TIDMECO

RNS Number : 0777K

Eco (Atlantic) Oil and Gas Ltd.

19 December 2022

19 December 2022

ECO (ATLANTIC) OIL & GAS LTD.

("Eco," "Eco Atlantic," "Company," or together with its

subsidiaries, the "Group")

Receipt of Government Approval and Closing of the Acquisition of

Additional Interest in Block 3B/4B, South Africa

Eco Atlantic (AIM: ECO, TSX -- V: EOG) , the oil and gas

exploration company focused on the offshore Atlantic Margins,

announces an update, further to its announcement of 27 June 2022,

in relation to the acquisition by its wholly owned subsidiary

Azinam Limited ("Azinam ") of an additional 6.25% Participating

Interest in Block 3B/4B, offshore South Africa from the Lunn Family

Trust (the "Vendor"), one of the shareholders of Ricocure

(Proprietary) Limited ("Ricocure") (the " Acquisition ") . Eco is

pleased to confirm that it has now received the requisite

regulatory approvals from the Department of Mineral Resources and

Energy ("DMRE") of South Africa and the Petroleum Agency of South

Africa ("PASA") in respect of the Acquisition, which was the final

condition in respect of completion.

Accordingly, Eco Atlantic, through Azinam, will now close the

Acquisition and hold an increased Participating Interest of 26.25%

in Block 3B/4B, with Africa Oil Corp., the Operator of the block,

holding a 20% Participating Interest, and Ricocure, holding the

remaining 53.75% Participating Interest .

In accordance with the completion consideration outlined in

Eco's announcement on 27 June 2022, the Company will now:

-- pay a cash amount of US$500,000 to the Vendor;

-- issue to the Vendor new Common Shares at the agreed price of

30p (CAD$0.48) having an aggregate value of US$500,000

-- issue to the Vendor new Common Shares at the agreed price of

30p (CAD$0.48) having an aggregate value of US$3 million, which

will be subject to special lock up restrictions (as further

detailed below) (the "Restricted Shares");

-- issue to the Vendor new Common Shares at the agreed price of

30p (CAD$0.48) having an aggregate value of US$2 million; and

-- issue to the Vendor, new Common Shares equal to US$2 million

divided by the greater of (i) the value of the 30 day VWAP per

Common Share prior to the date of the press release announcing the

issue of such Common Shares; and (ii) the lowest issuance price

then allowed by the rules of the TSXV and AIM (to the extent then

listed on such markets, otherwise the average (if listed on more

than one market) on such markets as the Common Shares are then

listed). This shall be subject to obtaining prior TSXV approval in

the event that such issue of Common Shares would cause the Vendor

to own more than 9.99% of the issued and outstanding Common Shares

(calculated at the time of issuance).

(together, the "Consideration Shares")

Lock up arrangements

The Restricted Shares will be subject to a lock up agreement

restricting the sale or transfer of all or any portion of the

Restricted Shares until the earlier of (i) signature of a farmout

agreement between the Block JV partners and a third party; or (ii)

March 15, 2023, provided that such transfer is compliant with UK

securities laws and Canadian securities laws.

Issue and Admission of the Common Shares

In accordance with the terms of the farmout agreement announced

on 27 June 2022, the Consideration Shares will be issued within the

next 30 days. A further announcement will be issued upon issuance

of the Consideration Shares, confirming the date for admission of

the Consideration Shares to trading on AIM.

The Consideration Shares will all be subject to a restrictive

hold period of four months and one day from the day of their

issuance (the "Hold Period"), which restricts them from being sold,

transferred, hypothecated or otherwise traded through the

facilities of the TSX Venture Exchange (the "TSXV") or otherwise in

Canada or to a Canadian during the Hold Period without the prior

written approval of the TSXV and compliance with all applicable

securities laws.

Gil Holzman, President and Chief Executive Officer of Eco

Atlantic, commented:

" We are extremely pleased to have received the South African

authorities' final approval and to be increasing our interest in

Block 3B/4B to 26.25%. The Block looks to be a very exciting

licence for all the partners involved. Recently completing a full

reprocessing of the 3D data on the Block, we are upbeat about the

prospectivity of the licence and following the significant oil

discoveries, Venus & Graff, made earlier in the year offshore

Namibia Orange Basin, and we are pleased to be strengthening our

working relationship with Ricocure and Africa Oil Corp.

"We are seeing growing industry interest in the entire Orange

Basin, and in particular in Block 3B/4B, and as announced last

month, a collaborative farm out process (of up to a 55% working

interest) is underway. In the past six months, we have worked very

closely with our partners to identify and determine the Block

drilling prospects for a drilling campaign we are contemplating for

next year."

Notice of AGM

The Company also notes that notice of its Annual General

Meeting, to be held virtually, on Thursday, 29 December 2022 at

10:00 a.m. (Toronto time) via teleconference at (+1) 416 764 8658

or toll free at (+1) 888 886 7786, is available on its website at

www.ecooilandgas.com and on SEDAR.

**ENDS**

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0)

20 8434 2754

Gil Holzman, CEO

Colin Kinley, COO

Alice Carroll, Head of Corporate Sustainability +44(0)781 729 5070

Strand Hanson (Financial & Nominated Adviser) +44 (0) 20 7409 3494

James Harris

James Bellman

Berenberg (Broker) +44 (0) 20 3207 7800

Matthew Armitt

Detlir Elezi

Echelon Capital (Financial Adviser N.

America Markets)

Ryan Mooney +1 (403) 606 4852

Simon Akit +1 (416) 8497776

Celicourt (PR) +44 (0) 20 8434 2754

Mark Antelme

Jimmy Lea

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

Notes to editors:

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM-quoted Atlantic Margin-focused

oil & gas exploration company with offshore license interests

in Guyana, Namibia, and South Africa. Eco aims to deliver material

value for its stakeholders through its role in the energy

transition to explore for low carbon intensity oil and gas in

stable emerging markets close to infrastructure.

Offshore Guyana in the proven Guyana-Suriname Basin, the Company

holds a 15% Working Interest in the 1,800 km(2) Orinduik Block

Operated by Tullow Oil. In Namibia, the Company holds Operatorship

and an 85% Working Interest in four offshore Petroleum Licences:

PELs: 97, 98, 99, and 100, representing a combined area of 28,593

km(2) in the Walvis Basin.

Offshore South Africa, Eco is Operator and holds a 50% working

interest in Block 2B and a 26.25% Working Interest in Block 3B/4B

operated by Africa Oil Corp., totalling some 20,643 km (2) .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPGRCPUPPGBR

(END) Dow Jones Newswires

December 19, 2022 02:00 ET (07:00 GMT)

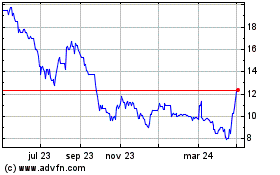

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

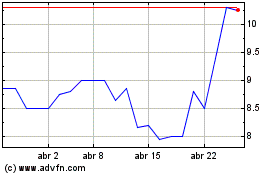

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024