TIDMEQT

RNS Number : 5947K

EQTEC PLC

22 December 2022

22 December 2022

EQTEC plc

("EQTEC", the "Company" or the "Group")

Amendments to Employment Incentive Warrant Pool

Issue of Warrants to Director

EQTEC plc (AIM: EQT), a global technology innovator powering

distributed, decarbonised, new energy infrastructure through its

waste-to-value solutions for hydrogen, biofuels, and energy

generation announces amendments to the Company's Employment

Incentive Warrant Pool (the "EIWP").

The Company on 31 March 2020 announced creation of the EIWP to

incentivise and retain key managers throughout a challenging and

transformational period. The EIWP allowed for issue of up to

590,906,437 warrants ("EIWP Warrants") over new ordinary shares of

EUR0.001 each in the Company ("Ordinary Shares") to directors and

employees, exerciseable for 36 months from the date the EIWP was

created. The exercise price of the EIWP Warrants was set at

GBP0.0025 per Ordinary Share, representing, at the time, a premium

of 43% to the middle market closing price of the Company's Ordinary

Shares.

To date, 519,609,299 EIWP Warrants have been allocated,

including 196,968,812 EIWP Warrants allocated to CEO David Palumbo

and 98,484,406 EIWP Warrants allocated to CTO Yoel Alemán, with an

unallocated balance of 71,297,138 EIWP Warrants. The total amount

of unexercised warrants stands at 404,325,407 representing 4.29% of

the Company's Issued Share Capital (inclusive of the allocation to

Jeffrey Vander Linden below) .

The Company's Board of Directors has agreed to extend the

existing EIWP through an increasingly challenging and

transformational period. To bring the EIWP in line with current

market performance, t he Company has amended its terms as

follows:

-- The EIWP Warrant exercise period will be extended by 24 months, to 31 March 2025.

-- The EIWP Warrant exercise price will be increased to

GBP0.0045 per Ordinary Share, representing a premium of 60% to the

market closing price on 21 December 2022.

-- From 22 December 2022 EIWP Warrantholders will only be

allowed to exercise their EIWP Warrants subject to the following

conditions:

o

% of Warrantholding Earliest exercise date

50% 31 March 2024

25% 30 September 2024

25% 28 February 2025

o The Company's share price at the time of exercise has been

GBP0.0075 or greater for a minimum of 30 consecutive days in the

period from today through to the date of exercise.

o The warrantholder remains a director or employee of the

Company in good standing at the time of exercise.

Additionally, the Company is allocating 71,297,138 EIWP Warrants

to Jeffrey Vander Linden, COO. Consequently, the EIWP Warrant pool

is fully allocated.

Ian Pearson, Chairman of EQTEC, commented:

"The last 24 months have been unprecedented in terms of market

volatility and equity market correction, especially for technology

stocks. On the other hand, the market demand for EQTEC technology

and the sector in general is poised to be one of the most exciting

areas of growth in the coming years, as the world replaces legacy

waste management and energy infrastructure with new technologies

that will dominate the future, redressing our dependency on fossil

fuels. The current management team is part-way through delivering

our growth strategy. Meaningful incentivisation is important to

ensure the retention of key management to support the successful

delivery of the strategy we have set, to springboard the Company

towards a position as a world-class licensor of leading-edge

technology for carbon-efficient conversion of waste into baseload

energy and biofuels. The Board believes this amendment of the EIWP,

without the addition of any new Warrants, is a pragmatic way to

support business continuity and growth."

Related party transaction

As Directors of the Company, David Palumbo, Yoel Alemán and

Jeffrey Vander Linden are considered related parties under the AIM

Rules for Companies ("AIM Rules"). As a result, the amendment of

the EIWP Warrants and, in relation to Mr Vander Linden, the

allocation of EIWP Warrants, constitutes a related party

transaction pursuant to Rule 13 of the AIM Rules. The Directors

independent of the transaction (being the Directors other than

David Palumbo, Yoel Alemán and Jeffrey Vander Linden) consider,

having consulted with the Company's Nominated Adviser, Strand

Hanson Limited, that the terms of the amendment of the EIWP

Warrants, and EIWP Warrant allocation, are fair and reasonable in

so far as the Company's shareholders are concerned.

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014, as it

forms part of United Kingdom domestic law by virtue of the European

Union (Withdrawal) Act 2018, as amended, and has been announced in

accordance with the Company's obligations under Article 17 of that

Regulation.

ENQUIRIES

EQTEC plc +44 203 883 7009

David Palumbo / Nauman Babar

---------------------------

Strand Hanson - Nomad & Financial Adviser +44 20 7409 3494

---------------------------

James Harris / Richard Johnson

---------------------------

Panmure Gordon - Joint Broker +44 207 886 2500

---------------------------

John Prior / Hugh RIch

---------------------------

Canaccord Genuity - Joint Broker +44 207 523 8000

---------------------------

Henry Fitzgerald-O'Connor / James Asensio

/ Patrick Dolaghan

---------------------------

Alma PR - Financial Media & Investor Relations +44 203 405 0205

---------------------------

Josh Royston / Sam Modlin EQTEC@almapr.co.uk

---------------------------

+44 207 457 2381 / +44 788

Instinctif - General Media Enquiries 788 4794

---------------------------

Chris Speight / Tim Field EQTEC@instinctif.com

---------------------------

About the project

The Project Site is in a heavily industrialised area, adjacent

to major plant facilities and estates, including those of CF

Fertilisers UK Limited, Seqens Group pharmaceuticals and many

others. Through its wholly owned project SPV, Haverton WTV, the

Company has secured all relevant permits and permissions to build a

refuse-derived fuel ("RDF")-to-combined heat and power ("CHP")

facility that would transform 200,000 tonnes per year of RDF into

up to 25MW of electricity for export to the national grid, with the

potential for creating up to 34MW of thermal energy. The Company

has agreed favourable heads of terms for over 250 per cent of its

required volume of feedstock, secured the contract for a grid

connection and is now pursuing discussions with neighbouring

companies about provision of private wire offtake.

On 13 December 2021, the Company confirmed it was investigating

new offtake opportunities for the Project and that it was working

with partners toward feasibility work. On 18 July 2022, the Company

announced that it had selected Petrofac as its front-end

engineering design ("FEED") contractor, further confirming that,

following full review of multiple financial models for the Project,

technical feasibilities and updated site drawings, the Company and

its partners were considering a range of additional facilities

including for hydrogen production, battery storage and/or hydrogen

refuelling. All such options would be subject to further planning

permission and agreement of future owners of the Project, which the

Company intends to sell in whole or in part.

The primary focus of the Company now is pursuit of Project

investors to support FEED work on the CHP facility and development

of the several other potential facilities on the site.

About EQTEC plc

As one of the world's most experienced gasification technology

and engineering companies, with a growing track record of

delivering operational and commercial success for transforming

waste-to-energy through best-in-class technology innovation,

engineering and project development , EQTEC brings together design

innovation, project delivery discipline and solid commercial

experience to add momentum to the global energy transition. EQTEC's

proven, proprietary and patented technology is at the centre of

clean energy projects, sourcing local waste, championing local

businesses, creating local jobs and supporting the transition to

localised, decentralised and resilient energy systems.

EQTEC designs, supplies and builds advanced gasification

facilities in the UK, EU and US, with highly efficient equipment

that is modular and scalable from 1MW to 30MW. EQTEC's versatile

solutions process over 50 varieties of feedstock, including

forestry wood waste, vegetation and other agricultural waste from

farmers, industrial waste and sludge from factories and municipal

waste, all with no hazardous or toxic emissions . EQTEC's solutions

produce a pure, high-quality synthesis gas ("syngas") that can be

used for the widest range of applications, including the generation

of electricity and heat, production of synthetic natural gas

(through methanation) or biofuels (through Fischer-Tropsch,

gas-to-liquid processing) and reforming of hydrogen.

EQTEC's technology integration capabilities enable the Group to

lead collaborative ecosystems of qualified partners and to build

sustainable waste reduction and green energy infrastructure around

the world.

The Company is quoted on AIM (ticker: EQT) and the London Stock

Exchange has awarded EQTEC the Green Economy Mark, which recognises

listed companies with 50% or more of revenues from

environmental/green solutions.

Further information on the Company can be found at www.eqtec.com

.

The notification below, made in accordance with the requirements

of the EU Market Abuse Regulation, provides further detail in

respect of the transaction as described above.

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Jeffrey Vander Linden

------------------------------- ----------------------------------------

2. Reason for the Notification

-------------------------------------------------------------------------

a) Position/status Executive Director

------------------------------- ----------------------------------------

b) Initial notification/amendment Initial notification

------------------------------- ----------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------

a) Name EQTEC plc

------------------------------- ----------------------------------------

b) LEI 63540085VSYVDEINJO04

------------------------------- ----------------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv)each place where transactions

have been conducted

-------------------------------------------------------------------------

a) Description of Ordinary Shares of EUR0.001 each

the Financial

instrument, type

of instrument

------------------------------- ----------------------------------------

Identification IE00BH3XCL94

code

------------------------------- ----------------------------------------

b) Nature of the Allocation of warrants to subscribe for

Transaction New Ordinary Shares

------------------------------- ----------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

0.45 pence 71,297,138

-----------

------------------------------- ----------------------------------------

d) Aggregated information N/A (Single transaction - see above)

Aggregated volume

Price

------------------------------- ----------------------------------------

e) Date of the transaction 21 December 2022

------------------------------- ----------------------------------------

f) Place of the transaction Off-exchange

------------------------------- ----------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHGLBDDRXDDGDD

(END) Dow Jones Newswires

December 22, 2022 03:00 ET (08:00 GMT)

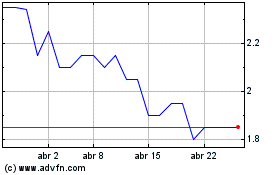

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024