TIDMDLN

RNS Number : 8621I

Derwent London PLC

10 August 2023

10 August 2023

Derwent London plc ("Derwent London" / "the Group")

UNAUDITED RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

STRONG LEASING ACTIVITY CONTINUES

Paul Williams, Chief Executive of Derwent London, said:

"We delivered our second highest H1 lettings on record with

momentum maintained into the second half as businesses continue to

commit to our distinctive central London buildings and brand. With

our strong balance sheet, we are well-positioned with the right

product and pipeline to capture London's diverse demand, despite

the uncertain economic outlook."

Letting activity

-- H1 2023 lettings of GBP19.3m (228,000 sq ft); H2 lettings to

date of GBP7.0m (81,200 sq ft); YTD average 8.3% above December

2022 ERV

-- Key transactions in the year to date include:

o PIMCO (106,100 sq ft in H1) and Moelis (49,200 sq ft in H2) at

25 Baker Street W1; commercial 76% pre-let

o Buro Happold (31,100 sq ft in H1) and Tide (14,400 sq ft in

H2) at The Featherstone Building EC1; 70% let

o Uniqlo (22,200 sq ft in H1) at One Oxford Street W1; retail

70% let

Financial highlights

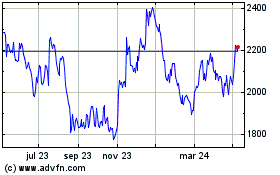

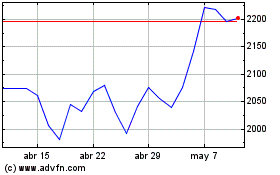

-- EPRA(1) net tangible assets 3,444p per share, down 5.2% from 3,632p at 31 December 2022

-- Gross rental income of GBP105.9m, up 3.9% from GBP101.9m (restated) in H1 2022

-- EPRA(1) earnings GBP55.6m or 49.5p per share, down 7.0% from 53.2p (restated) in H1 2022

-- IFRS loss before tax of GBP143.1m from a profit of GBP137.1m in H1 2022

-- First half dividend of 24.5p, up 2.1% from 24.0p

-- Total return -3.7% from +3.0% in H1 2022

-- Interest cover remains high at 411% (H1 2022: 419%) and

EPRA(1) loan-to-value ratio low at 25.0% (31 December 2022:

23.9%)

-- Net debt of GBP1,274.0m, a marginal increase compared to GBP1,257.2m at 31 December 2022

-- Undrawn facilities and unrestricted cash of GBP562m

Portfolio highlights

-- GBP11.7m of asset management transactions, 4.6% ahead of

December 2022 ERV; 86% retention/re-letting rate

-- EPRA vacancy of 4.5%, from 6.4% at December 2022

-- Portfolio valued at GBP5.2bn, an underlying decline of 3.7%;

development valuations up 10.6% underlying

-- True equivalent yield of 5.13%, a 25bp increase in H1 2023;

total increase since 30 June 2022 of 67bp

-- Portfolio ERV growth of 1.0%

-- Total property return of -2.0%, outperforming our benchmark(2) at -3.2%

-- Project expenditure(3) of GBP68.8m

-- GBP65.6m of disposals

-- Two major on-site developments totalling 435,000 sq ft, due

for completion in 2025 on budget and programme

-- Planning consent received for c.100 acre 18.4MW solar park on our Scottish estate

Outlook

-- Guidance unchanged for average ERV growth across our portfolio at 0% to +3%

-- Our high quality portfolio yield to be more resilient than the wider London office market

(1) Explanations of how EPRA figures are derived from IFRS are

shown in note 24

(2) MSCI Central London Offices Quarterly Index

(3) Including capitalised interest

Webcast and conference call

There will be a live webcast together with a conference call for

investors and analysts at 09:30 BST today. The webcast can be

accessed via www.derwentlondon.com

To participate in the call, please register at

www.derwentlondon.com

A recording of the webcast will also be made available following

the event on www.derwentlondon.com

For further information, please contact:

Derwent London Paul Williams, Chief Executive

Tel: +44 (0)20 7659 3000 Damian Wisniewski, Chief Financial Officer

Robert Duncan, Head of Investor Relations

Brunswick Group Nina Coad

Tel: +44 (0)20 7404 5959 Emily Trapnell

CHIEF EXECUTIVE'S STATEMENT

Operational performance

In H1, we agreed GBP19.3m of new leases and momentum has been

maintained with a further GBP7.0m of leases signed in H2 to date.

On average, the GBP26.3m of new income agreed since the start of

2023 is 8.3% ahead of December 2022 ERV with a WAULT of 10.3

years.

Key lettings in 2023 to date include:

-- 25 Baker Street W1 pre-lets - both substantially ahead of

ERV; commercial element 76% pre-let or pre-sold

o PIMCO - 106,100 sq ft at GBP103 psf on a 15-year lease (no

break) in H1

o Moelis - 49,200 sq ft at GBP100 psf on a 15-year lease (break

at year 10) on lower floors in H2

-- The Featherstone Building EC1; now 70% leased

o Buro Happold - 31,100 sq ft on levels 5-8 at GBP74 psf on a

15-year lease (break at year 10) in H1

o Tide - 14,400 sq ft on level 4 at GBP71 psf on a 10-year lease

(break at year 5) in H2

-- One Oxford Street W1; retail element now 70% leased

o Uniqlo - 22,200 sq ft on a 10-year lease (break at year 5) in

H1

-- Tea Building E1 - newly refurbished space

o Jones Knowles Ritchie - 8,100 sq ft at GBP60 psf on a 10-year

lease (break at year 5) in H1

o Gemba - 7,100 sq ft (Furnished + Flexible) at GBP64 psf on a

5-year lease (no break) in H2

The first half of 2023 was characterised by increasing caution

as higher UK inflation became more embedded and monetary policy

continued to tighten. Encouragingly, figures released more recently

show the inflation rate reducing and a number of forward-looking

indicators suggest this should continue. There remains a disconnect

between the investment market, where yields came under further

pressure in H1, and the occupational market, where we have

delivered a near record level of leasing in the year to date.

In addition, our Asset Management team agreed GBP11.7m of rent

reviews, renewals and regears on average 4.6% ahead of December

2022 ERV. The portfolio WAULT is 7.2 years (on a 'topped-up' basis)

and our EPRA vacancy rate has reduced from 6.4% during H1 to

4.5%.

Our business model incorporates a disciplined approach to

capital allocation and leverage. Including GBP65.6m of disposals in

H1 2023, we have sold almost GBP900m of assets since 2018. Over the

same period, we have invested over GBP900m in development capex and

have added to our longer-term pipeline with acquisitions of over

GBP500m.

Following the signing of the main construction contract with

Laing O'Rourke in early 2022 at 25 Baker Street W1, we have now

completed the fixed price contract with Kier at Network W1.

Together these projects comprise 435,000 sq ft.

The next phase of our new-build pipeline extends to c.240,000 sq

ft at 50 Baker Street W1, held in a 50/50 joint venture, and

c.150,000 sq ft at Holden House W1. Beyond that, our conditional

GBP239m acquisition of Old Street Quarter EC1, the current

Moorfields Eye Hospital site, is expected to complete from 2027. We

also have a programme of rolling refurbishments which we expect to

deliver attractive rental uplifts.

Valuations

Despite the strong operational performance, against a weak

economic backdrop, our central London focused portfolio reduced in

value by 3.7% in H1, taking the overall decline to 11.4% from H1

2022. The majority of the correction is yield-driven, with the

portfolio EPRA true equivalent yield increasing a further 25bp to

5.13% (up 67bp since 30 June 2022). The portfolio ERV increased

1.0%, partly offsetting the impact of outward yield shift on the

valuation. Our total property return was -2.0%, outperforming the

quarterly MSCI Central London Offices index which was -3.2%. Our

on-site developments increased in value by 10.6%, helped by the

pre-let at 25 Baker Street to PIMCO.

In line with the trend reported at FY2022, our higher quality

properties outperformed. Buildings valued above GBP1,500 psf saw

capital values reduce by only 1.3% compared to properties valued

below GBP1,000 psf, principally our future pipeline, which fell

6.3%.

Financial performance

The Group's EPRA net tangible asset (NTA) value per share

declined 5.2% to 3,444p as at 30 June 2023 from 3,632p as at 31

December 2022. After allowing for the 54.5p dividend paid to

shareholders in June 2023, the total return for the first half was

-3.7% (H1 2022: +3.0%).

The total downward investment property revaluation movement in

H1 2023 was GBP204.1m including owner-occupied property and our

share of joint ventures. This compares with a surplus in H1 2022 of

GBP72.9m (restated from GBP73.0m after a change in accounting

treatment for incentives) but the deficit is less than half the

GBP503.6m seen in H2 2022.

Gross rental income increased to GBP105.9m from GBP101.9m

(restated) in H1 2022 with a GBP4.7m overall increase in

irrecoverable property expenditure the main factor behind the

reduction in EPRA earnings. This cost increase was principally due

to a combination of higher average portfolio vacancy and the

exceptionally high irrecoverable service charges seen through the

first quarter of 2023 when energy pricing was elevated. Energy

prices fell in Q2 2023 to levels closer to those seen in early

2022. The IFRS loss before tax was GBP143.1m in H1 2023 (H1 2022:

GBP137.1m profit) and, after the usual adjustments for fair value

movements and property disposals, EPRA earnings were GBP55.6m (H1

2022: GBP59.7m restated) or 49.5p (H1 2022: 53.2p restated) on a

per share basis.

Our annual dividend remains well covered by EPRA earnings and we

have increased the interim 2023 dividend by 2.1% to 24.5p.

Capital recycling means net debt rose marginally to GBP1.27bn

from GBP1.26bn at December 2022, but is GBP87m below the GBP1.36bn

reported a year ago. Lower property valuations led to a slight

increase in the EPRA loan-to-value (LTV) ratio to 25.0%, compared

to 23.9% at December 2022. It remains comfortably within our target

range.

The balance sheet is very well placed with 98% of borrowings at

fixed rates, GBP562m of undrawn available facilities and

unrestricted cash, and only GBP83m of debt due to expire in October

2024, at a fixed interest rate of 3.99%.

London's global appeal

London is recognised as a world-leading city with broad appeal.

For occupiers, it has a deep talent pool and sophisticated business

ecosystem. This makes it a particularly appealing destination for a

wide range of occupiers, including both UK and European Head

Quarters. For investors, the restrictive planning environment and

strong long-term performance provide a robust investment case.

One of the key drivers of the London office market is job

creation. In 2021 and 2022, c.335,000 net new office-based jobs

were added (CBRE). A further c.235,000 jobs are forecast between

2023 and 2028. In addition, the population of London continues to

grow and is forecast to reach 10.6m by 2035, an 11% increase

compared to 2022. This is significantly higher than the general

rate of growth forecast in most other major European cities.

London attracts a broad range of occupiers while many other

global cities are more reliant on specific sectors. The three

largest sectors currently looking for space in the capital are

banking & finance, business services and creative industries.

There is also good demand from high growth areas such as AI and

life sciences.

London is a major contributor to the UK economy, accounting for

24.4% of UK GDP. Since 2013, it has delivered average economic

growth of 2.8% pa, outperforming the UK as a whole by c.130bp

annually and is expected to continue to outperform the UK overall

over the next five years.

Market backdrop

Businesses are more discerning around their occupational

requirements as the flight to quality gathers pace. Encompassing

many factors including amenity, location and sustainability

credentials, the definition of prime is becoming more nuanced. Set

against this, a large part of the current available supply does not

meet these more stringent needs.

London has recently seen a trend of companies committing to

return to more central, well-located and amenity-rich locations,

notwithstanding the higher occupational costs. The opening of the

Elizabeth line last year has emphasised the importance of location

and connectivity and c.80% of our portfolio is within a 10 minute

walk of an Elizabeth line station.

In a recent Knight Frank report, 77% of businesses surveyed

expect their total floorspace to increase or remain the same over

the next three years. In addition, 87% of businesses believe the

office will play a central role in their future occupational

models. The return to the office is continuing and a rising number

of corporates have issued more prescriptive guidelines to their

employees. The majority of those reported now require a minimum of

three days in the office as businesses plan for peak

occupation.

Vacancy is not evenly spread across central London. While

overall office availability remains elevated at 8.5%, the West End

is very tight at 3.8% compared to the City at 11.7% and Docklands

at 14.3%. New supply, however, is constrained. Only 3.4m sq ft of

projects are due to complete in the West End by the end of 2026, of

which 28% is pre-let. Against long-term average annual take-up of

4.1m sq ft, the West End faces an emerging supply shortage.

Central London office take-up in H1 of 4.2m sq ft was down 36%

compared to H1 2022, but space under offer increased 51% to 4.1m sq

ft through H1. Pre-letting levels across central London are high at

45% as companies with larger requirements increasingly recognise

the forthcoming lack of prime supply, particularly in central

locations. Active demand increased 35% in H1 to 7.7m sq ft, a

positive indicator for future take-up.

Investment volumes of GBP2.9bn in H1 were low against long-term

trends. Market interest rates have increased with the 10-year gilt

yield rising from 3.0% in February to 4.4% at 30 June 2023. Lender

risk appetite has reduced leading to an increase in margins and

contraction in lending volumes. City prime yields increased by 75bp

to 5.25% in the first half. However, reflecting the level of equity

targeting the West End, prime investment yields were unchanged in

H1 2023 at 3.75%, per CBRE.

Derwent's brand and product differentiation

Our distinctive, design-led spaces are focused on the people

that occupy them. Through innovative design and high quality

materials, we continually push boundaries to create architecturally

striking buildings that have a positive impact on businesses and

communities.

Sustainability is embedded throughout our business.

Implementation of our Intelligent Building programme continues

across the portfolio and will play an important role in our journey

to net zero carbon, helping reduce both energy consumption and

costs. We were recently granted planning consent for our 18.4MW

solar park in Scotland which will deliver tangible environmental

benefits for us and our occupiers.

Derwent's offer extends beyond the bricks and mortar: customer

service and our 'member' approach is integral. We maintain strong

relationships with our occupiers at all levels. The second of our

lounges, DL/28, will open this autumn in our Old Street village,

following very positive feedback from our occupiers on DL/78. This

amenity - available to and highly valued by both our members and

potential occupiers - is a significant brand differentiator.

We do not take a 'one size fits all' approach to flex. Rather,

we tailor space to meet market demand across the board. Our

buildings are designed to be flexible, and our 'long-life, low

carbon' approach means space is adaptable to the needs of a diverse

range of occupiers.

As well as leasing space to third party serviced office

providers (163,000 sq ft), we provide a variety of 'Furnished +

Flexible' workspaces, each designed for the relevant sub-market.

This extends to 128,300 sq ft, including 44,200 sq ft which is on

site or committed. Overall, flex comprises 5.4% of our portfolio

floorspace which compares to the wider London market at 5-6%.

Guidance and outlook

Although availability across central London is elevated, supply

of the best space is constrained, particularly in the West End. The

medium-term speculative development pipeline looks thin with some

new starts being delayed. Take-up was lower in H1, but we are

encouraged by the increased amount of space under offer and levels

of active demand.

We expect rents for the best space to continue to rise, with

poorer space to underperform. Our portfolio, which is 72% in the

West End, is well-placed as demonstrated by our near record leasing

activity in the year to date at rents well ahead of ERV. Our

guidance for average ERV growth across the portfolio in 2023 is

unchanged at 0% to +3%.

Our EPRA equivalent yield has increased to 5.13%, up 67bp over

the last 12 months to levels last seen in 2014. We expect our

portfolio to be more resilient than the wider London office market,

with the West End to continue to outperform. Our strong and

well-financed balance sheet means we are well-placed to continue

upgrading our properties through developments and refurbishments

while remaining opportunistic should attractive acquisitions

emerge.

As the flight to quality continues in an increasingly complex

world, we are well positioned with the right product to capture

London's diverse demand.

CENTRAL LONDON OFFICE MARKET

Occupational market

Take-up in H1 2023 totalled 4.2m sq ft across central London,

36% below H1 2022 and 25% lower than the 10-year H1 average.

However, space under offer increased 51% to 4.1m sq ft which is 18%

above the 10-year average. Pre-let space comprised 25% of H1

take-up, and eight of the top 10 lettings. Banking & finance

was the most active sector at 29% of take-up, followed by business

services at 22% and creative industries at 16%. These trends

further underline the flight to quality.

Average vacancy rose through H1 to 8.5% from 7.7% at December

2022. However, performance by sub-market continues to diverge. In

the West End, supply is constrained at 3.8% compared to the City

with availability at 11.7%. Supply is dominated by secondhand space

while demand is focused on prime, green space. According to CBRE,

secondhand space accounts for 67% of total availability.

CBRE estimates 12.7m sq ft of new space will be delivered across

central London by 2026, split 61% new developments and 39%

refurbishments. The 3.4m sq ft in the West End equates to 3.7% of

existing stock and is 28% pre-let. The 2.4m sq ft being delivered

speculatively compares to average annual take-up of 4.1m sq ft. The

5.6m sq ft in the City is equivalent to 7.2% of existing space, and

is 62% pre-let.

Combined with low existing vacancy, there is expected to be an

ongoing shortage of prime supply. New construction starts in H1

2023 were below trend at 1.7m sq ft. The long-term six-monthly

average for new construction starts is 2.3m sq ft.

Investment market

London is an attractive location for international investors. In

H1, overseas capital comprised 71% of investment volume with Asian

investors the most active at 49% in part reflecting their access to

cheaper domestic debt. CBRE estimated prime West End investment

yields were flat in H1 at 3.75%, while in the City there was a 75bp

increase to 5.25%. This compares to prime yields in key European

cities which range between 3.75% and 4.70%.

Investment volumes in H1 2023 of GBP2.9bn were 11% lower than in

H2 2022 (GBP3.3bn) and below the 10-year H1 average of GBP6.0bn. Q1

was stronger at GBP1.7bn as transactions that had been put on hold

at the end of 2022 completed. Q2, however, slowed to GBP1.2bn as

inflation and interest rate concerns added to economic uncertainty.

Deals in the West End represented 29% of the total compared to 45%

in the City.

Market interest rates have increased with the 10-year gilt yield

rising from February's low of 3.0% to 4.4% at the end of H1 2023.

The 5-year swap rate and SONIA experienced similar increases in H1

to 5.3% and 4.9% respectively. UK lending markets remain

constrained in terms of both cost and availability of debt.

Liquidity is focused on the sub-GBP100m lot size 'value-add'

market and is dominated by equity buyers. To date, there has not

been a significant change in the level of market distress but as

refinancing events gather pace the number of motivated vendors is

expected to increase. Lenders are seeking to deleverage facilities

to lower LTVs on refinancing given the rise in investment yields

and decline in capital values.

VALUATION

The Group's investment portfolio was valued at GBP5.2bn on 30

June 2023. There was a deficit of GBP201.5m in the first half

which, after accounting adjustments of GBP2.7m (see note 11),

produced a decline of GBP204.2m including our share of joint

ventures. On an underlying basis the portfolio decreased by 3.7%,

following an 8.0% decline in H2 2022.

The background to this performance continues to be weak economic

conditions with the impact of stickier than expected inflation and

higher interest rates feeding through to the economy. This has

resulted in a further outward movement of property valuation yields

in the first half of the year.

By location, our central London properties, which represent 99%

of the portfolio, reduced in value by 3.7% with the West End -2.4%

and City borders -7.2%. The balance of the portfolio, our Scottish

holdings, was down 2.5%.

Our portfolio capital growth outperformed the MSCI Quarterly

Index for Central London Offices, at -4.9%. The wider MSCI

Quarterly UK All Property Index decreased by 1.8%.

Our leasing activity provided valuation support, with the

strongest occupier demand being for high quality space with strong

ESG credentials. Our EPRA rental value moved up 1.0% in H1, in line

with our guidance and showed an improvement on the 0.5% growth in

H2 2022.

The portfolio's true equivalent yield expanded by 25bp, from

4.88% to 5.13% in H1. The initial yield is 3.9% (December 2022:

3.7%) which, after allowing for the expiry of rent frees and

contractual uplifts, rises to 4.8% on a 'topped-up' basis (December

2022: 4.6%).

The total property return for the six month period was -2.0%,

which compares to the MSCI Quarterly Index of -3.2% for Central

London Offices and 0.5% for UK All Property.

During the first half we were on-site at two West End

developments - 25 Baker Street W1 and Network W1. We are making

good construction progress at each project. 76% of the commercial

space at 25 Baker Street has been pre-let or pre-sold at a

significant premium to the valuer's ERV. The completion date for

each project is 2025 and GBP289m of capital expenditure is required

to complete. Together, they were valued at GBP330.1m at 30 June

2023 and delivered a strong 10.6% valuation uplift, after capital

expenditure. Excluding these projects, the portfolio declined in

value by 4.6% on an underlying basis.

Further details on the progress of our projects are in the

'Developments' section below and additional guidance on the

investment market is laid out in the 'Guidance and outlook' section

above.

Portfolio reversion

Our contracted annualised cash rent at 30 June 2023 was

GBP203.3m. With a portfolio net ERV of GBP305.6m there is GBP102.3m

of potential reversion. Within this, GBP47.3m is contracted through

rent-frees and fixed uplifts, the majority of which is already

straight-lined in the income statement under UK-adopted

international accounting standards. On-site developments and

refurbishments could add GBP35.6m, of which GBP10.7m is pre-let.

The ERV of available space is GBP12.1m. The balance of the

potential reversion of GBP7.3m comes from future reviews and

expiries less future fixed uplifts that are above current ERV.

LEASING, ASSET MANAGEMENT & INVESTMENT ACTIVITY

Lettings - GBP19.3m of new rent, 7.3% above ERV

Leasing activity in H1 2023 was the second strongest first half

since 2007. GBP19.3m of new rent was signed in 33 transactions

covering 228,000 sq ft, of which GBP11.3m (59%) were pre-lets. On

average, new leases were agreed 7.3% above December 2022 ERV, or

8.9% excluding short-term lettings at properties earmarked for

development, principally Holden House. This provides further

evidence that occupiers are prepared to pay a premium rent for the

right space which meets their requirements. The three key

transactions in the period were:

-- 25 Baker Street W1 - 106,100 sq ft pre-let to PIMCO two years ahead of completion;

-- The Featherstone Building EC1 - 31,100 sq ft letting to Buro Happold; and

-- One Oxford Street W1 - 22,200 sq ft letting to Uniqlo.

Our 'Furnished + Flexible' space continues to lease well, with

13 units (21,400 sq ft) leased in H1 for a combined rent of

GBP1.4m, on average 10.9% ahead of December 2022 ERV

Post-H1 lettings - GBP7.0m of new rent, 11.2% above ERV

Since the end of H1, occupier demand for our product has

continued to be strong. We have agreed a further GBP7.0m of

lettings. The two principal lettings in H2 are:

-- 25 Baker Street W1 - 49,200 sq ft pre-let to Moelis at a rent

of GBP4.9m, significantly above June 2023 ERV. The commercial

element is now 76% pre-let/sold; and

-- The Featherstone Building EC1 - 14,400 sq ft letting to Tide

at a rent of GBP1.0m, in line with June 2023 ERV. The building is

now 70% leased.

Leasing activity in 2023 to date

Let Performance against

Dec-22 ERV (%)

Area Income WAULT(1) yrs Open market Overall(2)

sq ft GBPm pa

-------- ------------ -----------

H1 2023 228,000 19.3 11.0 8.9 7.3

-------- --------- ------------- ------------ -----------

H2 to date 81,200 7.0 8.3 11.2 11.2

-------- --------- ------------- ------------ -----------

(1) Weighted average unexpired lease term (to break)

(2) Includes short-term lettings at properties earmarked for

redevelopment

Principal lettings in 2023 to date

Total annual Rent free

Property Tenant Area Rent rent Lease term Lease break equivalent

sq ft GBP psf GBPm Years Year Months

----------------- -------- --------- ---------------- ----------- ------------ ---------------

H1

25 Baker Street

W1 PIMCO 106,100 103.40 11.0 15 - 37

The

Featherstone 24, plus 12 if

Building EC1 Buro Happold 31,100 74.40 2.3 15 10(1) no break

One Oxford

Street W1 Uniqlo 22,200 Conf (2) Conf (2) 10 5 12

Jones Knowles 12, plus 12 if

Tea Building E1 Ritchie 8,100 60.00 0.5 10 5 no break

The White

Chapel 6, plus 1 if

Building E1 Comic Relief 5,000 61.90 0.3 5 3 no break

Middlesex House Zhonging Holding

W1 Group 4,200 81.00 0.3 3 1.5 -

----------------- -------- --------- ---------------- ----------- ------------ ---------------

Q3 to date

25 Baker Street 24, plus 9 if

W1 Moelis 49,200 100.00 4.9 15 10 no break

The

Featherstone 15, plus 11 if

Building EC1 Tide 14,400 71.00 1.0 10 5 no break

Tea Building E1 Gemba 7,100 63.80 0.5 5 - 8

----------------- -------- --------- ---------------- ----------- ------------ ---------------

(1) There is an additional break at year 5 on level eight

subject to a 12-month rent penalty payable by the tenant

(2) Uniqlo will pay a base rent (subject to annual indexation)

plus turnover top-up

Asset management progress - Extending income and capturing

reversion

Overall asset management activity in H1 2023, excluding two

short-term development-linked regears, totalled 195,700 sq ft, 18%

higher than in H1 2022 (166,400 sq ft). There were 15 rent reviews

totalling 145,400 sq ft which were settled on average 3.8% above

the December 2022 ERV.

Rent on lease renewals was 10.1% higher than December 2022 ERV

on average. Lease regears completed in line with the previous rent

but were 4.9% on average above December 2022 ERV. This excludes two

development-linked regears at Holden House where works are expected

to start on site in 2025.

In aggregate, 86% of breaks/expiries were retained or re-let

prior to the end of H1 excluding space taken back for projects and

disposals. The Group's WAULT (to break) is unchanged compared to

FY2022 at 6.4 years, rising to 7.2 years on a 'topped-up'

basis.

The EPRA vacancy rate reduced through H1 to 4.5% from 6.4% at

FY2022.

Asset management activity in H1 2023

Area Previous rent New rent Uplift New rent vs Dec-22 ERV %

'000 sq ft GBPm pa GBPm pa %

Rent reviews 145.4 8.5 9.0 5.8 3.8

Lease renewals 24.0 1.2 1.2 (1.0) 10.1

Lease regears(1) 26.3 1.5 1.5 0.0 4.9

------------ -------------- --------- ------- -------------------------

Total(1) 195.7 11.2 11.7 4.3 4.6

------------ -------------- --------- ------- -------------------------

(1) Excludes two development-linked regears

Investment activity

Investment activity in H1 2023 was quiet with disposals of

GBP65.6m and no acquisitions. The Group takes a proactive approach

to capital recycling with disposal proceeds largely reinvested into

development capex. Since the start of 2018 the Group has made

investment property disposals totalling almost GBP900m, compared to

acquisitions of over GBP500m and development capex of over GBP900m.

This is aligned to our strategy of keeping our prime recently

completed buildings for longer and disposing of buildings with less

repositioning potential.

Disposals

The principal disposal in H1 2023 was the sale of 19

Charterhouse Street EC1 for GBP53.6m, slightly ahead of December

2022 book value, reflecting a net initial yield of 4.6% and a

capital value of GBP850 psf. The other key disposal was 12-16

Fitzroy Street W1 for GBP6.7m, 4.8% below December 2022 book value,

which equates to a yield of 6.9% and a capital value of GBP775 psf.

Other smaller disposals totalled GBP5.3m.

Disposals in H1 2023

Area Total after costs Net yield Net rental income

Property Date sq ft GBPm % GBPm pa

19 Charterhouse Street EC1 Q1 63,200 53.6 4.6 2.6

12-16 Fitzroy Street W1 Q2 8,600 6.7 6.9 0.5

Other 2,200 5.3 - -

------- ------------------ ---------- ------------------

Total H1 2023 74,000 65.6 4.4 3.1

------- ------------------ ---------- ------------------

SUSTAINABILITY

We continue to make meaningful progress in a number of areas on

our journey to net zero carbon.

On our Scottish estate, following receipt of resolution to grant

planning for a c.100 acre 18.4MW solar park in 2022, planning

consent was formally granted in H1. On completion, we expect the

electricity generated, on an annualised basis, to be in excess of

40% of our London managed portfolio's usage. Providing our

occupiers with certifiable renewable electricity will lead to a

lower residual operational carbon footprint.

Implementation of our Intelligent Buildings programme, in

collaboration with Johnson Controls, has been completed at seven

buildings, 29% of our portfolio by area, and we are now starting to

receive integrated data on their performance. This will allow for

greater running efficiency, reducing both operational costs and our

carbon footprint.

Alongside this, our programme of occupier collaboration and

education continues to gather pace. Energy intensity across the

managed portfolio was 67 kWh/sqm in H1 compared to 123 kWh/sqm in

FY 2022. We are on track to again achieve our SBTi-verified targets

in 2023 for the fourth consecutive year.

As refurbishment projects complete, the EPC profile of our

portfolio continues to strengthen. At H1, 67.6% by ERV was rated

EPC A or B (including on-site projects), with a further 18.4% rated

EPC C. Our portfolio is 100% compliant with 2023 EPC legislation.

We have a schedule of works estimated at c.GBP100m to ensure we

remain compliant with evolving environmental legislation.

DEVELOPMENTS

On-site projects - 435,000 sq ft of best-in-class space (43%

pre-let/pre-sold)

At H1 2023, we were on site at two major projects totalling

435,000 sq ft which we currently expect will deliver a 17%

development profit and 5.9% yield on cost. These figures do not

include the impact of the post-H1 pre-let to Moelis at 25 Baker

Street W1 which was agreed significantly ahead of the June 2023

ERV. Our current embodied carbon estimates for both projects are in

line with or ahead of our 2025 target of <=600 kgCO(2)

e/sqm.

25 Baker Street W1 (298,000 sq ft)

This office-led multi-use scheme comprises 218,000 sq ft of

offices, 28,000 sq ft of retail and 52,000 sq ft of residential.

Against an increasingly supply-constrained backdrop for

best-in-class offices with strong sustainability characteristics,

the commercial element of 25 Baker Street is now 76%

pre-let/pre-sold (by floor area) to PIMCO and Moelis. The Courtyard

retail and Gloucester Place offices have been pre-sold to The

Portman Estate. There is also strong early interest in the private

residential units.

Construction is progressing on time and on budget. The private

residential building at 100 George Street has topped out and the

super-structure of 25 Baker Street has reached level 7. Since the

start of the year, a fixed price contract has been signed with Make

One for the 30 Gloucester Place element and we are finalising the

contract for the private residential element. The mid stage 5

embodied carbon estimate is c.600 kgCO(2) e/sqm.

Network W1 (137,000 sq ft)

Demolition works at this office-led project completed in H1 and

ground works have commenced. A fixed price construction contract

was signed with Kier prior to the end of H1. The scheme is

currently being delivered on a speculative basis, but with very

little competing office supply in Fitzrovia and the broader West

End, we are confident in the letting prospects for this high

quality building which is adjacent to 80 Charlotte Street W1 and

DL/78.Fitzrovia. The stage 4 embodied carbon estimate is c.530

kgCO(2) e/sqm.

Major developments pipeline

Project Total 25 Baker Street W1 Network W1

Completion H1 2025 H2 2025

Office (sq ft) 350,000 218,000 132,000

Residential (sq ft) 52,000 52,000 -

Retail (sq ft) 33,000 28,000 5,000

-------- ------------------- ----------------

Total area (sq ft) 435,000 298,000 137,000

-------- ------------------- ----------------

Est. future capex(1) (GBPm) 289 191 98

Total cost(2) (GBPm) 729 483 246

ERV (c.GBP psf) - 95 90

ERV (GBPm pa) 32.4 20.0(3) 12.4

Pre-let/sold area (sq ft) 137,100 137,100(4) -

Pre-let income (GBPm pa, net) 10.7 10.7 -

-------- ------------------- ----------------

Embodied carbon intensity (kgCO(2) e/sqm)(5) c.600 c.530

Target BREEAM rating Outstanding Outstanding

Target NABERS rating 4 Star or above 4 Star or above

Green Finance Elected Elected

-------- ------------------- ----------------

(1) As at 30 June 2023

(2) Comprising book value at commencement, capex, fees and

notional interest on land, voids and other costs. 25 Baker Street

W1 includes a profit share to freeholder The Portman Estate

(3) Long leasehold, net of 2.5% ground rent

(4) 19,000 sq ft courtyard retail and 12,000 sq ft Gloucester

Place offices sold to The Portman Estate, 106,100 sq ft pre-let to

PIMCO

(5) Embodied carbon intensity estimate as at stage 4 or 5

Longer-term pipeline - c.1.3m sq ft of space consented or under

appraisal

In addition to our on-site projects, our longer-term pipeline

extends to c.1.3m sq ft across four projects.

The next phase of projects are expected to commence in late 2024

or 2025 and total c.390,000 sq ft (at 100%):

-- 50 Baker Street W1 (c.240,000 sq ft; 50:50 JV with Lazari

Investments) - planning application submitted;

-- Holden House W1 (c.150,000 sq ft) - consented.

In the longer-term, Old Street Quarter EC1 (c.750,000 sq ft)

could commence from 2027 and 230 Blackfriars Road (c.200,000 sq ft)

from 2030.

Refurbishments

Derwent London has a strong and established reputation for both

development and refurbishment. We expect refurbishment projects

will comprise an increasing proportion of capital expenditure over

the coming years as we continue to upgrade the portfolio to meet

both ever higher occupier requirements and evolving EPC

legislation. Larger refurbishments likely to commence over the near

to medium term, on a rolling basis, include 1-2 Stephen Street W1,

20 Farringdon Road EC1 and Middlesex House W1. Through improving

the amenity offer and overall quality, we expect these projects

will deliver substantial uplifts in ERV.

We will continue to appraise sub-10,000 sq ft units for our

'Furnished + Flexible' product where we see strong occupier demand

at an attractive rental level. We currently have 128,300 sq ft of

'Furnished + Flexible' space across the portfolio, which includes

44,200 sq ft which is on-site or committed. This equates to 2.2% of

portfolio floorspace.

FINANCIAL REVIEW

Gross property and other income increased to GBP133.3m in the

first half of 2023 from GBP122.5m in H1 2022 (restated by GBP0.2m

for a change in the accounting treatment relating to Covid-19

incentives in past years). The increase in the first half was

mainly due to much higher service charge income of GBP25.0m when

compared with the GBP16.8m in H1 2022. Much of this came from the

exceptional level of energy costs recharged to tenants after the

price of energy on fixed price green tariffs increased almost

threefold during 2022, but was also impacted by general cost

inflation. Energy tariffs have since returned to a level close to

that in early 2022 and we expect some unwinding of this impact in

H2 2023.

Gross rental income was up by 3.9% to GBP105.9m with additional

income from the occupied offices at Soho Place W1 and The

Featherstone Building EC1, both of which reached practical

completion during H1 2022. However, the level of irrecoverable

property expenditure has risen by GBP4.7m from H1 2022 to H1 2023,

due to higher average vacancy rates combining with these unusually

high service charge levels. Recent lettings at The Featherstone

Building and the majority of the retail space at Soho Place (known

as 1 Oxford Street) together with lower energy tariffs from March

2023 should see this cost move down relative to rental income in H2

2023 but it is likely to remain above the levels generally seen in

recent years. These temporary service charge peaks also meant that

the minority of tenants who have capped service charges paid less

than the full cost; the associated cost borne by us was GBP1.0m in

the first half of 2023. Irrecoverable service charge overruns

totalling GBP1.1m also came through from 2022 in the first half of

2023.

Rent collection for office tenants has remained very strong in

the first half but an increased provision against retail, gyms and

hospitality occupiers, which together make up only 7% of portfolio

income, has led to impairment and bad debt charges totalling

GBP1.9m. This contrasts with a release of impairment provisions in

H1 2022 of GBP0.5m. These all combined to take net rental income to

GBP90.9m in H1 2023 from GBP94.0m (restated) in H1 2022. Net

property and other income moved by a similar amount from GBP96.6m

(restated) in H1 2022 to GBP93.3m in H1 2023.

Administrative expenses increased to GBP19.2m from GBP17.8m in

H1 2022 largely due to higher headcount, wage inflation and GBP1.2m

in relation to 2022 bonuses awarded to directors and executive

committee members. These are calculated and paid in March following

the year to which they relate unlike staff bonuses which are paid

in December.

The revaluation deficit in the income statement was GBP196.7m

relating to our wholly-owned investment property. There was a

further GBP2.6m deficit for the Group's owner-occupied offices at

25 Savile Row W1 plus a GBP4.8m deficit from our 50% share of the

50 Baker Street W1 joint venture. Together, these total GBP204.1m,

a considerable reduction on the GBP503.6m deficit seen in H2 2022

but contrasting strongly with the GBP72.9m (restated) surplus in H1

2022 when market conditions were more favourable.

Gross interest costs were GBP23.0m in H1 2023, marginally lower

than the GBP23.4m in H1 2022. However, capitalised interest of

GBP2.7m in the period was GBP2.0m lower than the GBP4.7m in H1

2022. This is a result of the completion of mature developments in

H1 2022 when the monthly rate of interest capitalisation is at its

peak. As a result, net finance costs were a little higher in H1

2023 at GBP20.3m compared to GBP18.7m in H1 2022.

The resulting IFRS loss before tax for the first half was

GBP143.1m which compares with the profit before tax seen in H1 2022

of GBP137.1m. EPRA earnings, which exclude fair value movements,

fell 7% to GBP55.6m from GBP59.7m (restated) a year earlier and

EPRA earnings per share (EPS) were down to 49.51p per share. In H1

2022, EPRA EPS were 53.22p (restated). As noted above, most of the

decline came from higher irrecoverable property costs.

EPRA like-for-like gross rental income, which excludes the

effect of acquisitions, disposals and developments, was up 1.4%

compared to H2 2022 while like-for-like net rental income was down

1.7% compared with H2 2022.

Irrecoverable property costs, increased overheads and the

impairment charges booked in H1 2023 have also increased our EPRA

cost ratio (including direct vacancy costs); it rose to 28.8% in H1

2023 against 23.3% in both H1 and the whole of 2022. Excluding

direct vacancy costs, it was 23.2% (H1 2022: 20.4%).

Capital expenditure in H1 2023 on wholly-owned investment

properties was GBP54.1m plus capitalised interest of GBP2.3m, lower

than the GBP69.2m and GBP4.4m, respectively, in H1 2022. In

addition, we incurred GBP6.8m plus capitalised interest of GBP0.4m

on our residential trading property at 25 Baker Street plus GBP1.9m

on the development costs to be transferred to The Portman Estate

upon completion. Pre-development design fees also continue at Old

Street Quarter EC1, totalling GBP3.0m in the first half. This

brought the balance of prepaid development expenditure to GBP12.1m,

in advance of our acquisition of the site no earlier than 2027.

The Group's total return over the six-month period, including

the 54.5p dividend paid, was -3.7% compared to 3.0% for H1 2022 and

-6.3% for the full year 2022. The property valuation decline has

also taken the Group's EPRA Net Tangible Asset value per share down

5.2% to 3,444p at 30 June 2023 from 3,632p at 31 December 2022. As

at 30 June 2022, it was 4,023p. As interest rates continued to rise

across the curve, the mark-to-market adjustment for our fixed rate

debt has now increased to GBP190.6m from GBP159.5m in December

2022. As a result, EPRA Net Disposal Value was 3,609p at 30 June

2023, a smaller decline of 4.2% from the 3,768p reported as at 31

December 2022.

Financing and net debt

Lending conditions in the office real estate market have

deteriorated quite sharply in the last few months exacerbated by

higher rates across the curve. As a result, the market is seeing

increasing margins with funders becoming increasingly selective.

Derwent London is in a relatively strong position with low

leverage, 98% of our debt at fixed rates as at 30 June 2023 and

with an additional GBP75m forward start interest rate swap at 1.36%

out to April 2025. Our debt has a weighted average term of 5.6

years, our revolving bank facilities (which are substantially

undrawn) extend to Q4 2026 and Q4 2027, respectively, and we have

only one loan expiry of GBP83m prior to June 2025. That is a

secured loan at 3.99% which falls due in October 2024 and we have

held early and positive discussions to refinance it. The cost of

refinancing would currently be a little over 6% but may vary by the

time we transact.

As a result of property disposals early in the year, our debt

levels have barely increased in H1. Net debt at 30 June 2023 was

GBP1.27bn, only marginally higher than GBP1.26bn at the 2022 year

end and some way below the GBP1.36bn reported at 30 June 2022.

Total borrowings were GBP1.28bn at 30 June 2023, again only just

above the GBP1.25bn in December 2022.

EPRA loan-to-value ratio, which takes account of the lower

property valuations and which also includes a net payables amount

of GBP65.9m in addition to net debt, increased to 25.0% at 30 June

2023 (H1 2022: 23.7% and 23.9% at 31 December 2022).

As at 30 June 2023, the Group had GBP562m of unrestricted cash

and undrawn facilities (31 December 2022: GBP577m).

Interest cover remains very strong at 4.1 times (2022: 4.2

times). Our interest cover debt covenant is at 1.45 times so there

remains very substantial headroom. The weighted average interest

cost was 3.19% as at 30 June 2023 (31 December 2022: 3.14%) on a

cash basis.

The Group's balance sheet strength and debt metrics helped

maintain an unchanged issuer default credit rating from Fitch of

BBB+ in May 2023 with a stable outlook and a senior unsecured

rating of A-.

Qualifying expenditure under our Green Finance Framework

The qualifying expenditure as at 30 June 2023 for each Eligible

Green Project (EGP) is set out in the table below.

Subsequent spend

Look back spend Q4 2019 - FY 2022 2023 Spend Disposals Cumulative Spend

EGP GBPm GBPm GBPm GBPm GBPm

---------------- ------------------ ----------- ---------- -----------------

80 Charlotte Street W1 185.6 52.5 - - 238.1

Soho Place W1 66.3 192.8 (0.9) (34.8) 223.4

The Featherstone Building EC1 29.1 67.6 0.5 - 97.2

25 Baker Street W1 26.5 42.3 35.8 - 104.6

Network W1 14.7 - 9.1 - 23.8

---------------- ------------------ ----------- ---------- -----------------

322.2 355.2 44.5 (34.8) 687.1

---------------- ------------------ ----------- ---------- -----------------

Network W1 commenced on site in 2022 and was elected as an EGP

in 2023. As per our Green Finance Framework, costs incurred on this

development in the periods before election qualify as 'green'

expenditure, and have been included in the 'look-back' spend.

The cumulative qualifying expenditure on EGP's at 30 June 2022

was GBP687.1m, with GBP44.5m of this being incurred in H1 2023.

At 30 June 2023, total drawn borrowings from Green Financing

Transactions were GBP372.5m. This includes GBP22.5m from the green

tranche of the Group's RCF and the GBP350m Green Bonds.

Tax and dividend

We were advised by HMRC in July 2023 that we have been assigned

the lowest risk status across all tax categories following their

business risk review. This recognises the responsible approach to

tax taken by the Group. Our statement of tax principles is

available on the Derwent London website.

After considering our dividend cover and various stakeholder

obligations, we have increased the interim dividend by 2.1% to

24.5p per share from 24.0p last year. It will be paid as a PID on

13 October 2023 to shareholders on the register as at 8 September

2023.

RISK MANAGEMENT AND INTERNAL CONTROLS

We have identified certain principal risks and uncertainties

that could prevent the Group from achieving its strategic

objectives and have assessed how these risks could best be

mitigated, where possible, through a combination of internal

controls, risk management and the purchase of insurance cover.

The principal risks and uncertainties facing the Group for the

remaining six months of the financial year are set out on the

following pages with the potential impact and the mitigating

actions and controls in place. These risks are reviewed and updated

on a regular basis and were last formally assessed by the Board on

8 August 2023. The Group's approach to the management and

mitigation of these risks is included in the 2022 Report &

Accounts. The Board has confirmed that its risk appetite and key

risk indicators remain appropriate.

There has been no significant change to the Group's principal

risks and uncertainties since the publication of our 2022 Report

& Accounts. The last significant change was in August 2022 with

the reinstatement of 'a fall in property values'. There continues

to be a heightened risk to property values over the next six

months.

We are operating in a changed interest rate environment

following a long period of historically low rates. Conditions in

the debt markets have deteriorated with central banks raising rates

in an effort to deal with inflation. With 98% of borrowings at

fixed rates, the Group has minimal current exposure to market

interest rates. Our average interest rate is 3.19% on a cash basis.

Our next refinancing exposure arises in October 2024 on the GBP83m

secured debt currently paying a coupon of 3.99%. We do not consider

the cost of borrowing and the availability of funds to be a

principal risk for the Group during the next six months. In these

turbulent markets, we are helped by our high level of refinancing

activity in previous years, unrestricted cash and undrawn

facilities totalling GBP562m and our strong banking

relationships.

As UK economic growth slows, there is an increasing risk of

recession. A recession is unlikely to have a material impact on the

Group or its tenants in the short-term. However, in the medium to

long-term, a recession could lead to some of our occupiers facing a

more challenging financial situation which could result in Derwent

London having higher vacancy rates and reduced rent receipts. The

occupiers deemed to be most at risk are those which rely heavily on

consumer spending such as retail and hospitality, which make up

only 7% of the Group's income.

The principal risks and uncertainties facing the Group for the

remaining six months of the financial year are set out on the

following pages with the potential impact and the mitigating

actions and controls in place.

Strategic risks

The Group's business model and/or strategy does not create the

anticipated shareholder value or fails to meet investors' and other

stakeholders' expectations.

Risk, effect and progression Controls and mitigation

--------------------------------------------------------- -----------------------------------------------------------

1. Failure to implement the Group's strategy

The Group's success depends on implementing its strategy * The Board maintains a formal schedule of matters

and responding appropriately to internal which are reserved solely for its approval. These

and external factors including changing work practices, matters include decisions relating to the Group's

occupational demand, economic and strategy, capital structure, financing, any major

property cycles. The London office market has generally property acquisition or disposal, the risk appetite

been cyclical in recent decades, with of the Group and the authorisation of capital

strong growth followed by sharp economic downturns, expenditure above the delegated authority limits.

precipitated by rising interest rates.

The impact of these cycles is dependent on the quality

and location of the Group's portfolio. * Frequent strategic and financial reviews. An annual

strategic review and budget is prepared for Board

Should the Group fail to respond and adapt to such approval alongside two-year rolling forecasts which

cycles or execute the projects that underpin are prepared three times a year.

its strategy, it may have a negative impact on the

Group's expected growth and financial performance.

* Assess and monitor the financial strength of

potential and existing occupiers. The Group's diver

se

and high quality occupier base provides resilience

against occupier default.

* Maintain income from properties until development

commences and have an ongoing strategy to extend

income through lease renewals and regears.

Developments are de-risked through pre-lets.

* Maintain sufficient headroom for all the key ratios

and financial covenants, with a particular focus on

interest cover.

* Develop properties in central locations where there

is good potential for future demand, such as near t

he

Elizabeth Line. We do not have any properties in th

e

City Core or Docklands.

Financial risks

The main financial risk is that the Group becomes unable to meet

its financial obligations, which is not currently a principal risk.

Financial risks can arise from movements in the financial markets

in which we operate and inefficient management of capital

resources.

Risk, effect and progression Controls and mitigation

------------------------------------------------------- ------------------------------------------------------------

2. Risk of occupiers defaulting or occupier failure

The majority of the Group's revenues comprise rent * Assess and monitor the financial strength of

received from our occupiers and any deterioration potential and existing occupiers. The Group's diverse

in their businesses and/or profitability could in turn and high quality occupier base provides resilience

adversely affect the Group's rental against occupier default.

income or increase the Group's bad debts and/or number

of lease terminations.

* Focus on letting our buildings to large and

In the event that some of our occupiers went into established businesses where the risk of default is

default, we could incur impairments and lower.

write-offs of IFRS 16 lease incentive receivable

balances which arise from the accounting

requirement to spread any rent-free incentives given to * Active in house rent collection, with regular reports

an occupier over the respective lease to the Executive Directors on day 1, 7, 14 and 21.

term, in addition to a loss of rental income.

* Ongoing dialogue is maintained with occupiers to

understand their concerns and requirements.

* Rent deposits are held where considered appropriate.

3. Income decline

Changes in macroeconomic factors may adversely affect * The Credit Committee receives detailed reviews of all

London's overall office market. The prospective occupiers and ensures a variety of

Group is exposed to external factors which are outside occupiers and that focus is on large and established

the Group's control, such as future businesses where the risk of default is lower.

demand for office space, the 'cost of living' crisis,

the 'grey' market in office space (i.e.

occupier controlled vacant space), weaknesses in retail * A 'tenants on watch' register is maintained and

and hospitality businesses, increase regularly reviewed by the Executive Directors and the

in hybrid working, a recession, and subsequent rise in Board.

unemployment and/or interest rates.

Such macroeconomic conditions lead to a general * Ongoing dialogue is maintained with occupiers to

property market contraction, a decline in understand their concerns and requirements.

rental values and Group income, which could impact on

property valuation yields.

* The Group's low loan-to-value ratio and high interest

cover ratio reduces the likelihood that falls in

property values have a significant impact on our

business continuity.

4. Fall in property values

The potential adverse impact of the economic and * The impact of yield changes is considered when

political environment on property yields potential projects are appraised.

has heightened the risk of a fall in property values.

A fall in property values will have an impact on the * The impact of yield changes on the Group's financial

Group's net asset value and gearing levels. covenants and performance is monitored regularly and

subject to sensitivity analysis to ensure that

adequate headroom is preserved.

* The Group's mainly unsecured financing makes

management of our financial covenants more

straightforward.

* The Group's low loan-to-value ratio and high interest

cover ratio reduces the likelihood that falls in

property values have a significant impact on our

business continuity.

Operational risks

The Group suffers either a financial loss or adverse

consequences due to processes being inadequate or not operating

correctly, human factors or other external events.

Risk, effect and progression Controls and mitigation

------------------------------------------------------ ------------------------------------------------------------------

5. Risks arising from our development activities

A. Reduced development returns

Returns from the Group's developments may be * Our procurement process includes the use of highly

adversely impacted due to: regarded firms of quantity surveyors and is designed

* delays on site; to minimise cost uncertainty.

* increased construction costs; * Development costs are benchmarked to ensure that the

Group obtains competitive pricing and, where

appropriate, fixed price contracts are negotiated.

* material and labour shortages; and

* Post-completion reviews are carried out for all major

* adverse letting conditions. developments to ensure that improvements to the

Group's procedures are identified, implemented and

lessons learned.

Any significant delay in completing the development

projects may result in financial penalties * Investment appraisals are prepared and sensitivity

or a reduction in the Group's targeted financial analysis is undertaken to judge whether an adequate

returns. return is made in all likely circumstances.

* The Group's pre-letting strategy reduces or removes

the letting risk of the development as soon as

possible.

B. 'On-site' risk

Risks that can materialise whilst on site, include: * Prior to construction beginning on site, we conduct

thorough site investigations and surveys to reduce

* unexpected ground conditions the risk of unidentified issues, including

investigating the building's history and adjacent

buildings/sites.

* deleterious material (including asbestos)

* Adequately appraise investments prior to starting

* unidentified issues with the existing building work on site, including through: (1) the benchmarking

of development costs; and (2) following a procurement

process that is properly designed (to minimise

* activity in adjacent sites/buildings uncertainty around costs) and that includes the use

of highly regarded quantity surveyors.

'On-site' risks can cause development projects to be * Regular monitoring of our contractors' cash flows.

significantly delayed and could lead

to penalties and a deferral of rental income.

'On-site' risks typically arise if inadequate * Frequent meetings with key contractors and

contingencies, investment appraisals, or site subcontractors to review their work programme and

investigations have been conducted prior to maintain strong relationships.

starting work on site.

Risk of project delays and/or cost overruns caused * Off-site inspection of key components to ensure they

by unidentified issues. have been completed to the requisite quality.

* Monthly reviews of supply chain issues for each of

our major projects, including in respect to potential

labour shortages.

C. Contractor/subcontractor default

There have been ongoing issues within the * We use known 'Tier 1' contractors with whom we have

construction industry in respect of the level of established working relationships and regular work

risk and narrow profit margins being accepted by with tried and tested sub-contractors.

contractors.

Returns from the Group's developments are reduced due * Regular monitoring of our contractors, including

to delays and cost increases caused their project cash flows, is carried out.

by either a main contractor or major subcontractor

defaulting during the project.

* Key construction packages are acquired early in the

project's life to reduce the risks associated with

later default.

* The financial standing of our main contractors is

reviewed prior to awarding the project contract.

* Our main contractors are responsible, and assume the

immediate risk, for subcontractor default.

* Payments to contractors are in place to incentivise

the achievement of project timescales, with damages

agreed in the event of delay/cost overruns.

* Regular on-site supervision by a dedicated Project

Manager who monitors contractor performance and

identifies problems at an early stage, thereby

enabling remedial action to be taken.

* Contractors are paid promptly and are encouraged to

pay subcontractors promptly. In addition, we

externally publish our payment terms.

6. Risk of business interruption

A. Cyber-attack on our IT systems

The Group may be subject to a cyber attack that * The Group's Business Continuity Plan and cyber

results in it being unable to use its information security incident response procedures are regularly

systems and/or losing data. reviewed and tested.

Such an attack could severely restrict the ability of

the Group to operate, lead to an increase * Independent internal and external

in costs and/or require a significant diversion of penetration/vulnerability tests are regularly

management time. conducted to assess the effectiveness of the Group's

security.

* Multi-Factor Authentication is in place for access to

our systems.

* The Group's data is regularly backed up and

replicated off-site.

* Our IT systems are protected by anti-virus software,

24/7/365 threat hunting, security incident detection

and response, security anomaly detection and

firewalls that are frequently updated.

* Frequent staff awareness and training programmes.

* Security measures are regularly reviewed by the IT

team.

B. Cyber-attack on our buildings

The Group is exposed to cyber attacks on its * The Group's Business Continuity Plan and cyber

properties which may result in data breaches security incident response procedures are regularly

or significant disruption to IT-enabled occupier reviewed and tested.

services.

A major cyber attack against the Group or its * Physical segregation between the building's core IT

properties could negatively impact the Group's infrastructure and occupiers' corporate IT networks.

business, reputation and operating results.

* Physical segregation of IT infrastructure between

buildings across the portfolio.

* Frequent staff awareness and training programmes.

Building Managers are included in any cyber security

awareness training and phishing simulations.

* Sophos Rapid Response team provide unlimited support

to our Cyber Incident Response Team in the event of a

cyber attack.

C. Significant business interruption (for example

pandemic, terrorism-related event or other

business interruption)

Major incidents may significantly interrupt the * Fire protection and access/security procedures are in

Group's business, its occupiers and/or supply place at all of our managed properties. At least

chain. Such incidents could be caused by a wide range annually, a fire risk assessment and health and

of events such as fire, natural catastrophes, safety inspection are performed for each property in

cyber events, terrorism, pandemic outbreak, material our managed portfolio.

supply chain failures and geopolitical

factors.

* The Group has comprehensive business continuity and

This could result in issues such as being unable to incident management procedures both at Group level

access or operate the Group's properties, and for each of our managed buildings which are

occupier failures or reduced rental income, share regularly reviewed and tested.

price volatility or loss of key suppliers.

* Continuous review of property health and safety

statutory compliance.

* Comprehensive property damage and business

interruption insurance which includes terrorism.

* Robust security at our buildings, including CCTV and

access controls.

* Most of our employees are capable of working remotely

and have the necessary IT resources.

7. Reputational damage

The Group's reputation could be damaged, for example, * Social media channels are monitored, and the Group

through unauthorised or inaccurate media retains the services of an external PR agency to

coverage, unethical practices or behaviours by the monitor external media sources.

Group's executives, or failure to comply

with relevant legislation.

* The Executive Directors and Board receive ad hoc

This could lead to a material adverse effect on the social media reports. Our social media strategy is

Group's operating performance and overall approved by the Executive Directors.

financial position. Our strong culture, low overall

risk tolerance and established procedures

and policies mitigate against the risk of internal * Close involvement of senior management in day-to-day

wrongdoing. operations and established procedures for approving

all external announcements.

* All new members of staff attend an induction

programme and are issued with our Group staff

handbook.

* A Group whistleblowing system is in place for staff

to report wrongdoing anonymously.

* Ongoing engagement with local communities in areas

where the Group operates.

* Staff training and awareness programmes.

8. Our resilience to climate change

If the Group fails to respond appropriately, and * The Board and Executive Directors receive regular

sufficiently, to climate-related risks or updates and presentations on environmental and

fails to benefit from the potential opportunities. sustainability performance and management matters as

well as progress against our pathway to becoming net

This could lead to reputational damage, loss of zero carbon by 2030.

income and/or property values. In addition,

there is a risk that the cost of construction

materials and providing energy, water and other * The Sustainability Committee monitors our performance

services to occupiers will rise. and management controls.

* Strong team led by an experienced Head of

Sustainability.

* Production of an annual Responsibility Report with

key data and performance points which are externally

assured.

* In 2017 we adopted independently verified

science-based targets which have been approved by the

Science-Based Targets initiative (SBTi) and will be

updated in 2023 in line with changing methodologies

and guidance.

* Undertake periodic multi-scenario climate risk

assessments (physical and transition risks).

9. Non-compliance with regulation

A. Non-compliance with health and safety legislation

An incident or breach of health and safety

legislation, including in respect of fire safety, * All our properties have the relevant health, safety

water hygiene, asbestos exposure, building safety, and fire management procedures in place, which are

construction design management etc. reviewed annually.

A major health and safety incident could cause

significant business interruption for the Group, * The Group has a qualified Health and Safety team

a risk to life, Company or Director fines or whose performance is monitored and managed by the

imprisonment, reputational damage, and/or loss Health and Safety Committee.

of our licences to operate.

* Health and safety statutory compliance within our

managed portfolio is managed and monitored using

RiskWise, a software compliance platform. This is

supported by a programme of annual property health

checks (internal audits).

* The Managed Portfolio Health and Safety team, with

the support of internal and external stakeholders,

support our Portfolio and Building Managers to ensure

statutory compliance.

* The Construction Health and Safety team, with the

support of internal and external stakeholders, ensure

our Construction (Design and Management) Regulations

(CDM) client duties are executed and monitored and

they will review health, safety and welfare on each

'major' construction site on a monthly basis, with

periodic visits to 'small works' construction

projects also.

* The Board, Risk Committee and Executive Directors

receive frequent updates and presentations on key

health and safety matters, including both physical

and mental health.

B. Other regulatory non-compliance

The Group breaches any of the legislation that forms * The Board and Risk Committee receive regular reports

the regulatory framework within which prepared by the Group's legal advisers identifying

the Group operates. upcoming legislative/regulatory changes. External

advice is taken on any new legislation, if required.

The Group's cost base could increase and management

time could be diverted. This could lead

to damage to our reputation and/or loss of our * Managing our properties to ensure they are compliant

licence to operate. with the Minimum Energy Efficiency Standards (MEES)

for Energy Performance Certificates (EPCs).

* A Group whistleblowing system ('Speak-up') for staff

is maintained to report wrongdoing anonymously.

* Ongoing staff training and awareness programmes.

* Group policies and procedures dealing with all key

legislation are available on the Group's intranet.

* Quarterly review of our anti-bribery and corruption

procedures by the Risk Committee.

10. Financial instruments - risk management

The Group is exposed through its operations to the following

financial risks:

-- credit risk;

-- market risk; and

-- liquidity risk.

In common with other businesses, the Group is exposed to risks

that arise from its use of financial instruments. The following

describes the Group's objectives, policies and processes for

managing those risks and the methods used to measure them. Further

quantitative information in respect of these risks is presented

throughout these financial statements.

There have been no substantive changes in the Group's exposure

to financial instrument risks, its objectives, policies and

processes for managing those risks or the methods used to measure

them from previous years. The Group's EPRA loan-to-value ratio has

increased to 25.0% as at 30 June 2023.

Principal financial instruments

The principal financial instruments used by the Group, from

which financial instrument risk arises, are trade receivables,

accrued income arising from the spreading of lease incentives, cash

at bank, trade and other payables, floating rate bank loans, fixed

rate loans and private placement notes, secured and unsecured bonds

and interest rate swaps.

General objectives, policies and processes

The Board has overall responsibility for the determination of

the Group's risk management objectives and policies and, whilst

retaining ultimate responsibility for them, it has delegated the

authority to executive management for designing and operating

processes that ensure the effective implementation of the

objectives and policies.

The overall objective of the Board is to set policies that seek

to reduce risk as far as possible without unduly affecting the

Group's flexibility and its ability to maximise returns. Further

details regarding these policies are set out below:

Credit risk

Credit risk is the risk of financial loss to the Group if a

customer or counterparty to a financial instrument fails to meet

its contractual obligations. The Group is mainly exposed to credit

risk from lease contracts in relation to its property portfolio. It

is Group policy to assess the credit risk of new tenants before

entering into such contracts. The Board has a Credit Committee

which assesses each new tenant before a new lease is signed. The

review includes the latest sets of financial statements, external

ratings when available and, in some cases, forecast information and

bank or trade references. The covenant strength of each tenant is

determined based on this review and, if appropriate, a deposit or a

guarantee is obtained. The Committee also reviews existing tenant

covenants from time to time.

Impairment calculations have been carried out on trade

receivables and accrued income arising as a result of the spreading

of lease incentives using the forward-looking, simplified approach

to the expected credit loss model within IFRS 9. In addition, the

Credit Committee has reviewed its register of tenants at higher

risk, particularly in the retail or hospitality sectors, those in

administration or CVA and the largest tenants by size with the

remaining occupiers considered on a sector by sector basis.

As the Group operates predominantly in central London, it is

subject to some geographical concentration risk. However, this is

mitigated by the wide range of tenants from a broad spectrum of

business sectors.

Credit risk also arises from cash and cash equivalents and

deposits with banks and financial institutions. For banks and

financial institutions, only independently rated parties with a

minimum rating of investment grade are accepted. This risk is also

reduced by the short periods that money is on deposit at any one

time.

The carrying amount of financial assets recorded in the

financial statements represents the Group's maximum exposure to

credit risk without taking account of the value of any collateral

obtained.

Market risk

Market risk is the risk that the fair value or future cash flows

of a financial instrument will fluctuate due to changes in market

prices. Market risk arises for the Group from its use of variable

interest bearing instruments (interest rate risk).

It is currently Group policy that generally between 60% and 85%

of external Group borrowings (excluding finance lease payables) are

at fixed rates. Where the Group wishes to vary the amount of

external fixed rate debt it holds (subject to it being generally

between 60% and 85% of expected Group borrowings, as noted above),

the Group makes use of interest rate derivatives to achieve the

desired interest rate profile. Although the Board accepts that this