TIDMESO TIDMEO.P TIDMEC.P TIDMEL.P

RNS Number : 8090A

EPE Special Opportunities Limited

07 February 2022

EPE Special Opportunities Limited

("ESO" or the "Company")

Trading Statement

The Board of EPE Special Opportunities is pleased to provide an

update on the Company's performance for the year ended 31 January

2022.

Summary

-- The Company's performance in the year ended 31 January 2022

was led by robust trading within the portfolio, despite the

continuing impact of the COVID-19 pandemic. The Company completed

two new investments in the period, EPIC Acquisition Corp announced

in December 2021 and The Rayware Group in July 2021. The Board and

Investment Advisor are carefully monitoring the UK economic

outlook. The Board expects continued headwinds from inflation and

ongoing global supply chain disruption. The Board also notes

evidence of increased political risk and the residual risk posed by

COVID-19.

-- The unaudited estimate of the Net Asset Value ("NAV") per

share of the Company as at 31 January 2022 was 455.66 pence per

share, representing an increase of 4.1 per cent. on the NAV per

share of 437.63 pence as at 31 January 2021. The unaudited estimate

has been prepared using the Company's historic valuation

methodology and accounting principles.

-- The share price of the Company as at 31 January 2022 was

309.00 pence, representing an increase of 14.0 per cent. on the

share price of 271.00 pence as at 31 January 2021.

-- In January 2022, Luceco released a trading update for the

year ended 31 December 2021, announcing strong revenue growth, 36.0

per cent. ahead of a 2019 pre-COVID-19 comparator, operating profit

of GBP39.0 million and net debt to EBITDA of 0.7x. The business

outperformed the market due to new business wins, superior channel

access and superior product availability despite global supply

chain disruption. In October 2021, Luceco plc announced the

acquisition of DW Windsor Group for GBP16.9 million on a cash and

debt-free basis. Luceco plc delivered share price growth, achieving

a 15.4 per cent. increase in the year ended 31 January 2022. In

June 2021, ESO sold 4.5 million shares in Luceco plc, returning

GBP15.0 million in cash, whilst retaining a 22.1 per cent. holding

in the business.

-- The Rayware Group ("Rayware") has performed well in the

period since acquisition in July 2021, achieving sales ahead of

forecast and the prior year, and maintaining strong profitability

despite headwinds from increased input and freight costs. The

business has made a number of additions to the management team,

appointing a new CFO, as well as a US Sales VP to support the

strategic focus on the US market. Looking ahead, Rayware is well

positioned for growth via international expansion and development

of its digital offering.

-- Whittard of Chelsea ("Whittard") continued to face a

difficult trading environment as a result of ongoing COVID-19

disruption throughout 2021. Whittard's retail stores remained

closed until April 2021 in line with government restrictions, while

fourth quarter trading was impacted by the resurgent Omicron

variant. The business benefitted from further government support

extended in the period as well as the agreement of bilateral deals

with the majority of the business' landlords. Whittard's e-commerce

platform continued to trade at an elevated level in the period,

partially mitigating the disruption to the retail channel. Whittard

has made encouraging progress in its international channels,

securing a new franchise partner in South Korea, as well as new

marketplace partners in the US and the EU.

-- David Phillips achieved sales growth in the period, supported

by delivery of strong project pipelines. However, profitability has

been adversely affected by exceptional global supply chain

pressures and raw material price increases. Whilst the narrowing of

profitability represents a set-back, the sales growth achieved in

the year is validation of the market opportunity for the business

and provides the scale to achieve meaningful profitability once

margin pressure subsides.

-- Pharmacy2U continued to build on the increased scale achieved

following the shift to online pharmacy in the COVID-19 period,

delivering further sales growth and improving profitability. In

addition, the business has supplemented its core divisions with a

new Services division, operating vaccination centres and associated

services.

-- In December 2021, the Company announced a EUR10 million

investment in EPIC Acquisition Corp ("EAC"), a special purpose

acquisition company. EAC was admitted to Euronext Amsterdam on 6

December 2021, raising EUR150 million. EAC intends to leverage the

experience of the Investment Advisor, TTB Partners and their

respective affiliates to identify, acquire and develop a consumer

company operating in the EEA or UK which has the potential for

significant growth in Asian markets. EAC has appointed a highly

experienced group of non-executive directors, who are leaders in

global consumer businesses and will be able to provide further

access and guidance on potential targets for EAC. EAC is targeting

companies with an enterprise value of between EUR500 million and

EUR1 billion.

-- The Company had liquidity of GBP27.6 million as at 31 January

2022. In December 2021, the Company raised GBP20.0 million gross

proceeds from a placement of zero dividend preference shares

("ZDP") to provide additional capital for the Company's strong

pipeline of potential investments. The ZDP is repayable in December

2026. The Company has GBP4.0 million of unsecured loan notes

repayable in July 2022 and no other third-party debt

outstanding.

-- In December 2021, the Company completed buybacks in the

market totalling 628,884 ordinary shares (or 1.8 per cent. of the

Company's issued ordinary share capital).

-- As at 31 January 2022, the Company's unquoted portfolio was

valued at a weighted average EBITDA to enterprise value multiple of

5.2x (excluding Pharmacy2U, which is valued on a sales multiple)

and the portfolio had a low level of third party leverage with net

debt at 0.8x EBITDA in aggregate.

Mr Clive Spears, Chairman, commented: "The performance of the

Company in the year ended 31 January 2022 was robust, despite the

challenging macroeconomic environment. The Company has made

pleasing progress in the development of the existing portfolio, the

successful completion of two new investments, and the raising of

additional capital to fund the future investment pipeline. The

Board would like to extend its thanks to the Investment Advisor for

their efforts in a challenging, but interesting year. The Board

will monitor the development of the portfolio over the coming

period and looks forward to updating shareholders at the half

year."

The person responsible for releasing this information on behalf

of the Company is Amanda Robinson of Langham Hall Fund Management

(Jersey) Limited.

Enquiries:

EPIC Investment Partners LLP +44 (0) 207 269 8865

Alex Leslie

Langham Hall Fund Management (Jersey) Limited +44 (0) 15 3488 5200

Amanda Robinson

Cardew Group Limited +44 (0) 207 930 0777

Richard Spiegelberg

Numis Securities Limited +44 (0) 207 260 1000

Nominated Advisor: Stuart Skinner

Corporate Broker: Charles Farquhar

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDZGGZGKRGZZZ

(END) Dow Jones Newswires

February 07, 2022 01:59 ET (06:59 GMT)

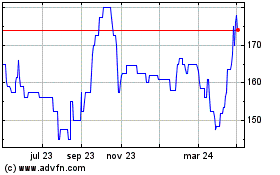

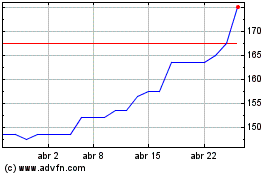

Epe Special Opportunities (LSE:ESO)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Epe Special Opportunities (LSE:ESO)

Gráfica de Acción Histórica

De May 2023 a May 2024