TIDMFEN

RNS Number : 0821O

Frenkel Topping Group PLC

29 September 2023

29(th) September 2023

Frenkel Topping Group plc

("Frenkel Topping", or "the Group")

Interim Results

Frenkel Topping (AIM: FEN), a specialist financial and

professional services firm operating within the personal injury and

clinical negligence marketplace (PI and Clin Neg), is pleased to

announce its interim results for the six months ended 30 June

2023.

Financial Highlights

H1 2023* H1 2022* % change FY2022

(GBPm) (GBPm) Full year

(GBPm)

---------

Revenue 16.0 11.1 44% 24.8

---------- --------- ---------

Recurring revenue 5.9 5.4 9% 11.0

---------- --------- ---------

Gross profit 6.6 5.0 32% 11.1

---------- --------- ---------

EBITDA** 3.5 2.7 30% 6.1

---------- --------- ---------

Profit attributable

to shareholders 1.7 0.9 89% 1.7

---------- --------- ---------

EPS (basic) 1.4 pence 0.8 pence 75% 1.5 pence

---------- --------- ---------

Cash generated from

operating activities 1.5 0.6 150% 0.7

---------- --------- ---------

Cash at period end 4.9 1.8 272% 5.0

---------- --------- ---------

AUM 1,261 1,155 9% 1,187

---------- --------- ---------

Assets on a discretionary

mandate 761 667 14% 715

---------- --------- ---------

*Unaudited

**EBITDA before share based compensation, acquisition strategy,

integration and reorganisation costs

Operational Highlights

-- Results for first six months in line with management expectations

-- AUM resilient despite challenging market conditions

demonstrating the differentiated and conservative way the Group

manages its clients' assets

-- Client retention rate remains high at 99%

-- Acquisitions made in Q4 2022 bedded in and performing well

-- Cardinal Management Ltd ("Cardinal"), a milestone acquisition

during 2022, has added two new major trauma centres to its

portfolio

-- Continued delivery of the "Working in Partnership" programme

- aligning with top law firms, adding Serious Injury Law and Lime

Solicitors to the growing number of firms who we have joint

ventures with

-- A healthy pipeline of AUM for the second half of the year, a

traditionally stronger half, to underpin management's expectations

for the full year outturn

Delivery of strategy with a strong start to the second half

-- Continued execution of acquisition strategy, with a number of

opportunities being evaluated and the businesses acquired to date

showing positive contribution to the Group

-- Acquisition strategy has built one of the largest players in

the pre-settlement professional services market for Personal Injury

("PI") and Clinical Negligence ("Clin Neg")

-- Entering second half of the year carrying momentum from H1

with services revenue performing particularly well from Somek and

Associates, Bidwell Henderson Cost Consultants (BH) and Forth

Associates.

For further information:

Frenkel Topping Group plc www.frenkeltoppinggroup.co.uk

Richard Fraser, Chief Executive Officer Tel: 0161 886 8000

Cavendish Capital Markets Limited (Nominated Tel: 020 7220 0500

Advisor & Broker)

Carl Holmes/Abigail Kelly (Corporate

Finance)

Tim Redfern / Charlotte Sutcliffe (ECM)

CEO statement - Richard Fraser:

We are pleased with our performance in the first half of FY2023

and the momentum we are carrying into the second half of the year.

Despite the backdrop of economic headwinds and market volatility,

our team has shown remarkable resilience and focus, delivering a

robust set of results for the first six months of the year.

We constantly strive to deliver the best outcomes for our

clients. In response to rising interest rates and subsequent

returns available on cash, our Investment Management business,

Ascencia, has recently launched a cash solution to add to our

existing portfolio of products focused on protecting our clients'

assets, thus adding to our range of recurring income streams. The

solution has been particularly well received by professional

intermediaries and clients.

Further, Ascencia has continued to outperform in its core risk

rated investment strategies, with returns being ahead of their

respective Private Client ARC indices. Ascencia's IP Growth 4

returned 1.24% compared to ARC Sterling Balanced Asset PCI of 1.01%

and Ascencia's IP Growth 3 returned 0.95% compared to ARC Sterling

Cautious PCI of 0.09%.

Our client retention rate, a critical KPI of the Group, remains

exceptionally high at 99%, a testament to the trust and confidence

our clients place in us.

The successful integration of our acquisitions has not only

diversified our income streams but also strengthened our position

in the personal injury and clinical negligence sectors. We continue

to pursue future acquisition opportunities within the space that

will further add to our full market offering.

The Company's group businesses have enjoyed real momentum in the

period with Cardinal adding two new sites to its Major Trauma

Centre portfolio in recent months both John Radcliffe Hospital, run

by Oxford University Hospitals NHS Foundation Trust, and Alder Hey

Children's Hospital opting to join Cardinal after a competitive

tender process.

Somek and Associates (Somek), Bidwell Henderson Cost Consultants

(BH) and Forth Associates (Forths) have especially contributed to

the service revenue performance during the first six month of the

year. This is primarily due to the successful execution of our

people plan, specifically increasing the number of Experts in

Somek, the success of the BH training academy and recruitment

programme, and staff progression in Forths, all underpinned by the

overall execution of our strategy to be the 'go to' provider of

professional services within PI and Clin Neg.

Our marketplace continues to present significant opportunity for

growth with cGBP1.2bn of personal injury awards related to motor

accident claims alone paid out in H1 2023. In addition, we have

noticed a tightening of court deadlines within the industry which

presents opportunities across our full service offering which, in

turn, we expect should drive faster settlement of damages moving

forward.

As we look ahead, we are excited about the potential of AI to

drive efficiencies and are committed to delivering value to our

shareholders and clients alike. It's not just about numbers; it's

about making a meaningful difference in the lives of those who have

been through life-altering experiences. That's what keeps us

motivated every single day.

Outlook

The Group has entered the second half of the year carrying real

momentum from H1, benefiting from the diversification of revenue

and encouraging growth in transactional revenue. We expect

financial markets to remain challenging, which will continue to

moderately impact AUM growth and consequently the Company's

recurring revenue. However, the Board maintains its confidence in

the full year outturn which is tracking in line with management's

expectation.

CFO statement - Elaine Cullen-Grant:

We are pleased to report such a strong set of results against

the backdrop of a challenging economic climate and furthermore to

have been able to grow our recurring revenue in the first half by

9% to GBP5.9m (H1 22 - GBP5.5m) .

The acquisitions made in recent years have further strengthened

our position in these challenging times by broadening our income

streams and helping to contribute to an overall 44% growth in

revenue to GBP16.0m (H1 22: GBP11.1m).

By their nature the margin profile within our transactional

businesses is a little lower than our financial businesses, however

we are delighted that we continue to grow EBITDA across the

Group.

Our acquisition strategy is focused on profitable and growing

businesses. Evidence of the success of this strategy can be seen

within our Costs businesses, Partners in Costs, A&M Bacon and

BH, acquired during 2021, which have increased their EBITDA

contribution from GBP0.6m in the first half of last year to GBP1.1m

in the same period this year.

Following the increase in share capital with our fundraise in

2022, it is pleasing that we have been able to increase our basic

earnings per share by 74% to 1.4 pence for H1 23 (H1 22: 0.8

pence), coming close to delivering the same earnings per share as

we did in the full year 2022 (FY22: 1.5 pence) in just six

months.

Whilst the transactional businesses do have a greater working

capital requirement when compared with the financial businesses, we

are pleased that even the with the 44% increase in revenue, cash

generated from operating activities has improved by 150%. This is

both a reflection on the Group's focus on cash conversion and

evidence of the strength of the recoverability of our debtor book.

This has helped contribute to our strong balance sheet and cash

position of GBP4.9m (H1 22 1.8m)

Change of Name of Nominated Adviser and Broker

The Company also announces that its Nominated Adviser and Broker

has changed its name to Cavendish Capital Markets Limited following

completion of its own corporate merger.

Frenkel Topping Group plc 6 Months 6 Months Year

ended

ended ended 31-Dec-

Group income statement for the period: 30-Jun-23 30-Jun-22 22

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

REVENUE 16,042 11,110 24,850

Direct staff costs (9,436) (6,068) (13,717)

------------ ----------- ---------

Gross Profit 6,606 5,042 11,133

Administrative expenses 2 (3,996) (3,544) (8,230)

Underlying profit from operations 3,200 2,422 5,492

* share based compensation (314) (349) (660)

* acquisition strategy, integration and reorganisation

costs (276) (575) (1,929)

------------------------------------------------------------------- ------ ------------ ----------- ---------

PROFIT FROM OPERATIONS 2,610 1,498 2,903

Finance and other income/ (fair value

losses on investments) 4 (9) (7)

Finance costs 3 (186) (205) (477)

------------ ----------- ---------

PROFIT BEFORE TAX 2,428 1,284 2,419

Income tax expense (628) (309) (570)

------------ ----------- ---------

PROFIT FOR THE PERIOD 1,800 975 1,849

Gains on property revaluation arising net

of tax - - 127

------------ ----------- ---------

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD 1,800 975 1,976

============ =========== =========

PROFIT ATTRIBUTABLE TO:

Owners of parent undertakings 1,680 881 1,652

Non-controlling interest 120 94 197

============ =========== =========

TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE

TO:

Owners of parent undertakings 1,680 881 1,779

Non-controlling interest 120 94 197

============ =========== =========

0. 0.

Earnings per share - basic (pence) 1.4 0.8 1.5

Earnings per share - diluted (pence) 1.3 0.8 1.4

------------ ----------- ---------

The results for the period are derived from continuing

activities.

Frenkel Topping Group plc

Group Statement of Financial Position

as at: 30-Jun-23 30-Jun-22 31-Dec-22

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

ASSETS

NON CURRENT ASSETS

Goodwill and other intangibles 29,250 24,088 29,579

Plant, property and equipment 2,717 2,457 2,834

Loans receivable 168 166 162

32,135 26,711 32,575

CURRENT ASSETS

Accrued income 4,903 3,102 4,072

Trade receivables 11,086 7,693 10,661

Other receivables 1,146 858 749

Investments 101 99 100

Cash at bank and in hand 4,866 1,761 4,986

---------- ---------- ----------

22,102 13,513 20,568

TOTAL ASSETS 54,237 40,224 53,143

========== ========== ==========

EQUITY AND LIABILITIES

EQUITY

Share capital 637 566 637

Share premium 22,705 13,140 22,705

Merger reserve 6,245 6,245 6,245

Revaluation reserve 479 352 479

Own share reserve (2,134) (2,315) (2,210)

Other reserve (341) (341) (341)

Retained earnings 14,149 12,965 12,296

---------- ---------- ----------

Equity attributable to owners of

the parent company 41,740 30,612 39,811

Non-controlling interests 238 180 283

---------- ---------- ----------

TOTAL EQUITY 41,978 30,792 40,094

---------- ---------- ----------

CURRENT LIABILITIES

Current taxation 1,075 871 760

Trade and other payables 7,375 4,508 7,680

---------- ---------- ----------

8,450 5,379 8,440

LONG TERM LIABILITIES 3,809 4,053 4,609

TOTAL EQUITY AND LIABILITIES 54,237 40,224 53,143

========== ========== ==========

Frenkel Topping Group plc 6 Months 6 Months Year

ended

Group Cash Flow Statement ended ended 31-Dec-

For the period: 30-Jun-23 30-Jun-22 22

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit before tax 2,428 1,284 2,419

Adjustments to reconcile profit

for the period to cash generated

from operating activities:

Finance income/loss (4) 9 7

Finance costs 186 205 477

Share based compensation 242 349 480

Depreciation 304 238 574

(Increase)/decrease in accrued income,

trade and other receivables (1,660) (1,015) (2,205)

(Decrease)/increase in trade and other

payables 405 (101) (95)

------------ ----------- ---------

Cash generated from operations 1,901 969 1,657

Income Tax paid (363) (323) (999)

------------ ----------- ---------

Cash generated from operating activities 1,538 646 658

Investing Activities

Acquisition of plant, property

and equipment (148) (163) (240)

Acquisition of subsidiaries (1,100) (8,084) (13,478)

Cash acquired on acquisition of

subsidiaries - 1,033 1,992

Loans advanced - (21) (22)

Cash (used) / generated in investing

activities (1,248) (7,235) (11,748)

Financing activities

Shares issued (net of costs) - - 9,637

Exercise of share options 1 - 1

Dividend paid (165) (110) (1,771)

Repayment of borrowing (36) - (2)

Interest received 4 - -

Interest element of lease payments (17) (17) (36)

Principal element of lease payments (197) (141) (368)

Other interest paid and FX losses - - (3)

Cash used in financing (410) (268) 7,458

------------ ----------- ---------

(Decrease)/ increase in cash (120) (6,857) (3,632)

Opening cash 4,986 8,618 8,618

------------ ----------- ---------

Closing cash 4,866 1,761 4,986

============ =========== =========

Closing Cash and Cash Equivalents

Cash 4,866 1,761 4,986

Cash equivalents 101 99 100

------ ------ ------

Closing cash and cash equivalents 4,967 1,860 5,086

====== ====== ======

Cash equivalents are held in liquid investments.

Notes to the Interim Financial Statements

1. Revenue and Segmental Reporting

All of the Group's revenue arises from activities within the

UK.

Revenue arising from recurring and non-recurring sources is as

follows:

6 Months 6 Months Year

ended

ended ended 31-Dec-

30-Jun-23 30-Jun-22 22

GBP'000 GBP'000 GBP'000

Recurring 5,899 5,424 11,045

Non-recurring 10,143 5,686 13,805

_______ _______ _______

Total revenue 16,042 11,110 24,850

_______ _______ _______

Operating Segments

The Group's chief operating decision maker is deemed to be the

CEO. The CEO has identified the following operating segments:

Financial Services

This segment includes our independent financial advisory,

discretionary fund management and financial services

businesses.

Costs Law

This segment includes each of our costs law services

businesses.

Other Professional Services

This segment includes our major trauma signposting, forensic

accountancy, care and case management and medico-legal reporting

businesses.

Central Services

This is predominantly a cost centre for managing Group related

activities or other costs not specifically related to a

product.

Other

6 Months ended June 2023 Financial Costs Professional Central

services Law Services Services Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 6,305 4,162 5,550 25 16,042

Adjusted EBITDA 1,924 1,056 1,437 (888) 3,529

Other

6 Months ended June 2022 Financial Costs Professional Central

services Law Services Services Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 5,846 3,154 2,110 - 11,110

Adjusted EBITDA 2,124 631 693 (788) 2,660

Other

Year ended December 2022 Financial Costs Professional Central

services Law Services Services Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 11,792 7,057 6,001 - 24,850

Adjusted EBITDA 4,302 1,721 1,763 (1,732) 6,054

2. Administrative Expenses

The following table analyses the nature of expenses:

6 Months 6 Months Year

ended

ended ended 31-Dec-

30-Jun-23 30-Jun-22 22

GBP'000 GBP'000 GBP'000

Depreciation 329 238 574

Share based compensation 314 349 660

Acquisition strategy, integration and

reorganisation costs 276 575 1929

Other administrative expenses 3,077 2,382 5,067

------------ ----------- ---------

Total Other administrative expenses 3,996 3,544 8,230

3. Interest and similar items

6 Months 6 Months Year

ended

ended ended 31-Dec-

30-Jun-23 30-Jun-22 22

GBP'000 GBP'000 GBP'000

Interest on lease liabilities 17 17 36

Loan and other interest charges - - 3

Unwinding discount - deferred consideration 169 188 438

------------ ----------- ---------

Total finance costs 186 205 477

About Frenkel Topping Group

The Frenkel Topping Group of companies specialises in providing

financial advice and asset protection services to clients at times

of financial vulnerability, with particular expertise in the field

of personal injury (PI) and clinical negligence (CN).

For more than 30 years the Group has worked with legal

professionals and injured clients themselves to provide

pre-settlement, at-settlement and post-settlement services to help

achieve the best long-term outcomes for clients after injury. It

boasts a client retention rate of 99%.

Frenkel Topping Group is focused on consolidating the fragmented

PI and CN space in order to provide the most comprehensive suite of

services to clients and deliver a best-in-class service offering

from immediately after injury or illness and for the rest of their

lives.

The group's services include the Major Trauma Signposting

Partnership service inside NHS Major Trauma Centres, expert

witness, costs, tax and forensic accountancy, independent financial

advice, investment management, and care and case management.

The Group's discretionary fund manager, Ascencia, manages

financial portfolios for clients in unique circumstances, often who

have received a financial settlement after litigation. In recent

years Ascencia has diversified its portfolios to include a

Sharia-law-compliant portfolio and a number of ESG portfolios in

response to increased interest in socially responsible investing

(SRI).

Frenkel Topping has earned a reputation for commercial

astuteness underpinned by a strong moral obligation to its clients,

employees and wider society, with a continued focus on its

Environmental, Social and Governance (ESG) impact.

For more information visit: www.frenkeltoppinggroup.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFIIADITFIV

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

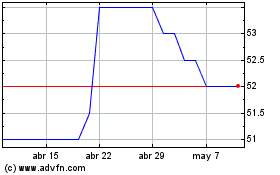

Frenkel Topping (LSE:FEN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Frenkel Topping (LSE:FEN)

Gráfica de Acción Histórica

De May 2023 a May 2024