TIDMDFCH

RNS Number : 9709U

Distribution Finance Cap. Hldgs PLC

29 November 2023

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation (EU no.

596/2014) as it forms part of UK law by virtue of the European

Union (Withdrawal) Act 2018 (as amended from time to time).

29 November 2023

Distribution Finance Capital Holdings plc

("DF Capital" or the "Company" together with its subsidiaries

the "Group")

Trading and Capital Strategy Update

Distribution Finance Capital Holdings plc, a specialist bank

providing working capital solutions to dealers and manufacturers

across the UK, provides an update in relation to its single large

obligor arrears balance, a trading update and a change to its

medium-term capital strategy.

Update relating to large single obligor's arrears balance

The Group previously reported that as at 30 June 2023 the

Group's arrears included GBP10.4m of balance outstanding in respect

of a large single obligor; RoyaleLife and associated companies

("RoyaleLife"), a customer of the Company since June 2018,

representing c.2 per cent of the Group's loan book as at 30

September 2023. Whilst the refinancing and restructuring of

RoyaleLife was in progress, it had been delayed, and at that time

the Group's assessment, following engagement with key stakeholders,

was that the Group would be repaid should the proposed refinance

complete as planned.

The Group is aware of a significant number of assets which have

been sold out of trust or are missing from confirmed locations and

following continued work with various stakeholders, it is now clear

that RoyaleLife's financial situation and operation is much opaquer

and more complex than originally determined, adversely impacting,

to a greater degree than expected, a larger number of secured

lenders and other creditors.

Whilst the Group understands that action to refinance RoyaleLife

remains in progress, there is no certainty at this stage given the

elapsed time and new information that this will lead to a

satisfactory outcome and successful refinance, which will see the

Group being substantively repaid.

Whilst the Group will continue to work with stakeholders to

effect a good outcome, pursuing recovery of the outstanding debt to

the fullest extent possible, the Group intends to make an

appropriate credit loss provision in its full year accounts for the

year ending 31 December 2023. Due to the unique circumstances

associated with RoyaleLife and the one-off nature of any provision,

the Group does not anticipate any further impact to its results for

the next financial year ending 31 December 2024.

The Group maintains a highly cautious and vigilant approach to

credit risk management and the circumstances surrounding RoyaleLife

facility are unique in the context of the Group's loan book.

Trading update and capital strategy

As reported in the results for six months ended 30 June 2023 the

Group delivered pre-tax profit, including impairment provisions, of

GBP3.2m in the first half, more than the entire previous financial

year. Additionally, new loan origination remained strong, stock

turn extended further and the Group continued to generate elevated

net interest margin. However, in light of any expected credit loss

provision in relation to RoyaleLife, the Group now expects to

deliver a pre-tax profit of no less than GBP2.0m for the year

ending 31 December 2023.

Given the strong underlying momentum combined with the Group's

expectations of further loan book growth, the Company has

determined that, in the medium term, it will remain flexible and

pragmatic in the pursuit of its growth strategy, balancing this

against its ability to generate retained earnings as a route to

organic capital accretion.

As previously announced the Group believes it has capacity to

grow its current loan book to the envisaged level of approximately

GBP800m based on current capital, a full drawdown of the GBP20m

Tier 2 Capital Facility as announced on 8 September 2023 and

upsizing of the previously announced ENABLE Guarantee from GBP250m

to GBP350m. At a cGBP800m loan book the financial characteristics

of the Group would allow it to achieve further organic growth at a

slower, but healthy rate without the need to raise additional Tier

1 capital. The Group remains committed to becoming a multi-product

lender in the near-term, considering organic and inorganic product

development strategies which underpin the Group's longer-term

earnings potential.

Carl D'Ammassa, Chief Executive, commented: "Despite our best

efforts, it is very disappointing that we have not been able to

resolve the RoyaleLife situation. This is a complex, demanding and

unique exposure that we have been working through over many months

alongside other lenders and creditors. Despite the material changes

to the landscape most recently, we continue to seek recovery, but

feel prudency and transparency of approach is critical at this time

and central to our model".

"Notwithstanding this situation, the Group is seeing strong

underlying financial momentum and we remain well placed to build a

diverse multi-product lending proposition, without the pressing

need to raise Tier 1 capital through an equity raise."

The person responsible for arranging the release of this

announcement on behalf of the Company is Karen D'Souza (Company

Secretary).

For further information contact:

Distribution Finance Capital Holdings

plc

Carl D'Ammassa - Chief Executive Officer +44 (0) 161 413 3391

Kam Bansil - Head of Investor Relations +44 (0) 7779 229508

http://www.dfcapital-investors.com

Investec Bank plc (Nomad and Joint

Broker) +44 (0) 207 597 5970

David Anderson

Bruce Garrow

Harry Hargreaves

Maria Gomez de Olea

Liberum Capital Limited (Joint Broker) +44 (0) 203 100 2000

Chris Clarke

Lauren Kettle

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZZMZMRRRGFZM

(END) Dow Jones Newswires

November 29, 2023 02:00 ET (07:00 GMT)

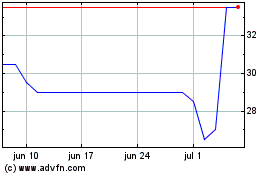

Distribution Finance Cap... (LSE:DFCH)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Distribution Finance Cap... (LSE:DFCH)

Gráfica de Acción Histórica

De May 2023 a May 2024