TIDMFNTL

RNS Number : 5648J

Fintel PLC

17 August 2023

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014), as it forms part of domestic law by

virtue of the European Union (Withdrawal) Act 2018) ("MAR") prior

to its release as part of this announcement and is disclosed in

accordance with the Company's obligation under Article 17 of those

regulations.

17 August 2023

Fintel plc

("Fintel " or the " Company ", or the "Group" )

Implementation of new long-term incentive plan,

grant of awards and PDMR dealing

Fintel plc (AIM: FNTL) is pleased to announce the implementation

of a new long-term incentive plan, its Growth Share Plan (the

"Plan") and a number of initial grants of awards under the Plan to

certain employees ("2023 Awards")

The current Value Builder Plan

The Company's current Value Builder Plan ("VB Plan") was

intended to operate as an LTIP and be issued annually. The only

award under this plan was announced on 30 November 2021, and no

further awards are to be expected to be made.

Background and rationale to the new Growth Share Plan

The Plan has been designed as a longer term replacement to the

VB Plan, with a scheme that the Remuneration Committee believe to

be more appropriately structured. The Plan includes a wider

participation amongst the senior management at the Company.

It is the view of the Remuneration Committee ("RemCo") that

there is little or no current value in the existing VB Plan, which

therefore renders it ineffective as an incentive mechanism to the

key personnel who have successfully delivered against business

objectives in a challenging macro environment and who collectively

remain responsible for driving future business performance and

delivering against the Company's future strategic objectives.

The new Plan has been subject to an extensive shareholder

consultation process with a number of the Company's largest

shareholders. This exercise provided valuable feedback which has

been considered by RemCo in finalising the terms of the Plan.

The Plan has been designed to deliver a repeatable incentive

structure on which annual awards are expected to be made under the

program as part of a balanced and holistic remuneration review.

The Plan creates a distributable value pot ("Value Pot"), the

size of which is determined as being a proportion of total

shareholder value of the Company comprising the increase in market

capitalisation ("Shareholder Value") above a defined set of hurdles

over a five year performance period.

The size of the Value Pot to be received by the beneficiaries

will be dependent on the average market capitalisation in the first

quarter post following the end of each five year vesting period

(the "Measurement Period"), subject to an individual participant's

continued employment over this subsequent period (or their having

become a "Good Leaver"), including additional behaviour and

delivered performance KPIs for each individual.

The Value Pot for each award under the Plan will be granted at

the discretion of RemCo, with each participant acquiring a fixed

number of partly paid B Shares, C Shares and/or D Shares in an

intermediary holding company, Fintel Group Holdings Limited

(together "Growth Shares"). Subject to continued service, the

Growth Shares on vestiture will be transferable into Fintel shares

to the extent the relevant Value Pot has been earned.

RemCo will have full discretion to amend the terms of the Plan

to take account of, for example, corporate activities such as

acquisitions to ensure the market capitalisation hurdles remain

appropriate.

2023 Awards

On 16 August 2023, the 2023 Awards were allocated under the

Plan. The Measurement Period for the 2023 Awards will be the first

quarter following the end of the five year vesting period to 31

December 2027, being the period from 01 Jan 2028 to 31 March

2028.

The Value Pot under the 2023 Awards is comprised as follows:

Tier Market capitalisation Proportion of Shareholder Total number of

at end of performance Value tranche distributed Growth Shares in

period in Value Pot Growth Share class

Tier 1 Between GBP275m 8% 163 B Shares

and GBP300m

----------------------- --------------------------- --------------------

Tier 2 Between GBP300m 15% 419 C Shares

and GBP400m

----------------------- --------------------------- --------------------

Tier 3 Between GBP400m 20% 418 D Shares

and GBP425m

----------------------- --------------------------- --------------------

Value will only accrue to the beneficiaries within each tier to

the extent that average market capitalisation in the Measurement

Period is above the minimum market capitalisation for that tier.

The return thresholds will exclude dividends paid to

shareholders.

For example, should the average market capitalisation in the

Measurement Period be GBP350 million, the full award under Tier 1

would have accrued, however only half of the maximum award would

become payable within Tier 2. Under this scenario, no value would

accrue to the beneficiaries within Tier 3, as the minimum market

capitalisation threshold of GBP400 million will have not been

achieved.

Should the market capitalisation in the Measurement Period be

greater than GBP425 million, the maximum award for each of the

tiers would be accrued, representing a cumulative value of GBP22

million for delivering at least GBP205 million of shareholder

value, excluding any dividends.

2023 Awards Summary

Base hurdle Tier 1(4) Tier 2 Tier 3

---------------------------------------- ------------ ---------- ---------- ----------

Fintel market capitalisation GBP275m GBP300m GBP400m GBP425m

upper target

---------------------------------------- ------------ ---------- ---------- ----------

Implied share price(1) GBP2.65 GBP2.89 GBP3.85 GBP4.09

---------------------------------------- ------------ ---------- ---------- ----------

Annual growth in market capitalisation

to achieve maximum award within

each tier 4.3% 6.1% 12.4% 13.8%

---------------------------------------- ------------ ---------- ---------- ----------

Award size as at the date Nil GBP2.0m GBP15.0m GBP5.0m

of the performance condition

being achieved(1)

---------------------------------------- ------------ ---------- ---------- ----------

Cumulative award size as at Nil GBP2.0m GBP17.0m GBP22.0m

the date of the performance

condition being achieved(2)

---------------------------------------- ------------ ---------- ---------- ----------

Implied shareholder value c.GBP55m c.GBP80m c.GBP180m c.GBP205m

created over term of plan(5)

---------------------------------------- ------------ ---------- ---------- ----------

Dilution per tranche(2,3) Nil 0.67% 3.58% 0.93%

---------------------------------------- ------------ ---------- ---------- ----------

Cumulative dilution(2,3) Nil 0.67% 4.25% 5.18%

---------------------------------------- ------------ ---------- ---------- ----------

1 Based on the total shares in issuance as at 16 August 2023 of

103,835,333

2 Assuming the whole tranche is awarded and subsisting

3 Calculated using the maximum award size for each tier against

the market capitalisation required to achieve the award

4 Matt Timmins and Neil Stevens as Joint CEOs will not

participate in any award from Tier 1

5 Based on current market capitalisation as at market close on

16 August 2023

2023 Awards Participation

The 2023 Awards include 21 key employees across key personnel

within the business including PLC Board Executive Directors,

Executive committee members, key senior management.

The awards are designed to weight value to the most senior

beneficiaries (i.e. Executive Directors) at the higher tiers (Tier

2 and Tier 3), to appropriate reflect their respective ability to

influence wider business outcomes and therefore probability of

value creation. A proportion of the 2023 Awards remain unallocated

and may be granted at a later date at the discretion of the

Remuneration Committee.

Participation Total

(Number of respective Growth Tier 1 Tier 2 Tier 3

Shares) B Shares C Shares D Shares

2 Joint CEOs 0 190 190 380

CFO 70 82 83 235

18 Other management 83 127 124 334

Unissued (retained) 10 20 21 51

-------

163 419 418 1,000

-------

Related Party Transactions

Awards under the Growth Share Plan have been made to the

following individuals, each of whom is considered a related party

within the meaning of the AIM Rules for Companies by virtue of

being a Board director or a statutory director of a subsidiary

company of the Group. These awards (as detailed below) (the

"Related Party Awards") each constitute a related party

transaction.

Participant Maximum potential

award under

the Growth

Share Plan

------------------------------- ------------------

Matt Timmins (Joint CEO) GBP4.5m

------------------------------- ------------------

Neil Stevens (Joint CEO) GBP4.5m

------------------------------- ------------------

David Thompson (CFO) GBP4.8m

------------------------------- ------------------

John Milliken (Subsidiary GBP1.4m

Director)

------------------------------- ------------------

Kyle Augustin (Subsidiary GBP1.2m

Director)

------------------------------- ------------------

Martin Reynolds (Subsidiary GBP1.2m

Director)

------------------------------- ------------------

Dan Russell (Subsidiary GBP0.8m

Director)

------------------------------- ------------------

Steve Lomax (Subsidiary GBP0.2m

Director)

------------------------------- ------------------

Paul Dagley-Morris (Subsidiary GBP0.2m

Director)

------------------------------- ------------------

The Independent Directors, being Phil Smith, Imogen Joss,

Timothy Clarke (who each also sit on the Remuneration Committee)

and Kenneth Davy, consider, having consulted with the Company's

Nominated Adviser, Zeus Capital Limited ("Zeus") that the Related

Party Awards to the participants in the table above are fair and

reasonable insofar as its shareholders are concerned. It should be

noted that the joint CEOs and CFO will cash fund their crystallised

dry tax charge under the awards. For 2023 this will amount to

c.GBP430k, and represents capital at risk to these executives as

the amounts are non refundable should the targets not be met. The

remaining staff eligible for the plan are also required to pay the

dry tax charge applicable, but will be offered a low cost loan to

fully or partly fund their tax liability.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

Details of the person discharging managerial responsibilities/person

1 closely associated

a) Name Neil Stevens

==================================== =================================

Reason for the notification

2

=======================================================================

a) Position/status Joint Chief Executive Officer

(PDMR)

==================================== =================================

b) Initial notification/Amendment Initial notification

==================================== =================================

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

=======================================================================

a) Name Fintel plc

==================================== =================================

b) LEI 213800DXP1VY21GCTH04

==================================== =================================

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

=======================================================================

a) Description of the financial Growth Shares in Fintel Group

instrument, type of instrument Holdings Limited

Identification Code

ISIN: GB00BG1THS43

==================================== =================================

b) Nature of the transaction Grant of Growth Shares

==================================== =================================

c) Price(s) and volume(s) Price(s) Nil

Volume(s)

95 C Shares

95 D Shares

==================================== =================================

d) Aggregated information N/a - single transaction

==================================== =================================

e) Date of transaction 1 6 August 2023

==================================== =================================

f) Place of transaction Outside a trading venue

==================================== =================================

Details of the person discharging managerial responsibilities/person

1 closely associated

a) Name Matthew Timmins

==================================== =================================

Reason for the notification

2

=======================================================================

a) Position/status Joint Chief Executive Officer

(PDMR)

==================================== =================================

b) Initial notification/Amendment Initial notification

==================================== =================================

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

=======================================================================

a) Name Fintel plc

==================================== =================================

b) LEI 213800DXP1VY21GCTH04

==================================== =================================

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

=======================================================================

a) Description of the financial Growth Shares in Fintel Group

instrument, type of instrument Holdings Limited

Identification Code

ISIN: GB00BG1THS43

==================================== =================================

b) Nature of the transaction Grant of Growth Shares

==================================== =================================

c) Price(s) and volume(s) Price(s) Nil

Volume(s)

95 C Shares

95 D Shares

==================================== =================================

d) Aggregated information N/a - single transaction

==================================== =================================

e) Date of transaction 1 6 August 2023

==================================== =================================

f) Place of transaction Outside a trading venue

==================================== =================================

Details of the person discharging managerial responsibilities/person

1 closely associated

a) Name David Thompson

==================================== =================================

Reason for the notification

2

=======================================================================

a) Position/status Chief Financial Officer (PDMR)

==================================== =================================

b) Initial notification/Amendment Initial notification

==================================== =================================

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

=======================================================================

a) Name Fintel plc

==================================== =================================

b) LEI 213800DXP1VY21GCTH04

==================================== =================================

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

=======================================================================

a) Description of the financial Growth Shares in Fintel Group

instrument, type of instrument Holdings Limited

Identification Code

ISIN: GB00BG1THS43

==================================== =================================

b) Nature of the transaction Grant of Growth Shares

==================================== =================================

c) Price(s) and volume(s) Price(s) Nil

Volume(s)

70 B Shares

82 C Shares

83 D Shares

==================================== =================================

d) Aggregated information N/a - single transaction

==================================== =================================

e) Date of transaction 1 6 August 2023

==================================== =================================

f) Place of transaction Outside a trading venue

==================================== =================================

For further information please contact:

Fintel plc via MHP Group

Matt Timmins (Joint Chief Executive

Officer)

Neil Stevens (Joint Chief Executive

Officer)

David Thompson (Chief Financial

Officer)

Zeus (Nominated Adviser and

Joint Broker)

Martin Green

Dan Bate

Kieran Russell +44 (0) 20 3829 5000

Investec Bank (Joint Broker)

Bruce Garrow

David Anderson

Harry Hargreaves +44 (0) 20 7597 5970

MHP Group (Financial PR) +44 (0) 20 3128 8147

Reg Hoare Fintel@mhpgroup.com

Robert Collett-Creedy

Notes to Editors

Fintel is the UK's leading fintech and support services business,

combining the largest provider of intermediary business support,

SimplyBiz, and the leading research, ratings and Fintech business,

Defaqto.

Fintel provides technology, compliance and regulatory support

to thousands of intermediary businesses, data and targeted

distribution services to hundreds of product providers and

empowers millions of consumers to make better informed financial

decisions. We serve our customers through three core divisions:

The Intermediary Services division provides technology, compliance,

and regulatory support to thousands of intermediary businesses

through a comprehensive membership model. Members include directly

authorised IFAs, Wealth Managers and Mortgage Brokers.

The Distribution Channels division delivers market Insight

and analysis and targeted distribution strategies to financial

institutions and product providers. Clients include major Life

and Pension companies, Investment Houses, Banks, and Building

Societies.

The Fintech and Research division (Defaqto) provides market

leading software, financial information and product research

to product providers and intermediaries. Defaqto also provides

product ratings (Star Ratings) on thousands of financial products.

Financial products are expertly reviewed by the Defaqto research

team and are compared and rated based on their underlying features

and benefits. Defaqto ratings help consumers compare and buy

financial products with confidence.

For more information about Fintel, please visit the website:

www.wearefintel.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDGGDIBGBDGXL

(END) Dow Jones Newswires

August 17, 2023 02:00 ET (06:00 GMT)

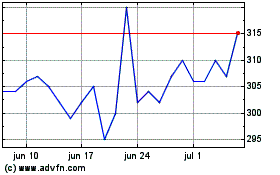

Fintel (LSE:FNTL)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Fintel (LSE:FNTL)

Gráfica de Acción Histórica

De May 2023 a May 2024