TIDMDWF

RNS Number : 6982L

Inflexion Private Equity Partners

07 September 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT

JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

7 September 2023

Disclosure under Rule 2.10(a) of the Code in respect of the

RECOMMED CASH ACQUISITION

OF

DWF GROUP PLC

BY

AQUILA BIDCO LIMITED

a newly incorporated wholly-owned subsidiary of funds advised

by

INFLEXION PRIVATE EQUITY PARTNERS LLP

to be implemented by means of a Scheme of Arrangement

under Part 26 of the Companies Act 2006

Additional Irrevocable Undertaking Received by Aquila Bidco

Limited

On 21 July 2023, the boards of Aquila Bidco Limited ("Bidco"), a

newly incorporated wholly-owned subsidiary of funds advised by

Inflexion Private Equity Partners LLP ("Inflexion") and DWF Group

plc ("DWF") , made an announcement pursuant to Rule 2.7 of the

Takeover Code that they had reached agreement on the terms and

conditions of a recommended cash offer by Bidco to acquire the

entire issued and to be issued ordinary share capital of DWF (the

"Acquisition") . A circular (the "Scheme Document") in relation to

the scheme of arrangement to effect the Acquisition (the " Scheme

") was published on 15 August 2023.

Capitalised terms used in this announcement (the " Announcement

"), unless otherwise defined, shall have the meanings given to them

in the Scheme Document.

Additional Irrevocable Undertaking

Bidco hereby announces that it has today received an irrevocable

undertaking from Pangaea Three-B, LP, as beneficial owner to funds

managed by Cartesian Capital Group, to direct the vote in favour of

the Scheme at the Other Shareholder Court Meeting and the

Resolutions(s) to be proposed at the General Meeting in respect of

18,214,338 DWF Shares, representing approximately 5.3 per cent. of

the issued share capital of DWF and 11.3 per cent. of the Scheme

Shares entitled to vote at the Other Shareholder Court Meeting as

at 1 September 2023 (being the last practicable Business Day prior

to the date of this Announcement on which the share register of DWF

has been verified for the purpose of the two different classes of

DWF Shareholders).

Bidco has, therefore, received irrevocable undertakings in

respect of a total of 160,240,787 DWF Shares representing, in

aggregate, approximately 78.5 per cent. of Scheme Shares entitled

to vote at the Employee Shareholder Court Meeting, 11.3 per cent.

of Scheme Shares entitled to vote at the Other Shareholder Court

Meeting and 46.9 per cent. of the ordinary share capital of DWF, as

at 1 September 2023.

The irrevocable undertaking will only cease to be binding

if:

(i) the required number of shareholders in accordance with the

terms of the Acquisition do not vote in favour of the Scheme at the

General Meeting or the Court Meetings;

(ii) the Scheme lapses or is withdrawn in accordance with its terms;

(iii) the Acquisition has not become effective by 15 December 2023;

(iv) the date on which any competing offer for the entire issued

and to be issued share capital of DWF is declared unconditional (if

implemented by way of a Takeover Offer) or, if proceeding by way of

a scheme of arrangement, becomes effective; or

(v) if any third party announces a firm intention to make a

general offer pursuant to the Takeover Code for the entire issued

and to be issued ordinary share capital of DWF (other than any such

share capital acquired or agreed to be acquired by such third party

at the time of making such proposal) on terms which in the

reasonable opinion of Rothschild & Co. represent an improvement

in the terms of the offer.

Enquiries:

Bidco and Inflexion +44 7767 481163

Sarah Gestetner

Rothschild & Co +44 20 7280 5000

(Financial Adviser to Bidco and Inflexion)

Ravi Gupta

Martin Tomaszewski

Harry Thompson

Disclaimers

N.M. Rothschild & Sons Limited ("Rothschild & Co"),

which is authorised and regulated by the FCA in the United Kingdom,

is acting exclusively as financial adviser to Bidco and Inflexion

and for no one else in connection with the matters referred to in

this Announcement and will not be responsible to anyone other than

Bidco and Inflexion for providing the protections afforded to

clients of Rothschild & Co, nor for providing advice in

relation to the Acquisition or any other matters referred to in

this Announcement. Neither Rothschild & Co nor any of its

affiliates (nor their respective directors, officers, employees or

agents) owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Rothschild & Co in connection with this Announcement, any

statement contained in this Announcement, the Acquisition or

otherwise. No representation or warranty, express or implied, is

made by Rothschild & Co as to the contents of this

Announcement.

Further information

This Announcement is for information purposes only and is not

intended to and does not constitute, or form part of, an offer to

sell or an invitation to purchase any securities or the

solicitation of an offer to buy, otherwise acquire, subscribe for,

sell or otherwise dispose of any securities, pursuant to the

Acquisition or otherwise, nor shall there be any purchase, sale,

issuance or exchange of securities or such solicitation in any

jurisdiction in which such offer, solicitation, sale, issuance or

exchange would be unlawful prior to the registration or

qualification under the laws of such jurisdiction. The Acquisition

will be made solely by means of the Scheme Document published and

posted to DWF Shareholders on 15 August 2023 which contains the

full terms and Conditions of the Acquisition, including details of

how to vote in respect of the Acquisition.

This Announcement has been prepared in connection with proposals

in relation to a scheme of arrangement pursuant to and for the

purpose of complying with English law, the Listing Rules and the

Takeover Code and information disclosed may not be the same as that

which would have been disclosed if this Announcement had been

prepared in accordance with the laws of jurisdictions outside

England. Nothing in this Announcement should be relied on for any

other purpose.

This Announcement contains inside information in relation to DWF

for the purposes of Article 7 of the Market Abuse Regulation. Upon

publication of this Announcement, this information is now

considered to be in the public domain.

Overseas jurisdictions

This Announcement has been prepared in accordance with and for

the purpose of complying with the laws of England and Wales, the

Takeover Code, the Listing Rules, and the Market Abuse Regulation

(EU 596/2014) (which is part of UK law by virtue of the European

Union (Withdrawal) Act 2018) and the Disclosure Guidance and

Transparency Rules and information disclosed may not be the same as

that which would have been disclosed if this Announcement had been

prepared in accordance with the laws of jurisdictions outside

England and Wales.

The release, publication or distribution of this Announcement in

certain jurisdictions may be restricted by law. Persons who are not

resident in the United Kingdom or who are subject to the laws of

other jurisdictions should inform themselves of, and observe, any

applicable requirements. Further details in relation to Overseas

Shareholders are contained in the Scheme Document. Any failure to

comply with the applicable restrictions may constitute a violation

of the securities laws of any such jurisdiction. To the fullest

extent permitted by applicable law, the companies and persons

involved in the Acquisition disclaim any responsibility or

liability for the violation of such restrictions by any person.

Unless otherwise determined by Bidco or required by the Takeover

Code, and permitted by applicable law and regulation, the

Acquisition shall not be made available, directly or indirectly,

in, into or from a Restricted Jurisdiction where to do so would

violate the laws in that jurisdiction and no person may vote in

favour of the Scheme by any such means from within a Restricted

Jurisdiction or any other jurisdiction if to do so would constitute

a violation of the laws of that jurisdiction. Accordingly, copies

of this Announcement and all documents relating to the Acquisition

are not being, and must not be, directly or indirectly, mailed or

otherwise forwarded, distributed or sent in, into or from a

Restricted Jurisdiction where to do so would violate the laws in

that jurisdiction, and persons receiving this Announcement and all

documents relating to the Acquisition (including custodians,

nominees and trustees) must not mail or otherwise distribute or

send them in, into or from such jurisdictions where to do so would

violate the laws in that jurisdiction.

The availability of the Acquisition to DWF Shareholders who are

not resident in the United Kingdom may be affected by the laws of

the relevant jurisdictions in which they are resident. Persons who

are not resident in the United Kingdom should inform themselves of,

and observe, any applicable requirements. To the fullest extent

permitted by applicable law, the companies and persons involved in

the Acquisition disclaim any responsibility or liability for the

violation of such restrictions by any person.

The Acquisition is subject to English law and the jurisdiction

of the Court and to the applicable requirements of the Takeover

Code, the Panel, the London Stock Exchange, the FCA, the Listing

Rules and the Registrar of Companies.

Disclosure requirements of the Takeover Code

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in 1 per cent. or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the offer period and, if later, following the

announcement in which any securities exchange offeror is first

identified. An Opening Position Disclosure must contain details of

the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s). An Opening

Position Disclosure by a person to whom Rule 8.3(a) applies must be

made by no later than 3.30 p.m. (London time) on the 10th business

day following the commencement of the offer period and, if

appropriate, by no later than 3.30 p.m. (London time) on the 10th

business day following the announcement in which any securities

exchange offeror is first identified. Relevant persons who deal in

the relevant securities of the offeree company or of a securities

exchange offeror prior to the deadline for making an Opening

Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange

offeror(s), save to the extent that these details have previously

been disclosed under Rule 8. A Dealing Disclosure by a person to

whom Rule 8.3(b) applies must be made by no later than 3.30 p.m.

(London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk ,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on website

A copy of this Announcement and the documents required to be

published pursuant to Rule 26.1 of the Takeover Code will be

available, free of charge, subject to certain restrictions relating

to persons resident in Restricted Jurisdictions on DWF's website at

https://dwfgroup.com/en/investors/possible-offer-for-dwf-group-plc

and Bidco's website at www.dwfoffer.com by no later than 12.00 p.m.

on the Business Day following this Announcement. For the avoidance

of doubt, neither the content of DWF's website nor Bidco's website

is incorporated into, or forms part of, this Announcement.

Rounding

Certain figures included in this Announcement have been

subjected to rounding adjustments.

General

If you are in any doubt about the contents of this Announcement

or the action you should take, you are recommended to seek your own

independent financial advice immediately from your stockbroker,

bank manager, solicitor or independent financial adviser duly

authorised under FSMA if you are resident in the United Kingdom or,

if not, from another appropriate authorised independent financial

adviser.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASNXESPDEEA

(END) Dow Jones Newswires

September 07, 2023 02:00 ET (06:00 GMT)

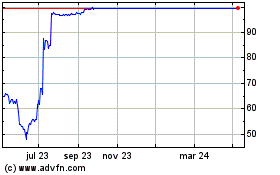

Dwf (LSE:DWF)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Dwf (LSE:DWF)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024