021 consolidated profits stem mainly

from Payserv revenues of US$1.13 million. Net Asset Value (NAV)

fell by 1.63% from US $6.42 million in FY 2020 to $6.32 million FY

2021 (1.16 US cents per share). The reduction in NAV was

attributable in part to a $200,000 downward adjustment in the

valuation of its commercial property conducted by Hollands Harare

Estate Agents (Hollands). The Company's property was valued by

Hollands at $2.3 million as of January 2022.

NAV was further impacted by the change in the closing value of

the Company's Old Mutual Limited shares on the Johannesburg Stock

Exchange (JSE) compared to the last closing price on the Zimbabwe

Stock Exchange (ZSE).

In its efforts to realize its NAV, the Company is actively

pursuing avenues to sell its property and its indirect interest in

Radar Holdings Limited ("Radar") shares. While we believe there is

firm interest in our investment, the Company will only sell such

investments if it can achieve value at the holding level.

FY 2021 Results highlights:

12 Months Ended 31 August (US$'000) 2021 2020 Change

------------------------------------------- -------- --------- --------

Group:

- Revenue 1,216 1,319 (8%)

- Operating Costs 838 845 1%

- Consolidated EBITDA (before exceptional

items) 369 160 131%

- Consolidated Profit /(Loss) after tax 181 (470) 139%

- Profit/(Loss) after tax attributable to

shareholders (excluding minorities) 82 (408) 120%

- Central costs 151 224 33%

120

- Earnings/(Loss) per share - cents 0.02 ( 0. 07) %

- Net Asset Value (NAV) (Attributable to

shareholders excluding minorities) 6,317 6,4 23 (2 %)

- NAV per share - cents 1.16 1. 18 (2 %)

Weighted average shares in issue ('000) 544,576 544,576 -

Shares in issue at year-end ('000) 544,576 544,576 -

Divisional:

- Payserv - consolidated profit after tax

("PAT") 652 34 1,818%

- Payserv - consolidated EBITDA 484 (103) 568%

- Millchem - EBITDA 11 140 (92%)

Group Highlights:

-- NAV decreased by 1.63% from US $6.42 million (1.18 US cents

per share) to US $6.32 million (1.16 US cents per share).

-- Group Finance costs dropped by 63% to $22,000 in FY 2021 from

$60,000 in FY 2020 after rising 17.6% from $51,000 in FY 2019.

Finance costs are expected to decrease significantly in FY

2022.

-- Revenues declined by 8% to $1.22 million while operating

costs declined by 0.8% to $838,000. As a result of careful cost

management, such as line item cost control and orderly reductions

in staffing, the Company has managed to avoid significant losses

from the shrinkage of its revenue as a consequence of the impact of

the COVID-19 pandemic and its inability to regain traction for its

bulk payment and clearing software for banks.

-- Cambria's Attributable PAT was positive at $82,000 (0.02

cents per share) as operations edged above breakeven. Central Costs

associated with listing and interest expense dropped by 33% to

$151,000 from $224,000. The balance of Central Costs was associated

with hyperinflationary adjustments, foreign currency translation

and the loss of value in the shares of Old Mutual Limited.

-- Consolidated EBITDA before fair value adjustments to

investments and marketable securities increased by 131% to $369,000

from $160,000 in FY 2020. FY 2020 EBITDA was negatively impacted by

the fair value adjustment of the Company's indirect holding of

Radar Holdings Limited shares from 40 US cents to 35 US cents.

-- Cambria's central costs dropped by 33% to $151,000 in FY

2021. Cambria's CEO and Directors continued to render their

services to Cambria without compensation during FY 2021.

-- The Statement of Comprehensive Income includes a small

foreign currency translation adjustment (loss) of $4,000

attributable to Cambria.

Divisional Highlights:

-- Tradanet (Pvt) Ltd, Paynet Zimbabwe's 51% held subsidiary,

continued to provide loan management services to Central African

Building Society (CABS), the country's largest building society.

The continued devaluation of the country's currency led to a slight

increase in salary-based loans.

-- Autopay, Paynet Zimbabwe's payroll processing division, saw

an increase in its revenue base due to a new management team with

extensive payroll experience and established an independent

contract relationship with payroll managers on a pure profit share

basis.

-- Millchem, through its partnership with Merken (Pvt) Ltd.

still sees profitability, though diminishing, in the sanitizer

sector.

Net Equity (Net Asset Value):

Components of Loss to NAV in 2021

The Group reported a slight drop of $106,000 in NAV to $6.32

million (1.16 US cents per share) in August 2021, compared to $6.42

million (1.18 US cents per share) at 31 August 2020. This marginal

decrease was caused by the following material factors:

-- Downward adjustment of $200,000 in the valuation of Company's

Mt. Pleasant Business Park commercial property by Hollands from

$2.5 million to $2.3 million. Hollands cited business and economic

conditions for the change in their valuation.

-- Reduction of $16,000 in the carrying value of Old Mutual

Limited shares which were suspended from trading on the Zimbabwe

Stock Exchange (ZSE) on 31 July 2020.

-- Foreign Currency Translation loss of $4,000 from the

deterioration of the official bank rate from ZWL 83.4/USD on 31

August 2020 to 85.91/USD on 31 August 2021. The foreign currency

translation loss was nominal in FY 2021 due to less cash held in

Zimbabwe dollars compared to FY 2020.

Components of NAV at 31 August 2021

The Group NAV of $6.32 million as at the end of FY 2021 consists

of the following tangible and intangible assets:

Building and properties valued at $2.3 million - This number,

down $200,000 from the prior valuation, was prepared by Hollands

Harare Estate Agents in February 2022. Holland conducted the

previous valuations of this prominently located commercial office

space and its equally well-positioned vacant plot in Harare's Mount

Pleasant Business Park.

Indirect shareholding of 9.74% of Radar Holdings Limited - (4.98

million shares) valued at US $1.743 million (net of minority

interests) based on 35 US cents per equivalent Radar share.

USD Cash and Cash Equivalents - US dollar cash net of

liabilities Zimbabwe totalled $1.34 million at the end of FY

2021.

Old Mutual Limited shares - the Company holds 204,047 Old Mutual

Limited common shares that were suspended on the Zimbabwe Stock

Exchange (ZSE) on 31 July 2020 and valued on its FY 2021 Statement

of Financial Position at US $184,000 based on the closing price of

Old Mutual Limited on the JSE at year end. The value of Old Mutual

shares closed at US $196,000 on the JSE on 29 March 2022.

Goodwill - The Company has a goodwill value of $717,000 on its

Statement of Financial Position. The Company believes this is a

fair assessment of its intangible assets. Despite the shrinkage of

Paynet's operations, it continues to maintain turnaround

opportunities particularly in Tradanet and Autopay as real salaries

catch up with inflation. The Company continues to believe that the

Paynet's intellectual property has value and the amalgamation of

the above should exceed the book value of its goodwill.

The Company therefore believes its tangible, intangible and

realizable NAV are not subject to significant negative shocks and

will probably benefit from any positive events.

Chief Executive's Report

Cambria Africa earned 0.02 US cents per share during the 2021

financial year compared to a loss of 0.07 US cents per share in the

2020 financial year. The Company continues to rationalise its

operations by reducing staff costs and ensuring a more effective

model to realise earnings from its intellectual property and cash

holdings.

At this point in time, the Company's investment attraction is

realizable NAV within the constructs of Zimbabwe's current economic

policy and its outlook. It is important to consider the components

of NAV and efforts of the Company to ensure that any disposal is

realized at the holding level. The Company's investment in Zimbabwe

since its establishment has been over $100 million. Almost $6

million of this investment was my direct contribution to this

investment since taking the helm of Cambria when it was at the

brink of bankruptcy.

Strategy

The strategic goals of the Company have been and continue to

be:

-- Conserving cash resources of US$1.65 million as at 31 August

2021 (US$1.56 million at 28 Feb 2022)

-- Realizing value for US $1.35 million held by the Reserve Bank

of Zimbabwe (RBZ) as "Legacy Debts" or "Blocked Funds" and owed to

the Company. This asset has been depreciated in our accounts to the

official value until such time as the RBZ honours this commitment.

Therefore its contribution to NAV is practically zero but remains a

legal obligation of the RBZ to Cambria Africa plc.

-- Achieving value for US $196,000 of Old Mutual shares (based

on JSE closing price on 29 March 2022) through repatriation of

these shares to the South African register.

-- Maximizing value at the holding level for disposals of about

$4 million in marketable securities and property.

-- Achieving value for the Company's intellectual property both

in current and future operations.

NAV Discussion

As announced, despite the turnaround in earnings, NAV declined

by US$106,000 from 1.18 US cents per share to 1.16 US cents per

share. I would like to further discuss and analyse the components

of Cambria's realizable NAV at the holding level.

Commercial Property - One component of this drop was the change

in Hollands Harare Estate Agents valuation of our prominently

located Mt. Pleasant Business Park Commercial Property from $2.5

million in FY 2020 to $2.3 million as of January 2022. I believe

this is a conservative valuation.

Old Mutual Shares - NAV, was marginally impacted by the change

in the closing value of the Company's Old Mutual Limited shares on

the JSE compared to the last closing price on the Zimbabwe Stock

Exchange (ZSE). On 31 July 2020, the ZSE, under pressure from the

government of Zimbabwe, halted trading in dual listed shares. In

March 2020, the Government of Zimbabwe had already blocked the

fungibility of dual listed in either direction and applied this

rule to foreign and local investors alike, regardless of the

Exchange where the shares were originally purchased. The suspension

of fungibility was extended for 12 months to March 2022 and will

likely be extended again by the Government of Zimbabwe.

We continue to appeal to the Government of Zimbabwe to allow

repatriation of Old Mutual shares by foreign investors to the

foreign exchange where the shares were originally purchased before

transfer to the Zimbabwe register. Old Mutual shares have an

intrinsic international value and we will continue to work towards

achieving this value despite not being able to hedge the market

value of the shares.

Radar Holdings Limited - Another component of the Company NAV is

its indirect shareholding in Radar having failed in our bid to

exercise constructive control. The Company is actively pursuing

avenues to sell its interest in Radar. If successful, such a sale

will earn the Company about $1.7 million less costs. The Company

will only sell its investment if it can achieve value at the

holding level. The investment is robust and if a sale is not

achievable in this fiscal year, the Company is confident that the

holding will preserve its value.

Goodwill - Another component of NAV is the Company's goodwill

(intellectual property). Currently, intellectual property is

driving the earnings in Tradanet - the largest contributor to the

Company's earnings. This 51% owned subsidiary of Paynet processes

microloans on behalf of CABS, Zimbabwe's largest Building Society.

At their peak in in 2019, these microloans comprised about a third

of the bank's assets and the Directors believe that a return to

those levels is fully conceivable.

Almost three years has passed since banks collectively blocked

the use of Paynet's payment technology, claiming varying levels of

ability to pay in foreign currency and immediate availability of

locally priced solutions. Recently, Paynet's technology has been

displaced at least in part by ZeePay. ZeePay's payment technology

is operated by ZimSwitch and developed by Bankserv. ZimSwitch,

which is headed by Cyril Nyatanza (formerly Bankserv's Business

Development manager), now effectively controls 99% of national

payment in Zimbabwe

The Company understands that ZeePay is charging banks 16 US

cents in foreign currency, which is the same price banks

collectively refused to pay Payserv Africa in 2019. Transaction

costs for the consumer have catapulted by several hundred percent

since the banking fraternity ousted Paynet from competition. The

Company believes that its technology, which processed close to 25

million transactions annually before June 2019 with revenues of

over $7 million, remains the most cost-effective solution for the

banking industry and would promote competition. Moreover, in its

agreement with the RBZ Governor in 2019, Paynet had committed to

repatriate 70% of its transaction revenue to Zimbabwe. The Board of

Paynet approved licensing an unlabelled version of the product if

favourable transaction terms can be established with a reputable

licensor.

Continuing Operations

Tradanet - As mentioned in the discussion of our goodwill above,

Tradanet, the 51%-owned subsidiary of Paynet Zimbabwe, is now the

company's most profitable operation. With the impact of Zimbabwe

dollar inflation, this saw a rise in the loan book administered by

the business. However, this is watered down in real US dollar value

terms. The value of the Zimbabwe dollar to the US dollar fell by 2%

since the prior trading year according to the official foreign

currency auction. The RBZ auction rate however belies the

significant rate of inflation and the concomitant decline in the

purchasing power of the Zimbabwe Dollar. Cambria applies

hyperinflationary accounting rules which are meant to adjust for

such idiosyncrasies.

Autopay - The company's payroll operation saw its revenues

decline as Paywell granted non-exclusive licenses to multiple

competitors in the market including former employees. During the

year, the company reached a management agreement with Propay (Pvt)

Ltd and established former account executives as independent

contractors. This has resulted in cost containment and aligned the

incentives of the payroll executives to that of Autopay.

Millchem - Millchem remains with its sanitizer business. The

sanitiser market has been characterized by many small players and

competition which drove prices down and sadly the quality and

reliability of the competing products.. Our joint venture with

Merken (Pvt) Ltd in the production of sanitizer products remains

cash flow positive, but will likely wind down by the end of this

fiscal year if demand does not improve.

Cambria's Board of Directors and I have continued to serve the

Company without compensation since 2015, fighting to return value

to shareholders. Despite the unfavourable economic factors leading

to the abandonment of parity to the US dollar and its huge impact

on the Company, we hold on jealously to our cash, our liabilities

are negligible, and our remaining operations are profitable. We

still see value in our listing, having disposed of most of the

Company's depreciating assets and used the proceeds to bring

remaining liabilities down to their current negligible values.

We remain cautiously optimistic about achieving full value for

the Company's assets beyond its NAV. At this point in time, we hope

to increase shareholder value through appreciation of the Company's

share price to reflect at the very least, net equity per share.

This would bring our market valuation closer to the Company's

current NAV of 1.16 US cents per share which is 3.5 times the

closing price of 0.36 US cents per share (GBP0.275) on 28 March

2022.

Samir Shasha

Chief Executive Officer

31 March 2022

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Contacts

Cambria Africa Plc www.cambriaafrica.com

Samir Shasha +44 (0)20 3287 8814

WH Ireland Limited https://www.whirelandplc.com/

James Joyce / Ben Good +44 (0) 20 7220 1666

Cambria Africa Plc

Audited consolidated income statement

For the year ended 31 August 2021

Audited Audited

31-Aug-21 31-Aug-20

US$'000 US$'000

--------------------------------------- ---------- ----------------

Revenue 1,216 1,319

Cost of sales (138) (519)

--------------------------------------- ---------- ----------------

Gross profit 1,078 800

Operating costs (838) (845)

Other income 79 55

Exceptionals (21) (375)

--------------------------------------- ---------- ----------------

Operating P rofit / (Loss) 298 (365)

Finance income - 1

Finance costs (22) (60)

--------------------------------------- ---------- ----------------

Net finance costs (22) (59)

--------------------------------------- ---------- ----------------

P rofit/ ( Loss ) before tax 276 (424)

Income tax (95) (46)

--------------------------------------- ---------- ----------------

Profit/ ( Loss ) for the year 181 (470)

======================================= ========== ================

Attributable to:

Owners of the company 82 (408)

Non-controlling Interests 99 (62)

--------------------------------------- ---------- ----------------

Profit/ ( Loss ) for the year 181 (470)

======================================= ========== ================

Earnings/ ( Loss ) per share

Basic and diluted earnings / ( loss )

per share (cents) 0.02c (0.07c)

Earnings/(Loss) per share - continuing

operations

Basic and diluted earnings / ( loss )

per share (cents) 0.02c (0.07c)

Weighted average number of shares 544,576 544,576

Cambria Africa Plc

Audited consolidated statement of comprehensive

income

For the year ended 31 August 2021

--------------------------------------------------------------------------- ---------------------------------------------

Audited

Audited 31-Aug-

31-Aug- 21 20

US$'000 US$'000

--------------------------------------------------------------------------- -------------- -----------------------------

Profit/(Loss) for the year 181 (470)

Other comprehensive income

Items that will not be reclassified to Statement

of Profit or Loss:

Increase in investment in subsidiary - impact

on equity - (74)

Foreign currency translation differences for

overseas operations (4) (511)

--------------------------------------------------------------------------- -------------- -----------------------------

Total comprehensive profit/ (loss) for the year 177 (1,055)

=========================================================================== ============== =============================

Attributable to:

Owners of the company 78 (993)

Non-controlling interest 99 (62)

--------------------------------------------------------------------------- -------------- -----------------------------

Total comprehensive profit/ (loss) for the year 177 (1,055)

=========================================================================== ============== =============================

Cambria Africa Plc

Audited consolidated statement of changes in

equity

For the year ended 31 August 2021

Foreign

Share Share Revaluation exchange Accumulated Non-Controlling

US$000 Capital premium reserve reserve losses NDR Total interests Total

----------------- -------- -------- ----------- -------- ----------- ------- ----- ----------------- ------------

Balance at 1

September (10,7 6,4

2020 77 88,459 - 36 ) (73,748) 2,371 23 496 6,919

-------- -------- ----------- -------- ------------ ------- ----- ----------------- ----------

Profit for the

year - - - - 82 - 82 99 181

Increase in

investment

in subsidiary -

Revaluation of

investment

property held at

fair

value (190) (190) (190)

Foreign currency

translation

differences

for overseas

operations - - - (4) - - (4) - (4)

Foreign currency

translation

differences for

overseas

operations - NCI - - - 6 - 6 (6) -

-------- -------- ----------- -------- ------------ ------- ----- ----------------- ----------

Total

comprehensive

income for the

year 77 88,459 (190) (10,734) (73,666) 2,371 6,317 589 6,906

Contributions

by/distributions

to owners of

the Company

recognised

directly in

equity

Dividends paid to

minorities - - - - - - - (112) (112)

-------- -------- ----------- -------- ------------ ------- ----- ----------------- ----------

Total

contributions

by and

distributions

to owners of the

Company - - - - - - - (112) (112)

----------------- -------- -------- ----------- -------- ------------ ------- ----- ----------------- ----------

Balance at 31

August

2021 77 88,459 - (10,734) (73,666) 2,371 6,317 477 6,794

================= ======== ======== =========== ======== ============ ======= ===== ================= ==========

Foreign

Share Share Revaluation exchange Accumulated Non-Controlling

US$000 Capital premium reserve reserve losses NDR Total interests Total

----------------- ---------- --------- --------------- --------- ----------- ----- ----- ---------------- ------------

Balance at 1

September

2019 77 88,459 - (10,251) (73,266) 2,371 7,390 747 8,137

---------- --------- --------------- --------- ----------- ----- ----- ---------------- ------------

Loss for the year - - - - (408) - (408) (62) (470)

Increase in

investment

in subsidiaries - - - - (74) - (74) (137) (211)

Foreign currency

translation

differences for

overseas

operations - - - (511) - - (511) - (511)

Foreign currency

translation

differences for

overseas

operations - ( 26

(NCI) - - - 26 - 26 ) -

---------- --------- --------------- --------- ----------- ----- ----- ---------------- ------------

Total

comprehensive

profit for the ( 485 (9 67 ( 225

year 77 88,459 - ) (482) 2,371 ) ) (1,192)

Contributions

by/distributions

to owners of the

Company

recognised

directly

in equity

Dividends paid to

minorities - - - - - - - (26) (26)

---------- --------- --------------- --------- ----------- ----- ----- ---------------- ------------

Total

contributions

by and

distributions

to owners of the

Company - - - - - - - (123) (123)

----------------- ---------- --------- --------------- --------- ----------- ----- ----- ---------------- ------------

Balance at 31

August (10,7 6,4

20 20 77 88,459 - 36 ) (73,748) 2,371 23 496 6,919

================= ========== ========= =============== ========= =========== ===== ===== ================ ============

Cambria Africa Plc

Audited consolidated statement of financial position

As at 31 August 2021

Audited Audited

Group Group

31-Aug-21 31-Aug-20

US$'000 US$'000

------------------------------- ---------- ----------------------------

Property, plant and equipment 2,317 2,604

Goodwill 717 717

Intangible assets 1 1

Investments in subsidiaries

and investments at f air v

alue 2,228 2,228

Financial assets at fair value

through profit and loss 184 201

---------------------------------- ---------- ----------------------------

Total non-current assets 5,447 5,751

---------------------------------- ---------- ----------------------------

Inventories 158 102

Financial assets at fair value

through profit and loss 75 16

Trade and other receivables 155 151

Cash and cash equivalents 1,656 1,896

---------------------------------- ---------- ----------------------------

Total current assets 2,044 2,165

---------------------------------- ---------- ----------------------------

Total assets 7,491 7,916

================================== ========== ============================

Equity

Issued share capital 77 77

Share premium account 88,459 88,459

Revaluation reserve (190) -

(10,7

Foreign exchange reserve (10,734) 36 )

Non-distributable reserves 2,371 2,371

Accumulated losses (73,666) (73,748)

---------------------------------- ---------- ----------------------------

Equity attributable to owners 6,42

of the company 6,317 3

Non-controlling interests 477 496

---------------------------------- ---------- ----------------------------

Total equity 6,794 6,919

================================== ========== ============================

Liabilities

Loans and b borrowings - -

Trade and other payables 90 22

Provisions - 1

Deferred tax liabilities 189 193

---------------------------------- ---------- ----------------------------

Total non-current liabilities 279 216

---------------------------------- ---------- ----------------------------

Current tax liabilities 107 38

Loans and borrowings 101 50 9

Trade and other payables 210 2 34

---------------------------------- ---------- ----------------------------

Total current liabilities 418 781

---------------------------------- ---------- ----------------------------

Total liabilities 697 997

================================== ========== ============================

Total equity and liabilities 7,491 7,916

================================== ========== ============================

Cambria Africa Plc

Audited consolidated statement of cash flows

As at 31 August 2021

Audited Audited

31-Aug-21 31-Aug-20

US$'000 US$'000

---------------------------------------------- ------------ ----------

Cash generated from operations 294 605

Taxation (paid) (31) ( 43 )

----------------------------------------------- ------------ ----------

Cash generated from operating activities 263 562

----------------------------------------------- ------------ ----------

Cash flows from investing activities

Proceeds on disposal of property, plant

and equipment 144 37

Purchase of property, plant and equipment - -

Net proceeds from marketable securities - 226

Other investing activities (210) (210)

Interest received - 1

----------------------------------------------- ------------ ----------

Net cash (utilized in)/ generated investing

activities (66) 54

----------------------------------------------- ------------ ----------

Cash flows from financing activities

Dividends paid to non-controlling interests (112) (26)

Interest paid (22) (60)

Proceeds from issue of share capital - -

Loans repaid (299) (88)

Proceeds from drawdown of loans - 45

----------------------------------------------- ------------ ----------

Net cash (utilized) by financing activities (433) (129)

----------------------------------------------- ------------ ----------

Net (decrease)/ increase in cash and cash

equivalents (236) 487

Cash and cash equivalents at the beginning

of the Period 1,896 1,920

Foreign exchange (4) (511)

----------------------------------------------- ------------ ----------

Net cash and cash equivalents at 31 August 1 ,656 1,896

=============================================== ============ ==========

Cash and cash equivalents as above comprise

the following

Cash and cash equivalents attributable

to continuing operations 1, 656 1, 896

----------------------------------------------- ------------ ----------

Net cash and cash equivalents at 31 August 1,656 1,896

=============================================== ============ ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BKDBBPBKDKNN

(END) Dow Jones Newswires

March 31, 2022 11:25 ET (15:25 GMT)

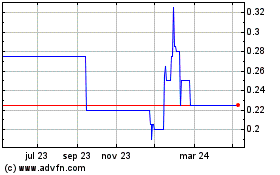

Cambria Africa (LSE:CMB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Cambria Africa (LSE:CMB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024