TIDMEUZ

RNS Number : 8339U

Europa Metals Ltd

04 August 2022

4 August 2022

Europa Metals Ltd

("Europa Metals", the "Company" or the "Group") (AIM, AltX:

EUZ)

Further Highly Encouraging Metallurgical Results at Toral and

Operational Update

Europa Metals, the European focused lead, zinc and silver

developer, is pleased to announce highly encouraging results from

its comprehensive metallurgical testwork programme and an update on

its resource drilling campaign at its wholly owned Toral lead, zinc

and silver project in the Castilla y León region, Spain ("Toral" or

the "Toral Project").

Highlights :

-- Metallurgical testwork results received from Wardell

Armstrong International Ltd ("WAI") in respect of locked cycle

flotation tests ("LCT") on products from an ore sorted bulk

siliceous sample

o Concentrate Grades 56.6% Zinc 69.6% Lead

o Overall recovery (Sort & Float) 78.6% Zinc 80.7% Lead

-- Metallurgical results received for LCT from WAI on a further two carbonate samples from:

Hole TOD-025D:

o Concentrate Grades 57.4% Zinc 75.2% Lead

o Overall recovery (Sort & Float) 81.4% Zinc 94.4% Lead

Hole TOD-028:

o Concentrate Grades 60.3% Zinc 64.1% Lead

o Overall recovery (Sort & Float) 84.0% Zinc 87.3% Lead

-- Resource drilling ongoing

o Following a delay to the start of the current campaign,

progress has been impacted by drilling personnel contracting

COVID-19

o Hole TOD-041 has been completed with mineralisation being

intersected at the planned target depth

o Hole TOD-042 drilling is underway and currently at 280m with a

target depth of approximately 900m

o Rig is now operating on a double shift basis in order to seek

to catch up with the original programme schedule

Commenting today, Myles Campion, Executive Chairman and acting

CEO of Europa Metals, said :

"We have been busy so far this year on all fronts, including the

recent completion of our metallurgical testwork campaign with WAI

which achieved excellent results from both the upper siliceous zone

and the lower carbonate zone.

"Lead and zinc recoveries to respective concentrates are very

good. Ore sorting has played a part in lifting these recoveries

(zinc to zinc concentrate by approximately 4 percentage points and

lead to lead concentrate by approximately 3 percentage points,

versus the previous results on unsorted ore) which is highly

encouraging. The grades achieved for both Zinc and Lead are better

than previous results, with the siliceous showing that the upper

levels can also produce a high-grade concentrate.

"I am also pleased with our ongoing drill programme, albeit

there is some catching up still to do, which will aim to prove up

further indicated resources at depth."

Metallurgical Testwork : Ore Sorting followed by Froth Flotation

of Ore Sort Concentrates

Samples from Ore Sorting undertaken by Tomra GmbH, were

submitted to WAI earlier this year. The samples tested were a bulk

sample of siliceous style mineralisation and two borehole

composites of carbonate style mineralisation. The siliceous sample

was a composite of intersections from boreholes TOD-029, TOD-029D,

TOD-029D2, TOD-029D3, TOD-034 and TOD-034D (a total of 701.09 kg).

The carbonate samples were taken from boreholes TOD-025D and

TOD-028 (96.36 kg and 50.7 kg respectively).

The ore sorting results announced previously by the Company in

March 2022 were as follows:

Siliceous bulk sample

-- Recovery of 95.7% Pb and 94.3% Zn metal

-- 43.7% mass rejection of waste

Carbonate composite from hole TOD-025D

-- Recovery of 98.9% Pb and 94.7% Zn metal

-- 46.8% mass rejection of waste

Carbonate composite from hole TOD-028

-- Recovery of 96.6% Pb and 96.1% Zn metal

-- 47.7% mass rejection of waste

The sorter products were the subject of the recently completed

campaign of locked cycle flotation with the metallurgical results

received from WAI comprising:

-- Siliceous bulk sample

o Flotation Recoveries 83.4% Zinc 84.3% Lead

o Flotation Concentrate Grades 56.6% Zinc 69.6% Lead

o Overall recovery (Sort & Float) 78.6% Zinc 80.7% Lead

-- Carbonate sample from hole TOD-025D

o Flotation Recovery 85.9% Zinc 95.4% Lead

o Flotation Concentrate Grades 57.4% Zinc 75.2% Lead

o Overall recovery (Sort & Float) 81.4% Zinc 94.4% Lead

-- Carbonate sample from hole TOD-028

o Flotation Recovery 87.4% Zinc 90.3% Lead

o Flotation Concentrate Grades 60.3% Zinc 64.1% Lead

o Overall recovery (Sort & Float) 84.0% Zinc 87.3% Lead

Comparison with the 2019 locked cycle flotation tests on

carbonate drill core

Locked cycle flotation tests simulate a full-scale plant

flowsheet. Each test at WAI's facilities was conducted in a series

of six cycles using the flowsheet shown in Figure 1 below. For the

second and subsequent cycles, lead and zinc cleaner tailings

products were combined with the feed to the previous stage of

flotation. For example, lead second cleaner tails were returned to

first cleaner feed. The final concentrates, zinc scavenger tailings

and zinc rougher tailings from the final two cycles, were weighed

and sent for independent analysis. The results were then used to

calculate recovery and concentrate grades.

Figure 1 :

Locked Cycle Test Flowsheet

http://www.rns-pdf.londonstockexchange.com/rns/8339U_1-2022-8-3.pdf

Results of the 2019 and 2022 testwork programmes are summarised

in Table 1 below. These results indicate that Toral could clearly

achieve excellent concentrate grades.

Table 1 :

Summarised Results of the 2019 and 2022 Testwork

(Note : recovery and concentration data are from the original

feed)

Test Lead Concentrate Zinc Concentrate

Lead Recovery CR Conc Zinc Recovery CR Conc

(%) (% Pb) (%) (% Zn)

-------------- ----- -------- -------------- ----- --------

2019 Carbonate

LCT1 Float 84.3 39.4 57.5 70.7 29.8 55.8

-------------- ----- -------- -------------- ----- --------

2019 Carbonate

LCT2 Float 83.7 34.9 60.0 77.0 24.9 59.1

-------------- ----- -------- -------------- ----- --------

2022

Carbonate

025D

Sort + Float 94.4 18.8 75.2 81.4 42.3 57.4

-------------- ----- -------- -------------- ----- --------

2022

Carbonate

028

Sort + Float 87.3 51.4 64.1 84.0 24.0 60.3

-------------- ----- -------- -------------- ----- --------

2022 Silicate

Sort + Float 80.7 59.7 69.6 78.6 52.9 56.6

-------------- ----- -------- -------------- ----- --------

Ore sorting and froth flotation are processes that concentrate

and recover metal values. The concentration ratio ("CR") is defined

as the weight of feed divided by the weight of concentrate.

Performance of an individual test can be judged in terms of

recovery and CR. For an operating plant, daily results for recovery

and CR continually vary. However, the results generally form a

trend when plotted on axes of recovery versus CR. The same type of

plot can be useful in comparing locked cycle test results.

Figure 2 :

Zinc Recovery vs Concentration Ratio Plot of LCT Results

http://www.rns-pdf.londonstockexchange.com/rns/8339U_1-2022-8-3.pdf

Overall results for zinc recovery (for 2022, sort & float

and for 2019, just float) are shown in Figure 2. At any given CR,

higher recovery indicates improved performance, and figure 2

illustrates that the combined sort plus float procedure has given

better performance than flotation alone for the zinc

concentrate.

In respect of the 2022 results, the best estimate of zinc

recovery is the trendline shown in Figure 2, which is "a least

squares fit" for the three different testwork data points. This

line intersects the recovery axis at 89.7%.

This intercept incorporates for zinc metal losses during the

sorting process of 3.9% and also a recovery loss during the

flotation process of a further 6.4% of zinc to lead

concentrate.

The equation of the trend line is as follows:

Recovery % = 89.7 - (0.21 * CR)

In practice, when a full-scale plant and concentrator are in

operation the aim is to produce a saleable zinc concentrate grade

of approximately 55% to 60% Zn. To achieve this target concentrate

grade, the required concentration ratio (and achievable recovery)

depends mainly on the headgrade from the deposit.

At Toral, the average resource grade (October 2021 Resource

Estimate, @ 4% Zn equivalent cut off) is 3.9% zinc, such that a

future potential processing plant could operate at a CR of 17 to

zinc concentrate, which would achieve a zinc recovery of 86.1% and

a concentrate grade of 57.1% zinc.

An approximate estimate of the zinc recovery improvement

resulting from sorting can be made from Figure 2 . Projecting the

two points from the 2019 testwork back to a CR of 17 and then

comparing with the best estimate of recovery trendline indicates a

recovery improvement of approximately 4 percentage points.

Figure 3 :

Lead Recovery vs Concentration Ratio Plot of LCT Results

http://www.rns-pdf.londonstockexchange.com/rns/8339U_1-2022-8-3.pdf

Overall results for lead recovery (for 2022, sort & float

and for 2019, just float) are shown in Figure 3, with the combined

sort plus float procedure again giving better performance than

flotation alone.

In respect of the 2022 results, the best estimate of lead

recovery is the trendline shown in Figure 3, which is "a least

squares fit" for the three testwork data points, intersecting the

recovery axis at 97.4%. This intercept allows for the average loss

of lead during sorting of 2.6% and the equation of the trend line

is as follows:

Recovery % = 97.4 - (0.24 * CR)

In practice, a concentrator would seek to produce a saleable

lead concentrate grade of approximately 70% lead. The average

resource grade at Toral (October 2021 Resource Estimate) is 2.7%

lead, such that a CR of 29 to lead concentrate would be required to

achieve a lead recovery of 90.4% and a concentrate grade of 70.8%

lead.

An approximate estimate of the lead recovery improvement

resulting from sorting can be made from Figure 2 . Projecting the

two points from the 2019 testwork back to a CR of 29 and then

comparing with the best estimate of recovery trendline indicates a

recovery improvement of approximately 3 percentage points.

In summary, the Europa Metals' team believes that ore sorting

followed by flotation has significant cost, performance and

operational advantages compared with flotation alone.

The Company will now consider how best to utilise ore sorter

rejects and flotation tailings. These waste products will be

valuable as potential cemented aggregate backfill and paste fill

for underground mining operations. Some tailings products could

also be used as landfill for reclamation of an existing quarry.

Analysis of Final Concentrates Produced in the 2022 Locked Cycle

Testwork

Final zinc and lead concentrates from the 2022 testwork were

sent for detailed chemical analyses. The analyses for commonly

applied penalty elements are shown in Table 2 below. The

concentrates were generally below penalty levels except for

mercury. High mercury levels are common for Spanish zinc

concentrates and local smelters are able to manage such feeds. As

an alternative, a future plant at Toral could incorporate a

concentrate treatment process in order to reduce the mercury to

below penalty levels.

Table 2 :

Penalty Element Analyses of Concentrates Produced in the 2022

Testwork

Concentrate As (ppm) Bi Cd (ppm) Fe Mg (%) Mn (ppm) Hg (ppm) F (ppm)

From Testwork (ppm) (%)

Siliceous

Lead Conc 513 2.6 87 4.32 0.08 80 234 120

--------- ------- --------- ----- ------- --------- --------- --------

Siliceous

Zinc Conc 104 0.2 1,325 2.72 0.06 120 2,970 40

--------- ------- --------- ----- ------- --------- --------- --------

Carbonate

025D Lead

Conc 80 2.6 60.8 1.04 0.29 60 96 <20

--------- ------- --------- ----- ------- --------- --------- --------

Carbonate

025D Zinc

Conc 33 0.1 1,445 1.83 0.28 70 1,745 30

--------- ------- --------- ----- ------- --------- --------- --------

Carbonate

028 Lead

Conc 212 7.9 177.5 5.6 0.17 60 197 30

--------- ------- --------- ----- ------- --------- --------- --------

Carbonate

028 Zinc

Conc 16 0.1 1,635 1.75 0.08 50 1,085 20

--------- ------- --------- ----- ------- --------- --------- --------

Penalty

Level for

Zinc Conc 2,000 200 2,500 8% 0.18% 5,000 50 200

--------- ------- --------- ----- ------- --------- --------- --------

Resource Drilling

Following an initial delay to the arrival of the rig on site due

to increased exploration activity and therefore rig demand in

Spain, the first hole, TOD-041, has recently been completed. Hole

TOD-041 intersected mineralisation at its target depth, whilst

drilling of hole TOD-042 has commenced and is advancing well, as

the rig contractor is operating on a double shift, and is currently

at 280m with a target depth of approximately 900m.

The objective of this ongoing campaign is to seek to extend the

indicated resource at depth towards the east of the current zone

and link up a known area of encouraging data. If successful, this

will add tonnes to the envisaged future mining plan. Additionally,

all holes are being geotechnically evaluated as we drill, thereby

providing additional information for the feasibility study

process.

This drilling campaign will also complete our R&D

collaboration project with the Centre for the Development of

Industrial Technology (CDTI) which will conclude later this

year.

Competent Person's statement

The information contained in this announcement that relates to

exploration activities is based upon information compiled by Evan

Kirby, Non-Executive Director of Europa Metals. Dr Kirby is a

Fellow of the Southern African Institute for Mining and Metallurgy

and has sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity being undertaken to qualify as a Competent Person as

defined in the December 2012 edition of the "Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves" (JORC Code). Dr Kirby consents to the inclusion in this

announcement of the matters based upon the information in the form

and context in which it appears.

For further information on the Company, please visit

www.europametals.com or contact:

Europa Metals Ltd

Dan Smith, Non-Executive Director and Company Secretary

(Australia)

T: +61 417 978 955

Myles Campion, Executive Chairman and acting CEO (UK)

T: +44 (0)20 3289 9923

Strand Hanson Limited (Nominated Adviser)

Rory Murphy/Matthew Chandler

T: +44 (0)20 7409 3494

WH Ireland Limited (Broker)

Harry Ansell/Dan Bristowe/Katy Mitchell/Sarah Mather

T: +44 (0)20 7220 1666

Questco Corporate Advisory Proprietary Limited (JSE Sponsor)

Sharon Owens

T: +27 (11) 011 9212

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZGGRKFGGZZM

(END) Dow Jones Newswires

August 04, 2022 02:00 ET (06:00 GMT)

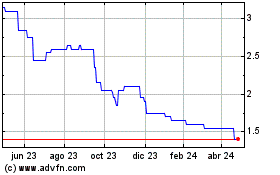

Europa Metals (LSE:EUZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

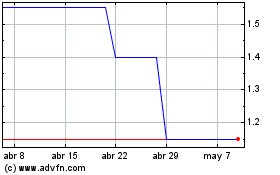

Europa Metals (LSE:EUZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024