TIDMEUA

RNS Number : 2363B

Eurasia Mining PLC

30 September 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

REGULATION NO. 596/2014 (AS IT FORMS PART OF RETAINED EU LAW AS

DEFINED IN THE EUROPEAN UNION (WITHDRAWAL) ACT 2018) AND IS IN

ACCORDANCE WITH THE COMPANY'S OBLIGATIONS UNDER ARTICLE 7 OF THAT

REGULATION.

30 September 2022

Eurasia Mining plc

("Eurasia" or the "Company")

Interim Results for the six months ended 30 June 2022

Eurasia, the palladium, platinum, rhodium, iridium and gold

producing company, today reports its unaudited interim results and

operational summary for the six months ended 30 June 2022.

Chairman's Statement

Dear Shareholder,

The first half of 2022 has seen significant progress at our West

Kytlim mine, as described in the Operations Update below. Eurasia's

plan to install grid power to site to reduce the carbon output

associated with overburden stripping, while also reducing

operational expenditure and improving efficiency, is advancing well

and our electric dragline, which is currently being assembled, is

aimed to significantly improve the stripping programme this coming

winter.

At Monchetundra the ongoing DFS study for the Loipishnune and

West Nittis open pits represents an important reporting milestone

for the project's development and is on schedule for submission

before the end of 2022.

Since February the conflict in Ukraine has affected all

international commerce to some extent. The effect on our

operations, including funding group subsidiary companies has been

minimal to date. We took the decision to stockpile ore from West

Kytlim at the beginning of the mining season due to our strong cash

position, volatility in the market currently, and in anticipation

of higher realisable sales revenue in the future. As such, despite

producing 167 kg of PGM concentrate (113kg for full year 2021), we

have made no commercial sales of platinum in the period, instead

opting to retain this PGM concentrate, which has a net realisable

value of c.GBP3 million for refining at a later date. The value

ascribed to this concentrate is for the platinum content only and

does not include any other PGMs or gold.

Our cash balance remains robust, with more than GBP3 million and

US$6.6 million at the time of writing in the Group's sterling and

US$ denominated bank accounts respectively. Due to volatility in

exchange rates in funding subsidiaries through inter-company loans,

a net gain of GBP6.1 million was reported for the period. The

Company's cash reserves are held in USD and GBP accounts outside of

Russia and therefore not directly exposed to Ruble foreign exchange

gains or losses against other major hard currencies.

Following the Company's Annual Results announcement of 29 June

2022, Eurasia's directors have maintained a regular dialogue with

the Company's legal advisers regarding the potential impact of any

UK or EU sanctions. The Company remains satisfied that neither of

its current activities at the West Kytlim Mine or on the Kola

Peninsula are prohibited under UK or EU sanctions rules.

Furthermore, the Group does not engage and has not engaged with any

sanctioned persons, entities or agencies.

To date there has been no significant impact on the Group's

activities as a result of the ongoing updates to the UK and EU

sanctions legislation. Sanctions introduced by the Russian Federal

government have also not affected the Group. The Group continues to

closely monitor all regulatory requirements and changes to the

laws, rules and regulations, taking steps whenever necessary to

ensure compliance with new legislation.

With regards to the proposed sale of our Russian assets, as

previously announced, our M&A team is focusing on BRICS

counterparties, and discussions are ongoing with predominantly

Russian, Indian and Chinese non-sanctioned counterparties. Whereas

progress has been made with certain parties, at present there can

be no guarantee that the Company will enter into a legally binding

sale and purchase agreement with any of the interested parties. We

expect potential buyers to remain anonymous until the Company is in

a position to execute a legally binding agreement and further

updates regarding the sale process will be made as appropriate.

In terms of the future development of Eurasia Mining PLC, we

continue to look at expanding the business in various ways,

including the development of hydrogen projects internationally

coupled with new mining opportunities in investment friendly

jurisdictions. The Company is also committed to the continued

development of Monchetundra as well as NKT (Eurasia's project, a

Tier-1 scale Nickel mine formerly operated by Norilsk Nickel) and

continuing to mine at West Kytlim.

The Company's Board has decades of experience in mineral project

identification and the management of complex engineering projects

during the development phase, such as the three pits at West Kytlim

(Malaya Sosnovka, Klyuchiki and Bolshaya Sosnovka) which were

successfully brought into production by Eurasia's technical team.

James Nieuwenhuys, our CEO launched a number of mines, including as

COO of Polyus (the world's largest gold company in terms of

reserves and resources) as well as Managing Director of SNC-Lavalin

and Bateman (large EPC companies).

We again thank our shareholders for their continued support.

Christian Schaffalitzky

Chairman of Eurasia Mining Plc

James Nieuwenhuys, Chief Executive Officer of the Company,

commented;

"We continue to advance our plans at both operations in the

Urals and Kola Peninsula, adding value to both projects while

pursuing a potential sale of assets as previously announced.

Despite significant geopolitical tensions the operating environment

within Russia itself has not changed materially with respect to our

operations there. The Board will take a view on the best

opportunity to refine to saleable metals at a later date, meanwhile

production is ongoing at the time of writing, and we look forward

to updating on our electric power and dragline projects, both

expected to contribute to the winter 2022/23 stripping

programme."

Consent for release

Christian Schaffalitzky, FIMMM, PGeo, CEng, is a director of the

Company. He has reviewed the update and consents to the inclusion

of the exploration information in the form and context in which it

appears here. He is a Competent Person for the purposes of the

reporting of these results.

For further information, please contact:

Eurasia Mining Plc

Christian Schaffalitzky/ Keith Byrne

+44 (0)207 932 0418

SP Angel Corporate Finance LLP (Nomad and Joint Broker)

Jeff Keating / David Hignell / Adam Cowl

+44 (0)20 3470 0470

Optiva Securities (Joint Broker)

Christian Dennis

Tel: +44 (0) 20 3137 1902

Operations update

West Kytlim

Eurasia's mine at West Kytlim commenced production on schedule

this season, with all three process plants in operation, due in

large part to the careful management of the winter stripping

operation which precedes the mining season. Major projects

including the installation of an electric dragline and a power line

to site have progressed well through the summer months. All 286

posts on the power lines route to site have been installed and the

line itself is currently being pulled through. Electric

infrastructure at site, including the high voltage sub-station

constructing and commissioning and six separate electrical hook

ups, have been installed.

The work plan for the 2023 season envisages mining of the

western bank of the Tylai River. A detailed design for a small

bridge has been prepared at an estimated material cost of GBP231k.

Work on this temporary construction, designed to be moveable to

another site as required, will commence in October 2022.

Lost time injury frequency rate ("LTIFR") remains at zero. A

full-time labour safety engineer, appointed earlier in this season

has now introduced all required protocols.

Year to date operational highlights

-- Power line and e-dragline construction projects on course for

completion later in this season.

-- LTIFR remains at zero for the 2022 season.

-- Three process plants operational throughout the mining season

processing Kluchiki and Bolshaya Sosnovka ores.

-- Typil exploration license drilling results show prospective

ore bodies at this exploration permit west of the main West Kytlim

mine permit.

-- A total of 434,000 cubic meters PGM bearing gravels washed at

three sites to 31 August 2022.

-- A total of 167 kg raw platinum (113kg for full year 2021) has

been produced year to date and has been transported to a secure

location in Ekaterinburg for later refining.

West Kytlim is an ESG focussed mine site, as such it is the

Company's intention to keep the mine's environmental

impact to a minimum:

-- Cooperation Agreement signed in July 2022 with the Karpinsk

Municipal Administration on social and economic development in the

town of Kytlim.

-- Limited use of reinforced concrete and asphalt. Mine

buildings built mostly of timber milled on site.

-- Open pits remediated when 'mined out', with recovery within 5 to 10 years post mining.

-- Modern machinery powered by renewable generated electricity utilised where possible.

Our plans to transition from predominantly diesel-based

stripping to renewable generated electric powered stripping are

nearing completion. The board recognises the potential to remove

the operational Green House Gas emissions associated with this

stage of the mining process as valuable in improving the projects'

environmental credits.

Typil license

An exploration programme for the 24.5km(2) Typil exploration

license, directly adjacent to the operating mine was approved in

early 2021 allowing geological mapping, using soil and stream

sediment sampling on both banks of the Kosva River to commence in

August 2021.

468.1m (75 holes) were drilled on 7 lines in the northeast

portion of the Licence area and in areas where tree felling was not

required. Key highlights from the programme, with a drilling

density commensurate with Russian standard C2 Reserves are provided

as follows;

-- At the confluence of the Typil and Kosva rivers, a potential

ore body of 20m wide and 0.8m thick at an average grade of 235

mg/m(3) raw platinum is contoured in Quaternary sediments.

-- At the eastern bank of the Typil River a potential ore body

0.8m thick with an inferred width of 80m at an average grade of 192

mg/m(3) raw platinum is contoured in pre-Quaternary (Neogene)

sediments.

-- On Line 24, in Quaternary sediments of the Typil eastern

bank, a 110m wide and not less than 0.6 m thick layer is identified

with an average grade of 284mg/m(3) (sample grades up to 860

mg/m3).

-- On the eastern bank of the Typilez Creek, two lodes with

potentially economic platinum grades are identified. At a placer

width of 160m and average thickness of 1.3m, the average grade

reported is 261 mg/m(3) . At a width of 80m and average thickness

of 0.9m, the average grade increases to 310 mg/m(3) (sample grades

up to 1,524 mg/m(3) ).

-- Numerous other platinum bearing intervals were identified in

the drill programme for follow up in the next stage of drilling

while several other prospective areas including the Typilez,

Mulychevka and Kyria River areas remain understudied.

These results are presented in a table in Appendix I below. The

Typil exploration report was provided by Michael Sukhov, Chief

Geologist at Kosvinsky Kamen.

Monchetundra, Monchetundra Flanks and other Kola projects

The Definitive Feasibility Study for the Monchetundra (West

Nittis and Loipishnune) open pits is well advanced and on schedule

for completion this year. Details of this report will be provided

when a response is received from the relevant authorities. The

Company has previously released a report commissioned by Wardell

Armstrong International covering the adjacent NKT deposit, a

deposit which the Company has title to through its Monchetundra

Flanks license. Reporting on other Kola deposits, including Nyud

and Moroshkovoe will be provided when Eurasia holds title to the

relevant licenses. Operational highlights include:

-- Monchetundra Definitive Feasibility Study being progressed

for completion by the end of 2022.

-- Metallurgical testwork reports now available for compilation

into the larger DFS report. New metallurgical study by SGS,

Mekhanobr-St Petersburg, LIMS and Gipronickel (Norilsk Nickel's

engineering arm) suggests grades, recoveries and flowsheet

unchanged from the 2016 feasibility study.

-- Rock mechanics studies and Hydro/Geotech drilling now

complete for West Nittis and Loipishnune open pits.

-- Recalculation of Monchetundra project resources and pit

outlines, reflecting metal price movement since the feasibility

study, for submission as a necessary component of the DFS.

-- Work continues on assessment of the NKT Project, contained

within Eurasia's 80% Flanks exploration license adjacent the

Monchetundra (West Nittis and Loipishnune) mining license, as a

standalone project or as a project combined with Monchetundra

deposits.

Appendix I: Representative Typil exploration license drilling

results:

Drill Drill From To Length Width Sediments Raw

line hole (m) (m) Pt* mg/m(3)

no no

Sample Drill hole intervals

------ ------- ------- ------ ----------- -------------

21 C-21-11 4.5 5.3 0.8 20 Quaternary 235

---------------- ------ ------- ------- ------ ----------- -------------

25 C-25-94 7.0 7.8 0.8 80 Neogene 192

---------------- ------ ------- ------- ------ ----------- -------------

Provisional placer

deposits contoured

at C2 drilling density

------ ------- ------- ------ ----------- -------------

Drill

holes

24 2-14 3.8* 7.3* 0.6*** 110 Quaternary 284

---------------- ------ ------- ------- ------ ----------- -------------

40 15-27 10.5* 13.6** 1.3*** 160 Quaternary 261

---------------- ------ ------- ------- ------ ----------- -------------

may be restated, at a higher cut-off

grade as;

------- ------ ----------- -------------

40 23-27 10.5* 13.6** 0.9*** 80 Quaternary 310

---------------- ------ ------- ------- ------ ----------- -------------

Note: * minimal depth; ** maximum depth; *** average length

The mineral measured at the West Kytlim mine is referred to as

Raw Platinum which is comprised of Platinum, Iridium, Palladium,

Rhodium and Gold.

Drilling density for the programme is that of Russian standard

C1 and C2 as defined in Russian industry mineral reporting

nomenclature. All drilling to date at a drilling diameter of

20cm.

Condensed consolidated statement of comprehensive income

for the six months ended 30 June 2022

Note 6 months 12 months 6 months

to to to

30 June 31 December 30 June

2022 2021 2021

(unaudited) (audited) (unaudited)

GBP GBP GBP

Sales 4 101,836 2,331,225 425,965

Cost of sales (36,197) (2,584,680) (665,448)

------------------------------------------------------------------- ----- ------------- ------------ ------------

Gross profit/(loss) 65,639 (253,455) (239,483)

Administrative costs (1,257,924) (2,717,765) (1,197,899)

Investment income 10,070 1,394 511

Finance costs (49,717) (103,445) (53,144)

Other gains 5 6,108,902 - 24,093

Other losses 5 (1,024,892) (65,250) -

Profit/(loss) before tax 3,852,078 (3,138,521) (1,465,922)

------------------------------------------------------------------- -----

Income tax expense - -

------------------------------------------------------------------- ----- ------------- ------------ ------------

Profit/(loss) for the period 3,852,078 (3,138,521) (1,465,922)

Other comprehensive (loss)/income:

Items that will not be reclassified

subsequently to

profit and loss:

NCI share of foreign exchange differences

on translation of foreign operations 405,694 36,855 1,293

Items that will be reclassified

subsequently to

profit and loss:

Parents share of foreign exchange

differences on translation

of foreign operations 945,695 (58,679) 4,116

Other comprehensive income/(loss) for the period, net of tax 1,295,040 1,351,389 5,409

-------------------------------------------------------------------------- ------------- ------------ ------------

Total comprehensive income/(loss)

for the period 5,203,467 (3,160,345) (1,460,513)

=================================================================== ===== ============= ============ ============

Profit/(loss) for the period attributable

to:

Equity holders of the parent 2,556,416 (2,910,479) (1,351,127)

Non-controlling interest 1,295,662 (228,042) (114,795)

3,852,078 (3,138,521) (1,465,922)

------------------------------------------------------------------- ----- ------------- ------------ ------------

Total comprehensive income/(loss) for the period attributable to:

Equity holders of the parent 3,502,111 (2,969,158) (1,347,011)

Non-controlling interest 1,701,356 (191,187) (113,502)

5,203,467 (3,160,345) (1,460,513)

------------------------------------------------------------------- ----- ------------- ------------ ------------

Basic and diluted profit/(loss) (pence per share) 0.09 (0.10) (0.05)

Condensed consolidated statement of financial position

As at 30 June 2022

Note At 30 At 31 December At 30 June

June

2022 2021 2021

(unaudited) (audited) (unaudited)

GBP GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 6 12,634,691 5,061,743 4,578,844

Assets in the course of construction 1,329,132 640,423 124,303

Intangible assets 7 3,146,073 1,389,029 792,425

Investment to potential share in

joint venture 8 584,591 367,464 368,447

Total non-current assets 17,694,487 7,458,659 5,864,019

--------------------------------------- ----- -------------- --------------- -------------

Current assets

Inventories 9 2,135,082 38,673 360,630

Trade and other receivables 10 4,124,692 1,681,864 450,659

Current tax assets 10,371 5,334 5,348

Cash and bank balances 13,559,308 22,009,507 16,067,991

Total current assets 19,829,453 23,735,378 16,884,628

--------------------------------------- ----- -------------- --------------- -------------

Total assets 37,523,940 31,194,037 22,748,647

======================================= ===== ============== =============== =============

EQUITY

Capital and reserves

Issued capital 11 61,187,111 61,187,111 51,080,629

Reserves 12 4,868,386 3,922,691 3,985,486

Accumulated losses (30,558,116) (33,114,532) (31,555,180)

--------------------------------------- ----- -------------- --------------- -------------

Equity attributable to equity holders

of the parent 35,497,381 31,995,270 23,510,935

Non-controlling interest (248,693) (1,950,049) (1,872,364)

--------------------------------------- ----- -------------- --------------- -------------

Total equity 35,248,688 30,045,221 21,638,571

--------------------------------------- ----- -------------- --------------- -------------

LIABILITIES

Non-current liabilities

Lease liabilities 14 431,973 307,136 405,494

Provisions 16 470,029 143,268 99,422

Total non-current liabilities 902,002 450,404 504,916

--------------------------------------- ----- -------------- --------------- -------------

Current liabilities

Borrowings 13 50,833 31,953 32,038

Lease liabilities 14 211,397 122,407 113,059

Trade and other payables 15 1,111,020 486,558 443,943

Provisions 16 - 57,494 16,120

Total current liabilities 1,373,250 698,412 605,160

--------------------------------------- ----- -------------- --------------- -------------

Total liabilities 2,275,252 1,148,816 1,110,076

--------------------------------------- ----- -------------- --------------- -------------

Total equity and liabilities 37,523,940 31,194,037 22,748,647

======================================= ===== ============== =============== =============

Condensed statement of changes in equity

For the six months ended 30 June 2021

Attributable to owners of the parent

-------------------------------------------------------------------------------

Foreign Total

currency attributable

Share Share Deferred Other translation Accumulated to owners Non-controlling Total

Note capital premium shares reserves reserve losses of parent interest equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1 January

2021 2,758,702 28,028,671 7,025,483 3,924,026 57,344 (30,204,053) 11,590,173 (1,758,862) 9,831,311

Issue of ordinary

share

capital for cash 53,307 14,072,982 - - - - 14,126,289 - 14,126,289

Share issue cost - (858,516) - - - - (858,516) - (858,516)

Transaction with

owners 53,307 13,214,466 - - - - 13,267,773 - 13,267,773

----------------------- ---------- ------------ ----------- ----------- ------------ ------------- ------------- ---------------- -------------

Loss for the period - - - - - (1,351,127) (1,351,127) (114,795) (1,465,922)

Other

comprehensive

loss

Exchange differences

on translation

of foreign operations - - - - 4,116 - 4,116 1,293 5,409

Total comprehensive

income - - - - 4,116 (1,351,127) (1,347,011) (113,502) (1,460,513)

Balance at 30 June

2021 2,812,009 41,243,137 7,025,483 3,924,026 61,460 (31,555,180) 23,510,935 (1,872,364) 21,638,571

======================= ========== ============ =========== =========== ============ ============= ============= ================ =============

Condensed statement of changes in equity

For the six months ended 30 June 2022

Attributable to owners of the parent

--------------------------------------------------------------------------------

Foreign Total

currency attributable

Share Share Deferred Other translation Accumulated to owners Non-controlling Total

Note capital premium shares reserves reserve losses of parent interest equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1 January

2022 2,853,560 51,308,068 7,025,483 3,924,026 (1,335) (33,114,532) 31,995,270 (1,950,049) 30,045,221

Transaction

with owners - - - - - - - - -

--------------- ------ ---------- ------------ ----------- ----------- ------------ -------------- ------------- ---------------- ------------

Loss for the period - - - - - 2,556,416 2,556,416 1,295,662 3,852,078

Other

comprehensive

loss

Exchange differences

on translation

of foreign operations - - - - 945,695 - 945,695 405,694 1,351,389

Total comprehensive

income - - - - 945,695 2,556,416 3,502,111 1,701,356 5,203,467

Balance at 30 June (248,693

2022 2,853,560 51,308,068 7,025,483 3,924,026 944,360 (30,558,116) 35,497,381 ) 35,248,688

======================= ========== ============ =========== =========== ============ ============== ============= ================ ============

Condensed consolidated statement of cash flows

for the six months ended 30 June 2022

6 months 12 months 6 months

to to to

30 June 31 December 30 June

2022 2021 2021

(unaudited) (audited) (unaudited)

GBP GBP GBP

Cash flows from operating activities

Profit/(loss) for the period 3,852,078 (3,138,521) (1,465,922)

Adjustments for:

Depreciation and amortisation of

non-current assets 1,194,452 422,752 289,850

- Asset value write off to cost

of sales - 149,882

(Loss)/gain on sale or disposal

of property, plant and equipment (4,219) - -

Finance costs recognised in profit

or loss 49,717 103,445 53,144

Investment revenue recognised in

profit or loss (10,070) (1,394) (511)

Loss on impairment of financial

assets

Loss on impairment of inventory 1,024,892

Rehabilitation cost recognised in

profit or loss 90,096 145,785 61,643

Net foreign exchange (profit)/loss (6,104,683) 65,250 (24,093)

92,263 (2,252,801) (1,085,889)

Movements in working capital

Increase in inventories (3,098,450) (24,862) (346,782)

Increase in trade and other receivables (1,614,762) (1,395,059) (163,307)

Increase in trade and other payables 508,844 197,729 155,217

Cash used in operations (4,112,105) (3,474,993) (1,440,761)

Net cash used in operating activities (4,112,105) (3,474,993) (1,440,761)

------------------------------------------ -------------- ------------ ------------

Cash flows from investing activities

Interest received 10,070 1,394 511

Investment to acquire interest in

joint venture - (367,465) (368,447)

Payments for property, plant and

equipment (6,221,805) (1,910,033) (629,005)

Payments for other intangible assets (910,258) (682,419) (92,774)

Proceeds from disposal of property,

plant and equipment 4,219 - -

Net cash used in investing activities (7,117,774) (2,958,523) (1,089,715)

------------------------------------------ -------------- ------------ ------------

Cash flows from financing activities

Proceeds from issues of equity shares - 24,929,694 14,126,289

Payment for share issue costs - (1,555,439) (858,516)

Repayment of lease liability (24,757) (101,674) (13,971)

Interest paid (41,449) (101,048) (51,966)

Net cash (used in)/generated by

financing activities (66,206) 23,171,533 13,201,836

------------------------------------------ -------------- ------------ ------------

Net (decrease)/increase in cash

and cash equivalents (11,296,085) 16,738,017 10,671,360

Effects of exchange rate changes

on the balance of

cash held in foreign currencies 2,845,886 (132,611) (7,470)

Cash and cash equivalents at the

beginning of period 22,009,507 5,404,101 5,404,101

Cash and cash equivalents at the

end of the period 13,559,308 22,009,507 16,067,991

========================================== ============== ============ ============

Selected notes to the condensed consolidated financial

statements

for the six months ended 30 June 2022

1. General information

Eurasia Mining plc (the "Company") is a public limited company

incorporated and domiciled in Great Britain with its registered

office at International House, 42 Cromwell Road, London SW7 4EF,

United Kingdom and principal place of business at Clubhouse Bank, 1

Angel Court, EC2R 7HJ. The Company's shares are listed on AIM, a

market of the London Stock Exchange. The principal activities of

the Company and its subsidiaries (the "Group") are related to the

exploration for and development of platinum group metals, gold and

other minerals in Russia.

The financial information set out in these condensed interim

consolidated financial statements (the "Interim Financial

Statements") do not constitute statutory accounts as defined in

Section 435 of the Companies Act 2006. The Group's statutory

financial statements for the year ended 31 December 2021, prepared

under International Financial Reporting Standards (the "IFRS"),

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified. The report

did not contain a statement under Section 498(2) of the Companies

Act 2006.

2. Basis of preparation

The Group prepares consolidated financial statements in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006. These condensed

consolidated interim financial statements for the period ended 30

June 2022 have been prepared by applying the recognition and

measurement provisions of IFRS and the accounting policies adopted

in the audited accounts for the year ended 31 December 2021.

These Interim Financial Statements have been prepared under the

historical cost convention.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

condensed consolidated interim financial statements.

The Interim Financial Statements are presented in Pounds

Sterling (GBP), which is also the functional currency of the parent

company.

3. Accounting policies

The Interim Financial Statements have been prepared in

accordance with the accounting policies adopted in the Group's last

annual financial statements for the year ended 31 December

2021.

4. Sales

6 months 12 months 6 months

to to to

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Sale of platinum and other metals 52,037 2,331,225 425,965

Rental income 49,799 - -

101,836 2,331,225 425,965

=================================== ========= ============ =========

There has been no commercial sale of platinum in H12022. Raw

platinum concentrate from the West Kytlim mining operation is

currently being stockpiled at a secure location in Ekaterinburg for

refining at more favourable Platinum and other PGM prices at a

later date. Revenue generated in the first six months of 2022 is

from the price adjustment due to timing between point of sale of

other metals in 2021 and settlement date in early 2022 (GBP52,037),

as well as income from rental of mining equipment to a mine site

contractor (GBP49,799).

5. Other gains and losses

6 months 12 months 6 months

to to to

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Gains

Gain on disposal of property, plant 4,219 - -

and equipment

Net foreign exchange gain * 6,104,683 - 24,093

6,108,902 - 24,093

Losses

Impairment of inventory ** (1,024,892) - -

Net foreign exchange loss - (65,250) (429,171)

(1,024,892) (65,250) (429,171)

5,084,010 (65,250) (405,078)

===================================== ============= ============ ==========

* Significant exchange gain is a result of revaluation of

monetary items expressed in Russian Rubles ('RUB') which

strengthens from GBP/RUB 101.18 at 1 January 2022 to GBP/RUB 63.6

at 31 June 2022.

** Impairment of inventory - revaluation of stockpiled platinum

concentrate to net realisable value using platinum price and

RUB/USD exchange rate prevailing at 30 June 2022.

6. Property, plant and equipment

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Net book value at the beginning

of period 5,061,743 4,295,908 4,295,908

Additions 5,911,509 1,298,813 533,983

Written off to cost of sales - (149,882) -

Depreciation (1,194,452) (422,752) (289,850)

Exchange differences 2,855,891 39,656 38,803

Net book value at the end of period 12,634,691 5,061,743 4,578,844

====================================== ============= ============ ==========

7. Intangible assets

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Net book value at the beginning

of period 1,389,029 696,504 696,504

Additions 910,258 682,420 92,774

Exchange differences 846,786 10,105 3,147

Net book value at the end of period 3,146,073 1,389,029 792,425

====================================== =========== ============ =========

Intangible assets represent capitalised costs associated with

Group's exploration, evaluation and development of mineral

resources.

8. Investment to potential share in joint venture

Investments to potential share in joint venture represents an

investment made in March 2021 to enter into a joint venture and

acquire, in stages, 75% interests in new assets on Kola peninsula

leveraging agreements in place with both Rosgeo and the Far East

and Arctic Region Development Corporation. ('ERDC', see RNS dated 6

December 2021). It is intended that these assets would be held in

new joint venture companies to be developed at the Company's

option. By 31 December 2021 The Company had invested RUB37,180,000

(GBP367,464 at the then prevailing RUB/GBP exchange rate). No

further investments have been made in the reporting period, and the

amount is carried to 30 June 2022 as RUB37,180,000

(GBP584,591).

9. Inventory

30 June 31 December 30 June

2022 2021 2021

Platinum concentrate 1,753,532 - -

Other inventory 381,550 38,673 360,630

2,135,082 38,673 360,630

======================= ========== ============ =========

Stockpiled platinum concentrate has been revalued to net

realisable value using platinum price and RUB/USD exchange rate

prevailing at 30 June 2022.

10. Trade and other receivables

30 June 31 December 30 June

2022 2021 2021

Trade receivables 78,520 480,588 495

Advances made 1,759,183 520,385

Prepayments 36,681 140,335 22,707

VAT receivable 2,123,355 359,290 324,261

Other receivables 126,953 181,266 103,196

4,124,692 1,681,864 450,659

==================== =========== ============ ========

The fair value of trade and other receivables is not materially

different to the carrying values presented. None of the receivables

are provided as security or past due.

11 . Share capital

30 June 31 December 30 June

2022 2021 2021

Issued ordinary shares with a

nominal value of 0.1p:

Number 2,853,559,995 2,853,559,995 2,724,774,624

Nominal value (GBP) 2,853,560 2,853,560 2,724,775

Fully paid ordinary shares carry one vote per

share and carry the right to dividends.

Issued deferred shares with a

nominal value of 4.9 p:

Number 143,377,203 143,377,203 143,377,203

Nominal value (GBP) 7,025,483 7,025,483 7,025,483

Deferred shares have the following rights and restrictions

attached to them:

- they do not entitle the holders to receive any dividends and

distributions;

- they do not entitle the holders to receive notice or to attend

or vote at General Meetings of the Company;

- on return of capital on a winding up the holders of the

deferred shares are only entitled to receive the amount paid up on

such shares after the holders of the ordinary shares have received

the sum of 0.1p for each ordinary share held by them and do not

have any other right to participate in the assets of the

Company.

There had been no change in the issued share capital during the

reporting period

Ordinary shares Number of Share Share

shares capital premium

GBP GBP

Balance at 1 January 2022 2,853,559,995 2,853,560 51,308,068

Balance at 30 June 2022 2,853,559,995 2,853,560 51,308,068

==================================== ============== ========== ===========

Deferred shares Number of Deferred

deferred share

shares capital

GBP

Balance at 1 January and 30 June

2022 143,377,203 7,025,483

==================================== ============== ========== ===========

12 . Reserves

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Capital redemption reserve 3,539,906 3,539,906 3,539,906

Foreign currency translation reserve 944,360 (1,335) 61,460

Equity-based payment reserve 384,120 384,120 384,120

4,868,386 3,922,691 3,985,486

====================================== =========== ============ ==========

The capital redemption reserve was created as a result of a

share capital restructuring in earlier years. There is no policy of

regular transactions affecting the capital redemption reserve.

The foreign currency translation reserve represents exchange

differences relating to the translation from the functional

currencies of the Group's foreign subsidiaries into GBP.

The equity-based payments reserve represents a reserve arisen on

(i) the grant of share options to employees under the employee

share option plan and (ii) on issue of warrants under terms of

professional service agreements.

13 . Borrowings

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Current

Unsecured loan 50,833 31,953 32,038

----------------- -------- ------------ --------

50,833 31,953 32,038

================ ======== ============ ========

In 2017 the Group entered into unsecured loan facility to borrow

up to 57 million Russian Rubles ('RUB') at 14% per annum, from

Region Metal, the then contractor and the West Kytlim mine

operator. The Group had drawn RUB 4.18 million and repaid RUB 0.9

million by 31 December 2021. As the contractor's arrangements had

been discontinued the Group has no intention to utilise any more

funds from this facility. The loan was due for repayment in 2021

but the Group received a court order not to repay the loan due to

ongoing court arbitrage between the lender and its creditors.

The Group is not a party of this arbitrage and/or not linked to

any party.

No borrowing costs were capitalised in 2022 and 2021.

14 . Lease liabilities

The Group leases certain of its plant and equipment. The average

remaining lease term is 3 years (2021: 4 years). . The Group has

option to purchase the equipment for a nominal amount at the

maturity of the finance lease. The Group's obligation under finance

leases are secured by the lessor's title to the leased assets.

Interest rates underlying all obligations under finance leases

are fixed at respective contract dates ranging from 21.9% to 23.5%

per annum.

Minimum lease payments 30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Less than one year 315,252 200,633 203,647

Between one and five years 496,817 377,027 511,819

More than five years - - -

--------------------------------

812,069 577,660 715,466

Less future finance charges (168,699) (148,117) (196,913)

--------------------------------- ---------- ------------ ----------

Present value of minimum lease

payments 643,370 429,543 518,553

================================= ========== ============ ==========

Present value of minimum lease

payments 30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Less than one year 211,397 122,407 113,059

Between one and five years 431,973 307,136 405,494

More than five years - - -

Present value of minimum lease

payments 643,370 429,543 518,553

================================= ========== ============ ==========

15 . Trade and other payables

30 June 31 December 30 June

2022 2021 2021

Trade payables 615,115 210,665 232,746

Accruals 56,826 161,035 23,051

Social security and other taxes 167,392 18,751 44,594

Other payables 271,687 96,107 143,552

1,111,020 486,558 443,943

================================== ========== ============ =========

The fair value of trade and other payables is not materially

different to the carrying values presented. The above listed

payables were all unsecured.

16 . Provision

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Long term provision:

Environment rehabilitation 470,029 143,268 99,422

------------------------------------------ ------------ ------------ ------------

Short term provision:

Environment rehabilitation - 57,494 16,120

------------------------------------------ ------------ ------------ ------------

470,029 200,762 115,542

========================================= ============ ============ ============

Six months 12 months Six months

Movement in provision to to to

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

At 1 January 200,762 52,137 52,137

Recognised in the period 79,541 138,020 60,292

Utilised in the period - - -

Reduction resulting from re-measurement

or settlement without cost 10,555 7,487 -

Unwinding of discount and effect of

changes in the discount rate 8,268 2,397 1,178

Exchange difference 170,903 721 1,935

At the end of the period 470,029 200,762 115,542

========================================== ============ ============ ============

Provision is made for the cost of restoration and environmental

rehabilitation of the land disturbed by the West Kytlim mining

operations, based on the estimated future costs using information

available at the reporting date.

The provision is discounted using a risk-free discount rate of

from 8.65% to 8.70% (2021: 3.87% to 5.08%) depending on the

commitment terms, attributed to the Russian Federal Bonds.

Provision is estimated based on the sub-areas within general

West Kytlim mining licence the company has carried down its

operations on by the end of the reporting period. Timing is

stipulated by the forestry permits issued at the pre-mining stage

for each of sub-areas. Actual costs in respect of the long-term

provision recognised in 2022 will be incurred within 2023-2025.

17 . Commitments

At the time of the award of the Monchetundra mining license a

royalty payment was calculated by the Russian Federal Reserves

Commission. 20% of this payment was paid in December of 2018 and

the remaining 80%, or RUB 16.68 million (approximately GBP262,000)

to be paid by November 2023.

During 2020 the Group entered into several lease agreements to

lease mining plant and equipment. As at 30 June 2022 the average

lease term was 3 years and present value of minimum lease payments

GBP643,370 (30 June 2021: GBP518,553).

18. Contingent liabilities

In 2021 the Company had invested RUB 37,180,000 (GBP584,591 at a

prevailing exchange rate at 30 June 2022) in respect of the

Nyud-Moroshkovoe and other potential licenses and projects as per

the agreements in place with Rosgeo and ERDC.

Further investments are at the Company's discretion. The

Nyud-Moroshkovoe project is being used by the Company as the

template for the remaining assets, which will only be evaluated

after the successful conclusion of the Nyud-Moroshkovoe

project.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCUBDDGDC

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

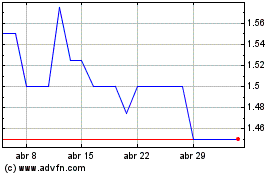

Eurasia Mining (LSE:EUA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Eurasia Mining (LSE:EUA)

Gráfica de Acción Histórica

De May 2023 a May 2024