TIDMFAR

RNS Number : 9314L

Ferro-Alloy Resources Limited

11 September 2023

11 September 2023

Ferro-Alloy Resources Limited

("Ferro-Alloy" or "the Company" or "the Group")

2023 Interim Results

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer

and developer of the large Balasausqandiq vanadium deposit in

Southern Kazakhstan, is pleased to announce its interim results for

the six months ended 30 June 2023.

Overview

Feasibility Study

-- Feasibility study ongoing with completion of Stage 1 of the

study expected in April 2024 and Stage 2 later in 2024:

o Ore resource for ore-body 1 was revised upwards during the

period by SRK Consulting (Kazakhstan) to 32.9m tonnes at a mean

grade of 0.62%, giving an increase of 35.4% in the resource and 23%

in contained V(2) O(5) .

o Drilling of ore-bodies 2, 3 and 4 has been completed with the

exception of an area which is difficult to access. The Company is

awaiting assays for these ore-bodies which are expected to provide

the feed for the larger Stage 2 development of the deposit.

o Metallurgical test-work is nearing completion.

Operations

-- Final planned improvements completed at the Existing

Operation (where the Group processes secondary materials and

recovers the contained vanadium, molybdenum and nickel for sale to

third parties) including:

o The conversion of the fuel used for the various roasting ovens

from diesel to natural gas.

o A further press filter and tanks to allow a second pulpation

process to give a further recovery of vanadium.

o A further press filter and tanks to allow for

recrystallisation of ammonium metavanadate, an essential step in

producing a high purity product as required for electrolyte

purposes.

o Improved molybdenum processes to increase recovery to around

90% depending on the raw-material treated.

o Various additional equipment to contain production

emissions.

-- Following poor availability of concentrate supply in Q1, Q2

achieved best production by the Group to date in terms of both

tonnes of concentrates treated and tonnes of metal recovered across

all product lines, however, H1 production constrained by a lack of

raw materials caused by continuing defaults of certain of the

Group's suppliers.

-- The Group has subsequently made changes to suppliers and has

secured future deliveries to allow full production from mid-late

September 2023.

Financial

-- Total revenues of US$3.3m for the period (H1 2022: US$3.9m)

reflecting the reduced volumes of raw materials delivered to the

existing plant for processing during the first quarter of the

year.

-- Overall loss for the period of US$1.5m (2022: loss of US$0.7m).

Corporate

-- Post period, launched the first tranche of a new Kazakhstan

exempt offer bond programme in July 2023. The proceeds of the

Programme will be used to strengthen the Company's balance sheet

and provide working capital, allowing the acceleration of the

project's development as far as possible.

Commenting on the interim financial results, Nick Bridgen, CEO

of Ferro-Alloy Resources said:

"I am pleased to report the good progress with the feasibility

study. With the completion of the expansion of the existing process

plant, and the improved raw-material supply position, I look

forward to much better operational performance from the fourth

quarter of this year onwards."

- Ends -

For further information, visit www.ferro-alloy.com or contact:

Ferro-Alloy Resources Nick Bridgen (CEO) info@ferro-alloy.com

Limited / William Callewaert

(CFO)

Shore Capital Toby Gibbs/Lucy Bowden

(Joint Corporate Broker) +44 207 408 4090

Liberum Capital Limited Scott Mathieson/Kane

(Joint Corporate Broker) Collings +44 20 3100 2000

St Brides Partners

Limited

(Financial PR & IR Catherine Leftley/Ana

Adviser) Ribeiro +44 207 236 1177

Operations Review

Balasausqandiq feasibility study

The Company is currently undertaking a comprehensive bankable

feasibility study on the Balasausqandiq project, with completion of

Stage 1 of the study expected in April 2024 and Stage 2 later in

the year. Although a full mineral resource estimate has only been

completed for ore-body 1 ("OB1"), indications are that

Balasausqandiq will be one of the largest vanadium operations in

the world.

The ore resource for OB1 was revised upwards during the period

by SRK Consulting (Kazakhstan) Limited, the author of the

feasibility study, to 32.9m tonnes at a mean grade of 0.62%, giving

an increase of 35.4% in the resource and 23% in contained V(2) O(5)

.

The drilling of ore-bodies 2, 3 and 4 has been completed with

the exception of an area which is difficult to access. This is

planned to be drilled closer to the time of mining when access has

been developed. The Company is awaiting assays for these ore-bodies

which are expected to provide the feed for the larger Stage 2

development of the deposit.

The metallurgical test-work is nearing completion. The Company's

metallurgical process was previously tested in a pilot plant and

the process parameters are now being rigorously tested in

independent laboratory conditions by SGS Canada Inc under the

direction of Tetra Tech Limited, who are carrying out the

metallurgical section of the feasibility study.

Other parts of the study are also nearing completion and the

overall study for Stage 1 is expected to be announced in April

2024, as noted above.

The existing operation

The existing operation was developed from the original 15,000

tonnes per year ore-treatment test plant which was used to develop

and pilot the proposed treatment process of the Balasausqandiq ore.

The plant was subsequently adapted to treat purchased concentrates.

The most common raw material is the loaded catalysts used in

refineries to remove the metal impurities from crude oil. The Group

buys these secondary materials and recovers the contained vanadium,

molybdenum and nickel for sale to third parties.

During the first half of 2023, the final planned improvements

were made to the plant, including:

1. The conversion of the fuel used for the various roasting ovens from diesel to natural gas;

2. A further press filter and tanks to allow a second pulpation

process to give a further recovery of vanadium, taking the average

overall recovery of vanadium from catalysts treated to over

90%;

3. A further press filter and tanks to allow for

recrystallisation of ammonium metavanadate ("AMV"), an essential

step in producing a high purity product as required for electrolyte

purposes;

4. Improved molybdenum processes to increase recovery to around

90% depending on the raw material treated; and

5. Various additional equipment to contain production emissions.

The Group received grant funding from the Kazakhstan National

Scientific Council to develop the process and install equipment for

the production of various oxides of vanadium suitable for use in

electrolyte for vanadium redox flow batteries. The development work

is in association with the Physical-Technical Institute of Almaty

(part of the Satbayev University) who are building a laboratory in

which a battery will be installed and electrolyte produced from the

Group's oxides for test purposes.

Production

The second quarter of the year achieved the best production by

the Group to date in terms of both tonnes of concentrates treated

and tonnes of metal recovered across all product lines.

By comparison, production for the first quarter of the year was

severely constrained by the availability of concentrate supply to

the existing plant and is reflected in the corresponding production

figures.

2023 2022 2023 2022 2023 2022

Quarter Tonnes Tonnes Tonnes Tonnes Tonnes Tonnes

of vanadium of vanadium of molybdenum** of molybdenum** of nickel*** of nickel***

pentoxide* pentoxide*

------------- ------------- ----------------- ----------------- -------------- --------------

Q1 31.3 81.1 6.5 11.3 9.7 25.1

------------- ------------- ----------------- ----------------- -------------- --------------

Q2 141.4 91.7 14.1 10.4 50.8 32.2

------------- ------------- ----------------- ----------------- -------------- --------------

H1 172.7 172.8 20.6 21.7 60.5 57.3

------------- ------------- ----------------- ----------------- -------------- --------------

* contained in AMV

** contained in ferro-molybdenum

*** contained in nickel concentrate

Outlook

The first half of 2023's output was constrained by a lack of raw

materials, caused by continuing defaults of certain of the Group's

suppliers. The Group responded by signing several new long-term and

spot supply contracts but further delays to delivery were

experienced. In response, the Group has made yet further changes to

its suppliers and signed new contracts to secure future deliveries.

The indications are that more material is being offered to the

Group, allowing the Group to select the more reliable

counterparties. Despite these setbacks, sufficient volumes of raw

materials have been purchased and are en route to the Group's plant

site to allow full production from mid to late September. Winter

transport delays may impact on winter deliveries, albeit to a

lesser extent than previously experienced.

Corporate

The Company's previously issued and outstanding bonds, amounting

to US$1.1m at 31 December 2022, were redeemed at maturity during

March 2023.

Subsequently, the Company launched a new Kazakhstan US$20m

exempt offer bond programme ("the Programme") in July 2023. Cash

proceeds generated by the Programme will be used, in general, to

strengthen the Company's balance sheet and provide working capital

for the existing operation.

The key features of the Programme are as follows:

- the Programme can comprise of one or more tranches of bonds,

each listed on the Astana International Exchange ("AIX");

- the total nominal value of all tranches issued under Programme will not exceed US$20m;

- only accredited investors resident in Kazakhstan will be

eligible to invest in the Programme;

- bonds issued under the Programme will be denominated in either

US dollars or Kazakhstan tenge;

- all bonds issued will rank as unsecured debt obligations of the Company;

- the applicable coupon rate, duration, issue price and other

relevant terms of any bonds issued under the Programme will be

defined and determined by the terms and conditions of each tranche

of bonds issued; and

- the Programme is governed by the laws and regulations of the

Astana International Finance Centre and is valid until 31 July

2033.

Following the launch of the Programme, the Company listed the

first tranche of bonds on the AIX on 27 July 2023 with the ability

to raise an initial US$3 million. As at the date of this report,

the first tranche of bonds has been materially sold and the cash

proceeds received.

The Company is preparing to list a second tranche of bonds on

the AIX during the course of September / October with the ability

to raise a further US$5 million. The cash proceeds from the second

tranche will be deployed to accelerate the development of the

project, including front-end engineering.

Product prices in the period

Vanadium pentoxide

At the start of 2023, the price of vanadium pentoxide was around

US$9.30/lb, rising slightly to between US$10.00/lb and US$10.50/lb

for the period January to March inclusive, after which the price

dropped to US$6.85/lb during June before recovering to around

US$7.50/lb at the period end.

Ferro-molybdenum

At the start of 2023, the price of ferro-molybdenum was around

US$79/kg rising sharply to a period high of US$101/kg in February

before gradually falling to a period low of US$42/kg in April,

after which prices stabilised at around US$50/kg for the balance of

the period.

Earnings and cash flow

The Group generated total revenues of US$3.3m for the period (H1

2022: US$3.9m). The reduction in revenue reflects the reduced

volumes of raw materials delivered to the existing plant for

processing during the first quarter of the year.

The cost of sales for the period under review was US$3.6m in

line with the first six months of 2022 (US$3.5m).

Administrative expenses for the period were US$1.3m (2022:

US$1.2m).

The Group made a loss before and after tax of US$1.5m (2022:

loss of US$0.7m).

Net cash outflows used in operating activities were US$1m (2022:

cash outflow of US$0.5m). Net cash used in investing activities

during the period was US$2.3m, an increase of US$0.6m in comparison

to the prior period, reflecting the Group's continued investment in

the Balasausqandiq feasibility study and planned upgrades to the

plant at the existing processing operation. Net cash used in

financing activities increased by US$1.1m between the periods due

to the maturity and repayment of the Company's outstanding bonds in

issue during March 2023.

Balance sheet review

At the period end, non-current assets totalled US$11.9m (2022:

US$8.0m) reflecting the continued capitalisation of expenses

incurred by the Group on the development of the Balasausqandiq

feasibility study (as an exploration and evaluation asset) and

capital additions made to the plant at the existing processing

operation.

Current assets, excluding cash balances, totalled US$5.0m at the

period end compared to US$4.8m for the prior period.

The Group held an aggregate cash balance of US$0.6m at the

period end (2022: US$0.5m). As at the date of this report, the

Group held an aggregate cash balance of US$1.8m.

The Group did not hold any significant or material non-current

liabilities at the period end.

With respect to current liabilities, the reduction in the

overall balance from US$4.2m at 30 June 2022 to US$3.0m at the

period end can be attributed, in the main, to the repayment of the

Company's outstanding bonds.

Environmental, social and governance

Both the existing operation and the planned process plant for

Balasausqandiq will have a strongly positive environmental impact.

The vanadium from production will benefit energy storage in both

vanadium redox flow batteries, the front-running technology for

fixed ground long-term energy storage, but also potentially in

certain technologies for mobile batteries used in electric

vehicles.

Furthermore, in both operations we are aiming to leave little or

no residues from processing operations, since all the components of

the ore are potentially useful. The CO(2) emissions created by our

production at Balasausqandiq are expected to be a fraction of most

other producers which generally require concentration and

high-temperature roasting to liberate the vanadium. The carbon

concentrate which we plan to market as a replacement for carbon

black is produced without burning hydrocarbons, as is the usual

production process.

Description of principal risks, uncertainties and how they are

managed

(a) Current processing operations

Current processing operations make up a small part of the

Company's expected future value but are expected to provide useful

cash flows in the near term and allow the Group to gain valuable

experience of the vanadium industry. The principal risks of this

operation are the prices of its products (vanadium, molybdenum and

nickel), availability of vanadium bearing concentrates and the

efficiency of recovery of products from those concentrates.

The Group is constantly reviewing the market opportunities for

supplies of vanadium bearing concentrates. The Group aims to

extract all the useful components of the raw materials so that no

residues remain on site and so maximum value is obtained from each

tonne treated. By this means, we aim to be one of the most

efficient and lowest cost secondary vanadium treatment plants so

that our competitive position reduces the danger of high prices for

raw materials making the operation uneconomic.

(b) Balasausqandiq project

The Balasausqandiq project is a much larger contributor to the

Company's value than the current processing operation and is

primarily dependent on long-term vanadium prices.

The project is dependent on raising finance to meet projected

capital costs (see below) and the successful construction and

commissioning of the project's proposed mine processing facilities.

It is not unusual for new mining projects to experience unforeseen

problems, incur unexpected costs and be exposed to delays during

construction, commissioning, and initial production, all of which

could have a material adverse effect on the Company's operations

and financial position. The Company has taken steps to mitigate

such potential adverse effects by engaging globally recognised

engineers and consultants to assist with the development and design

of the key elements of the project in addition to the Group's own

highly qualified workforce.

(c) Geopolitical situation

The Directors remain vigilant of the situation created by the

ongoing invasion of Ukraine by Russia. The continued main risk of

the conflict is to the Group's transport routes, many of which

involve transit through Russia. Whilst these are currently

operating without issue, sanctions have been made against Russian

and Belorussian vehicles transiting through Europe (but not against

vehicles registered in other jurisdictions in the region such as

Kazakhstan). There is a risk that further sanctions might prevent

transit through Russia. The Company continues to review alternative

transit routes for raw material imports and product exports through

the West of Kazakhstan, either via the Caspian Sea or overland

south of the Caspian Sea. Routes to China are working normally.

With respect to the global sanctions imposed on certain Russian

entities and individuals, the Group monitors the implications of

those sanctions on the Group's trading activities on an ongoing

basis.

(d) Financing risk

The Balasausqandiq project will require substantial funds to be

raised in debt and possibly further equity which will be dependent

upon market conditions at the time and the successful completion of

the Stage 1 feasibility study.

The existing operation is fully developed and operating well

and, subject to the uncertainty over vanadium bearing concentrate

availability, prices and costs, is forecast to make profits going

forward.

In March of 2021 the Company signed an investment agreement with

Vision Blue Resources Limited ("Vision Blue"). Under the terms of

this agreement and in addition to Vision Blue's participation in

the 2022 equity fundraise, investments totalling US$14.3m have

already been made and Vision Blue has the right to subscribe a

further US$2.5m at the original deal price of 9 pence per share at

any time up to two months after the announcement of the Stage 1

feasibility study. Vision Blue also has further options to

subscribe up to US$30m at higher prices to partially finance the

construction of the Balasausqandiq project.

The favourable financial and other characteristics of the

project determined by studies so far completed give the Directors

confidence that the outcome of the Stage 1 feasibility study will

be successful. Initial discussions with potential providers of debt

finance have been encouraging.

(e) Climate change risk

The Group has not identified any particular climate change

related scenarios that would likely have a significant impact on

the Balasausqandiq project or the existing operation. The existing

operation already functions in an environment that is subject to

extreme weather conditions and is, therefore, considered to have a

strong resilience to existing and future climate-related

scenarios.

(f) Risks associated with the developing nature of the Kazakh economy

According to the World Bank, Kazakhstan has transitioned from

lower-middle-income to upper-middle-income status in less than two

decades. Kazakhstan's regulatory environment has similarly

developed and the Company believes that the period of rapid change

and high risk is coming to an end. Nevertheless, the economic and

social regulatory environment continues to develop and there remain

some areas where regulatory risk is greater than in developed

economies.

(g) Commodity price risk

As already noted above, the success of the Company is dependent

upon the long-term prices of the products to be produced by the

planned mine processing facilities. As a result of there being no

formally established trading markets for the Company's principal

products from the project, there is a risk that price fluctuations

and volatility for these products may have an adverse impact on the

Company's future financial performance

Condensed unaudited Statement of Profit or Loss and Other

Comprehensive Income

for the six months ended 30 June 2023

Unaudited

six-month

period ended

30 June

Unaudited 2022 $000

Audited

six-month year

period

ended ended

30 June 31 December

2023 2022

Note $000 $000

------------- ------------- -------------

Revenue from customers (pricing

at shipment) 2 3 ,410 4,327 6 , 773

Other revenue ( adjustments

to price after delivery and

fair value changes) 2 ( 9 6) (417) (502)

------------- ------------- -------------

Total revenue 2 3 ,314 3,910 6,271

( 3,541 ( 7,516

Cost of sales 3 (3,565) ) )

------------- ------------- -------------

Gross (loss) / profit (251) 369 (1,245)

Other income 4 13 12 77

( 2,545

Administrative expenses 5 (1,337) (1,154) )

Distribution expenses (66) ( 52 ) ( 265 )

Other expenses 6 (47) - (426)

------------- ------------- -------------

( 4,404

Loss from operating activities (1,688) ( 825 ) )

------------- ------------- -------------

Net finance income 8 158 131 118

------------- ------------- -------------

( 4 , 286

Loss before income tax (1,530) ( 694 ) )

============= ============= =============

Income tax - - -

=============

( 4 , 286

Loss for the period (1,530) ( 694 ) )

=============

Other comprehensive income / (loss)

Items that may be reclassified subsequently

to profit or loss

Exchange differences arising

on translation of foreign

operations 496 (834) (541)

------------- ------------- -------------

Total comprehensive loss

for the period (1,034) (1,528) (4,827)

============= ============= =============

Loss per share (basic and

diluted) 16 (0.0 0 3) (0.0 0 2) (0.011)

------------- ------------- -------------

These condensed unaudited financial statements were approved by

the directors on 8 September 2023 and signed by:

_____________________________

William Callewaert

Director

Condensed unaudited Statement of Financial Position

for the six months ended 30 June 2023

Unaudited Unaudited

Audited

3 0 June 3 0 June 31 December

2023 2022 2022

Note $000 $000 $000

---------- ---------- ------------

ASSETS

Non-current assets

Property, plant and equipment 9 6,072 4,624 5,434

Exploration and evaluation

assets 10 5,581 2,819 4,208

Intangible assets 11 20 19 19

Prepayments 14 185 575 1,273

----------

Total non-current assets 11,858 8,037 10,934

---------- ---------- ------------

Current assets

Inventories 12 2,015 2,422 1,628

1 , 8 9

Trade and other receivables 1 3 2 1,356 1,151

Prepayments 14 1,115 1,043 911

Cash and cash equivalents 15 606 542 4,331

----------

Total current assets 5,628 5,363 8,021

---------- ---------- ------------

Total assets 17, 486 13,400 18,955

========== ========== ============

EQUITY AND LIABILITIES

Equity

Share capital 16 50,827 41,252 50,827

Convertible loan notes 16 4,019 4,019 4,019

Additional paid-in capital 397 397 397

Share-based payment reserve 5 - 5

Foreign currency translation

reserve (3,665) (4,454) (4,161)

Accumulated losses (37,204) (32,082) (35,674)

---------- ---------- ------------

Total equity 14,379 9,132 15,413

---------- ---------- ------------

Non-current liabilities

Provisions 33 45 33

----------

Total non-current liabilities 33 45 33

---------- ---------- ------------

Current liabilities

Loans and borrowings 17 - 1,390 1,108

Trade and other payables 18 3, 074 2,404 2,383

Payables at FVTPL 19 - 405 -

Interest payable 17 - 24 18

---------- ---------- ------------

Total current liabilities 3, 074 4,223 3,509

---------- ------------

Total liabilities 3, 107 4,268 3,542

---------- ---------- ------------

1 7 ,

Total equity and liabilities 486 13,400 18,955

========== ========== ============

Condensed unaudited Statement of Changes in Equity

for the six months ended 30 June 2023

Foreign

Additional Share-based currency

Share Convertible paid in payment translation Accumulated

capital loan notes capital reserve reserve losses Total

$000 $000 $000 $000 $000 $000 $000

-------- ----------- ---------- ----------- ------------ ------------------ -------

Balance at 1

January 2022 41,252 4,019 397 - (3,620) (31,388) 10,660

Loss for the

year - - - - - (4,286) (4,286)

Other

comprehensive

expenses

Exchange

differences

arising on

translation

of foreign

operations - - - - (541) - (541)

-------- ----------- ---------- ----------- ------------ ------------------ -------

Total

comprehensive

loss for the

year - - - - (541) (4,286) (4,827)

-------- ----------- ---------- ----------- ------------ ------------------ -------

Transactions

with owners,

recorded

directly in

equity

Shares issued,

net of issue

costs 9,575 - - - - - 9,575

Other

transactions

recognised

directly

in equity - - - 5 - - 5

-----------

Balance at 30

June 2022 41,252 4,019 397 - (4,454) (32,082) 9,132

======== =========== ========== =========== ============ ================== =======

Balance at 31

December 2022 50,827 4,019 397 5 (4,161) (35,674) 15,413

======== =========== ========== =========== ============ ================== =======

Balance at 1

January 2023 50,827 4,019 397 5 (4,161) (35,674) 15,413

Loss for the

period - - - - - (1,530) (1,530)

Other

comprehensive

expenses

Exchange

differences

arising on

translation

of foreign

operations - - - - 496 - 496

-------- ----------- ---------- ----------- ------------ ------------------ -------

Total

comprehensive

loss for the

period - - - - 496 (1,530) (1,034)

-------- ----------- ---------- ----------- ------------ ------------------ -------

Transactions

with owners,

recorded

directly in

equity

Shares issued, -

net of issue

costs - - - - - -

Other -

transactions

recognised

directly

in equity - - - - - -

-----------

Balance at 30

June 2023 50,827 4,019 397 5 (3,665) (37,204) 14,379

======== =========== ========== =========== ============ ================== =======

Condensed unaudited Statement

of Cash Flows for the six months

ended 30 June 2023

-------------- ----------- -------------

Unaudited Unaudited

six-month six-month Audited

period

period ended ended year ended

30 June 31 December

30 June 2023 2022 2022

$000 $000 $000

-------------- ----------- -------------

Cash flows from operating activities Note

Loss for the period (1,530) (694) (4,286)

Adjustments for:

3,

Depreciation and amortisation 5 210 269 505

Write-off of property, plant

and equipment - - 54

Write-down of inventory to net

realisable value - - 160

Share-based payment expense - - 5

Net finance gains 8 (158) (131) (118)

--------------

Cash used in operating activities

before changes in working capital (1,478) (556) (3,680)

Change in inventories (387) (516) 312

Change in trade and other receivables ( 7 4 1 ) (1,256) (1,035)

Change in prepayments 884 (137) (584)

Change in trade and other payables 6 8 3 1,583 1,555

Change in receivables / payables

at FVTPL - 419 -

-------------- ----------- -------------

Net cash used in operating activities (1,039) (463) (3,432)

-------------- ----------- -------------

Cash flows from investing activities

Acquisition of property, plant

and equipment 9 (773) (361) (1,466)

Acquisition of exploration and

evaluation assets 10 (1,481) (1,385) (2,871)

Acquisition of intangible assets 11 (1) (1) (1)

Proceeds on fixed asset disposal - - 36

--------------

Net cash used in investing activities (2,255) (1,747) (4,302)

-------------- ----------- -------------

Cash flows from financing activities

Proceeds from issue of share

capital 16 - - 10,000

Transaction costs on shares subscription 16 - - (425)

Repayment of borrowings 17 (1,112) - (300)

Interest paid 17 (32) (41) (82)

--------------

Net cash used in financing activities (1,144) (41) 9,193

-------------- ----------- -------------

Net (decrease) / increase in

cash and cash equivalents (4,438) (2,251) 1,459

Cash and cash equivalents at

the beginning of the period 15 4,331 2,810 2,810

-------------- ----------- -------------

Effect of movements in exchange

rates on cash and cash equivalents 713 (17) 62

-------------- ----------- -------------

Cash and cash equivalents at

the end of the period 606 542 4,331

============== =========== =============

Notes to the Condensed unaudited Financial Statements for the

six months ended 30 June 2023

1 (a) Basis of preparation

These Condensed unaudited Financial Statements have been

prepared in accordance with IAS34 'Interim Financial Reporting' and

International Financial Reporting Standards as adopted by the

European Union ("IFRS") on a going concern basis.

The same accounting policies and basis of preparation have been

followed as adopted in the annual financial statements of the Group

which were published on 27 April 2023.

(b) Going concern

The Directors have reviewed the Group's cash flow forecasts for

a period of at least 12 months from the date of approval of the

financial statements, together with sensitivities and mitigating

actions. In addition, the Directors have given specific

consideration to the continued risks and uncertainties associated

with the geopolitical situation with respect to Russia and

Ukraine.

The Group has the plant facilities and capacity in place to

operate profitably and although the amount of those profits

available to fund the Stage 1 feasibility study and investment

programme may vary with metal prices and other factors, the

Directors are confident that the Company has sufficient resources

to continue as a going concern for at least the next 12 months.

(c) Use of estimates and judgements

Preparing the financial statements requires management to make

judgements, estimates and assumptions that affect the application

of accounting policies and the reported amounts of assets and

liabilities, income and expenses. Actual results may differ from

these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected.

Carrying value of processing operations

The Directors have tested the existing operation's property,

plant and equipment ("PP&E") for impairment (Note 9) at 30 June

2023. In doing so, net present value cash flow forecasts were

prepared using the value in use method which required key estimates

including vanadium pentoxide, ferro-molybdenum and nickel prices,

production including the impact of ongoing PP&E maintenance

costs and an appropriate discount rate. Key estimates included:

-- Production volumes of 64 tonnes per month of vanadium

pentoxide (as AMV), 6 tonnes of molybdenum (as ferro-molybdenum)

and 41 tonnes of nickel (as nickel concentrate).

-- Average prices of vanadium pentoxide of US$7.5/lb,

ferro-molybdenum of US$50/kg and nickel of US$20/kg in 2023 and

thereafter, reflecting management estimates having consideration of

market commentary less a discount, and used by the Company as a

long-term assumption for other planning purposes.

-- Discount rate of 10% post tax in real terms.

Based on the key assumptions set out above, the recoverable

amount of PP&E (US$31.8m) exceeds its carrying amount (US$6.1m)

by US$25.7m and, therefore, PP&E has not been impaired.

Inventories (Note 12)

The Group holds material inventories which are assessed for

impairment at each reporting date. The assessment of net realisable

value requires consideration of future cost to process and sell and

spot market prices at the period end less applicable discounts. The

estimates are based on market data and historical trends.

Exploration and evaluation assets (Note 10)

The Group holds material exploration and evaluation assets and

judgement is applied in determining whether impairment indicators

exist under the Group's accounting policy. In determining that no

impairment indicator exists management have considered the

Competent Person's Report on the asset, the strategic plans for

exploration and future development and the status of the Subsoil

Use Agreement ("SUA"). Judgement was required in determining that a

current application for deferral of obligations under the SUA will

be granted and management anticipate such approvals being provided

given their understanding of the Kazakh market and plans for the

asset.

(d) Unaudited status

These Condensed unaudited Financial Statements have not been

audited or reviewed by the Group's auditor.

2 Revenue

Unaudited Unaudited Audited

six-month six-month year ended

period ended period ended 31 December

2022

30 June 30 June 2022 $000

2023

$000 $000

--------------- --------------- --------------

Sales of vanadium products 2,340 3,343 5,163

Sales of ferro-molybdenum 955 897 1,509

Sales of nickel products 109 87 86

Service revenue 6 - 15

--------------- --------------- --------------

Total revenue from customers

under IFRS 15 3,410 4,327 6,773

=============== =============== ==============

Other revenue (adjustments to

price after delivery and fair

value changes) (96) (417) (502)

--------------- --------------- --------------

Total revenue 3,314 3,910 6,271

=============== =============== ==============

Vanadium products

Under certain sales contracts the single performance obligation

is the delivery of products to the designated delivery point at

which point possession, title and risk on the product transfers to

the buyer. The buyer makes an initial provisional payment based on

volumes and quantities assessed by the Company and market spot

prices at the date of shipment. The final payment is received once

the product has reached its final destination with adjustments for

quality / quantity and pricing. The final pricing is based on the

historical average market prices during a quotation period based on

the date the product reaches the port of destination and an

adjusting payment or receipt will be made to the revenue initially

received. Where the final payment for a shipment made prior to the

end of an accounting period has not been determined before the end

of that period, the revenue is recognised based on the spot price

that prevails at the end of the accounting period.

Other revenue related to the change in the fair value of amounts

receivable and payable under the sales contracts between the date

of initial recognition and the period end resulting from market

prices are recorded as other revenue.

3 Cost of sales

Unaudited Unaudited

six-month six-month Audited

period ended period ended year ended

31 December

30 June 2023 30 June 2022 2022

$000 $000 $000

-------------- -------------- -------------

Materials 2,651 2,738 5,863

Wages, salaries and related taxes 538 451 937

Depreciation 190 254 406

Electricity 42 74 111

Other 144 24 199

-------------- -------------- -------------

3,565 3,541 7,516

============== ============== =============

4 Other income

Unaudited Unaudited

six-month six-month Audited

period ended period ended year ended

31 December

30 June 2023 30 June 2022 2022

$000 $000 $000

-------------- -------------- -------------

Currency conversion gain 8 8 41

Other (sales of equipment) 5 4 36

13 12 77

============== ============== =============

5 Administrative expenses

Unaudited Unaudited Audited

six-month six-month year ended

period ended period 31 December

ended 2022

30 June 2023 30 June $000

2022

$000 $000

--------------- ------------ --------------

Wages, salaries and related taxes 867 633 1,619

Professional services 61 163 263

Taxes other than income tax - - 15

Listing and reorganisation expenses 97 13 162

Audit 126 57 111

Materials 24 43 37

Rent 17 18 53

Depreciation and amortisation 20 15 99

Insurance 2 2 44

Bank fees 12 15 23

Travel expenses 13 10 16

Security - 7 -

Communication and information

services 8 6 12

Other 90 172 91

--------------- ------------ --------------

1,337 1,154 2,545

=============== ============ ==============

6 Other expenses

Unaudited Unaudited

six-month six-month Audited

period ended period ended year ended

31 December

30 June 2023 30 June 2022 2022

$000 $000 $000

-------------- -------------- -------------

Currency conversion loss 27 - 204

Write-down of inventory to net

realisable value - - 160

Write-down of obsolete assets - - 54

Share-based payment expense - - 5

Other 20 - 3

-------------- -------------- -------------

47 - 426

============== ============== =============

7 Personnel costs

Unaudited Unaudited

six-month six-month Audited

period ended period ended year ended

31 December

30 June 2023 30 June 2022 2022

$000 $000 $000

-------------- -------------- -------------

Wages, salaries and related taxes 1,610 1,083 2,569

1,610 1,083 2,569

============== ============== =============

Personnel costs of US$495,000 (2022: US$421,000) have been

charged to cost of sales, US$867,000 (2022: US$633,000) to

administrative expenses and US$248,000 (2022: US$29,000) were

charged to cost of inventories which were not yet sold as at the

end of the period.

8 Finance costs

Unaudited Unaudited

six-month six-month Audited

period ended period ended year ended

31 December

30 June 2023 30 June 2022 2022

$000 $000 $000

-------------- -------------- -------------

Net foreign exchange gain (175) (172) (195)

Interest expense on financial liabilities

(bonds) 17 41 77

Net finance income (158) (131) (118)

============== ============== =============

9 Property, plant and equipment

Land and Plant and Construction

buildings equipment Vehicles Computers Other in progress Total

$000 $000 $000 $000 $000 $000 $000

---------- ---------- -------- --------- ----- ------------ -------

Cost

Balance at 1 January 2022 2,060 2,639 509 39 102 2,632 7,981

Additions 35 85 - 1 11 229 361

Disposals - - (17) - - - (17)

Foreign currency translation

difference (150) (194) (36) (3) (8) (196) (587)

---------- ---------- -------- --------- ----- ------------ -------

Balance at 30 June 2022 1,945 2,530 456 3 7 105 2,665 7,738

========== ========== ======== ========= ===== ============ =======

Balance at 31 December 2022 1,959 2,723 458 43 174 3,448 8,805

Additions - 254 - 1 8 510 773

Transfers 255 46 - - - (301) -

Disposals - (4) - - (5) - (9)

Foreign currency translation

difference 35 51 10 - 3 64 163

---------- ---------- -------- --------- ----- ------------ -------

Balance at 30 June 2023 2,249 3,070 468 44 180 3,721 9,732

========== ========== ======== ========= ===== ============ =======

Depreciation

Balance at 1 January 2022 688 2,028 327 28 47 - 3,118

Depreciation for the period 34 186 17 3 5 - 245

Disposals - - (17) - - - (17)

Foreign currency translation

difference (51) (152) (23) (2) (4) - (232)

---------- ---------- -------- --------- ----- ------------ -------

Balance at 30 June 2022 671 2,062 304 29 48 - 3,114

========== ========== ======== ========= ===== ============ =======

Balance at 31 December

2022 708 2 , 256 322 28 57 - 3 , 371

========== ========== ======== ========= ===== ============ =======

Balance at 1 January 2023 708 2 , 256 322 28 57 - 3 , 371

Depreciation for the period 45 165 16 2 7 - 235

Disposals - (4) - - (5) - (9)

Foreign currency translation

difference 12 41 7 1 2 - 63

---------- ---------- -------- --------- ----- ------------ -------

Balance at 30 June 2023 765 2,458 345 31 61 - 3,660

========== ========== ======== ========= ===== ============ =======

Carrying amounts

At 1 January 2022 1,372 611 182 11 55 2,632 4,863

========== ========== ======== ========= ===== ============ =======

At 30 June 2022 1,274 468 152 8 57 2,665 4,624

========== ========== ======== ========= ===== ============ =======

At 31 December 2022 1,251 467 136 15 117 3,448 5,434

========== ========== ======== ========= ===== ============ =======

At 30 June 2023 1,484 612 123 13 119 3,721 6,072

========== ========== ======== ========= ===== ============ =======

Depreciation expense of US$190,000 (2022: US$254,000) has been

charged to cost of sales, excluding cost of finished goods that

were not sold at the period end, US$20,000 (2022: US$15,000) to

administrative expenses, and US$67,000 has been charged to cost of

finished goods that were not sold at the end of the period (2022:

US$21,000).

Construction in progress relates to upgrades to the processing

plant associated with the expansion of the facility.

10 Exploration and evaluation assets

The Group's exploration and evaluation assets ("E&EA")

relate to the Balasausqandiq deposit. During the six month period

ended 30 June 2023, the Group capitalised the cost of geotechnical

drilling work, technical design, sample assaying and project

management costs, all relating to the Company's Stage 1 feasibility

study. As at 30 June 2023, the carrying value of exploration and

evaluation assets was US$5.6 m (2022: US$2.8m).

Unaudited Unaudited

six-month six-month Audited

period ended period ended year ended

31 December

30 June 2023 30 June 2022 2022

$000 $000 $000

-------------- -------------- -------------

Balance at 1 January 4,208 1,434 1,434

Additions (Stage 1feasibility study) 1,481 1,653 2,871

Foreign currency translation difference (108) (268) (97)

Balance at 30 June / 31 December 5,581 2,819 4,208

============== ============== =============

11 Intangible assets

Mineral Computer

rights Patents software Total

$000 $000 $000 $000

-------- -------- ---------- --------

Cost

Balance at 1 January

2022 88 33 3 124

Additions - 1 - 1

Foreign currency translation

difference (6) (3) - (9)

-------- -------- ---------- --------

Balance at 30 June

2022 82 31 3 116

======== ======== ========== ========

Balance at 31 December

2022 83 32 3 118

======== ======== ========== ========

Balance at 1 January

2023 83 32 3 118

Additions - 1 - 1

Foreign currency translation

difference 1 1 - 2

-------- -------- ---------- --------

Balance at 30 June

2023 84 34 3 121

======== ======== ========== ========

Amortisation

Balance at 1 January

2022 88 12 3 103

Amortisation for the

year - 1 - 1

Foreign currency translation

difference (6) (1) - (7)

-------- -------- ---------- --------

Balance at 30 June

2022 82 12 3 97

======== ======== ========== ========

Balance at 31 December

2022 83 13 3 99

======== ======== ========== ========

Balance at 1 January

2023 83 13 3 99

Amortisation for the

year - 1 - 1

Foreign currency translation

difference 1 - - 1

-------- -------- ---------- --------

Balance at 30 June

2023 84 14 3 101

======== ======== ========== ========

Carrying amounts

At 1 January 2022 - 21 - 2 1

======== ======== ========== ========

At 30 June 2022 - 19 - 19

======== ======== ========== ========

At 31 December 2022 - 19 - 19

======== ======== ========== ========

At 30 June 2023 - 20 - 20

======== ======== ========== ========

During the six months ended 30 June 2023 and 2022, amortisation

of intangible assets was charged to administrative expenses.

12 Inventories

Unaudited

Audited 31

30 June 2023 December 2022

Unaudited

30 June 2022

$000 $000 $000

-------------- -------------- --------------

Raw materials and consumables 1,422 2,223 1,379

Finished goods 584 192 216

Work in progress 9 7 33

2,015 2,422 1,628

============== ============== ==============

During the six months ended 30 June 202 3 , inventories expensed

to profit and loss amounted to US$2.7m (six month period ended 30

June 2022:US$2.8m).

13 Trade and other receivables

Current Unaudited Unaudited Audited

31 December

2022

30 June 2023 30 June 2022

$000

---------------

$000 $000

--------------- --------------- -------------

Trade receivables from

third parties 920 351 65

Due from employees 55 44 50

VAT receivable 920 976 1,062

Other receivables 64 20 10

--------------- --------------- -------------

1 , 959 1,391 1,187

Expected credit loss provision

for receivables (67) (35) (36)

--------------- --------------- -------------

1 , 892 1,356 1,151

=============== =============== =============

The expected credit loss provision for receivable relates to

credit impaired receivables which are in default and the Group

considers the probability of collection to be remote given the age

of the receivable and default status.

14 Prepayments

Unaudited Unaudited Audited 31

December 2022

30 June 2023 30 June 2022 $000

$000 $000

--------------- --------------- ---------------

Non-current

Prepayments 185 575 1,273

--------------- --------------- ---------------

185 575 1,273

=============== =============== ===============

Current

Prepayments for goods and

services 1,115 1,043 911

--------------- --------------- ---------------

1,115 1,043 911

=============== =============== ===============

15 Cash and cash equivalents

Unaudited Unaudited Audited

31 December

2022

30 June 30 June 2022 $000

2023

$000 $000

----------- --------------- -------------

Cash at current bank accounts 592 529 1,010

Cash at bank deposits 13 13 3,321

Petty cash 1 - -

----------- --------------- -------------

Cash and cash equivalents 606 542 4,331

=========== =============== =============

16 Equity

(a) Share capital

Number of shares unless otherwise stated Ordinary shares

Unaudited Unaudited Audited 31

30 June 2023 30 June 2022 December 2022

-------------- ------------------------- -------------------------

Par value - - -

Outstanding at beginning of

period / year 449,702,150 377,676,799 377,676,799

Shares issued - - 72,025,351

-------------- ------------------------- -------------------------

Outstanding at end of period

/ year 449,702,150 377,676,799 449,702,150

============== ========================= =========================

Ordinary shares

All shares rank equally. The holders of ordinary shares are

entitled to receive dividends as declared from time to time and are

entitled to one vote per share at meetings of the Company.

The Company did not issue any ordinary shares during the period

(2022: no ordinary shares issued during the period).

Convertible loan notes

Convertible loan notes are considered as equity as the

conditions that are set out in the Convertible Loan Note agreement

provide for conversion into equity in all circumstances except

certain conditions that the Directors do not consider probable. In

particular, the conditions required to be fulfilled before

conversion takes place include an obligation on the Company to

receive certain consents from the regulatory authorities and

avoidance of the possibility of triggering a requirement for the

issue of a prospectus.

Reserves

Share capital: Value of shares issued less costs of

issuance.

Convertible loan notes: Further investment rights at issue

price.

Additional paid in capital: Amounts due to shareholders which

were waived.

Share-based payment: Share options issued during the period.

Foreign currency translation reserve: Foreign currency

differences on retranslation of results from functional to

presentational currency and foreign exchange movements on

intercompany balances considered to represent net investments which

are considered as permanent equity.

Accumulated losses: Cumulative net losses.

(b) Dividends

N o dividends were declared for the six months ended 30 June

2023 (2022: US$ Nil).

(c) Loss per share (basic and diluted)

The calculation of basic and diluted loss per share has been

based on the loss attributable to ordinary shareholders and

weighted-average number of ordinary shares outstanding. There are

no convertible bonds and convertible preferred stock, so basic and

diluted losses are equal.

(i) Loss attributable to ordinary shareholders (basic and diluted)

Unaudited Unaudited Audited year

ended

six-month six-month 31 December

2022

period ended period $000

ended

30 June 2023 30 June

2022

$000 $000

--------------- ------------ --------------

Loss for the period, attributable

to owners of the Company (1,530) (694) (4,286)

--------------- ------------ --------------

Loss attributable to ordinary

shareholders (1,530) (694) (4,286)

=============== ============ ==============

(ii) Weighted-average number of ordinary shares (basic and diluted)

Shares Unaudited Unaudited Audited year

six-month six-month ended

period ended period 31 December

30 June 2023 ended 2022

30 June

2022

-------------- --------------

Issued ordinary shares at 1 January

(after subdivision) 449,702,150 377,676,799 377,676,799

Effect of shares issued (weighted) - - 21,410,276

-------------- -------------- --------------

Weighted-average number of ordinary

shares at period / year end 449,702,150 377,676,799 399,087,075

============== ============== ==============

Loss per share of common stock

attributable to the Company:

(Basic and diluted / US$) (0.003) (0.002) (0.011)

-------------- -------------- --------------

17 Loans and borrowings

In prior periods, the Company had issued unsecured three year

term corporate bonds with varying effective interest rates that

were listed on the AIX.

All of the Company's issued bonds in circulation at 1 January

2023 were redeemed by the Company on 24 March 2023.

Current liabilities

Bonds payable (early repayment

rights) - 1,390 1,108

Interest payable - 24 18

------ -------- --------

- 1,414 1,126

====== ======== ========

Non-cash transactions from financing activities are shown in the

reconciliation of liabilities from financing transactions

below.

Unaudited Unaudited

six-month six-month Audited year

ended 31 December

2022

period ended period ended $000

30 June 30 June 2022

2023

$000 $000

---------------- ---------------- --------------------

At 1 January 1,127 1,427 1,427

Cash flows:

-Interest paid (32) (41) (82)

-Repayment of loans and borrowings (1,112) - (300)

---------------- ---------------- --------------------

Total (17) 1,386 1,045

================ ================ ====================

Non-cash flows

* Interest accruing in the period 17 41 82

---------------- ---------------- --------------------

At 30 June / 31 December - 1,427 1,127

================ ================ ====================

18 Trade and other payables

Unaudited Unaudited Audited 31

December 2022

30 June 2023 30 June $000

2022

$000 $000

--------------- ----------- ---------------

Trade payables 2,550 2,130 1,889

Debt to directors/key management

(Note 22) 11 75 214

Debt to employees 154 73 99

Other taxes 225 116 171

Advances received 134 10 10

=============== =========== ===============

3 , 074 2,404 2,383

19 Payables at FVTPL

Unaudited Unaudited Audited 31

December 2022

30 June 2023 30 June $000

2022

$000 $000

--------------- ----------- ---------------

Payables at FVTPL - 405 -

--------------- ----------- ---------------

- 405 -

=============== =========== ===============

20 Contingencies

(a) Insurance

The insurance industry in the Kazakhstan is in a developing

state and many forms of insurance protection common in other parts

of the world are not yet generally or economically available. The

Group does not have full coverage for its plant facilities,

business interruption or third party liability in respect of

property or environmental damage arising from accidents on Group

property or relating to Group operations. There is a risk that the

loss or destruction of certain assets could have a material adverse

effect on the Group 's operations and financial position.

(b) Taxation contingencies

The taxation system in Kazakhstan is relatively new and is

characterised by frequent changes in legislation, official

pronouncements and court decisions which are often unclear,

contradictory and subject to varying interpretations by different

tax authorities. Taxes are subject to review and investigation by

various levels of authorities which have the authority to impose

severe fines, penalties and interest charges. A tax year generally

remains open for review by the tax authorities for five subsequent

calendar years but under certain circumstances a tax year may

remain open for longer.

These circumstances may create tax risks in Kazakhstan that are

more significant than in other countries. Management believes that

it has provided adequately for tax liabilities based on its

interpretations of applicable tax legislation, official

pronouncements and court decisions. However, the interpretations of

the relevant authorities could differ and the effect on these

consolidated financial statements, if the authorities were

successful in enforcing their interpretations, could be

significant.

There are no tax claims or disputes at present.

21 Segment reporting

The Group's operations are split into three segments based on

the nature of operations: processing, subsoil operations (being

operations related to exploration and mining) and corporate segment

for the purposes of IFRS 8 Operating Segments. The Group's assets

are primarily concentrated in the Republic of Kazakhstan and the

Group's revenues are derived from operations in, and connected

with, the Republic of Kazakhstan.

Unaudited six-month period ended 30 June

2023

Processing Subsoil Corporate Total

$000 $000 $000 $000

---------- ------- --------- -------

Revenue 3,314 - - 3,314

( 3,565

Cost of sales (3,565) - - )

Other income 8 - 5 13

( 1,337

Administrative expenses ( 402 ) ( 24 ) ( 911 ) )

Distribution & other

expenses ( 113 ) - - ( 113 )

Finance costs (40) - 198 158

( 708

Loss before tax (798) ( 24 ) ) (1,530)

========== ======= ========= =======

Unaudited six-month period ended 30 June 2022

Processing Subsoil Corporate Total

$000 $000 $000 $000

---------- ------- --------- -------

Revenue 3,910 - - 3,910

( 3,541 ( 3,541

Cost of sales ) - - )

Other income 12 - - 12

( 1,154

Administrative expenses ( 466 ) (2 9 ) ( 659 ) )

Distribution & other

expenses ( 52 ) - - ( 52 )

Finance costs 596 - ( 465 ) 131

---------- ------- --------- -------

Loss before tax 459 (29) (1,124) (694)

========== ======= ========= =======

Audited year ended 31 December

2022

Processing Subsoil Corporate Total

$000 $000 $000 $000

---------- ------- --------- -------

Revenue 6,271 - - 6,271

( 7,516 ( 7,516

Cost of sales ) - - )

Other income 73 - 4 77

( 1,758 ( 2,545

Administrative expenses ( 763 ) ( 24 ) ) )

Distribution & other

expenses ( 691 ) - - ( 691 )

Finance costs 531 - ( 413 ) 118

---------- ------- --------- -------

Loss before tax (2,095) (24) (2,167) (4,286)

========== ======= ========= =======

Included in revenue arising from processing are revenues of

US$3.1m (2022: US$3.7m) which arose from sales to three of the

Group' largest customers. No other single customer contributes 10

per cent or more to the Group's revenue.

All of the Group's assets are attributable to the Group's

processing operations.

Sales to the Group's largest customers during the six months

ended 30 June 2023 were as follows:

Customer A US$ 1.5m (46%) (2022:US$ 1.9m)

Customer B US$ 1.5m (47%) (2022: US$1.1m)

Customer C US$ 0.1m (4%) (2022: US$ 0.7m)

22 Related party transactions

Transactions with management and close family members

Management remuneration

Key management personnel received the following remuneration

during the year, which is included in personnel costs (see Note

7):

Unaudited Unaudited Audited

six-month six-month year ended

period period ended 31 December

ended 30 June 2022 2022 $000

30 June $000

2023

$000

----------- -------------- -------------

Wages, salaries and related

taxes 474 360 986

=========== ============== =============

The amount of wages and salaries outstanding at 30 June 2023 is

equal to US$11,000 (2022: US$75,000).

Other

The Company is party to a sub-let agreement between Turian

Sports Horses Limited as head lessee and NH Limited as landlord for

the rental of office space in Guernsey. Turian Sports Horses

Limited is wholly owned by James Turian, one of the Company's

directors and NH Limited is owned by James Turian and Sharon

Turian, equally. Sums paid to NH Limited during the six months

ended 30 June 2023 were US$10,667 (2022: US$7,445).

23 Subsequent events

On 27 July 2023, the Company launched a phased Kazakhstan US$20

million exempt offer bond programme valid until 31 July 2033.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSDFLUEDSEIU

(END) Dow Jones Newswires

September 11, 2023 02:00 ET (06:00 GMT)

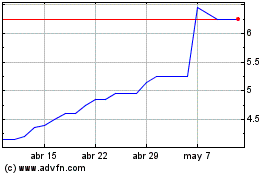

Ferro-alloy Resources (LSE:FAR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ferro-alloy Resources (LSE:FAR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024